OLIGOPOLY.doc

advertisement

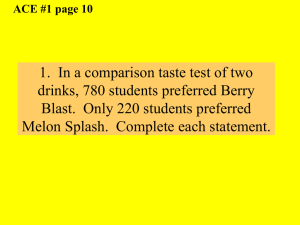

OLIGOPOLY Main Characteristic: (See the text book for a complete list of features. These are the essential elements.) Few firms: 1. Each firm is a large enough part of the market that the behaviour of one firm has a large impact on the demand curve of the others. 2. The result is that the firms do not have stable demand curves. If Pepsi changes its price, Coka Cola’s demand curve shifts. 3. As a result the method of finding the profit maximising output by comparing the firm’s costs to the firm’s demand curve is complicated or unworkable. Pepsi can decide on its best price and output, but then Coke will react and change its price or output. That will shift Pepsi’s demand curve, changing its best strategy and so one and so on. The ordinary model of the firm is less applicable, because the demand curve of one firm depends on the behaviour of other firms. If Pepsi introduces a price cut, the Coke will lose large numbers of customers. The price of a substitute will have changed If Pepsi raises its price, Coke’s demand curve shifts out. Coke won’t mind, but Pepsi will very likely find the quantity it sells falls very sharply. If Pepsi lowers its price, it will likely win many customers from Coke and have a very large increase in total revenue. Coke’s demand curve will shift in sharply and Coke will be very unhappy. Coke is very unlike to stand by and let Pepsi undercut its price. If Pepsi insists on reducing its price, Coke will very like have to match the cut. When Coke matches Pepsi’s price, the other things equal assumption doesn’t hold. Pepsi’s price reduction causes an equally large change in price by Coke, and Pepsi’s demand will not increase nearly so much. Kinked demand curve If initially the price is P, and Pepsi increases its price, only true blue Pepsi loyalists will continue to buy it, and others will switch to Coke. Coke is quite happy to let this happen. But if Pepsi reduces its price, Coke can’t stand by and lose its customers who may even come to develop a taste for Coke; preferences often depend in part on habit. As a result, Coke will match Pepsi’s price cut. If Coke becomes as cheap as Pepsi, customers have little reason to switch. The total quantity demanded will increase somewhat because the price of cola has fallen, but the danger of a price war is great. In that case both firm’s are likely to suffer heavy losses. The result, is that Pepsi and Coke try to avoid price competition. Instead they use advertising to compete and prices stay relatively stable. While many oligopolies behave this way, the strategies that firms follow vary from industry to industry – and the strategies depend on the legal environment. Canada has generally taken less strong action against firms operating to restrict competition than the U.S. In the past, some European countries permitted explicit contracts to restrict competition. Even in the United States, firms have found ways to agree not to compete without specific contracts that break the law. Common Behaviours: 1. Fix prices and act like a monopolist. a. In some nations, can sign a contract and form a cartel that sets a price and assigns an output to each firm. b. It may be profitable for some firm to ‘cheat’ and try to sell a larger quantity, even at a lower price. So cartels are unstable. 2. Enter into competition which results in relatively low prices. Depending on the nature of the market for the product, expenditures on advertising, packaging and product development may be high. 3. Compete on quality, advertising, packaging or other non-price characteristics. a. This behaviour avoids the tendency of price competition to reduce profits. b. It has proved to be a more stable behaviour than cartels. c. Free trade increased price competition in automobiles and many other commodities. Game theory: A method of analysing behaviour in an oligopoly. It plots out the strategies of firms. Each firm plots out its best behaviour, depending on what the other firm does. It’s like two people arrested for a crime. If neither confesses they both go free. But the first one to confess receives a sentence of 3 months. The other receives a sentence of 3 years. Most likely they will each rush to be first to confess. They would be better off if both kept quiet, but that strategy requires a very high degree of trust. – Now if the mafia lurks in the background and promises to shoot whoever confesses, they will keep quiet. In oligopoly the ‘confess’ strategy may be to cut prices. The first to cut prices will make the big gains in the market. The one who maintains a fixed price will take a large loss. So, if there is no equivalent to the ‘mafia’ both will rush to cut prices. However, there may be something like the ‘mafia’ to prevent price cutting. The biggest, strongest, lowest cost firm may be able to really hurt a smaller, weaker firm by cutting prices in its home market, or by maintaining a low price until the weak firm goes bankrupt. It is costly even for the big firm, but may discourage the small firm from even thinking about cutting prices. Main Point: Oligopolistic behaviour is complex – and lots of fun. Each firm behaviour regarding price, quantity, advertising, or product development influences the other firm’s profitability. As a result, firms can not make a decision without influencing the demand curve of its rivals. As a result, the rivals most desirable choice changes. They will respond, perhaps retaliate is a better word. A firm must consider the reaction of its rivals when it chooses its behaviours. In a static, well established business with good understanding among the firms, they may behave like a monopoly. In a more dynamic industry, firms are likely to want to make sure they keep their share of the dynamic market growing. In any case, some young scalawag with a new low cost firm may upset the apple cart. If it has a substantially superior product, or substantially lower costs, then it may be able to cut prices or just expand sales and encroach on other firms and be safe from retaliation.