- The University of North Carolina at Chapel Hill

advertisement

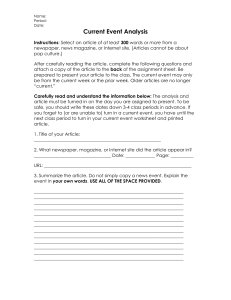

Page 1

1001 of 1258 DOCUMENTS

The New York Times

March 21, 2007 Wednesday

Late Edition - Final

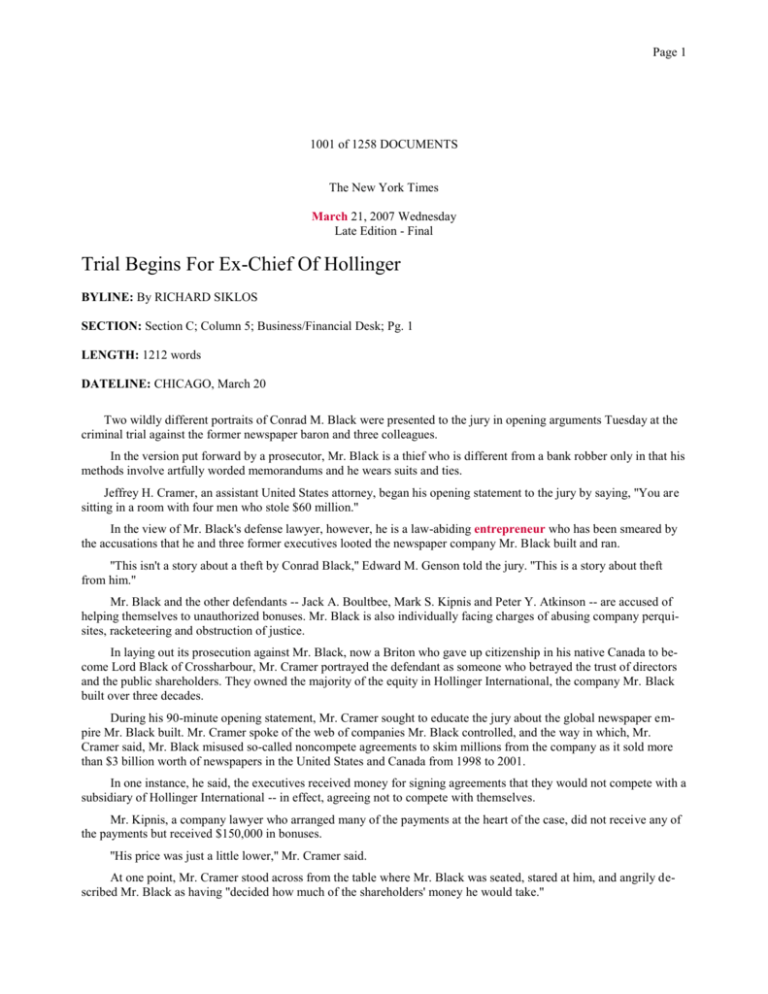

Trial Begins For Ex-Chief Of Hollinger

BYLINE: By RICHARD SIKLOS

SECTION: Section C; Column 5; Business/Financial Desk; Pg. 1

LENGTH: 1212 words

DATELINE: CHICAGO, March 20

Two wildly different portraits of Conrad M. Black were presented to the jury in opening arguments Tuesday at the

criminal trial against the former newspaper baron and three colleagues.

In the version put forward by a prosecutor, Mr. Black is a thief who is different from a bank robber only in that his

methods involve artfully worded memorandums and he wears suits and ties.

Jeffrey H. Cramer, an assistant United States attorney, began his opening statement to the jury by saying, ''You are

sitting in a room with four men who stole $60 million.''

In the view of Mr. Black's defense lawyer, however, he is a law-abiding entrepreneur who has been smeared by

the accusations that he and three former executives looted the newspaper company Mr. Black built and ran.

''This isn't a story about a theft by Conrad Black,'' Edward M. Genson told the jury. ''This is a story about theft

from him.''

Mr. Black and the other defendants -- Jack A. Boultbee, Mark S. Kipnis and Peter Y. Atkinson -- are accused of

helping themselves to unauthorized bonuses. Mr. Black is also individually facing charges of abusing company perquisites, racketeering and obstruction of justice.

In laying out its prosecution against Mr. Black, now a Briton who gave up citizenship in his native Canada to become Lord Black of Crossharbour, Mr. Cramer portrayed the defendant as someone who betrayed the trust of directors

and the public shareholders. They owned the majority of the equity in Hollinger International, the company Mr. Black

built over three decades.

During his 90-minute opening statement, Mr. Cramer sought to educate the jury about the global newspaper empire Mr. Black built. Mr. Cramer spoke of the web of companies Mr. Black controlled, and the way in which, Mr.

Cramer said, Mr. Black misused so-called noncompete agreements to skim millions from the company as it sold more

than $3 billion worth of newspapers in the United States and Canada from 1998 to 2001.

In one instance, he said, the executives received money for signing agreements that they would not compete with a

subsidiary of Hollinger International -- in effect, agreeing not to compete with themselves.

Mr. Kipnis, a company lawyer who arranged many of the payments at the heart of the case, did not receive any of

the payments but received $150,000 in bonuses.

''His price was just a little lower,'' Mr. Cramer said.

At one point, Mr. Cramer stood across from the table where Mr. Black was seated, stared at him, and angrily described Mr. Black as having ''decided how much of the shareholders' money he would take.''

Page 2

Trial Begins For Ex-Chief Of Hollinger The New York Times March 21, 2007 Wednesday

Mr. Black's stern expression did not change but his face turned slightly red as he stared straight ahead.

It was clear from Mr. Cramer's statement that the case against Mr. Black would rely heavily on testimony from

Hollinger's star-studded board -- which was hand-picked by Mr. Black -- as well as by Mr. Black's former partner, F.

David Radler, who has pleaded guilty to fraud and agreed to testify for the prosecution.

In the last week, Mr. Radler has also agreed to pay more than $100 million to settle civil litigation with the Securities and Exchange Commission and the Sun-Times Media Group, as Hollinger International is now called, stemming

from allegations of fraud.

In particular, Mr. Cramer said the former audit committee of the Chicago-based Hollinger International will offer

critical testimony.

Its members included James R. Thompson, the former Illinois governor and United States attorney; Richard Burt,

a former United States ambassador to Germany; and Marie-Josee Kravis, an economist who is the wife of the financier

Henry Kravis.

''The audit committee members will tell you they were never given full and accurate disclosure,'' Mr. Cramer said.

Mr. Radler, he added, will give ''an inside look at how they went about stealing $60 million; Radler will tell you

how it worked.''

The $60 million was lower than a figure of more than $80 million that had been used in the indictment against Mr.

Black and the others, and seemed to reflect a decision by the government to no longer challenge one payment made to

Mr. Black.

In his opening, Mr. Genson depicted Mr. Black as a tireless businessman and author who hobnobbed with the rich

and famous and a man for whom there was no distinction between his personal life and his business interests.

Perhaps in an attempt to defuse at least the tone of some evidence, Mr. Genson described Mr. Black as being egotistical and arrogant and prone to oratorical flourishes.

In one e-mail message the jury was shown by the prosecution, Mr. Black described queries from shareholders

about his pay as an ''epidemic of shareholder idiocy.''

Another e-mail message to Mr. Radler referred to the ''splendid conveyance of the noncompetition agreements

from which you and I profited so well and deservedly.''

But Mr. Genson said that Mr. Black's florid style did not mean he was a criminal, and he noted that there was no

accounting scandal or bankruptcy at Hollinger International the way there was at Enron.

''His life is different than ours -- it's not better, it's just different,'' Mr. Genson said of Mr. Black. ''You can't allow

the sparkle of wealth to blind you as to the facts of this case.''

At one point, the lawyer joked that one goal over the course of the trial was to get Mr. Black -- who sat slouching

and grim throughout much of the proceedings and during jury selection last week -- to sit straight in his chair.

Referring specifically to the idea that Mr. Black misled members of Hollinger's board, Mr. Genson said these are

''not people you could go in and trip and bully.''

He spent much of his presentation trying to distance Mr. Black from Mr. Radler, whom he characterized as a liar

who had turned against his longtime partner to assure himself a more lenient prison sentence that he could be able to

serve in Canada.

One of the biggest questions in the case is whether the jury will accept that portrayal or will instead accept the

prosecution's view that even though Mr. Radler was his hatchet man, Mr. Black knew exactly what he was doing.

Mr. Genson also pointed out that Mr. Black oversaw the company's newspaper interests in Britain and Canada,

while Mr. Radler oversaw the company's ownership of The Jerusalem Post and its United States papers, which at one

point included 400 community newspapers and The Chicago Sun-Times.

While Mr. Cramer told the jury that the buyers of several groups of small-town newspapers would be testifying

that they did not ask for the agreements that funneled millions to the defendants, Mr. Genson argued that those same

newspaper buyers would also testify that they never knew Mr. Black and dealt only with Mr. Radler.

Page 3

Trial Begins For Ex-Chief Of Hollinger The New York Times March 21, 2007 Wednesday

Similarly, Mr. Genson said, it was Mr. Radler's responsibility to obtain the approval for the noncompete payments

from the audit committee.

The trial will also include accusations that Mr. Black abused perquisites. These include charges that Mr. Black

stole money from the company by using the company jet to fly to Bora Bora for a vacation with his wife and refused to

pay for it and that he defrauded the company on the purchase of a Park Avenue apartment. Mr. Genson said he would

disprove all the accusations.

URL: http://www.nytimes.com

SUBJECT: ORGANIZED CRIME (92%); JUSTICE DEPARTMENTS (90%); LAWYERS (89%); COVENANTS

NOT TO COMPETE (89%); FRAUD & FINANCIAL CRIME (78%); ETHICS (74%); ROBBERY (72%); SHAREHOLDERS (69%); JURY TRIALS (90%) Accounting and Accountants; Ethics; Securities and Commodities Violations; Racketeering and Racketeers ; Frauds and Swindling; Bonuses

COMPANY: SUN-TIMES MEDIA GROUP INC (54%)

ORGANIZATION: Hollinger International Inc; Hollinger International Inc

TICKER: SVN (NYSE) (54%)

PERSON: Conrad M Black; Richard Siklos; Jack Boultbee; Mark Kipnis; Peter Atkinson; Jeffrey H Cramer; Edward

M Genson

GEOGRAPHIC: UNITED STATES (93%); CANADA (90%); NORTH AMERICA (79%)

LOAD-DATE: March 21, 2007

LANGUAGE: ENGLISH

PUBLICATION-TYPE: Newspaper

Copyright 2007 The New York Times Company

1002 of 1258 DOCUMENTS

The New York Times

March 21, 2007 Wednesday

Late Edition - Final

Add a Dash of Green and the Dish Is Done

BYLINE: By Florence Fabricant

SECTION: Section F; Column 2; Dining, Dining Out/Cultural Desk; FOOD STUFF; Pg. 2

LENGTH: 198 words

A finishing touch on a dish in a restaurant is often a scattering of tiny leaves, or microgreens, packing intense flavor.

Page 4

Add a Dash of Green and the Dish Is Done The New York Times March 21, 2007 Wednesday

Now home cooks can add this same professional grace note with fresh snippets of baby plants direct from the refrigerator. Lauri Roberts, an entrepreneur in Warwick, R.I., has started a company called Farming Turtles (''I wanted a

name that was funny and memorable,'' she said) to grow nine kinds of microgreens.

They are sold in plastic tubs, growing in soil. Tuck them into the refrigerator and cut with scissors to use on all

sorts of dishes.

They are called salad toppers, but they have other uses, like garnishing fillets of fish, dressing up sandwiches and

wraps, floating on soups and showering on pasta and risotto.

Basil and cilantro are deeply flavorful. Arugula and a blend called Firecracker Zest pack plenty of spice. The onion, with its tiny black seeds, tastes richly oniony.

Amaranth, carrot, baby red cabbage and an Asian blend are the other varieties, all $4.99 each and available at

D'Agostino supermarkets in New York City and Westchester County. Dave's Marketplace stores in Rhode Island and

Eastside Marketplace in Providence also sell them.

URL: http://www.nytimes.com

SUBJECT: GROCERY STORES & SUPERMARKETS (85%); RESTAURANTS (78%) Cooking and Cookbooks

COMPANY: D'AGOSTINO SUPERMARKETS INC (55%)

ORGANIZATION: Farming Turtles (Co)

PERSON: Florence Fabricant

GEOGRAPHIC: PROVIDENCE, RI, USA (57%); NEW YORK, NY, USA (65%) RHODE ISLAND, USA (93%);

NEW YORK, USA (79%) UNITED STATES (93%)

LOAD-DATE: March 21, 2007

LANGUAGE: ENGLISH

GRAPHIC: Photo (Photo by Tony Cenicola/The New York Times)

PUBLICATION-TYPE: Newspaper

Copyright 2007 The New York Times Company

1003 of 1258 DOCUMENTS

The New York Times

March 20, 2007 Tuesday

Late Edition - Final

National Briefing West: California: Man Indicted In Fire At Wine Warehouse

BYLINE: AP

Page 5

National Briefing West: California: Man Indicted In Fire At Wine Warehouse The New York Times March 20, 2007

Tuesday

SECTION: Section A; Column 1; National Desk; Pg. 15

LENGTH: 162 words

Federal prosecutors announced a 19-count indictment against a San Francisco Bay Area wine entrepreneur in an

October 2005 fire that destroyed a warehouse and millions of dollars' worth of bottled wine. The charges against the

businessman, Mark Anderson, include arson, tax evasion, mail fraud, using a fake name and interstate transportation of

fraudulently obtained property. They are the first stemming from the fire, which burned the Wines Central warehouse

on Mare Island, a former naval base in Vallejo, about 30 miles northeast of San Francisco. It destroyed the inventories

of more than 80 vintners, worth about $100 million. Mr. Anderson had stored wine at the warehouse but had removed

most of it after being asked to do so by business managers several months before the fire. He had been under investigation partly because he was at the warehouse when the fire erupted. The federal public defender in Sacramento, Matthew

C. Bockmon, declined to comment on the case.

URL: http://www.nytimes.com

SUBJECT: FIRES (90%); ARSON (90%); JUSTICE DEPARTMENTS (88%); GENERAL WAREHOUSING (88%);

WAREHOUSING & STORAGE (88%); INVESTIGATIONS (87%); TAX FRAUD (73%); ALCOHOLIC BEVERAGES (72%); PUBLIC DEFENDERS (50%); INDICTMENTS (91%) Fires and Firefighters; Arson

PERSON: Mark Anderson

GEOGRAPHIC: SAN FRANCISCO, CA, USA (91%); SAN FRANCISCO BAY AREA, CA, USA (92%); SACRAMENTO, CA, USA (79%) CALIFORNIA, USA (93%) UNITED STATES (93%) San Francisco (Calif)

LOAD-DATE: March 20, 2007

LANGUAGE: ENGLISH

PUBLICATION-TYPE: Newspaper

Copyright 2007 The New York Times Company

1004 of 1258 DOCUMENTS

The New York Times

March 18, 2007 Sunday

Late Edition - Final

Headline News

BYLINE: By BOB SHACOCHIS.

Bob Shacochis' next novel, ''The Woman Who Lost Her Soul,'' will be published in 2008.

SECTION: Section 7; Column 1; Book Review Desk; Pg. 16

LENGTH: 1314 words

Page 6

Headline News The New York Times March 18, 2007 Sunday

SURVEILLANCE

By Jonathan Raban.

258 pp. Pantheon Books. $24.

To whom shall we entrust the rendering of this moment and its attendant verities -- the artist or the correspondent,

the purveyors of fictions or the gatherers of facts? And who gets to play gatekeeper in this game? The question, both

plot device and intellectual premise, animates ''Surveillance,'' the gripping new novel by Jonathan Raban, a British writer who for years has embedded himself in America, earning acclaim for his fresh-eyed travelogues and journalism.

Once upon a time the question could be swatted away -- you're talking apples and oranges -- but not anymore.

Boundaries have corroded, shapes blurred, genres intermarried. Fabrications are as efficacious as facts.

When we read the Times Op-Ed columnist Bob Herbert on anger -- ''The anger quotient is much too low,'' he

wrote recently, addressing the political mood in the country -- and then Raban's observations on the same subject, we

find ourselves at the center of a murky debate about the current status of fiction versus nonfiction that occupies much of

the thematic space in Raban's novel. ''Tad was angry,'' Raban writes. Tad Zachary is a 50ish, gay, H.I.V.-positive, professional actor in Seattle. ''He was angry with himself, angry with the presidency, angry with the nation, angry with the

century. That much was rational, justifiable. ... Decent people now were angry people, and what America needed at this

low moment in its history was more anger, not less.'' Tad, however, doesn't seek ''to rescue the administration from its

folly: he wanted to see it blown to atomic dust or drowned in a sack.'' Here, at least, the anger quotient, considerably

more heated than congressional oversight hearings on the Iraq war, is much too high. +

At the place where Herbert and Raban intersect, do their words complement or cancel one another out, enhance or

diminish the force of Herbert's analysis or Raban's make-believe? This is precisely the sort of human algebra that Raban

bends his characters around throughout the book, to fascinating yet irresolute effect. Opinions appear to converge on a

single truth, but each character has read the thermometer differently, the disparity in this case perhaps explained by the

fact that ''Surveillance'' leans out from today's headlines to sniff at a horizon that is within walking distance, a Seattle

that might not be 2007 yet edges no further into the calendar than 2008. An overly familiar America, accurately portrayed and perforce underimagined. What's new? One hardly needs a crystal ball: national identity cards, stone-faced

soldiers manning checkpoints, an economy in the pits, intensified global warming. Bush still seems to be president, the

nation remains divided, Iraq is Iraq. There have been no new terrorist attacks upon the homeland, although extravagant

stagings of emergency and disaster drills, spiffed up with actors like Tad, are disruptively common.

The drama at hand is mostly atmospheric, the texture of society itself, the quotidian pressures inflated by a ubiquitous sense of dread for what might one day wake us up -- not from the nightmare but into the nightmare. Yet the lives

Raban zeroes in on are essentially stable, comfortable, urban middle-class or nouveau riche, their profiles instantly recognizable as our own in the cultural mirror.

Tad, the eternally aggrieved leftist, cherishes the one good, sane thing in his life -- the postmodern family he has

created with the tenants across the hall, Lucy Bengstrom and her 11-year-old daughter, Alida, in their slightly seedy

downtown apartment building. Over the years he has become Alida's surrogate father and Lucy's platonic lover and domestic task-sharer. Lucy, an overweight, boomer-aged single mom and a ''model bourgeois liberal'' who believes in neither evil nor certitude, is a freelance writer for A-list magazines (Tina Brown kept her on a monthly retainer in the '90s)

although the assignments have dwindled sufficiently of late for her to be grateful when she gets a timely call from GQ

asking her to track down the reclusive literary sensation of the season, a retired history professor named August Vanags,

who lives on an island in Puget Sound. Vanags, who claims to have been born in Latvia on the eve of World War II, has

written a best-selling memoir (yes, Spielberg's making the movie) about his childhood, which included time in both

Hitler's and Stalin's camps. He is one of two immigrants who bookend ''Surveillance'' -- the second is a ruthlessly ambitious Chinese landlord -- and their true identities remain uncertain throughout the narrative.

What happens then among these five is a replay of the polarized polemics any sentient citizen has been exposed to

throughout the past six years. Vanags, a former Kissinger aide during the Nixon administration, is a charming but unrepentant neocon who seems to be channeling Charles Krauthammer; Tad is to the diatribe born. The savantish 11-yearold interjects naive, untested idealism; the landlord provides the rapacious entrepreneurial spirit that vacuums capitalism clean of conscience. Agnostic, skeptical Lucy listens and referees. She is a watcher who, like the author himself,

has placed us all under benign surveillance and, given the conflicting evidence, is understandably reluctant to draw conclusions.

Page 7

Headline News The New York Times March 18, 2007 Sunday

Which returns us to the tricky question ''Surveillance'' forces upon its readers: In the courtroom of history, who

gets to testify as a credible witness? Bush is the author of his own legacy, certainly, but how do we sort out his narrative

from the one we ourselves create as a nation, especially in light of those among us who falsify, spin or otherwise revise

to suit agendas that spawn parallel realities?

There's plenty of talk in ''Surveillance'' about who reads what and why. Vanags distrusts The New York Times and

favors The Wall Street Journal. Tad listens to Al-Jazeera and scours the European press for the ''real'' story. Alida hates

fantasies but loves Agatha Christie. The Chinese landlord, contemptuous of novels, gulps down books about Sam Walton. For Lucy, the writer, the more alien the world she reads about, the happier she is.

We might assume then that she'd be unhappy reading ''Surveillance,'' which is a bit like reality TV, both authentic

and artificial. One begins to wonder, as I believe the author intends us to, if the contemporary moment is not ''better''

delivered by the news cycle and the unceasing slosh of cyberflotsam and citizen-journalists with videophones than by

literature. The very relevance of ''Surveillance'' to the present moment, in a culture where nearly every surface is hyperreflective, threatens to amplify the noise and weariness of the day and, paradoxically, actually drown the novel's own

relevance out.

To his credit, Raban seems to understand the gamble and make the most of it, though not without an occasional

misstep -- most noticeably the tendency of characters to stagger beneath the metaphorical load. What the book offers in

its auditing of the national dialogue contains no surprises. The talking heads talk. The characters also bloom into their

bodies, lives and loves. The insufferable weather turns nostalgically clement. We look in the mirror -- here we are -- and

look away, puzzled or embittered or cocksure.

It's during the denouement of the deceptively modest plot that the big message is delivered, the long-awaited

apocalyptic swipe brought to us by ... well, the Other Player in the mix. The novel unmasks itself as an elaborate, ingenious frame for a discourse on the nature of writing, and a platform from which to administer a strong kick of cosmic

reality to the backside of mankind's roiling affairs. We're tossed onto the stage of a profound truth, where literature outperforms anything else.

Good morning, Seattle. Welcome to New Orleans.

URL: http://www.nytimes.com

SUBJECT: BOOK REVIEWS (92%); NOVELS & SHORT STORIES (90%); EDITORIALS & OPINIONS (90%);

LITERATURE GENRES (78%); NON FICTION LITERATURE (78%); MARRIAGE (54%); GLOBAL WARMING

(50%); NATIONAL IDENTITY CARDS (50%); JOURNALISM (76%); LITERATURE (78%); WRITERS & WRITING (77%); IRAQ WAR (62%) Books and Literature; Reviews

PERSON: MICHAEL MCMAHON (57%) Bob Shacochis; Jonathan Raban

GEOGRAPHIC: SEATTLE, WA, USA (92%) WASHINGTON, USA (92%) UNITED STATES (93%); IRAQ (79%)

LOAD-DATE: March 18, 2007

LANGUAGE: ENGLISH

GRAPHIC: Photo (Photo by Andy Martin)

DOCUMENT-TYPE: Review

PUBLICATION-TYPE: Newspaper

Copyright 2007 The New York Times Company

1005 of 1258 DOCUMENTS

Page 8

Russ Whitney Wants You to Be Rich The New York Times March 18, 2007 Sunday

The New York Times

March 18, 2007 Sunday

Late Edition - Final

Russ Whitney Wants You to Be Rich

BYLINE: By RANDALL PATTERSON.

Randall Patterson, who lives in Asheville, N.C., has written for The New York Times Magazine, New York and

Mother Jones.

SECTION: Section 6; Column 1; Key; Pg. 104

LENGTH: 4129 words

Among the promises made after midnight to people who want to believe them, amid ads for the cream that will

make you look young again and the ''motionless exercise'' system that will melt away your fat comes the voice from the

television that asks, ''Are you among the thousands living paycheck to paycheck, just getting by, making payments on

debts and credit cards?''

And ''Have you ever wondered how it would feel being rich?''

Visions of wine-sipping then fill the screen, of golf-playing, of sailboats sailing into the sunset. Strolling down a

dock, a smart-looking fellow in a bright polo shirt and khaki shorts turns to the camera and says, ''With real estate,

there's no question you can amass the most amount of money in the least amount of time.''

This is Russ Whitney, ''who started out working in a slaughterhouse for $5 an hour,'' the announcer tells us, ''and

turned $1,000 in borrowed money into a personal wealth of $4.7 million -- in only 18 months!'' He has since devoted

himself to helping others, the spot continues, and ''on this important television special,'' Whitney will show you how to

build wealth -- ''even with only a part-time effort!''

He is displayed standing before a rather plain-looking house. What would he do if he had ''no money and no

credit''? Why, he'd go out and find a ''horrible''-looking house like this one and buy it ''with literally no money ... no

banks involved.'' Then ''we do a little paint and clean-up, and we turn this right over for a $15,000 profit.''

If you happen to doubt any of this, there is testimony from a woman who recently collected seven ugly houses in

six months, thus replacing her yearly income, and from a man who says Russ Whitney ''changed my life.'' And, too,

there is the former slaughterhouse worker himself, telling you again, amid swells of elevator music, that real estate is

the fastest way to wealth for ''folks like you and me.''

By this time, however, Whitney has switched into the future tense, and it becomes clear he is not actually going to

reveal any of his wealth-building techniques until you attend one of his ''truly unique'' workshops. Not only is admission

to this ''special, limited-seating event'' free, but Whitney will also give you, ''absolutely free,'' his special Russ Whitney's

Building Wealth Entrepreneur Start-Up Kit -- ''a $199 value.'' In other words, he will pay you to attend, so how could

you not? ''You have everything to gain by attending!'' ''Call now!'' ''Operators are standing by.'' And so on.

In this way, a sorting process begins. Most people are not awake after midnight to avail themselves of such opportunities. Of those who are, a smaller number shop for answers in infomercials. Fewer still reach for the phone. Those

who do call and who attend the first Whitney workshop find that it is mainly a sales event for another workshop. The

fraction that agree to pay a few hundred dollars proceed to the second hotel workshop, where they discover yet another

sales event, or what sounds from the description of participants like a Holy Ghost revival. A powerful speaker stokes

passions until, one by one, about 20 percent of the audience rise from their seats -- the number is reliable, according to

the company -- and consent to pay thousands of dollars each to learn how to get rich through real estate.

Page 9

Russ Whitney Wants You to Be Rich The New York Times March 18, 2007 Sunday

In staging some 4,700 free events a year, Whitney Information Network attracts some 280,000 people, of whom

22,000 go on to enroll as students in advanced courses. Last November at the Clarion Hotel in Louisville, Pat Yarbrough, a 56-year-old custodian at the University of Louisville, became one of them. ''Fast money,'' she explained later,

''that's all I'm interested in.'' At the front of the conference room, a nice man had taught her how to raise her credit-card

debt limit, she said, and when she made her way with a cane to the back, a nice clerk showed her what she could buy:

three-day courses with names like Rehabbing for Profit and Keys to Creative Real Estate Financing. The courses cost

$4,995 each, but less if you bought more. Yarbrough chose four, including the Millionaire U Real Estate Training. She

had $130,000 in debt, some of it on her seven credit cards, and the clerk helped her to add $18,000 to it.

A month later, the custodian from Louisville joined an electrician from Baltimore, an unemployed longshoreman

from Delaware, a roofing contractor from New Jersey and an elderly doctor from Sebastian, Fla., at Russ Whitney's

Wealth Intelligence Academy, where they were welcomed as ''advanced students,'' ''the creme de la creme,'' and promised that all would be revealed.

Cape Coral, Fla., is bright sun, a jungle of strip malls -- the sort of town where a wealth intelligence academy fits

right in. ''Good morning, everybody!'' Whitney called out to his sales staff on a bright day in December. ''Are we having

fun yet?'' He was tanned and moussed; at 51, he looked like a million bucks. ''Good morning,'' he greeted a secretary.

''How are you?'' When she began complaining of cold symptoms, Whitney cut her off: ''You don't have cancer, do you?

You're doing great!'' After lunch, he played basketball in the lobby, pushing down one of his executives and driving to

the hoop. Late afternoon found Whitney in his office, chatting on the phone with Robert Kiyosaki, the author of ''Rich

Dad, Poor Dad,'' about whether to go on safari together -- or as Whitney put it, ''whether I should go out and kill things

with you.''

To look at Whitney now, you don't have to wonder how it feels to be rich. He has been all over television talking

about it. He's spoken of it to countless audiences, written about it in several books, including ''Millionaire Real Estate

Mentor,'' a BusinessWeek best seller. (Last fall, Whitney also appeared in New York City as a panelist at a New York

Times-sponsored event, the Great Read in the Park.) His rags-to-riches tale has been worn smooth, but he knows it's a

good story, and nothing else quite conveys his exceptional pluck.

After a ''very miserable'' childhood, he begins again, he developed an association with some shady characters. ''I

pretty much became a car thief,'' he says. ''I was damn good at it, too -- steal a car in 15 seconds.'' But Whitney wasn't

too good at crime to avoid getting caught for second-degree robbery, and it was only after a year and a half in prison

that he wound up, in 1976, at the slaughterhouse in Albany.

''I was a piece of dung,'' he remembered. Many people live with that feeling, but Whitney wasn't about to, and he

reached for the first of several texts that changed him -- a Zig Ziglar volume on positive thinking. The book told him

that happiness basically depends on a denial of reality, that ''if you're going to be a positive guy, have a good attitude,''

he said, ''you've got to say things like 'super!' and 'fantastic!' '' Whitney had just gotten out of prison and thought this

was the stupidest thing he'd ever heard. He wanted to be happy, though, and so tried to believe it and was soon wandering the slaughterhouse saying ''super'' and ''fantastic.'' The longer he tried to see the bright side, the more he thought he

actually did.

Within three months of arriving at the slaughterhouse, Whitney had convinced a woman there to marry him for

richer, for poorer. Within a year, he'd decided he was far too smart to go on killing hogs for life and was meant instead

for ''something big.'' Whitney began shopping among the get-rich-quick schemes advertised in the backs of magazines.

He had spent hundreds of dollars on such offers before he came upon another book that changed him: William Nickerson's ''How I Turned $1,000 Into $3 Million in Real Estate in My Spare Time.''

''Everything clicked,'' Whitney said. He saw that real estate was an investment he could control. Its value over the

long term generally rose, and could in fact be forced up. If he combined ''a sensible, mathematical approach with the

proper exit strategy,'' Whitney said, he would know in advance of a deal whether he would profit. ''And the book said

you can be a millionaire in time,'' he recalled, ''and I thought, Shoot, I can do that. I mean, I got it! I understood that

concept. And from that point on, my sole focus was to become a millionaire.''

His first deal in Schenectady was a ''steal.'' In another, he extracted ''exceptional terms'' from a 65-year-old widow.

After making the purchase, Whitney would rise early and take his baby daughter with him to the property, while his

wife worked at the slaughterhouse. All day he would paint and clean, not returning until night for his own slaughterhouse shift. This schedule went on for years. ''Hustle is heaven if you're a hustler,'' he wrote in his first book, but Whit-

Page 10

Russ Whitney Wants You to Be Rich The New York Times March 18, 2007 Sunday

ney's life was difficult enough that eventually he felt the need for stronger medicine than Zig Ziglar or William Nickerson could offer.

A third book that changed him was the Bible. Whitney says he reads it ''for wisdom and forgiveness'' for 15

minutes every morning after his workout. Without the Bible, he asked me, ''how would you know not to steal?'' Without

the Bible, he said, ''I'd be doing a whole lot of not looking in the mirror.'' He seems to have hesitated in his faith only

once, when he read in Matthew, Mark and Luke that ''it is easier for a camel to go through the eye of a needle than for a

rich man to enter into the kingdom of God.'' Whitney could understand the words only as they appeared: it seemed the

Bible frowned on wealth-building almost as much as upon stealing. ''I was trying to figure that out,'' he remembered,

when his Baptist preacher intervened to explain, no, no -- certain passages of the Bible must not be taken literally. A

rich man must try harder to get into heaven, it's true, but the preacher told him, ''God wants you to be successful.''

Whitney says he has gone on to hundreds of real estate deals, contributing to his Baptist church all the while. He

had been investing in real estate for seven years when, ''by the age of 27,'' according to the official bio, ''he was one of

America's youngest self-made millionaires.'' Whitney moved his family from New York to Cape Coral, a ''very positive,

beautiful place,'' he says. Now he seems to have what rich people are supposed to -- a Ferrari, a company plane, ''probably close to the biggest house in town,'' he says -- and he happily puts his net worth at ''oh, I would say in excess of

$100 million for sure.'' All Whitney really wants is more. ''I'm an opportunist,'' he explains. ''I'm a businessman.''

The one regret he mentions is that he ever put faith in get-rich-quick schemes. So many were just ''a lot of hype

and baloney,'' Whitney says, and it was to tell the truth about what real estate had done for him that he wrote his first

book. Whitney Information Network is now a public company that employs roughly 475 people and that took in about

$160 million in revenue in 2005, according to its annual report, all on the promise that anyone might become rich like

Whitney, if he will only do as Whitney has done. The difference, though, between Whitney and those who come to

WIN is that he bought his first real estate book for just $10, and they pay up to $54,000 a head for the full course package. When I asked if he would have enrolled in his school when he was starting out, Whitney said no. Then he added, ''I

shouldn't say that,'' and began trying to take it back.

Millionaire U is the three-day real estate training course designed to ''put you on the fast track to success.'' The

conference room at Whitney headquarters gradually filled in mid-December with blacks, whites, Hispanics, Asians,

Haitians and Jamaicans. As Whitney said later: ''We had America in there. We had America at Millionaire University.''

The students sat without talking beneath fluorescent lights, about 40 midnight loners waiting as though for a test.

''Real estate is a people-person business,'' the instructor told them, so get introduced. Gladstone from Fort Lauderdale

stood to say he was a physician's assistant ''tired, very tired'' of 16 years of 16-hour days; for this and other courses, he

had paid Whitney $14,000 and hoped to increase his cash flow. Terrin from Delaware was a single parent and unemployed longshoreman whose car had recently been repossessed; he had paid Whitney $20,000 to teach him ''how to not

make mistakes.'' Before coming here, Pat Yarbrough, the custodian from Louisville, had given a different get-rich guru

$24,000; that plan didn't work, but she was convinced this would be different. Probably the most educated man in the

room was Havelock Thompson, the elderly doctor from Sebastian, Fla. He had spent his career caring for indigents -''doing more good than making money.'' After buying a $53,000 package from Whitney, he expected to gross $1 million

in the next two years, which no one there seemed to think unrealistic. They were all hoping to make a change in their

lives.

Pacing before them was Tracie Taylor, a sleek African-American woman in red lipstick and dark business suit.

''How many of you want to be millionaires?'' she called out. When every hand shot up, Taylor told them she hoped they

would raise their goals; millionaires have become passe. Getting rich, as she explained it, seemed mainly a matter of

positive thinking. ''Our challenge is not real estate investing,'' the broker said, ''but changing your belief systems.'' Immediately she got to work.

She told the students that they were solutions-oriented individuals and that the solution they were oriented toward

was money. The economy is divided, Taylor said, between the rich and the poor, ''and you can choose which side you

want to be on.''

She advised the students to cease identifying with the poor. There are more people making a little than there are

making a lot, and those people, she said, need places to live. Expect to become landlords, she told the class. The neighborhoods they should expect to work in -- ''good cash-flow areas'' -- are indicated by the presence of laundromats, pawn

shops and any boulevard bearing the name Martin Luther King, she told them on a tour of one such neighborhood. To

find deals, she recommended keeping an ear out for death, divorce, job loss, any kind of despair. ''Situations,'' she whis-

Page 11

Russ Whitney Wants You to Be Rich The New York Times March 18, 2007 Sunday

pered with a grin; they tend to create motivated sellers. One must approach them gently. It's important to be positive, to

look as though you care about someone's situation -- and it's absolutely essential that you not care. When you make your

lowball offer, you'll have to stand firm; when tenants don't pay the rent, you'll have to evict. ''The cardinal rule of real

estate is don't get emotionally attached,'' Taylor instructed. ''Here's what you get attached to: ROI.'' Return on investment.

The students solemnly wrote her instructions down. Much of what was said clashed with the instincts of Dr.

Thompson, who said he couldn't imagine himself as a landlord, ''screwing in light bulbs for people less fortunate'' or, in

any case, making money without doing good. ''My conscience wouldn't allow it,'' he added, but he seemed one of only a

few with that problem. As the course went on, the challenge for most students appeared not to be changing their belief

systems but learning the rudiments of real estate.

Taylor knew early that her class of advanced students was strictly remedial. Assessing them, she found that only 8

of 40 had invested in real estate before. The infomercial had talked of buying and quickly selling houses, and those who

enrolled seemed largely unaware of the real estate slump.

Taylor introduced a hard-charging mortgage broker who began moving rapid-fire through nonconforming NINAs

and no docs, PITI reserves and the 28/36 rule. At last, she looked up: ''Everyone's shaking their heads like they know

this,'' she said. And she rolled right on.

''The second calculation is the same as the first ... the balance is divided by ... the rate is 12 percent so ... and that's

how you get a blended rate ... and what if it's an adjustable rate ... negative amortization, but I prefer not to be negative

so let's say deferred interest ... and ... we're done. Any questions?''

There wasn't a one. ''You guys are too quiet!'' the broker said.

Then came another banker. He was talking carefully about regulations, financing, exotic mortgages when a voice

rang out: ''We want to know how to find the deal when you drive around!'' It was a Haitian man from Brooklyn. ''Talk to

the real estate guy,'' the banker said. ''I'm the banker.'' But the man only replied, ''We want to know how to find the deal

when you drive around!''

They were eager to be good students, but blurted out terrible answers. ''Where did you guys study math?'' Taylor

asked. Later, she realized that not one student could even name the world's richest man. ''People with goals are the ones

who succeed,'' she lectured, and she assigned her class the homework of compiling a hundred goals. The next day, when

she asked all who had completed the homework to stand, the doctor rose, stunned to find himself alone. ''Why are you

surprised?'' Taylor asked him.

Yarbrough the custodian, meanwhile, sat fanning herself with her notebook, asking for words to be defined, concepts repeated. She said she wasn't getting much out of the presentations. She was mainly waiting, she admitted, for that

lesson on how to buy houses without money.

Taylor at last felt obliged to tell the class that ''real estate investing is not a get-rich-quick scheme.'' They would

have to work hard, and they would have to get informed. ''All the data's yours for the taking,'' she said. And that must

surely have been the most confusing lesson, because it was exactly contrary to what the students had been told at the

sales event. Information was supposed to be hard to come by, available only at high cost. What had they paid for, after

all? Why had they come all this way to the Wealth Intelligence Academy?

In his official company biography, Whitney says that ''his greatest achievement is the success of his students.'' The

immediate effect of becoming a Whitney student, though, is not to get rich, but poorer. The infomercial addresses people who are ''just getting by, making payments on debts and credit cards.'' Among the first lessons Whitney instructors

teach is how to raise the limits on their credit cards, and then how to plunge deeper into debt buying Whitney courses.

Documents his company submits to the Securities and Exchange Commission show that as chief executive, Whitney took home $1.6 million in salary and bonus in 2005. Minutes after telling me that he would not, when starting out,

have enrolled in his school, he tried to explain that he would ''probably have progressed a whole lot faster'' if he had. He

would have bought the $24,000 ''platinum package,'' he said, adding, ''Would have took a platinum for sure.'' Perhaps it

would have meant going into debt, but that makes sense to him. He was unabashed that his instructors help students put

the cost of those courses on credit cards. Don't most colleges help to arrange student loans? ''Of course they do,'' he said.

Compared with the cost of college, his school is ''a bargain,'' Whitney added, and ''when you think about it, too, the

business we're in, that money comes back very fast.''

Page 12

Russ Whitney Wants You to Be Rich The New York Times March 18, 2007 Sunday

In his book ''Millionaire Real Estate Mentor,'' Whitney claims to have ''helped thousands of people become

wealthy.'' On Whitney's Web site, the volume of ''success stories'' appears to support the claim -- but when you read the

stories, many are nothing more than testimonials of good will. I asked the company for examples of students who became wealthy thanks to what they learned. After many weeks, the company gave me a list of seven people, three whose

success had prompted Whitney to hire them as mentors for new students and two others who were doing business with

Whitney. Six of the seven returned calls; three claimed they had become millionaires. The impression they left is that

some Whitney students do indeed become wealthy, but that they are the exceptions.

The company recently reported that it was under investigation by the S.E.C. and the United States attorney for the

Eastern District of Virginia. The Florida and Kansas attorneys general are looking into Whitney's company for deceptive advertising, and they are not the first to have done so. Perhaps the most revealing case was brought by the state of

Tennessee and settled in 1997. Promoting a seminar, Whitney had placed newspaper ads, according to court records,

that read, ''Millionaire Swears Under Oath He Can Show Any Nashville Area Resident How to Get Rich in a Year.'' The

attorney general objected that Whitney had ''not in fact made any such statement under oath'' and seems to have been

astonished when Whitney ''informed the state that this claim is simply 'advertising language.' '' ''In fact,'' the attorney

general wrote in the complaint, ''Mr. Whitney has informed the state that in making his claim that he can show any

Nashvillian how to become 'rich' in a year, he did not necessarily mean that anyone would become 'rich' financially, but

'rich' in a spiritual sense.''

The state dropped the case after Whitney agreed never again to advertise unlikely results from use of a Whitney

product in Tennessee without disclosing that such results would be ''rare, highly unusual, exceptional or atypical and not

to be expected by the average person.'' If Whitney still wished to advertise that he could help people get rich, he would

also have to disclose that his ''use of the term 'rich' does not refer to financial success but is intended to refer to other

standards.''

Whitney says now that while he consented to pay costs and fees of $9,500 in Tennessee, he admitted no wrongdoing -- and that the Tennessee attorney general quoted him out of context. In an e-mail he wrote that ''every claim in our

ads can be documented'' and that with altered ads, the company continues to do business in Tennessee and would be

shown to be in full compliance with all laws in Florida and Kansas.

His work is ''God-driven,'' Whitney insists. How many of his students become materially wealthy, he claimed not

to know. But even for those who don't, he said, the training still has value. Spiritual value, in other words. ''We help

people build self-confidence,'' Whitney explained. ''We help them believe in themselves again.'' The students who come

to him, ''some of them, you know, couldn't work,'' he said, and then they start ''thinking on their own,'' and Whitney

watches as they ''break out from more conventional America'' and recognize, ''Holy cow, I can be somebody!'' He added,

''That doesn't necessarily mean be somebody wealth-wise.''

Toward the end of the class, Taylor told her students that most of them would become financially independent.

''Many of you will become multimillionaires,'' she said. Hoping to become somebody wealth-wise, Yarbrough signed up

for yet more classes. Her purchases added another $11,500 to her debt, but she reasoned, ''If I make the money they say

I will, it won't make any difference.''

On the last day of the course Taylor rather grandly introduced ''my mentor, my friend, Mr. Russ Whitney!'' Whitney came bounding in carrying a water bottle, as though fresh from his workout. As a teacher, he told me, his reward is

the gratification he feels when greeting students who are learning how to change their lives. The students quickly surrounded Whitney and proceeded to gratify him with hugs and handshakes and photos. Dr. Thompson patted him on the

back. Yarbrough got his autograph. A nurse from New Jersey said she was ''so touched'' to learn that Whitney's a Christian, and Whitney answered, ''Let me tell you, I've been blessed to handle God's money.''

He was soon strutting before them, saying again that real estate is ''the simplest way to make a lot of money'' but

warning them to be careful out there, because ''people don't always have your best interests in mind.'' In fact, he said ''in

9 out of 10 cases they don't.'' And that's why they needed more education -- to learn what they could expect.

''We've got a lot of classes,'' he went on. ''You probably think they're expensive.''

''They are expensive!'' Yarbrough called out from the front of the class.

Whitney turned to regard her. Yarbrough stared back at him. He began to insist that his profit margins were reasonable, that he wasn't gouging anyone, but Yarbrough quickly stopped him. ''Let me say,'' she replied, ''that if we didn't

want to be here, we wouldn't be here. Nobody twisted our arms.''

Page 13

Russ Whitney Wants You to Be Rich The New York Times March 18, 2007 Sunday

Whitney couldn't help but snort. He said he'd fire the salesman who didn't twist arms, and everybody had a good

laugh.

URL: http://www.nytimes.com

SUBJECT: REAL ESTATE (90%); WAGES & SALARIES (90%); WEALTHY PEOPLE (89%); MARKETING &

ADVERTISING (78%); ANIMAL SLAUGHTERING & PROCESSING (76%); TELEVISION PROGRAMMING

(72%) Real Estate; Finances; Frauds and Swindling; Prices (Fares, Fees and Rates); Suits and Litigation; Advertising

and Marketing; Real Estate; Credit and Money Cards; Housing

ORGANIZATION: SECURITIES & EXCHANGE COMMISSION (59%) Securities and Exchange Commission;

Whitney Information Network

PERSON: Randall Patterson; Russ Whitney

GEOGRAPHIC: FLORIDA, USA (78%) UNITED STATES (78%) Tennessee

LOAD-DATE: March 18, 2007

LANGUAGE: ENGLISH

GRAPHIC: Photos: Millionaire Hopefuls -- Students in a Whitney course ride a bus (left) to Fort Myers, Fla., where

they visit a house (right) offered as an example of an investment property. Whitney (center) addresses a Millionaire U

class. (Photograph By Brent Humphreys/Redux, For The New York Times)(pg. 105)

At the Wealth Intelligence Academy -- Students pay $4,995 for advanced courses. As chief executive of the company,

Whitney earned $1.6 million in 2005. (Photograph By Brent Humphreys/Redux, For The New York Times)(pg. 106)

(Photographs by Brent Humphreys)(pg. 102)

PUBLICATION-TYPE: Newspaper

Copyright 2007 The New York Times Company

1006 of 1258 DOCUMENTS

The New York Times

March 18, 2007 Sunday

Late Edition - Final

What Are The Amoral House Flippers, Charming Jerks, Snotty Buyers

And Greedy Sellers Of The New Property Shows Really Trying To Teach

Us?

BYLINE: By Rob Walker.

Rob Walker writes the Consumed column for The New York Times Magazine and is working on a book about consumer behavior.

SECTION: Section 6; Column 1; Key; TV LAND; Pg. 92

Page 14

What Are The Amoral House Flippers, Charming Jerks, Snotty Buyers And Greedy Sellers Of The New Property

Shows Really Trying To Teach Us? The New York Times March 18, 2007 Sunday

LENGTH: 4099 words

What makes a house a home is a topic suitable for poetry. But a house or a home is always something else. It is

property. Does this fact contain poetry? Probably not. But it does contain entertainment. It's a form of television entertainment I'd never paid the slightest bit of attention to until I got involved in buying property myself, which happened

right around the time that the long housing boom was unraveling last year. Previously invisible to me, these entertainments were, for months, the only things I wanted to watch. Buying, selling, updating, restoring and ''flipping'' for quick

profits -- it all ran together, but I watched even when I couldn't remember if the title of a certain show was ''Flip This

House'' or ''Flip That House.''

It turned out these were two different shows, and with every ''pain of U.S. housing slump'' headline, the inventory

of real estate entertainment looked a little more glutty. It made me ponder this curious genre's fate. Like sunny sellers'

agents, television executives and producers assured me that such shows had a post-housing-bubble future that was already in the works. I looked for signs of what that might mean as I watched, and pondered just what it was I was tuning

in to see. HOW TO EXPRESS THE SELF

In the distant world of 1980, episodes of ''This Old House'' began appearing nationally on PBS stations, documenting the restoration of an 1860 Victorian in Boston. Long, calm, detailed and earnest, the project carried the warm glow

of education and New England do-goodism. In time, ''This Old House'' became a franchise (multiple shows, books, a

magazine); its original star, a builder named Bob Vila, left in a dispute over endorsement deals and became a brand unto

himself. The Thoughtful Improvement ethic -- or at least the phrase ''do it yourself'' -- became a trendy idea.

Entertainment is supposed to be better in the hundreds-of-channels present than it was in 1980, but of course new

places for expressing ideas do not guarantee new ideas. The upshot is that what used to be a concept for a show is now

the basis for a genre, in the form of dozens of shows, entire channels, a category. The HGTV channel went on the air in

1994 and is now in more than 91 million homes; it's owned by Scripps Networks (which also owns DIY Network, Food

Network and Fine Living). HGTV is a soft, warm, pleasant place where nice ladies make quilts during the day and nice

young couples redecorate at night and lots of ''tips'' are shared. Here the home is an expression of the self: Michael

Dingley, senior vice president for programming and content strategy, says the channel aims to ''provide ideas and inspiration, to make the home better.'' He continues, ''And I don't mean home as in the sense of four walls, but also home in a

more emotional kind of way, more abstract.''

In 1999, the channel started ''House Hunters,'' which is now on five nights a week and is among its most popular

shows. On each episode, the hostess, a genial automaton called Suzanne Whang -- always shown wandering through

some anonymous suburban environment -- gives us a chipper sketch of the house hunter and his or her desires (the

software engineer seeking a shorter commute, the single mom looking for space, the tedious young English prof who

wants to have poets over more often, etc.) and three available choices. She remains in her undisclosed location as we

follow the hunter through the houses, scrutinizing pros and cons, while canned music plays just audibly enough to subtly suggest that something is happening. The episodes conclude with a decision, and usually a coda about how it all

worked out perfectly.

In part, ''House Hunters'' simply recreates the way that property functions as entertainment in the real world: like

scanning the real estate pages for new listings and going to open houses, it's a part of the mildly voyeuristic pastime of

''seeing what's out there,'' of taking a peek at how other people live, a crash course on the market in Chicago or Atlanta

or elsewhere.

Along with HGTV's home design shows, Dingley maintains, such programming demystifies property, and has

''enlightened and empowered consumers.'' He uses the phrase ''relevant entertainment.'' On ''House Hunters'' you may

learn that $379K gets you a surprisingly nice 3 BR, 2000 SF, 1927 Craftsman in Seattle. But by and large these happy

families are all the same: enlightened and empowered to congratulate themselves for having the same instinct for which

wallpaper is ''dated'' and which mantle has ''a lot of character'' that everybody on all the other shows has.

Meanwhile, much is left out. Buyer's remorse, for instance, never materializes. Almost all of the property shows

avoid one of the screaming issues of real-life real estate, which is the neighborhood. No one mentions crime statistics,

lousy school systems or proximity to homeless shelters or Superfund sites. In an episode of ''House Hunters,'' a cute

young New Jersey couple move to the shore, specifically to Asbury Park, which Whang brightly calls ''a majestic

boardwalk town.'' Have you ever been to Asbury Park? She adds that the place was made famous by the songs of Bruce

Springsteen, and that's true. For instance, it inspired ''My City of Ruins.''

Page 15

What Are The Amoral House Flippers, Charming Jerks, Snotty Buyers And Greedy Sellers Of The New Property

Shows Really Trying To Teach Us? The New York Times March 18, 2007 Sunday

HGTV, Dingley explains, is not a ''mean-spirited'' place. ''We're not a snarky, mean, nasty brand.'' Perhaps the

channel offers shelter from gloomy homeowner news. ''For most folks, a home is not only the most expensive investment in their lives, it's also the most personal,'' he says, and a rockier housing market sharpens the viewers' interest in

''making the right, prudent decision.'' That said, its ''relevant'' programming has been expanding to encompass a bit more

of the things that have dominated property entertainment on those networks that are a little less concerned about how

mean-spiritedness might affect the brand: namely, money and drama. HOW TO BE GREEDIER

The American entertainment consumer surely seeks enlightenment on matters of taste and style, but also on that

other key aspect of the self, net worth. The soaring stock market of the late 1990s made CNBC almost as popular as

CNN, supposedly because we'd become an enlightened and empowered nation of investors, but really because bull market geniuses loved watching a game they never seemed to lose. Tanking markets cleared up the difference between personal finance and rollicking fun, and CNBC's viewership retreated to niche levels. The Thoughtful Improvement ethic

of ''This Old House'' and the Something for Nothing ethic of Nasdaq-as-sporting-event come together in the form of the

flip shows. Don't make a home, don't invest in a house -- flip a property: how much money, how fast, for how little effort, can be extracted from a shabby, crumbling residence? Booyah! -- as CNBC throwback Jim Cramer might shout -now you've got something.

TLC has included home-related programming since 1997 (starting with Bob Vila's post-''This Old House'' project,

''Bob Vila's Home Again''). And its show ''Trading Spaces'' -- in which neighbors redecorate each other's homes -- was a

home-entertainment milestone. The network began airing ''Flip That House'' in 2005. Every half-hour episode features a

different ''flipper,'' some experienced, some with no particular background in real estate or construction but with an interest in what (on television at least) sounds like easy money. We learn the purchase price, tour the generally ramshackle property, and listen to an overview of planned updates and renovations. Usually a demolition montage follows: carpets ripped out, off-trend cabinetry smashed to pieces with a sledgehammer. Episodes involving experienced flippers

tend to go rather smoothly, and I suppose the instructional payoff for the viewer comes in the form of tips. These generally involve granite countertops, Brazilian cherry wood floors, travertine tile. Often, the tips are communicated in the

form of orders issued to the stoic head of some all-Hispanic construction crew, who simply nods.

The profit motive obliterates home-ness and all other topics. An episode involving a guy named Hay, who is ''in

the entertainment industry,'' and restores houses in the area once known as South Central Los Angeles so he can rent

them, begins: ''The 1992 riots tore the city apart. But now it's become an attractive destination for house flippers, hoping

to turn their property into profit.'' He goes over budget, and we learn to use angled paint brushes. When he's done, the

real estate agent says he can get $1,600 a month for the place.

The vague idea of learning from the pros animates ''Flip That House'' rival ''Flip This House,'' which runs on A&E.

''We're constantly looking to evolve the shelter brand,'' executive producer Michael Morrison informs me. ''And one of

the trends in real estate, obviously, is house flipping.'' ''Flip This House'' also made its debut in 2005, and rather than an

endless series of flippers, revolves around recurring sets of real estate pros. The first season followed Trademark Properties, based near Charleston, S. C. and run by Richard C. Davis. The second season has focused on two different realty

teams, one in San Antonio and one in Atlanta. ''Flip This House'' episodes each last an hour, and what's added to the mix

of tips are basic elements of drama. Most notably, the stars get more full-fledged character treatment.

The San Antonio shows are the serialized adventures of Armando and David Montelongo, who are brothers, and

their wives. The series works more because the people happen to be entertaining than because they happen to work in

real estate. Armando in particular has just the sort of polarizing charisma that can carry a show. A charming jerk, he

lowballs subcontractors, bullies an unpaid intern and taunts his wife with a fistful of roaches grabbed from the kitchen

of one nasty property he has acquired, pausing now and again to reflect on the all-American success story of his life so

far.

In one episode, for no obvious reason, the brothers and their wives compete, flipping two houses at once to see

who can make more money. By the time girls in bikinis arrive to distract one team's subcontractors with free beer, the

Enlightened Improvement ethic has been reduced to occasional text popping up on the screen making neversubstantiated assertions about how much ''value'' a new fence or windows supposedly add to the final sales price.

Davis of Trademark Properties will be back on television soon enough, as it happens, with a new show over on

TLC. It's called ''The Real Deal,'' and it will, as he describes it, be firmly about the business of real estate. Davis is a

creature relatively rare in entertainment but commonplace in real life: The Southern hustler, who doesn't care what

slow-witted stereotypes you read into his accent as long as he gets your money. Davis -- still involved in a lawsuit

Page 16

What Are The Amoral House Flippers, Charming Jerks, Snotty Buyers And Greedy Sellers Of The New Property

Shows Really Trying To Teach Us? The New York Times March 18, 2007 Sunday

against A&E that he filed after the channel decided to use those other groups in the second season of ''Flip This House''

-- sounds flat-out thrilled about the end of the housing bubble.

Seven years ago, real estate was dominated by ''A players'' like him. Eventually, ''you got to the point where you

got your F players in the game--and making money!'' Now that that's over, ''it becomes survival of the fittest, and cash

becomes king,'' he says, and the banks start telling loan-seeking F players to go back to their day jobs. He believes that

this will be good not only for Trademark, but for his show. ''Flip This House,'' he says, ignored the important point that

the key to his business isn't mere remodeling prowess; it's knowing how to find properties that are a bargain to begin

with. The premise of his show is that he is an inspiring, visionary entrepreneur, and a down market will only make that

clearer. ''That's when I'll entertain you the most,'' he says. ''My most dramatic deals are always in a down market. That's

when it gets really crazy, and really fun.'' HOW TO ENJOY THE MISFORTUNE OF OTHERS

Watching other people make money because they're smarter than I am doesn't actually sound like that much fun,

but there's little danger of it on another flip show on TLC that I found perversely gripping, ''Property Ladder.'' All reality

shows rise and fall on casting, and despite the show-opening tease (''Want to make more money in a few months than

you did last year?''), here the producers seem bent on finding ''real estate rookies'' capable of catastrophe. One episode

involved lunkhead buddies who got interested in house-flipping through an infomercial. In another, a newly married

couple more or less disintegrate over the course of an ill-fated, months-long flip fiasco. Shouting matches feature prominently in nearly every installment.

Like ''Flip That House,'' the show focuses on a different project every week. The twist is an expert named Kirsten

Kemp (billed as a veteran house flipper, she also, somewhat curiously, happens to have a bit-part acting resume that

includes appearances on ''JAG'' and ''Married With Children''), who shows up periodically to give advice and pass

judgment. My favorite episode involved a Simi Valley couple who bought a ''wrecked'' and ''abandoned'' house for

$435,000 and not only planned to flip it for $600,000 after putting in $50,000 worth of renovations over 10 weeks, but

pledged to do so in an eco-friendly manner. ''We're really supporting the planet this way,'' the wife cheerfully explains,

wearing an unconvincing smile that stays frozen on her face through the many disasters that follow.

Kemp openly scoffs at the particulars of their budget and makes a face when told about plans for a solar panel.

She tells them they're better off putting French doors in the master bedroom -- that way they will actually add some value. Perhaps what ensues can be characterized as advice. The smiling wife buys eco-trendy bamboo flooring but ''violated her green ideals,'' as the near-mocking narrator puts it, when tiles made from recycled material prove too expensive.

They also blow off some ''energy efficient'' windows in favor of the French doors that Kemp suggested, and of course

they give up on the solar panel scheme as time runs short and their spending balloons. And when Kemp returns toward

the end of the show, they inform her (big smile from the wife here) that not only did they opt not to install air conditioning, but they're going to sell the house themselves so they won't have to pay a real estate agent's fee.

Kemp is TV-attractive, articulate and informed, but her most fascinating quality is her two-faced snakiness. She

hugs her amateur charges, softens her stern advice and raised eyebrows with compliments and smiles - and then, alone

with the camera, coldly enumerates how they blew it. In this case, Simi Valley's summer highs average 91 degrees, and

the for-sale-by-owner approach just proves that in addition to being naive, the eco-flippers are greedy. It will end up

costing them money, she announces. And indeed, the show closes with a montage of months passing with no offer; an

end note says they finally went with a listing service, and found a buyer, after more than six months. Cackling on my

sofa, I'm pleasantly blase about where I stand in the property zeitgeist. Aside from inspirational business savvy or handy

news you can use, here's another thing that's entertaining: schadenfreude. HOW TO ESCAPE REALITY

Property shows seem so profoundly American -- it is our manifest destiny to own a 4,000-square-foot place in a

good school district within five years of obtaining a college degree -- it's a disappointment to learn that the contemporary property entertainment model is largely an import. ''Hot Property,'' which first aired on Channel 5 in Britain in

1997, involved a prospective home buyer looking at three houses. The original ''Property Ladder'' runs on Channel 4.

Fenton Bailey is one of the founders of World of Wonder Productions, which creates programming for both the

American and British markets. He's British, and he lives in Los Angeles. Not everything works in both markets. A

World of Wonder show that aired in Britain, ''Housebusters,'' addressed the problems of various homeowners -- can't

make friends in the neighborhood, can't seem to save any money since moving -- by bringing in supernatural types like

a ''geopathic stress'' expert, an electromagnetics guy, a feng shui advocate, a psychic and even a witch. Americans, he

says, seem uninterested in home solutions that are less tangible than, say, buying a plasma-screen television, and Bravo

passed on a United States pilot.

Page 17

What Are The Amoral House Flippers, Charming Jerks, Snotty Buyers And Greedy Sellers Of The New Property

Shows Really Trying To Teach Us? The New York Times March 18, 2007 Sunday

But the markets also have much in common. The key to property drama, Bailey says, is the key to all drama:

transformation. ''Very little of what's on television is about accepting who you are and being happy with it. The old you,

the threadbare you -- no one wants to know about that.'' If anything, he says, the British housing market has been even

more overheated than the United States market, and got that way earlier. And finally, he says, ''The destiny of television

is to put everything on television,'' so housing shows had to happen at some point.

''Buildings and interiors have been only something the very rich can enjoy,'' Bailey continues. ''They formed an

elite pastime that's been absolutely democratized by television.'' World of Wonder also happens to be responsible for

''Million Dollar Listing,'' which ran on Bravo last year and probably made real estate more entertaining than any other

single show, not least because it took place in Malibu, a world well beyond the reach of most of the democratized audience.

Over the course of six episodes, ''Million Dollar Listing'' deconstructed transactions and failed transactions in

astonishing detail, giving a more complete version of the harrowing mix of emotions and egos and half-truths of the

property drama. Getting suitable access to so many buyers, sellers and agents consumes a great deal of time, and Bailey

says the first season of ''Million Dollar Listing'' took nearly a year to complete; a second season is being cast now. Bailey doesn't sound worried about what effect the housing slump might have on the show, and it's easy to see why. ''Million Dollar Listing'' deals with falling property values by unfolding in the borderline freak show of high-dollar Southern

California, with characters who make Armando Montelongo look like a cream puff as they whine and wheedle in the

never-ending sunlight of this promised land. By now we are far from ''This Old House,'' where an earnest discussion of

cabinet installation might last three or four minutes and include the phrase ''medium density fiberboard with a thermofoil wrap.'' The only practical bit that I picked up from ''Million Dollar Listing'' was the superiority of ''whitewater''

ocean views to regular old ocean views. You can't get any further away from everyday reality without actually making

things up.HOW TO OBLITERATE THE SELF

''Many citizens set out to buy a house because of an indistinct yearning, for which an actual house was never the

right solution to begin with and may only be a quick (and expensive) fix that briefly anchors and stabilizes them, never

touches their deeper need, but puts them in the poorhouse anyway.'' So observes Frank Bascombe, narrator of Richard

Ford's novel ''The Lay of the Land.'' Bascombe drifted into realty in Ford's earlier novel ''Independence Day,'' and while

he may have done so in order ''to keep something finite and acceptably doable on my mind and not disappear,'' he is

perhaps the wisest observer of property drama we are likely to have.

The agony of property, for example, is rarely more visceral than in the long episode in ''Independence Day'' in

which Bascombe deals with a Vermont couple whose problems will most likely not be solved by a new home in New

Jersey. ''The realty dreads,'' in his view, are never about lost money or the wrong house, but ''in the cold, unwelcome,

built-in-America realization that we're just like the other schmo, wishing his wishes, lusting his stunted lusts, quaking

over his idiot frights and fantasies, all of us popped out from the same unchinkable mold.'' Thus when Bascombe successfully leads clients ''toward a feeling of finality and ultimate rightness,'' he achieves an outcome that is ''not poetry

but generalized social good with a profit motive.''

Television, however, differs from literature in the following way. The dramatic shows, for all their tears and

shouting matches, in the end, read as harmless, campy cartoons. It's the happy shows full of smiles and high-fives -- the

ones that loudly promise us that you need not worry about unchinkable molds when you can consider how much airier

the living room will feel if you simply move that sofa -- where, every so often, thin cracks in the happy facade can reveal things wholly unintended.

One of HGTV's newer hits, for instance, is the perfectly upbeat ''Designed to Sell.'' A relatively winning host

named Clive introduces us to someone who is having trouble selling a home and brings in experts to improve things as

much as possible for $2,000. One step in the process involves the homeowners watching a videotape of a real estate

agent walking from room to room, enumerating what they've done wrong. The basic lessons recur over and over: reduce

clutter, define the space, brighten up this bedroom, do something about the dated window treatments, and please, American house sellers, pack away your myriad collections of weird figurines immediately. What we learn, in other words, is

that despite the supposed home-design revolution, you people have not gotten the point.

Clive and a rotating crew of design experts soften the blow by reminding the homeowners, and us, just what the

point is: money. ''More light, more space . . . more money,'' one designer announces. Replace this ''losing-money lime''

color with a ''money-making mushroom'' hue, Clive advises, and ''Top dollar!'' he says, many times. So the homeowners

shrug off the remarks about their grandmotherly decor by smiling and saying, for instance, ''Ka-ching!' Or in one episode, huddling with the design team and chanting, ''One, two, three -- money!''

Page 18

What Are The Amoral House Flippers, Charming Jerks, Snotty Buyers And Greedy Sellers Of The New Property

Shows Really Trying To Teach Us? The New York Times March 18, 2007 Sunday

A remarkably similar show called ''Sell This House,'' on A&E, stars Tanya Memme, a high-energy party girl type

who favors plunging necklines and has no obvious skills, and a bulbous-muscled bear named Roger, identified as a

''home design consultant.'' In this version, the flummoxed homeowner listens to the snide, videotaped remarks of random prospective home buyers. The most crushing episode involved a faultlessly polite Southern woman whose wallpaper looked to be 31 years old for the simple reason that she had never stopped liking it. Other features of her long time

home include shag carpeting, a mind-boggling menagerie of tchotckes and a mailbox done over to resemble a fish. The

videotaped critiques are much what you'd expect, with the added insult of some ill-mannered oaf saying that the place

''smells like old people.''

''I will admit,'' this sweet woman tells Tanya Memme, ''I did cry.'' She knows full well that her things might seem

idiosyncratic -- but they are her things. And she cannot for the life of her see what difference that makes. ''If they buy

the house, there won't be any of this stuff here,'' she says, reasonably. ''That was my version.''

Here we learn the ultimate lesson of these shows: You can look at a free-standing building wherein some persons

reside, and you can spin house-or-home poetry out of that all day long. But at the end of that day, property is what it is.

Your home can look like an expression of you, but your property needs to look like a Pottery Barn catalog. Your wallpaper decisions may have expressed your individuality when you made them, but you are not an individual anymore,

and no one wants to think about you. Stop expressing yourself. This place you live needs to look, in fact, like the total

obliteration of ''you,'' because selling property is about someone else's dreams of self-expression and taste.

Tanya and Roger rip up the carpet and consign to storage every object that means anything to the nice Southern

lady. When the show ends, Tanya brightly informs us that prospective buyers are giving it ''a second look.'' In other

words, it hasn't sold. One imagines the dignified and bewildered owner imprisoned there still, looking around at the

catalog pages that have become, not so much her home, but merely the place where she lives.

URL: http://www.nytimes.com

SUBJECT: POETRY (90%); TELEVISION INDUSTRY (90%); LITERATURE GENRES (89%); REAL ESTATE

(78%); HOUSING MARKET (78%); RESIDENTIAL PROPERTY (78%); TELEVISION PROGRAMMING (77%);

PUBLIC TELEVISION (77%); NETWORK TELEVISION (74%); ETHICS (71%) Housing; Television; Television;

Television

COMPANY: FOOD NETWORK (50%)

PERSON: Rob Walker

GEOGRAPHIC: BOSTON, MA, USA (54%) NORTHEAST USA (70%); MASSACHUSETTS, USA (54%) UNITED STATES (70%)

LOAD-DATE: March 18, 2007

LANGUAGE: ENGLISH

GRAPHIC: Photos (Illustratons by Todd St. John)(pgs. 91,93,94,95)

PUBLICATION-TYPE: Newspaper

Copyright 2007 The New York Times Company

1007 of 1258 DOCUMENTS

The New York Times

Page 19

Paradise, In Contract The New York Times March 18, 2007 Sunday

March 18, 2007 Sunday

Late Edition - Final

Paradise, In Contract

BYLINE: By Somini Sengupta.

Somini Sengupta is chief of The New York Times's South Asia bureau.

SECTION: Section 6; Column 1; Key; Pg. 97

LENGTH: 3109 words

One afternoon in December, Roy Patrao peered through a sturdy iron gate and scanned the gnarled roots of a tree

embracing the ruin of an old stone house. Only a shell of the house survived, with thick columns holding up a portico. A

window shutter made of seashells and slatted wood was visible amid the overgrown bush. On this plot of land, Patrao

saw his dream.