Development Review - Short Answer / Long Essay (Please circle

advertisement

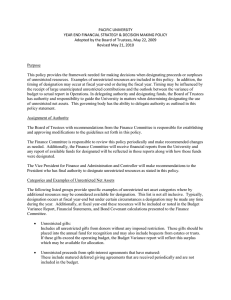

Development Review - Short Answer / Long Essay (Please circle one) Number _20_ 2005 Copy the Question here: Question: (a) What are the arguments in favour of unrestricted flows of financial capital between countries? (b) How might unrestricted capital flows be damaging to less developed countries? What are the 2-3 key words in the question to pay attention to? You should underline these in a real test situation. List Verb(s) and Nouns (concepts): (a) arguments in favour, unrestricted financial capital, between countries. (b) Damaging, LDCs What are the concepts to provide definitions for? Define them precisely here: (a) Financial capital flow: A net flow of financial capital, between countries, in the form of increased purchases of domestic assets by foreigners and/or reduced holdings of foreign assets by domestic residents. (b) LCD: Less Developed Country, a country which among other things suffers huge poverty, big unemployment, rapid population growth, income inequality, low savings etc. (The first characteristic (and the most important) should be low GNP per capita!) Structure of your answer What graph should you What example can you draw for this point? provide to illustrate your point? (Use numbered lists or bullet points: develop and explain your argument so that others can understand – no need to write them out here as this is only for your review. Please insert more rows as necessary). Remember to EVALUATE for Part B of Long Essays: (a) Free trade makes everyone better off. Production possibility Brazil has a comparative curves for two countries advantage in producing But free trade is not the same as free financial flow. You can have free showing free trade. bananas and thus trade trade with still restricting financial flow. So you have to make the case with the US and import that not only free trade is good but also that free trade is EASIER with computers, and vice versa. free financial flow – then it would be a good idea to have free financial flow. This is perhaps THE most important reason why there should be free financial flow. Many of your other points are simply discussing benefits of free TRADE, India and computer not free capital movements!!! software. This question needs to be almost completely revamped – you answered a different question!!! This would be disastrous on a real IB exam. HINT: Why should there be free capital flows – financial capital??? What does that do to investment in different countries? The entire world becomes one national market where investors can choose where to invest their money. What does that do to exchange rates and national monetary policies? (a) Introduction of new technology. Unrestricted financial capital flow will lead to an exchange of technology that will increase the world standard. (a) Consumers can enjoy more diverse products and producers can enjoy a bigger market to supply. (a) Reduce unemployment in LDCs (b) MNCs might push domestic firms out from the market and thus creating monopolist markets. The domestic firms might have been able to employ more people and generate more domestic income than the MNC. Thus making it more beneficial for the LDC. (b) Foreign firms might bring in inappropriate technology in a labour abundant LDC, thus creating a spill over effect that will further increase unemployment. (b) If a LDC has too much foreign investment its economy will be reliant on foreign firms and organs. (b) A threat to sustainable development since the foreign investors might AD/AS diagram. pull out from the LDC when the costs have increased. If there was no Italian cheese in Norway. Nike in Vietnam. Pepsi in Uganda. Introducing shoemaking machines in China Factories in the free trade zone in Jamaica left and domestic market for the particular good it will leave the LDC with more left people unemployed. unemployment than before and thus lower consumption. Multiplier effect will affect national income. Summary Conclusion (one sentence) (b) Unrestricted financial capital flow might be damaging to a LCD since it will make the domestic market vulnerable and might be a threat to sustainable development.