Evaluate Your Open Enrollment Strategy

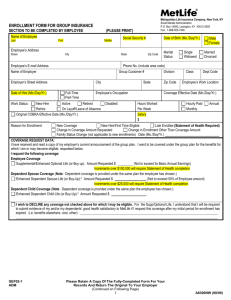

advertisement

Gauging Employee Benefits Communication Effectiveness and Preferences Open Enrollment season is the perfect time to showcase the breadth of your benefits program and the time of year that employees have to decide which benefits they will choose for themselves and their families. Understanding the effectiveness of benefits communications and employee communication preferences can help you optimize Open Enrollment and help increase employees’ ability to make smart decisions to fit their particular situations. This sample employee survey, developed by MetLife, a leading provider of employee benefits, may help you determine which benefits your employees need more help in understanding, which communications are most effective and what you can do to help improve employees’ experience during Open Enrollment. This survey is a sample of the kind of survey you can use to poll your employees. You should consult with your company’s human resources professional and legal department to determine which questions are appropriate for your employee population. How to use this survey: Review the survey questions. Use questions you feel are the most important to you and your company and appropriate for your employee populations. Each question focuses on different aspects of an employee’s Open Enrollment experience, from what tools and calculators do employees need to what can their employers do to improve employees’ experience. Customize the survey. While common answers for each question are included, this sample survey is designed to allow you to make edits and tailor the survey to your benefits program and communication tactics. Distribute to your employees. To learn what your employees think, make the survey easily accessible by your employees and clearly state that participation in the survey is completely optional. You can post to your intranet, create it in an online survey program such as SurveyMonkey or distribute via email or during employee meetings. Analyze survey responses. Based on the answers provided by your employees, you can use the information to help you refine your Open Enrollment communication strategy. Suggestions for how you can leverage the responses are provided below: Question #1 – This question focuses on if your employees know how much of each benefit they need. If a majority of employees have not determined their financial needs for one or more of the benefits, you may want to promote various Tools & Calculators such as MetLife’s Life Insurance Calculator, Disability Income Insurance Calculator or Benefits Simplifier Tool. Question #2 – This question highlights the most helpful communication tactics. Based on the employee responses, you can focus your communication plan on the tactics that are most helpful for your employees. Question #3 – This question is designed to help benefits professionals understand what they could do differently to help employees optimize Open Enrollment season. Depending on employee responses, you may want to choose one or two of the top responses and incorporate into your Open Enrollment communication strategy. Question #4 – This question identifies which benefits employees need more information on before making a decision. Use employees responses as a tool to learn which benefits your communications should focus on in terms of providing educational information. You may want to feature MetLife’s Benefits Simplifier Tool as a helpful, easy-to-use tool that provides employees with benefits guidance for “people like me.” Question #5 – This question focuses on major life events that an employee may have experienced within the last 18 months. Based on employees’ responses, you may want to provide access to MetLife’s Life Advice content, which provides advice and guidance on more than 80 topics addressing issues that affect one's family, health, property and financial well being. L0612262952[exp0813)[All States] Metropolitan Life Insurance Company, New York, NY 10166 1) Have you determined your household’s financial needs for the following benefits? SELECT ALL THAT APPLY Medical Insurance Life Insurance Disability Insurance Long-Term Care Insurance Retirement plan / 401(k) 2) Which of the following are helpful to you during your employer’s benefits enrollment period? SELECT ALL THAT APPLY Emails announcing upcoming enrollment period Flyers/Posters announcing the upcoming enrollment period Packet of enrollment material Meetings and seminars with your employer Reminders to complete enrollment by the deadline Your employer’s website/intranet A benefits specific teleconference or webinar Calculators or other decision tools to help you in making your benefits decisions A “benefits fair” where you had the opportunity to meet representatives of various insurance companies and other benefits providers 3) Which of the following, if any, would improve your overall experience during the benefits enrollment period? SELECT ALL THAT APPLY More time to decide Detailed information about the employee benefits provided Easier to understand format for benefits information Benefit fairs or meetings where you can ask questions concerning benefits Access to a benefits advisor or financial planner Guidelines or instructions for “people like me” (i.e. someone of my age, marital status and/or family size/situation) Other 4) Which of the following benefits do understand well and which would you like more information on? UNDERSTAND Health and Wellness Benefits POS (Point-of-Service) Medical Insurance: High Deductible Health Plan (HDHP) Medical Insurance: Preferred Provider Organization (PPO ) Medical Insurance: Health Maintenance Organization) Prescription Drug Plan Health Savings Account (HSA) Flexible Spending Account (FSA) L0612262952[exp0813)[All States] Metropolitan Life Insurance Company, New York, NY 10166 WANT MORE INFORMATION UNDERSTAND WANT MORE INFORMATION Wellness programs Life Insurance Benefits Term Life Insurance Dependent Life Insurance Supplemental Life Insurance Dental Benefits Dental Insurance Retiree Dental Insurance Disability Insurance Benefits Short Term Disability Long Term Disability Individual Disability Income Additional Benefits Critical Illness Insurance Long-Term Care Insurance Legal Services Plans Automobile Insurance Homeowner’s Insurance 401(k) or other retirement plan Annuities Vision Care Insurance Pet Insurance 5) Have you experience any of the following events in the past 18 months? SELECT ALL THAT APPLY Recently graduated from college Got married/engaged Became a parent/ had a child Bought car Bought a home Had a child enter college Became a grandparent Had a parent move into your home Began providing care to a parent/friend/relative who needs help with activities of daily living (i.e, eating, bathing) or who has a cognitive impairment such as Alzheimer’s Disease. L0612262952[exp0813)[All States] Metropolitan Life Insurance Company, New York, NY 10166