CHAPTER 7

advertisement

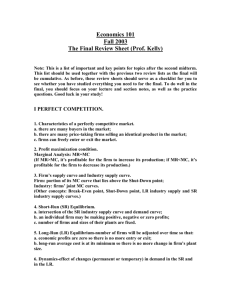

CHAPTER 7 MONOPOLY AND OLIGOPOLY After reading Chapter 7, MONOPOLY AND OLIGOPOLY, you should be able to: Define the characteristics of PURE MONOPOLY. Differentiate between the demand curve and MARGINAL REVENUE CURVE faced by a price searcher. Explain how monopolists select their profit-maximizing price and level of production. Describe how monopolies harm society. Define the characteristics of OLIGOPOLY and explain the causes and implications of MUTUAL INTERDEPENDENCE. Define CARTEL, discuss the two contradictory drives that motivate cartel members, and list various obstacles to successful collusion by cartels. Discuss how CONCENTRATION RATIOS are used to measure the extent of competition in an industry and explain their drawbacks. Discuss the trends in concentration in the U.S. economy. CHAPTER OUTLINE I. MONOPOLY AND OLIGOPOLY A. Price-searching firms face downward-sloping demand curves. The demand curve for price takers is horizontal. B. C. Pure monopoly and oligopoly are industry structures with price-searching firms. The MARGINAL REVENUE CURVE (MR) for a price-searching firm lies below its demand curve and is downward-sloping. This is illustrated above. 1. For a price searcher to sell additional output, it must lower the price it charges for all its production. Therefore, the marginal revenue from selling an extra unit is less than its price. 2. When demand is elastic, marginal revenue is positive; when demand is inelastic, marginal revenue is negative. 57 II. MONOPOLY A. A PURE MONOPOLY exists when there is 1. only one seller of a good that has no close substitutes; 2. the seller has control over the price of the good; and 3. competitors are unable to enter the market because of high barriers to entry. B. A monopolist maximizes its profit when it produces enough output so that marginal revenue equals C. D. marginal cost (MR = MC) and when the price, set from the demand curve, is the highest possible price such that demanders buy this quantity. This is illustrated in the figure above, where the firm produces Q and charges P. Monopolies may earn economic profits that persist even for the long run. A monopolist's price exceeds its marginal costs; that is, P > MC. When P > MC, ECONOMIC INEFFICIENCY is created because it is possible to increase production so that the benefits (measured by P) to consumers are larger than the costs (equal to MC) to the producers. 1. Since monopolists cause economic inefficiency, monopolies can harm society. MONOPOLY RENT SEEKING—expenditures designed to gain monopoly rights from the government— also harm society. 2. Monopolies may benefit society by being more apt to create new technology, but the empirical record on this suggestion is unclear. III. OLIGOPOLY A. B. An OLIGOPOLY is an industry with 1. a small number of firms; 2. moderate to high entry barriers; 3. the production of either identical products or differentiated products; 4. price-searching behavior; and 5. recognized mutual interdependence. The key distinguishing feature of oligopoly is that the number of firms is sufficiently small so that each of the firms knows its competitors will react to any action it takes. This means that each firm recognizes its MUTUAL INTERDEPENDENCE with the other companies in the industry. 1. Behavior in an oligopolistic industry is complex due to the mutual interdependence and the possibility of strategic behavior. This means that each firm must predict how its rivals will react to its competitive decisions. 58 2. IV. A. B. C. An oligopolistic firm's behavior depends on factors specific to its industry. If oligopolistic firms can learn to cooperate, they can earn higher profits by restricting their output and boosting their price. CARTELS A CARTEL is an arrangement for different firms to coordinate their production and pricing decisions so that the firms operate as one giant monopoly company. Underlying themes of cartels: 1. All members of a cartel can gain if everyone adheres to the cartel. 2. Each member can gain if it and no one else cheats on the cartel arrangement. Therefore cartels tend to break apart in the long run. Obstacles to the formation of an effective, long-lasting cartel: 1. Many sellers: The more sellers, the more costly and difficult it is to set up and monitor a cartel agreement. 2. Low entry barriers: If entry barriers are low, an effective cartel that increases firms' profits merely attracts interlopers who compete away the monopoly profit. 3. Product heterogeneity: The more differentiated the product produced by the industry, the more costly and difficult it is to start and monitor an agreement. 4. High rates of innovation: In an industry with high rates of innovation, cartel agreements can be broken easily by one firm introducing a new, improved version of a product. 5. Legal restrictions: If the formation of cartels is outlawed, forming (illegal) cartels is more costly. V. CONCENTRATION RATIOS A. B. C. D. The "x-firm" CONCENTRATION RATIO is the fraction of sales possessed by the "x" largest firms in the industry. The higher the concentration ratio, the greater is the presumed amount of monopoly or oligopoly power in the industry. Drawbacks of concentration ratios: 1. Definition of the market or industry is sometimes difficult. Some markets (automobiles) are worldwide, but concentration ratios use only domestic firms and the domestic market. Other markets (pharmaceuticals) may have important sub-markets with very high concentration, but these sub-markets are ignored since concentration ratios look at the entire market. 2. Concentration ratios do not take account of the existence of close substitutes for the industry's product. 3. Concentration ratios can mask the replacement of one of the top x firms by another firm with a similarly sized market share. 4. Concentration ratios cannot show the relative size of the largest firms. The share of manufacturing output accounted for by highly concentrated industries has hardly changed over the past fifty years. 59 REVIEW QUESTIONS True or False If the statement is correct, write true in the space provided; if it is wrong, write false. Below the question give a short statement that supports your answer. ____ 1. All firms in an industry could benefit if they form a successful cartel. ____ 2. If only one firm in a cartel cheats on the arrangement, that firm can increase its profits. ____ 3. For a price-searching firm, marginal revenue exceeds price. ____ 4. Since Kraft has a monopoly on its Parkay brand of margarine, Parkay is a good example of a pure monopoly. ____ 5. Monopoly firms always try to set the highest possible price. ____ 6. A price-searching firm can sell all it wants without having to lower its price. ____ 7. Since marginal revenue is the increase in total revenue from increasing sales by one unit, MR for a price-searching firm equals the price of the product. ____ 8. Profit-maximizing price-taking and price-searching firms produce until marginal revenue equals marginal cost. ____ 9. The MR curve for a price-searching firm lies below its demand curve. ____ 10. Monopolies can create economic inefficiencies. ____ 11. Most experts agree with the idea that it takes massive monopoly firms to spur progress through technological innovation. ____ 12. Once formed, most cartels generally persist for a very long period of time. ____ 13. The lower the barriers to entry in an industry, the less successful will be a cartel in that industry. ____ 14. It is easier to reach a cartel agreement when the industry's product is very heterogeneous. ____ 15. Concentration ratios are used to measure the extent of competition in an industry. 60 Multiple Choice Circle the letter corresponding to the correct answer. 1. What type of industry structure is typified by having only one seller of a good with no close substitutes? a. Perfect competition b. Monopolistic competition c. Oligopoly d. Monopoly e. None of the above 2. What type of industry is characterized by having only a few firms, each of which must worry about its rivals' responses to its actions? a. Perfect competition b. Monopolistic competition c. Oligopoly d. Monopoly e. None of the above 3. Which of the following industry structures do not have price-searching firms? a. Perfect competition b. Oligopoly c. Monopoly d. None of the above because all industries have price-searching firms e. None of the above because although there is an industry that does not have price-searching firms, it is not listed above 4. For a price-searching firm, the MR curve a. is horizontal. b. generally is the same as its demand curve. c. usually has a positive slope, so that MR increases as more output is sold. d. is the same as the firm's short-run supply curve. e. None of the above 5. Profit-maximizing price-searching firms produce where a. MR = P. b. P = MC. c. P < MR. d. MR = MC. e. P < MC. 6. If the demand for a product is price elastic, the marginal revenue a. is equal to zero. b. is positive. c. is negative. d. may be either positive, negative or zero. e. is not defined. 61 7. An important difference between a monopoly and an oligopolistic industry is a. oligopolistic firms face horizontal (perfectly elastic) demand curves for their products. b. MR = P for monopolies. c. oligopolistic firms always produce a homogeneous product. d. monopoly firms are price takers while oligopolistic firms are price searchers. e. the barriers to entry tend to be somewhat lower in oligopolistic industries. 8. After a price-searching firm determines its profit-maximizing level of production, it will determine the price of its output by referring to a. the demand curve for its product. b. its marginal revenue curve. c. its marginal cost curve. d. its long-run average cost curve. e. its marginal demand cost curve. 9. Economic inefficiency is created when a. P = MR. b. P > MC. c. P = MC. d. MR = MC. e. None of the above 10. Which of the following is not a characteristic of an oligopoly? a. A relatively small number of firms b. Moderate to high entry barriers c. Price searching d. Recognized mutual interdependence e. They are all characteristics of oligopoly. 11. It is more difficult for firms to form a successful cartel when there are a. high barriers to entry. b. few sellers of the product. c. relatively homogeneous products. d. high rates of product innovation. e. All of the above make it difficult to form a successful cartel. 62 Essay Questions Write a short essay or otherwise answer each question. 1. Complete the following table about the demand curve faced by a monopoly firm: Quantity 1 2 3 4 5 6 7 8 Price $60 $55 $50 $45 $40 $35 $30 $25 Total Revenue _____ _____ _____ _____ _____ _____ _____ _____ Marginal Revenue XXX _____ _____ _____ _____ _____ _____ _____ 2. Suppose the marginal cost of producing an extra unit of output is always $25. If a monopoly firm faces the demand curve in Question 1, what is the profit-maximizing level of output? What price does the firm charge? 3. Suppose the demand curve given in Question 1 was the demand curve of a perfectly competitive industry. If all the firms in this industry can produce an extra unit of output for a marginal cost of $25, how many units of output are produced? (Remember that in the long-run equilibrium, perfectly competitive industries produce so that MC = P.) What is the equilibrium price? 4. Relate your answers to Questions 2 and 3 to the harm produced to society by a monopoly. In particular, which industry structure produced more output: the monopoly or the perfectly competitive one? 5. Suppose a monopoly firm has a constant MC curve and a straight line demand curve. Draw a diagram showing the profit-maximizing level of output (label it Q) and profit-maximizing price (label it P). 6. Suppose cartels were legal. Do you think a cartel would be more likely to form in the auto industry or the wheat industry? Why? 7. Use the following data to calculate the four-firm concentration ratio of industry sales. Company A B C D E F G Sales $350,000 $150,000 $500,000 $250,000 $500,000 $150,000 $100,000 8. Say that effective competition by Company F causes its sales to climb to $350,000 while Company A's sales fall to $150,000. What now is the four-firm concentration ratio of industry sales? 63 9. Use the example given in the chapter to discuss how “code sharing” among the world’s airlines could result in more monopoly power. Consider particularly its effect on supply and prices. ANSWERS TO REVIEW QUESTIONS True or False True 1. If the firms agree to act as branches of a giant monopoly, the industry's total profits increase, so each firm could get more profit. (See the next question for another incentive that is at play.) True 2. This fact accounts for the instability of cartels: each firm has an incentive to cheat because if it can do so without the other firms cheating, its profits increase. False 3. For a price-searching firm, marginal revenue is less than price. False 4. Parkay Margarine is not a monopoly, because it competes with different brands of margarine that are very close substitutes for Parkay. False 5. Monopoly firms try to set the most profitable price. If the price is set as high as possible, no one will buy the product, and the firm will make no profits. (Indeed, it probably would suffer a short-run loss.) False 6. A price-searching firm must obey the law of demand: in order to induce demanders to buy more output, the firm must lower the price of the product. False 7. If a price-searching firm wants to sell one more unit of output, it must lower the price it charges for all the output it sells. This loss of revenue from the lower price on the initial units sold causes the marginal revenue of the extra unit to be below the price. True 8. The profit-maximizing rule is the same for both types of firms. A key difference, however, is that for the price-taking firm, P = MC, while for the price-searching firm, P > MC. True 9. This is the important difference between price-searching firms and price-taking firms. True 10. In this way monopolies can harm society. False 11. Contrary to popular view, research indicates that monopoly firms are not the only source of technological innovations. False 12. Each firm's incentive to cheat on the cartel and thereby increase its own profits accounts for the high failure rate of most cartels. True 13. A successful cartel in this type of industry would attract new firms. These new firms would quickly reduce the economic profit of the cartel by undercutting the cartel's price. False 14. The greater the differences in the product, the more costly it is to reach an agreement about the price each firm should charge. 64 True 15. Concentration ratios are usually the fraction of an industry's sales that are accounted for by the four largest firms. The higher the concentration ratio, the more sales are concentrated amongst these firms and so, presumably, the lower is the competition within the industry. Multiple Choice 1. d. For a firm to have a pure monopoly, there must be no close substitutes for its product. 2. c. Oligopoly theory is difficult because the industry is sufficiently small so that each firm must try to take account of its competitors' reactions to its actions. 3. a. Perfectly competitive firms do not price search, because the demand curve they face is perfectly horizontal at the going market price. In other words, they are unable to sell their product for more than the market price and are unwilling to sell it for less, so they are price takers. 4. e. For a price-searching firm, the MR curve lies below the demand curve and generally has a negative or inverse slope. 5. d. This is the same rule followed by perfectly competitive, price-taking firms. The important difference is that P = MR for price-taking firms, while P > MR for price searchers. As a result, for price takers, P = MC, while for price searchers, P > MC. 6. b. If the demand is elastic, an increase in output causes only a small reduction in price and so raises total revenue. Marginal revenue equals the change in total revenue. Since in this case total revenue increases, marginal revenue is positive. 7. e. Monopolies have high entry barriers, and oligopolies have only medium to high barriers. The fact that entry barriers are not prohibitive is why firms can enter an oligopoly, so that there is more than one firm in the industry. 8. a. It prices the product so that demanders are willing to buy just the quantity produced. 9. b. If P > MC, the value of another unit of output to consumers (which equals P) exceeds the cost of producing the unit (which equals MC). 10. e. All these are characteristics of oligopolistic industries. 11. d. If there are high rates of innovation, any agreement concerning existing products will become obsolete quickly as new products are introduced. 65 Essay Questions 1. Quantity 1 2 3 4 5 6 7 8 Price $60 $55 $50 $45 $40 $35 $30 $25 Total Revenue $60 $110 $150 $180 $200 $210 $210 $200 Marginal Revenue XX $50 $40 $30 $20 $10 $0 $-10 To calculate these answers, take the row where the quantity equals 2 as an example. The total revenue equals the quantity multiplied by the price, in this case (2) ($55), or $110. Then, marginal revenue equals the change in the total revenue when one more unit is produced. Hence the marginal revenue from the second unit is the difference between the total revenue when 2 units are produced, $110, minus the total revenue when 1 unit is produced, $60. Therefore, the marginal revenue equals $50. The key points to notice from this table are that price exceeds marginal revenue and that marginal revenue can be negative. 2. The profit-maximizing level of output is 4 units, because the MR of the fifth unit ($20) falls short of the MC ($25). The firm will charge $45 because that is the price at which demanders are willing to buy 4 units. 3. The price of the product would equal $25 (which is the same as the MC) and 8 units of output would be produced. 4. Monopolies restrict output and charge higher prices. This is evident in Questions 2 and 3 where economic inefficiency is created by the restriction of output. In Question 2, the marginal cost to the monopoly (which equals the marginal cost to society) of producing an extra unit is $25; yet, consumers are willing to pay $40 for another unit. This means consumers (or, in other words, society) value an additional unit of output more than the cost of producing it. 5. Please refer to the above figure. To maximize its profits, the monopoly produces where MR = MC. Therefore, the monopoly will produce Q. Then, to set its price, the monopoly uses the demand curve. It wants to set the highest possible price that will lead people to buy all that it has produced. This price is P. If it set a lower price, it could sell all it produces (and more, as demanders would want to buy more 66 than Q) but the monopoly would lose profits by setting a lower price. If it set a higher price, it could not sell all that it produced. Hence, Q is the equilibrium level of output and P the equilibrium price. 6. A cartel would be more likely in the auto industry. There are virtually no barriers to entry into the wheat industry, so there are thousands of wheat farmers. The only obstacle to the formation of an auto cartel is the fact that the different brands of autos are somewhat heterogeneous. Still, this is outweighed by the observation that there are only a relative handful of auto manufacturers and the barriers to entry into the auto industry are quite high. 7. The four-firm concentration ratio is 80 percent. The four-firm concentration ratio equals the fraction of total industry sales ($2,000,000) accounted for by the four largest companies (firms C, E, A, and D, which together have sales of $1,600,000), so the concentration ratio is: $1,600,000 / $2,000,000 = 80 percent. 8. The four-firm concentration ratio remains 80 percent. Total industry sales remain constant at $2,000,000 and the four largest firms (now C, E, F, and D) still have total sales of $1,600,000. This question points out an important failure of concentration ratios. They completely miss competition in which one large firm is replaced by another, similarly sized company. 9. The current practice of code sharing among the world’s airlines means that they basically share a particular market by selling tickets on each other’s flights and sharing the revenues. This gives them the incentive to reduce the number of seats offered between two points to achieve higher prices. 67