(file WORD - 233 K). - Université de Fribourg

advertisement

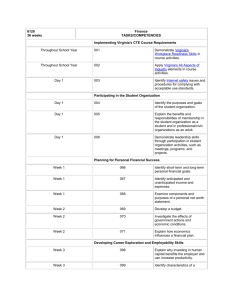

A BOOK-KEEPING ANALYSIS OF A MONETARY ECONOMY SOME BASIC THEORETICAL ELEMENTS by Sergio Rossi London School of Economics and Centre for the Study of Global Governance January 1997 Published in: S. P. Dunn et al. (eds) (1997) The Second Annual Postgraduate Economics Conference - Papers and Proceedings, Leeds: Leeds University Press, Chapter 9 (pp. 141-152). Abstract The aim of this paper is to show the way in which money enters the real world and is used in conformity with the logical rules governing modern banking. In particular, the first section stresses the vehicular nature of (bank) money and its endogenous character in providing the objective numerical measure of economic transactions. Bernard Schmitt and Alvaro Cencini are the authors who have developed the deepest analytical insight into both banking activity and the workings of modern macroeconomic systems. Referring to their skilful analysis, whose historical foundations go back to the works of Smith, Ricardo, Marx, Walras, and Keynes, it can be noted that money flows back to its point of departure at the very moment it is emitted, since each payment entails the creation-destruction of the immaterial vehicle necessary to circulate goods among economic agents. Further, the new conception of money gets rid of all kinds of subjectivistic approaches to monetary economics, for it logically explains the purchasing power of money by relating it to the production process (section 2). Being the result of the monetization of total costs of production, money-income is the avatar of real output, its factual alter ego. JEL classification: E40, E50, G21 Keywords: endogenous money, money-income, banking activity iii Introduction* The enigmatic phenomenon of money is even at this day without an explanation that satisfies; nor is there yet agreement on the most fundamental questions of its nature and functions. Even at this day we have no satisfactory theory of money. Karl Menger, ‘On the Origin of Money’, 1892 Broadly speaking, it is sometimes claimed that ‘[m]odern discussions of monetary theory have fairly well demolished its traditional foundations without so far putting anything definite in their place’ (Clower 1977: 206). The locus classicus of such claim is likely to be found in the various unsuccessful attempts to explain - through a dichotomous representation which distinguishes between real and nominal macroeconomic magnitudes - why money is essential in modern economic systems (see for example Hahn 1973). Now, the logical starting point of monetary economics ought to rest on a thorough investigation into the very nature of money and, therefore, the peculiar functions performed by the banking system. As a matter of fact, ‘money has its origin in the banking system and it is through a careful examination of the way it is issued by banks that the mystery of its twofold nature can be finally understood’ (Cencini 1995: 2). In this paper we thus aim to show the way in which money enters the real world and is used in conformity with the principles pertaining to banking activity, as recently pointed out by B. Schmitt and A. Cencini and whose analytical foundations can be traced back, as we shall see, to the beginnings of our science1. The emission of money Let us start from the classical distinction, put forward by A. Smith more than two hundred years ago, between money and its purchasing power. Consider a quotation from The Wealth of Nations: ‘[T]he wealth or revenue [...] is equal only to one of the two values which are thus intimated somewhat ambiguously by the same word, [...] to the money's worth more properly than to the money’ (Smith 1776/1970: 386). The theoretical consequences of this conceptual distinction are of the utmost importance, as we are going to see. Before addressing ourselves to the gist of the matter, it is worth recalling that in a considerable number of publications various authors have often propounded the view that a distinction should be made between the intrinsic and the extrinsic value of (bank) money2. This point, straightforward as it might seem, deserves a brief analysis, in order to clarify the terms of the problem. * The initial version of this paper was written while the author was a postdoctoral research student at the London School of Economics. It has benefited from comments and suggestions by Prof. Alvaro Cencini and Prof. Lord Desai. The author also wishes to thank Simona Cain for her assistance in improving the style of the English manuscript. Financial support (under grant number 81FR–048788) from the Swiss National Science Foundation is gratefully acknowledged. The usual disclaimer applies. 1 See Schmitt (1966, 1972 and 1984) and Cencini (1984, 1988 and 1995). 2 As Keynes puts it, ‘Jevons certainly, and Edgeworth and Dr. Bowley to the best of my understanding, have also pursued something distinct from the Purchasing Power of Money, something reached in quite a different way, something which has to do with what they might describe as the value of money as 4 A BOOK-KEEPING ANALYSIS OF A MONETARY ECONOMY According to this framework of inquiry, money as such has a positive value (i.e. a purchasing power) as it is issued by the banking system to enable the settlement of domestic transactions among economic agents (households, enterprises, government). In other words, the banking system seems to be endowed with the ability to create ex nihilo units of purchasing power by a mere stroke of the pen, thus evoking the power of the ancient kings to earn a profit - known as seigniorage - through the issuance of gold coins (Figure 1). Intrinsic value = 0 Banking system Extrinsic value > 0 Figure 1 This amounts to saying that the national payment system operates in such a way as to furnish the economy with a net asset without being compelled to produce it. From a book-keeping point of view, the argument would run as follows: the public or the economic agents as a whole have at their disposal a certain amount (or stock) of money, provided by the banking system at a trifling cost and without the need to resort to the (same) set of agents in order to obtain the real counterpart of the money thus created (Table 1). Table 1 Banking system liabilities Public assets + Public 0 Now, such an approach is clearly ill-founded, as a simple glance at Table 1 shows. It is hardly necessary to stress that the basic rule of double-entry book-keeping imposes the logical equivalence of both sides of the (bank's) balance sheet. A large body of literature has indeed grown up endeavouring to consider gold (or any precious metal) as the real counterpart of the money issued in the country3 (Table 2). such or, as Cournot called it, the ‘intrinsic value of money’’ (Keynes 1930: 80, italics in the original). See also Hahn (1973: 230). 3 In the scope of this paper we abstract from foreign exchange reserves because this would lead us too far. 5 SOME BASIC THEORETICAL ELEMENTS Table 2 Banking system liabilities Public assets x£ Gold reserves x£ Yet Friedman himself seems to be aware of the fallacy of this explanation. In his own words, ‘[t]he ‘gold’ that central banks still record as an asset on their books is simply the grin of a Cheshire cat that has disappeared’ (Friedman 1987: 7). This argument is nevertheless incomplete, for it neglects the heart of the matter. Following this approach, one could indeed argue that nowadays total national output has replaced gold on the asset side of the banking system's balance sheet, so that domestic money is eventually being created as the counterpart of Gross Domestic Product (GDP) (Table 3). Table 3 Banking system liabilities Stock of money assets x£ Total output x£ Similar ideas stem from an imperfect analysis of bank money, since they do not distinguish between the form and the object of payments. It is thus necessary to proceed one analytical step further in order to reach an important conclusion, already highlighted by the famous concept of ‘the great wheel of circulation’ so clearly stated by Smith. ‘The great wheel of circulation is altogether different from the goods which are circulated by means of it. The revenue of the society consists altogether in those goods, and not in the wheel which circulates them’ (Smith 1776/1970: 385). If money were the counterpart of national product, it would be logical to add up the ‘monetary mass’ and GDP in order to obtain the country's total wealth. But this would also amount to identifying the means of payment (money) with a net asset, used as intermediary good to facilitate exchanges of real output among economic agents (Figure 2). good Y good X A B A money first exchange money second exchange Figure 2 6 A BOOK-KEEPING ANALYSIS OF A MONETARY ECONOMY Since in the real world everyone carries out a series of daily transactions between (paper) money and all sorts of commodities (goods, services, financial assets), it is tempting to agree with the traditional view represented in Figure 2. However, despite appearances to the contrary, this conclusion is not corroborated by modern monetary analysis. Indeed, in accordance with the classical distinction referred to above, a thorough examination of (monetary) payments shows that ‘money and real goods [...] form a unique reality, one and the same magnitude whose peculiarity is indeed to comprehend two aspects, nominal and real’ (Schmitt 1984: 113, our translation). Consequently, money is not an exchange intermediary, as in all neo-Walrasian monetary models of general equilibrium (Clower 1969: 20-1; Starr 1989: 3), but the vehicle conveying goods among economic agents. In the light of the modern conception of money, Figure 2 should then be drawn as follows (Figure 3). money A good X B money A good Y B Figure 3 As was already pointed out by both Marx (1973: 141-2) and Keynes (1930: 55-6), money is the numerical form in which units of purchasing power are expressed4 and, as Walras would say, ‘the word franc [...] is the name of a thing which does not exist’ (Walras 1874/1954: 188, italics in the original). Now, an important point to be made at this juncture concerns the nature of the goods (X and Y in our example) exchanged between the two agents (A and B) in Figure 3. In effect, at first glance Figure 3 seems to support the view that ‘money does not matter’, since the exchange between A and B could equally be performed in purely real terms (as in a virtual barter economy). To establish whether this is true or not, we must ask ourselves in what terms goods could be valued in the absence of money. It is indeed widely recognised today that both individual and ‘social’ utility functions - and related indifference curves - cannot provide either an objective or a non-dimensional measure of the goods' exchange value5. In the scope of this paper we cannot dwell on this old controversy. The position of most national accountants - clearly summarised by 4 On Marx's contribution to modern monetary theory, see Cencini and Schmitt (1976) and Cencini (1988: 15-18, 28-30). 5 It is worth noting in passing that Ricardo's search for an invariable standard of value was bound to fail because of the very dimensional character of his measurement. See Schmitt's introduction to the Italian edition of the monetary writings of Ricardo (1985) and Cencini (1988: 104-9) for a thorough discussion of this problem. 7 SOME BASIC THEORETICAL ELEMENTS Friboulet (1987) - should here suffice to restate the logical need of a mere numerical standard in order to measure real output in economic terms. But let us go further and address ourselves to the very nature of the goods entering an exchange between any two agents. The determining factor is again provided by the modern analysis of (bank) money, since each (monetary) payment is at the same time an exchange. Following the skilful analysis worked out by Schmitt and Cencini, Figure 3 must be drawn considering the peculiar role of the banking system in providing the numerical vehicle for the circulation of domestic output (Figure 4). Banking system real output (good X) A bank deposit (good Y) B vehicular money Figure 4 The first point to be underlined here is the circular flow of money occurring whenever a payment is carried out. ‘As monetary intermediaries, banks confine themselves to supplying the economy with a numerical instrument that they immediately take back’ (Cencini 1995: 21). In other words, the emission of money is simultaneously the creation and the destruction of the numerical instrument necessary to both measure and circulate goods. At the practical level, this statement is supported by the mechanical law of double-entry book-keeping which guarantees the instantaneous matching of the figures entered on the asset side, on the one hand, and on the liability side, on the other hand, of any balance sheet. Since for our purposes it is also worth considering the result of the money flow, for it best highlights the case at issue, let us represent it by referring to the entry recorded on the balance sheet after the payment depicted in Figure 4 has occurred (Table 4). Table 4 Banking system liabilities assets Agent A (payee) x£ Agent B (payer) x£ 8 A BOOK-KEEPING ANALYSIS OF A MONETARY ECONOMY The money B borrows from the banking system in order to purchase A's good is, in one and the same motion, the numerical form in which A holds (a claim on) a bank deposit whose value is identically equivalent to that of the commodity he sells to B. Hence, there is no need to go any further into the study of banking activity to substantiate the famous expression ‘deposits make loans’ put forward by Withers (1909). The purchasing power earned by A on the market for produced goods is without any delay lent to B, who needs it in order to pay for his purchases on the same market. Let us reconsider both Figure 4 and the book-keeping entry in Table 4. Each payment (i.e. each monetary exchange) has two aspects - numerical and real - and involves three poles: the payer, the payee, and the banking system. True, ‘in one and the same act, money is created6, the borrower becomes a debtor to the bank and the agent receiving a payment becomes the creditor of the same bank’ (Graziani 1989: 4). The object of A's claim towards the bank (or, generally speaking, towards the banking system as a whole) is precisely the purchasing power the same bank lends to B. Put slightly differently, the seller of a real good (X) exchanges it for a financial claim (good Y) which gives him an equivalent drawing right over domestic output. It can in fact hardly be doubted today that bank deposits are the real good par excellence, since they define the monetary form in which total national product is held before final consumption takes place. The integration of money into the economy: a production-consumption process If money were to be introduced into the economy through the exchange process, as one might hastly infer from the preceding section, it would be already too late to give it an objective purchasing power over current output. With few notable exceptions, published studies on monetary economics maintain indeed that money circulates among the public thanks to its conventional general acceptability on the marketplace. This ‘subjectivistic’ approach is so deeply rooted in our science that even a leading monetary economist such as Goodhart does not hesitate to declare that If everyone, including the public sector and foreigners, was prepared to accept the liability of any intermediary, whether it be bank, building society, or insurance company, as final settlement for any debt, then the deposits of that intermediary would become equivalent to legal tender for all practical purposes. (Goodhart 1989: 111, italics in the original) Now, the precariousness of a monetary production economy resting on such a social contract among functional groups of agents whose economic interests are utterly clashing should be obvious. Households wishing to increase their welfare by higher wages and lower retail prices and firms aiming at profit maximisation through a constant reduction in production costs would indeed oppose each other in a classstruggle in which the State might be asked to play the delicate and challenging role of the go-between. Fortunately, as far as money emission is concerned, reality is much less complicated than this alleged conventional process of collective bargaining. As a matter 6 Let us stress that it would be better to say that money is emitted, for its creation (on the asset side of the bank's balance sheet) is simultaneously associated with its destruction (on the liability side of the same book-entry system). 9 SOME BASIC THEORETICAL ELEMENTS of fact, as is recognised by Deleplace and Nell among others, ‘people do not choose to use money in transactions. Money is a constituent part of the economy’ (Deleplace and Nell 1996: 733, italics ours). To provide analytical evidence in support of the endogeneity of money, we must consider the fundamental relationship taking place in the factors market between money and the newly produced physical output and whose factual result is the formation of national income. Indeed standard neoclassical models do not explain where the agents' ‘initial endowments’ come from, since they simply assume that production is a particular case of exchange, namely an exchange between a ‘productive service’ and a product. (A parallel restatement of this axiomatic conception of the real world is Friedman's well-known helicopter dropping (paper) money over a national economy.) If this were true, two dramatic consequences would inevitably follow: (1) money could never measure economic output objectively and, furthermore, (2) no macroeconomic income would ever exist. Let us try to show these two major shortcomings of received monetary theory by referring to Figure 5. real output productive service W F W money exchange on the factors market money exchange on the commodity market production as a relative exchange Figure 5 In this framework, workers (W) sell their productive services to firms (F) and buy from them the outcome of the production process (the newly produced goods). Production is seen as an exchange occurring ‘transversely’ between two different markets, namely the factors market and the commodity market, where each purchase on the former defines for the same agent - an equivalent sale on the latter (and vice versa). Now, by analogy with earlier discussion (see especially Figure 2), it follows that the exchange in the production process as depicted in Figure 5 cannot logically be measured in monetary terms, since money enters this kind of schemes as a numéraire-commodity and we are thus trapped again in a circular analysis flawed by the equation ‘money = intermediary good’. We have indeed to make a formal choice between two logically opposite and mutually exclusive claims: if money is really a good (even though of a particular nature), then it cannot measure real output since it must itself be measured; on the contrary, if money does not pertain to the set of products, then it cannot be their counterpart in any exchange whatsoever, either on the commodity market or on the factors market. 10 A BOOK-KEEPING ANALYSIS OF A MONETARY ECONOMY By the same token, the overwhelming micro-foundations of general equilibrium models cannot logically explain the existence of one of the principal macroeconomic magnitudes of capitalist systems, namely national income, because the exchange represented in Figure 5 does not account for the birth of a net revenue for the economy as a whole. Since neoclassical economics claims that income is generated by the difference between sales and purchases on the commodity market, let us refer to the right-hand side of Figure 5 in order to try to overcome this logical flaw (Figure 6). _ real output F + money + W _ national economy Figure 6 Without going into the detail of general equilibrium analysis, the essence of the argument may be summed up as follows. On the commodity market, so we are told, the purchases of households (i.e. workers as in Figures 5 and 6) determine the income earned by firms, which is circularly invested on the factors market in order to acquire the productive services. On the whole, the income spent (–) by W on the purchase of the newly produced goods is gained (+) by the set of enterprises thus defining a zero-sum game by which (net) national income can never be logically explained: whatever is gained by one side (F or W) is lost by the other (W or F) so that the revenue for the economy as a whole is always and tautologically equal to zero (+x –x = 0). In this respect, Ingham has recently coined an elegant though rather hermetic formula worth quoting as an opening gambit, which - according to the principle of excluded third - shall lead us to modern monetary theory. In his own words, ‘money cannot have ‘micro-foundations’ as these are constructed by neoclassical ‘real’ analysis in terms of object-object and/or object-agent relations’ (Ingham 1996: 14-15, italics in the original). In plain but provocative language, this amounts to saying that mainstream economics seeks to explain how it is possible to measure goods in terms of goods (or, in a similar vein, to produce commodities by means of commodities) in a world where money should be given an essential role in order to encompass most criticism of the savaged neoclassical dichotomy. Now, on a more sophisticated level, the logical flaw of received monetary theory can be best highlighted by referring to the conception of absolute exchange worked out by B. Schmitt over the last forty years. Starting from both the numerical and vehicular nature of (bank) money and endorsing Keynes's still unorthodox analysis on wage-units (Keynes 1936: Chapter 4), it is indeed possible to provide a rigorous and logical explanation of the production-consumption process occurring in contemporary national economies, where ‘income is defined as the exchange between two simultaneous 11 SOME BASIC THEORETICAL ELEMENTS emissions, a monetary one and a real one’ (Schmitt and Cencini 1982: 139). Let us try to elucidate this major revolution in economics by means of a flow chart (Figure 7). Banking system physical output W money-income F vehicular money Figure 7 This exchange, as indeed all other kinds of payments - i.e. those occurring on commodity or financial markets -, takes place between one and the same agent (W in Figure 7) thus justifying the expression of ‘absolute exchange’ first used by B. Schmitt (1966). This is tantamount to saying that in a monetary production economy there is only one category of agents, namely the set of households, because enterprises (following Schumpeter's expression) are simply interposed between the workers and themselves. The point we would like to make clear here is that production is a complex action whose result, money-income, is the consequence of an exchange between two flows pertaining to one and the same economic agent. In contrast with established economic theories, workers pay themselves for the productive services they provide firms, since they convert - via the catalysis operated by the banking system - the physically heterogeneous outcome of labour (real flow) into its homogeneous identical expression under the form of bank deposits (monetary flow). Hence, money-income has an objective purchasing power for the very reason that it is the alter ego of total domestic product. It need not be added that the absolute exchange taking place in the production sphere is thus a macroeconomic operation, for its result (money-income) defines a positive magnitude for the national economy as a whole. All in all, the main conclusion to be drawn here is that ‘[m]oney-income denotes the national output, and is therefore a real commodity, while a sum of money, taken as such, is a purely numerical and immaterial form’ (Schmitt 1996b: 86-7, italics in the original). This outcome does not alter but strengthens the fact that - as objects of economic analysis - money and output appear (and disappear) together, since they are precisely the two faces of the same reality. Through the absolute exchange occurring on the factors market, the physically heterogeneous newly produced goods acquire a numerical form which renders them commensurable for economic purposes. 12 A BOOK-KEEPING ANALYSIS OF A MONETARY ECONOMY Furthermore, it becomes thus visible that the sole operation which can logically succeed in integrating money and output is the payment of wages (Table 5). Table 5 Banking system liabilities Workers assets x£ Firms x£ Recalling the necessary monetary intermediation of the banking system (see also Figure 7) and endorsing Keynes's contention about the existence of only one factor of production (Keynes 1936), it should now be evident that households own total national product at the very moment wages are being paid through the book-keeping entry recorded in Table 5. Indeed, by analogy with Table 4, it makes sense to argue that workers pay themselves through the functional intervention of both firms and banks, thus confirming the aforementioned conclusion that ‘wages are not the monetary counterpart of the product, but the product itself’ (Schmitt and Cencini 1982: 141). Ultimately, the (absolute) exchange in the production process is the father of all economic transactions, for its result, national money-income, represents the form in which purchasing power is held before final consumption occurs. Now, before addressing ourselves to the destruction of income on the commodity market, we ought to dwell briefly on two important issues raised in the preceding paragraph. Let us follow the order in which they should have appeared to the reader. 1 According to Keynes (1936) and as testified by modern macroeconomic investigation, it can be maintained that labour is the sole factor of production since the payment of wages defines total income (see Figure 7) or, identically, the cost of production of current output7 (see Table 5). Yet this does not necessarily mean that households obtain all the newly produced goods when they spend their moneyincome on the commodity market. It is indeed not contradictory - on the contrary, it is meaningful but its far-reaching implications go beyond the scope of this paper - to claim that (a) the formation of national income is tantamount to the sum of wages earned by the factors of production, and that (b) the expenditure of income can engender its (partial) redistribution. A thorough explanation of this conundrum having already been provided by Schmitt (1984: 123-50), we shall here merely recall the fact that statement (a) concerns the factors market whereas statement (b) relates to the commodity market, where retail prices can modify the distribution of income and give rise to profits. A short numerical example taken from Schmitt and Cencini (1982: 142-4) may prove useful. Suppose that spending 100 (per cent) of 7 When he defines income in A Treatise on Money, Keynes proposes ‘to mean identically the same thing by the three expressions: (1) the community's money-income; (2) the earnings of the factors of production; and (3) the cost of production’ (Keynes 1930: 123, italics in the original). 13 SOME BASIC THEORETICAL ELEMENTS 2 their income workers obtain only 80 (per cent) of current output. The conclusion is straightforward: fixing the seller price at 125 (per cent), firms are able to earn a profit on the commodity market by capturing the purchasing power which identically corresponds to the unsold (100 – 80 = 20) goods. If households are the (initial) owners of all newly produced goods and services at the very moment wages are being paid, how can it still be maintained that consumption takes place only when income is spent on the commodity market? In accordance with modern monetary theory, we have to distinguish analytically between two kinds of consumption. As we are going to see, the expenditure on the commodity market is literally a destruction of income, since the physical goods are released from the monetary form in which they were held by income holders. But it should be recalled that the payment of wages is already an expenditure, namely on the factors market, whose object is precisely current output (see Figure 7). From a macroeconomic viewpoint the absolute exchange occurring in the production process defines the instantaneous consumption of the newly produced goods, since the physical outcome of labour is converted - through the intermediation of the banking system - into an identically equivalent certificate of deposit (Schmitt 1984: 88-94). The newly produced goods lose their physical dimension to be transformed into money-income, whose purchasing power is nothing else, as we already know, than these very products. In this respect, the peculiarity of the productionconsumption process is that the newly generated income is preserved as a drawing right (bank deposit) over national output. We may now be able to turn our attention to the commodity market, where income holders obtain the physical object represented by their bank deposit. For our purposes it should suffice here to note that income expenditure on the purchase of goods enables workers to get hold of the value-in-use they have produced (if we assume profits are nil). Since the essence of the argument is also revealed by the book-keeping entries in the banking system's balance sheet, let us consider together both the payment of wages and their final expenditure on the market for produced goods (Table 6). Table 6 Banking system liabilities assets (1) Workers x£ Firms x£ (2) Firms x£ Workers x£ The first entry relates to the factors market and depicts, as we have already observed (see particularly Table 5), the formation of national income. Entry (2) is the result of income expenditure on the purchase of current output and requires, as should be clear by now, the monetary intermediation of the banking system (Figure 8). 14 A BOOK-KEEPING ANALYSIS OF A MONETARY ECONOMY Banking system bank deposit W real output F vehicular money Figure 8 On further thought, it becomes visible that the final purchase by households of current output is another type of absolute exchange, by which workers change their moneyincome into real goods (cf. Figure 7). The monetary form under which units of purchasing power were held disappears, revealing its physical content, namely national product. The creation of income and its destruction are therefore two absolute exchanges of opposite sign. The first, which we could call positive absolute exchange, defines the transformation of current output into money income, whereas the second, negative absolute exchange, defines the transformation of income into physical output. (Cencini 1988: 91) SOME BASIC THEORETICAL ELEMENTS 15 Summing up In this paper we have attempted to stress the vehicular nature of (bank) money and its endogenous character in providing the objective numerical measure of economic transactions. B. Schmitt and A. Cencini are the authors who have developed the deepest analytical insight into both banking activity and the workings of modern macroeconomic systems. Referring to their skilful analysis, whose historical foundations go back to the works of Smith, Ricardo, Marx, Walras, and Keynes, it has been noted that money flows back to its point of departure at the very moment it is emitted, since each payment entails the creation-destruction of the immaterial vehicle necessary to circulate goods. Furthermore, the new conception of money gets rid of all kinds of subjectivistic approaches to monetary economics, for it logically explains the purchasing power of money by relating it to the production process. Being the result of the monetization of total costs of production, money-income is the avatar of real output, its factual alter ego. 16 A BOOK-KEEPING ANALYSIS OF A MONETARY ECONOMY Bibliography Cencini, A. (1982) ‘The Logical Indeterminacy of Relative Prices’, in M. Baranzini (ed.) Advances in Economic Theory, Oxford and New York: Basil Blackwell and St. Martins, Chapter 7. Cencini, A. (1984) Time and the Macroeconomic Analysis of Income, London and New York: Pinter Publishers. Cencini, A. (1988) Money, Income and Time: A Quantum-Theoretical Approach, London and New York: Pinter Publishers. Cencini, A. (1995) Monetary Theory: National and International, London and New York: Routledge (paperback edition 1997). Cencini, A. and Schmitt, B. (1976) La pensée de Karl Marx, critique et synthèse (Vol. I La valeur), Albeuve: Castella. Clower, R. W. (ed.) (1969) Monetary Theory: Selected Readings, Harmondsworth: Penguin. Clower, R. W. (1977) ‘The Anatomy of Monetary Theory’, American Economic Review, vol. 67, no. 1, February, pp. 206-212. Deleplace, G. and Nell, E. J. (1996) ‘Afterword: Why and How to Replace the Microeconomic Theory of Money’, in G. Deleplace and E. J. Nell (eds) Money in Motion: The Post Keynesian and Circulation Approaches, London and Basingstoke: Macmillan, pp. 725-749. Desai, M. (1977/1995) ‘The Value of Money in a Monetary Economy’, reprinted in The Selected Essays of Meghnad Desai (Vol. I Macroeconomics and Monetary Theory), Aldershot: Edward Elgar, Chapter 15. Friboulet, J.-J. (1987) ‘Ressources et emplois dans la comptabilité du commerce extérieur’, paper presented at the Annual meeting of the International Association of French-speaking Economists, Fribourg (Switzerland), June, mimeo. Friedman, M. (1987) ‘Quantity Theory of Money’, in J. Eatwell, M. Milgate and P. Newman (eds) The New Palgrave: A Dictionary of Economics, London and Basingstoke: Macmillan, vol. 4, pp. 3-20. Goodhart, C. A. E. (1989) Money, Information and Uncertainty, London and Basingstoke: Macmillan, second edition (first published 1975). Graziani, A. (1989) ‘The Theory of the Monetary Circuit’, Thames Papers in Political Economy, Spring. Hahn, F. H. (1973) ‘On the Foundations of Monetary Theory’, in M. Parkin and A. R. Nobay (eds) Essays in Modern Economics, London: Longman, Chapter 13. Ingham, G. (1996) ‘Money: Object, Symbol and Social Relationship’, University of Cambridge, mimeo. Keynes, J. M. (1930) A Treatise on Money (vol. I The Pure Theory of Money), London: Macmillan. Keynes, J. M. (1936) The General Theory of Employment, Interest and Money, London: Macmillan. Marx, K. (1973) Grundrisse, Harmondsworth: Pelican Marx Library. Ricardo, D. (1985) Scritti monetari, Roma: Istituto della Enciclopedia Italiana fondata da Giovanni Treccani (Bibliotheca Biographica). Schmitt, B. (1966) Monnaie, salaires et profits, Paris: Presses Universitaires de France. SOME BASIC THEORETICAL ELEMENTS 17 Schmitt, B. (1972) Macroeconomic Theory: A Fundamental Revision, Albeuve: Castella. Schmitt, B. (1984) Inflation, chômage et malformations du capital: macroéconomie quantique, Paris and Albeuve: Economica and Castella. Schmitt, B. (1996a) ‘A New Paradigm for the Determination of Money Prices’, in G. Deleplace and E. J. Nell (eds) Money in Motion: The Post Keynesian and Circulation Approaches, London and Basingstoke: Macmillan, Chapter 4. Schmitt, B. (1996b) ‘Unemployment: Is There a Principal Cause?’, in A. Cencini and M. Baranzini (eds) Inflation and Unemployment: Contributions to a New Macroeconomic Approach (‘Routledge Studies in the Modern World Economy’, 4), London and New York: Routledge, Chapter 3. Schmitt, B. and Cencini, A. (1982) ‘Wages and Profits in a Theory of Emissions’, in M. Baranzini (ed.) Advances in Economic Theory, Oxford and New York: Basil Blackwell and St. Martins, Chapter 8. Smith, A. (1970) The Wealth of Nations, Harmondsworth: Penguin (first published 1776). Starr, R. M. (ed.) (1989) General Equilibrium Models of Monetary Economies: Studies in the Static Foundations of Monetary Theory, (‘Economic Theory, Econometrics, and Mathematical Economics’), Boston: Academic Press (Harcourt Brace Jovanovich). Walras, L. (1954) Elements of Pure Economics or the Theory of Social Wealth, translated by W. Jaffé, London: George Allen & Unwin (first published 1874). Withers, H. (1909) The Meaning of Money, London: Smith, Elder & Co.