Key

advertisement

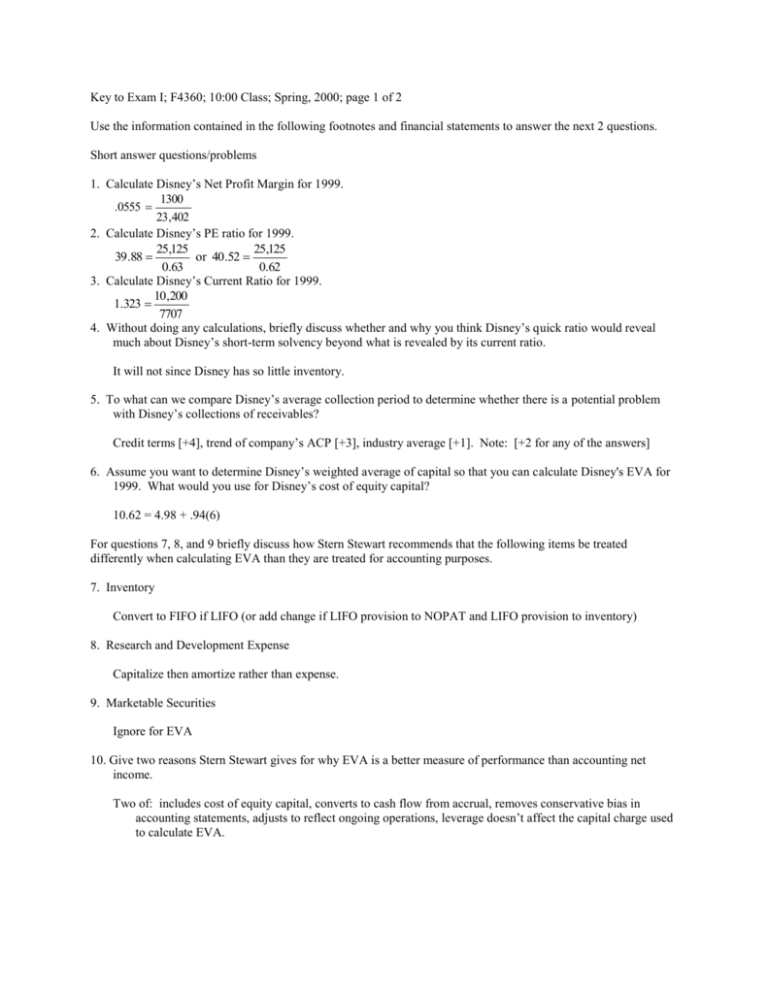

Key to Exam I; F4360; 10:00 Class; Spring, 2000; page 1 of 2 Use the information contained in the following footnotes and financial statements to answer the next 2 questions. Short answer questions/problems 1. Calculate Disney’s Net Profit Margin for 1999. 1300 .0555 23,402 2. Calculate Disney’s PE ratio for 1999. 25,125 25,125 39.88 or 40.52 0.63 0.62 3. Calculate Disney’s Current Ratio for 1999. 10,200 1.323 7707 4. Without doing any calculations, briefly discuss whether and why you think Disney’s quick ratio would reveal much about Disney’s short-term solvency beyond what is revealed by its current ratio. It will not since Disney has so little inventory. 5. To what can we compare Disney’s average collection period to determine whether there is a potential problem with Disney’s collections of receivables? Credit terms [+4], trend of company’s ACP [+3], industry average [+1]. Note: [+2 for any of the answers] 6. Assume you want to determine Disney’s weighted average of capital so that you can calculate Disney's EVA for 1999. What would you use for Disney’s cost of equity capital? 10.62 = 4.98 + .94(6) For questions 7, 8, and 9 briefly discuss how Stern Stewart recommends that the following items be treated differently when calculating EVA than they are treated for accounting purposes. 7. Inventory Convert to FIFO if LIFO (or add change if LIFO provision to NOPAT and LIFO provision to inventory) 8. Research and Development Expense Capitalize then amortize rather than expense. 9. Marketable Securities Ignore for EVA 10. Give two reasons Stern Stewart gives for why EVA is a better measure of performance than accounting net income. Two of: includes cost of equity capital, converts to cash flow from accrual, removes conservative bias in accounting statements, adjusts to reflect ongoing operations, leverage doesn’t affect the capital charge used to calculate EVA. Key to Exam I; F4360; 10:00 Class; Spring, 2000; page 2 of 2 Problems/Essays 1. Assume that Disney’s weighted average cost of capital is 9.97%. Calculate the capital charge used to determine Disney’s EVA for 1999. Operating cash plus: Receivables Inventory Other Current Assets Plant & Equipment Intangible Assets Capitalized R&D Other Assets less: Current liabilities Capital 127 3999 899 3887 10,346 16,940 0 4049 - 5402 34,845 [+4] [+4] [+4] = 3223 [+3] + 664 [+3] [+4] = 15,787 [+3] + 1153 [+3] [+4] = 2506 [+3] + 1543 [+3] =4767 [+3] + 635 [+3] Capital charge = 3474.05 [+2] = 34,845 x .0997 [+4] 2. Suppose you are interested in determining whether Disney has too much debt. Note on grading of #2. The numbers in brackets represent the number of “checks” possible for each concept. Use the scale at the bottom to convert to points out of 50 possible. a. Which ratios would you calculate? Debt ratio [4], interest coverage ratio [4] b. Calculate these ratios for 1999. Debt Ratio .51979 43,679 20,975 43,679 Interest Coverage Ratio 4.78105 [8] 2314 612 [8] 612 c. How would you go about using your numbers in part b to figure out whether Disney has too much debt? Debt ratio above [2] industry averages [4] and to a lesser extent above [1] own historical debt ratios [2] Interest coverage ratio less than [2] 1.0 [4] (which it is [2]) and to a lesser extent less than [1] the industry average [2] and less than [1] own historical interest coverage ratios [2] Scale [checks = points]: 42=50, 39-40=49, 38=48, 36=47, 35=46, 34=45, 33=44, 32=43, 31=42, 30=41, 29=40, 28=39, 27=38, 26=37, 24=36, 20-22=35, 17-18=34, 15-16=33, 13-14=32, 10-12=31, 7-8=30, 4=28, 3=27, 2=25 Market Based Information on Disney: Closing price for Disney stock: $25.125 on September 30, 1999, $25.375 on September 30, 1998 Disney’s Beta was 0.99 as of September 30, 1999 and 0.94 as of September 30, 1998 Return on 30-year Treasury Strip: 6.06% as of September 30, 1999 and 4.98% as of September 30, 1998 Information from Footnotes for Disney: Note 1: Investments includes debt securities and equity investments. The Company's share of earnings or losses in its equity investments is included in "Corporate and other activities" in the Consolidated Statements of Income. Note 10: Detail of Certain Balance Sheet Accounts 1999 1998 -------------------------------------------------------------Current receivables Trade, net of allowances Other Other current assets Prepaid expenses Other $ 3,160 473 ------$ 3,633 ======= $ 3,447 552 ------$ 3,999 ======= $ $ 515 164 ------$ 679 ======= Intangible assets Cost in excess of ABC's net assets acquired $14,248 Trademark 1,100 FCC licenses 1,100 Other 856 Accumulated amortization (1,609) ------$15,695 ======= 483 181 ------$ 664 ======= $14,248 1,100 1,100 492 (1,153) ------$15,787 ======= The Walt Disney Company CONSOLIDATED STATEMENTS OF INCOME (In millions, except per share data) Year Ended September 30 1999 1998 1997 ----------------------------------------------------------------------------Revenues Costs and expenses Amortization of intangible assets Restructuring charges Gain on sale of Starwave Gain on sale of KCAL Operating income Corporate and other activities Equity in Infoseek loss Net interest expense Income before income taxes Income taxes Net income Earnings per share Diluted Basic Average number of common and common equivalent shares outstanding Diluted Basic $ 23,402 (19,715) (456) (132) 345 --------3,444 (196) (322) (612) -------2,314 (1,014) -------$ 1,300 ======== $ 22,976 (18,466) (431) (64) ---------4,015 (236) -(622) -------3,157 (1,307) -------$ 1,850 ======== $ 22,473 (17,722) (439) --135 -------4,447 (367) -(693) -------3,387 (1,421) -------$ 1,966 ======== $ 0.62 ======== $ 0.63 ======== $ 0.89 ======== $ 0.91 ======== $ 0.95 ======== $ 0.97 ======== 2,083 ======== 2,056 ======== 2,079 ======== 2,037 ======== 2,060 ======== 2,021 ======== The Walt Disney Company CONSOLIDATED BALANCE SHEETS (In millions) September 30 1999 1998 ---------------------------------------------------------------------------ASSETS Current Assets $ 414 $ 127 Cash and cash equivalents Receivables 3,633 3,999 Inventories 796 899 Film and television costs 4,071 3,223 Deferred income taxes 607 463 Other assets 679 664 ------- ------Total current assets 10,200 9,375 Film and television costs 2,489 2,506 Investments 2,434 1,821 Theme parks, resorts and other property, at cost Attractions, buildings and equipment 15,869 14,037 Accumulated depreciation (6,220) (5,382) ------- ------9,649 8,655 Projects in progress 1,272 1,280 Land 425 411 ------- ------11,346 10,346 Intangible assets, net 15,695 15,787 Other assets 1,515 1,543 ------- ------$43,679 $41,378 ======= ======= LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities Accounts and taxes payable and other accrued liabilities $ 4,588 Current portion of borrowings 2,415 Unearned royalties and other advances 704 ------Total current liabilities 7,707 Borrowings 9,278 Deferred income taxes 2,660 Other long term liabilities, unearned royalties and other advances 3,059 Stockholders' Equity Preferred stock, $0.01 par value Authorized--100 million shares Issued--none Common stock, $0.01 par value 9,324 Authorized--3.6 billion shares Issued--2.1 billion shares Retained earnings 12,281 Cumulative translation and other (25) ------21,580 Treasury stock, at cost, 29 million shares (605) Shares held by TWDC Stock Compensation Fund, at cost-0.4 million shares as of September 30, 1998 -------20,975 ------$43,679 ======= $ 4,767 2,123 635 ------7,525 9,562 2,488 2,415 8,995 10,981 13 ------19,989 (593) (8) ------19,388 ------$41,378 ======= The Walt Disney Company CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Year Ended September 30 1999 1998 1997 ------------------------------------------------------------------------------NET INCOME $ 1,300 $1,850 $1,966 ITEMS NOT REQUIRING CASH OUTLAYS Amortization of film and television costs 2,472 2,514 1,995 Depreciation 851 809 738 Amortization of intangible assets 456 431 439 Gain on sale of Starwave (345) --Equity in Infoseek loss 322 --Gain on sale of KCAL --(135) Other 80 31 (15) CHANGES IN Receivables 376 (664) (177) Inventories 103 (46) 8 Other assets (165) 73 (441) Accounts and taxes payable and other accrued liabilities 477 218 608 Film and television costs television broadcast rights (319) (447) (179) Deferred income taxes (20) 346 292 ------- ------ -----4,288 3,265 3,133 ------- ------ -----CASH PROVIDED BY OPERATIONS 5,588 5,115 5,099 ------- ------ -----INVESTING ACTIVITIES Film and television costs (3,020) (3,335) (3,089) Investments in theme parks, resorts and other property (2,134) (2,314) (1,922) Acquisitions (net of cash acquired) (319) (213) (180) Proceeds from sale of investments 202 238 31 Purchases of investments (39) (13) (56) Investment in and loan to E| Entertainment -(28) (321) Proceeds from disposal of publishing operations --1,214 Proceeds from disposal of KCAL --387 ------- ------ -----(5,310) (5,665) (3,936) ------- ------ -----FINANCING ACTIVITIES Change in commercial paper borrowings (451) 308 (2,088) Other borrowings 2,306 1,522 2,437 Reduction of borrowings (2,031) (1,212) (1,990) Repurchases of common stock (19) (30) (633) Exercise of stock options and other 204 184 180 Dividends -(412) (342) Proceeds from formation of REITs --1,312 ------- ------ -----9 360 (1,124) ------- ------ -----Increase (Decrease) in Cash and Cash Equivalents 287 (190) 39 Cash and Cash Equivalents, Beginning of Year 127 317 278 ------- ------ -----Cash and Cash Equivalents, End of Year $ 414 $ 127 $ 317 ======= ====== ====== Supplemental disclosure of cash flow information: Interest paid $ 575 $ 555 $ 777 Income taxes paid $ 721 $1,107 $ 958 ======= ====== ======