The Role of IT.doc

advertisement

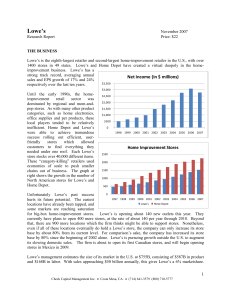

The Role of IT Home Depot and Lowe’s are continuously battling for market share in the home improvement industry. To create and maintain competitive advantages in this market, these companies need to have accurate, complete, relevant and timely information concerning all aspects of their operations. Managers must consistently assess and upgrade their information systems and technology to support the company’s growth, control costs and improve decision making. Since these companies are so alike, it is no surprise they have very similar technical needs; their technology must provide real-time inventory information, support administrative and decision making functions, and enhance the experience of the customer. In July of 2001, Lowe’s CIO, Steve Stone revamped the company’s approach to IT planning by investing in an enterprise portfolio management (EMP) system (Waxer, 2005). In the hopes of aligning IT initiatives with corporate strategy, Stone and his team sought to carefully document commitments, time lines and resource demands of every IT project in the works, from routine hardware upgrades to enterprise wide rollouts. Stone assembled an IT steering committee, consisting of Lowe’s CEO Robert Niblock, and six other executives from cross functional departments to review detailed project proposals. With a proper IT governance framework in place, management at Lowe’s is able to take on strategic projects and ensure they remain on budget, on schedule and align with corporate goals. In 2005, Lowe’s implemented the ‘Rapid Response Replenishment’ (R3) program to improve supply chain efficiency and better leverage inventory (Biederman, 2007). Lowe’s collaborated with vendors using CaseStack, a 3rd party logistics company that 1 specializes in retail vendor consolidation, to ensure full, on-time shipments to its eleven distribution centers. When the R3 initiative was first implemented, about 50% of stock moved through these distribution centers; by the end of 2006, over 75% of stock moved through the distribution center network. This gives managers real-time perpetual inventory information and allows business intelligence technology to track over 50 million items in its 1,400 stores to plan inventory levels and analyze the effectiveness of the 4,000 to 6,000 quantity-discount programs Lowe’s has in place at any one time (Havenstein, 2007). In 2001, when then-executive VP and CIO, Bob DeRodes joined Home Depot, he joked that the most advanced technology in some HD stores was a No. 2 pencil (Whiting, 2005). His mission was clear: to transform Home Depot into a “more information-based company.” DeRodes felt Home Depot lacked merchandising, inventory, and supply chain management capabilities, as well as visibility into its supply chain operations. Karen Etzkorn, VP of IT marketing and merchandising systems, also emphasized that they needed to be electronically connected to its suppliers. Under DeRodes leadership, Home Depot spent $1 billion, from 2001 to 2005, to overhaul both its front- and back-end IT infrastructure (“Most Powerful CIO’s,” 2005). Home Depot chose to implement SAP for its retail merchandising and supply chain applications because it is a scalable system that could stretch across its consumer and contractor businesses and expand as the company grows. The addition of a new point-of-sale (POS) system, cordless scan guns, and selfcheckout technology has allowed Home Depot to automate its inventory control systems so employees can spend less time restocking and replenishing, and more time on the sales floor (Dutton, 2007). 2 Another important function of IT for both companies is to improve customer satisfaction. Shoppers are becoming more familiar with emerging technologies and demanding the option of using them in stores and online. In response, Home Depot and Lowe’s have identified e-commerce as a growth area of its business and are hoping to replicate that in-store experience online (Pallavi, 2006). Allurent Research found that found that for every $1 spent online, the internet influences consumers to spend another $6 in stores (Murphy, 2007). In addition, 67% of consumers who visited an online store intending to make a purchase left because the retailer did not provide enough information. To that end, both companies have invested heavily in online retailing; proving detailed, up-to-date product descriptions and prices, product comparisons and reviews, and special online promotions. These companies are also bringing the web into stores with internet kiosks. Both companies are using technology created by EdgeNet to allow customers to design their own window treatments, counter tops and entire rooms with an easy to use, point and click design program (Desjardins, 2005). Customers can visualize how they want to transform their space, and then have the option to have it delivered directly to their homes and even installed. Besides creating convenience and a visual aid for customers, this technology is increasing sales by adding an average increase of 30% in ticket size. These stores are also enhancing customer satisfaction and convenience by improving POS systems. In 2006, Home Depot redesigned its POS system to allow for greater flexibility and creativity (“This Old POS,” 2006). This new system is now capable of improving inventory control, measuring employee performance, and provides an online price and receipt lookup feature. The introduction of this system as well as 3 wireless handheld scanners has reduced employee compensation claims and reduced transaction times by nearly 10%. Lowe’s followed Home Depot’s success by making major improvements to their returns system. CIO Steve Stone says, “if we can make this process as painless as possible, its yet another reason for them [customers] to choose Lowe’s” (Weier, 2007). Lowe’s was successful implementing this system because it considered business processes first and technology second. The system was designed to specifically handle the complexity of returning items from several different shopping trips that may have used different payment methods. Lowe’s has been able to reduce the average time of a return by 90 seconds and reduce labor time at the return desk by an average of 30 hours per week, per store. Both companies have also been pioneers in the fastest growing technology in retail: the self-checkout lane. Home Depot was able to reallocate between 5% and 12% of its cashier to other jobs on the sales floor, recapturing between 50 and 80 employee hours per week (“This Old POS,” 2006). Senior manager of front end operations at HD, Paul Burel says, “all other things being equal, between 9% and 12% will shop with you over a competitor if you’ve got self-checkout.” Both Home Depot and Lowe’s have been able to leverage information technology to improve their operations in merchandising and supply chains, allowing them to make better business decisions and create competitive advantages. These companies have been able to align IT with business objectives to create value and gain market share. 4