The Pros and Cons of Treasury Centralisation

advertisement

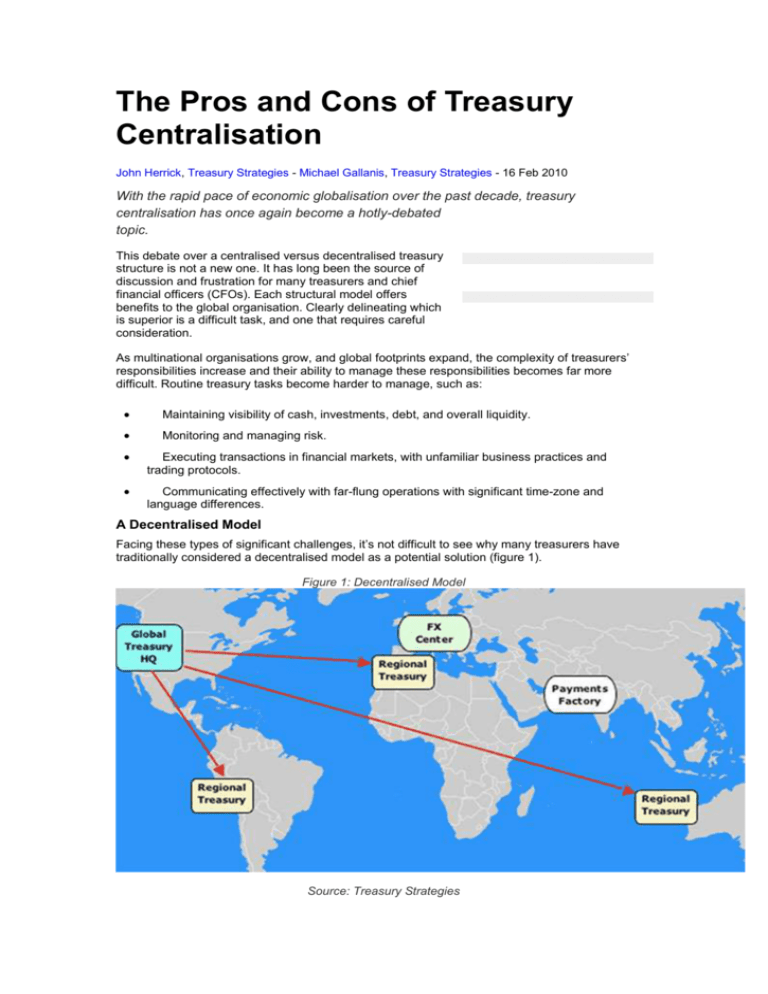

The Pros and Cons of Treasury Centralisation John Herrick, Treasury Strategies - Michael Gallanis, Treasury Strategies - 16 Feb 2010 With the rapid pace of economic globalisation over the past decade, treasury centralisation has once again become a hotly-debated topic. This debate over a centralised versus decentralised treasury structure is not a new one. It has long been the source of discussion and frustration for many treasurers and chief financial officers (CFOs). Each structural model offers benefits to the global organisation. Clearly delineating which is superior is a difficult task, and one that requires careful consideration. As multinational organisations grow, and global footprints expand, the complexity of treasurers’ responsibilities increase and their ability to manage these responsibilities becomes far more difficult. Routine treasury tasks become harder to manage, such as: Maintaining visibility of cash, investments, debt, and overall liquidity. Monitoring and managing risk. Executing transactions in financial markets, with unfamiliar business practices and trading protocols. Communicating effectively with far-flung operations with significant time-zone and language differences. A Decentralised Model Facing these types of significant challenges, it’s not difficult to see why many treasurers have traditionally considered a decentralised model as a potential solution (figure 1). Figure 1: Decentralised Model Source: Treasury Strategies The decentralised model usually includes a strong global treasury centre as the hub, or treasury headquarters (HQ). This site provides general ground rules to all decentralised operations by way of global policies and guidelines. Generally, the HQ is supported by one or more regional treasury centres, located in key markets throughout the company’s footprint. These centres provide regional treasury expertise and leverage local knowledge of regional banking and financial markets, practices and protocol. As the scale of trade and geographic growth dictates, companies can further enhance this decentralised model with the creation of payment factories and foreign exchange (FX) centres to manage the processing of transactions more affordably. While the decentralised model solves many of the problems that expansive global treasuries face, this model has its owns challenges. A decentralised treasury structure typically requires more aggregate global treasury personnel than a centralised structure. And the model still presents some challenges to the HQ treasury level in areas of communication and oversight. And, in these difficult economic times, the added costs of redundant staffing, maintenance of multiple treasury sites and systems can be a challenging economic hurdle to overcome. A Centralised Model Because of these issues, many treasurers have moved to a centralised treasury structure (figure 2). Figure 2: Centralised Model Source: Treasury Strategies A centralised treasury offers a number of tangible and intangible benefits to the corporation, including: Economic Improved working capital management through increased access to cash, resulting in reduced debt and increased return on investments of excess cash. Reduced number of cash flows leading to improved management of liquidity. Reduced number of bank accounts, which translates to lower transaction costs and bank fees. Control Standardised cash management across all legal entities. Global compliance with headquarters treasury policies and procedures, including Sarbanes-Oxley (SOX) and Office of Foreign Assets Control (OFAC) requirements. Risk management More effective management of FX exposures and interest rate risks through global oversight. Netting of exposures leading to cost savings from fewer FX conversions and bank transfers. Global view and management of limits on bank exposure. Scale economies Increased productivity by leveraging centralisation of treasury activities and technology to achieve more output with fewer human resources. Better process management through standardised key performance indicators (KPIs). Transition to a centralised treasury is no easy task. Treasurers should keep in mind several critical success factors for a smooth transition: Involvement of regional and local financial personnel Critical for local buy-in as subsidiaries give up responsibility for some treasury tasks. Local knowledge will undoubtedly be required to structure the right banking architecture for a global solution. Executive management support Senior corporate management must sponsor the project to ensure sufficient resources for a successful transition. Division, regional, and local senior management must also be on board to ensure coordination with corporate treasury to get the project done. Technology Best-in-class technology is a requirement for a centralised global treasury operation: Treasury management systems (TMS). Derivatives management and trading systems. Bank-to-book reconciliation software. SWIFT. Treasury technology should be bank-agnostic to ease the transition from one banking partner to another in the event of a bankruptcy or financial crisis. A global standard enterprise resource planning (ERP) system, while not necessarily a prerequisite, nevertheless will reduce the amount of effort to create interfaces with the new treasury technology needed for centralisation. The right banking partners Critical to the success of a treasury centralisation effort is the selection of the right banking partners. Bank capabilities must be appropriate on a local, regional, or global basis, depending on the banking need. Evaluation of the bank’s future commitment to providing a particular service is essential prior to awarding the business. Conclusion Both the centralised and decentralised treasury structures offer advantages and disadvantages. Which design a company chooses will depend on global footprint, available resources, executive commitment, and available technology. Regardless of which centralisation path treasurers select, a successful implementation will hinge on their ability to secure prior senior management buy-in, a well-defined plan, and sufficient resources to implement. Once in place, to remain successful, each structure will require: Strong, clear, global policies. Effective tools and technology. Effective ongoing management reporting. Well-trained, capable personnel. With an effective treasury structure and capable resources, treasury can support even the most challenging demands that a global business can present. Back to top