Audit Plenary Session Plan

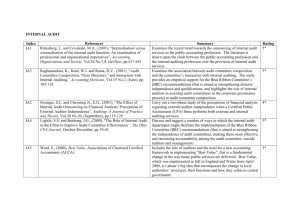

advertisement