Price-to-Book Ratio (P/B Ratio)

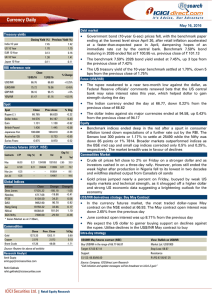

advertisement

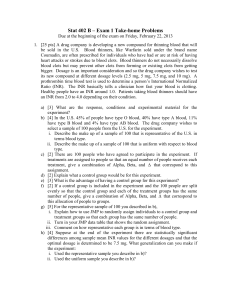

Price-to-Book Ratio (P/B Ratio) The price-to-book ratio, or P/B ratio, is a financial ratio used to compare a company's current market price to its book value.The price-to-book value ratio, expressed as a multiple (i.e. how many times a company's stock is trading per share compared to the company's book value per share), is an indication of how much shareholders are paying for the net assets of a company. The book value of a company is the value of a company's assets expressed on the balance sheet. It is the difference between the balance sheet assets and balance sheet liabilities and is an estimation of the value if it were to be liquidated. Calculation The calculation can be performed in two ways, but the result should be the same each way. 1. The company's market capitalization can be divided by the company's total book value from its balance sheet. 2. Divide the company's current share price by the book value per share (i.e. its book value divided by the number of outstanding shares). Example Assume a company has INR 100 million in assets and INR 75 million in liabilities. The book value of that company would be INR 25 million. If there are 1 million shares outstanding, each share would represent INR 25 of book value. If each share sells on the market at INR 75, then the P/B ratio would be 3 (75/25). What is it Significance ? A higher P/B ratio implies that investors expect management to create more value from a given set of assets, all else equal P/B ratios are commonly used to compare banks, because most assets and liabilities of banks are constantly valued at market values. Large discrepancies between P/B and ROE, a key growth indicator, can sometimes send up a red flag on companies. Overvalued growth stocks frequently show a combination of low ROE and high P/B ratios. If a company's ROE is growing, its P/B ratio should be doing the same. A lower P/B ratio could mean that the stock is undervalued. However, it could also mean that something is fundamentally wrong with the company. What are Limitations? The ratio is really only useful when you are looking at capital-intensive businesses or financial businesses with plenty of assets on the books. Book value doesn't carry much meaning for service-based firms with few tangible assets. Eq: Infosys whose bulk asset value is determined by intellectual property Book value doesn't really offer insight into companies that carry high debt levels or sustained losses. Debt can boost a company's liabilities to the point where they wipe out much of the book value of its hard assets, creating artificially high P/B values. The Bottom Line Admittedly, the P/B ratio has shortcomings that investors need to recognize. But it offers an easy-to-use tool for identifying clearly under or overvalued companies. For this reason, the relationship between share price and book value will always attract the attention of investors. Mutual fund investments are subject to market risks, read all scheme related documents carefully.