FIRST-ORDER ROUNDED INTEGER

advertisement

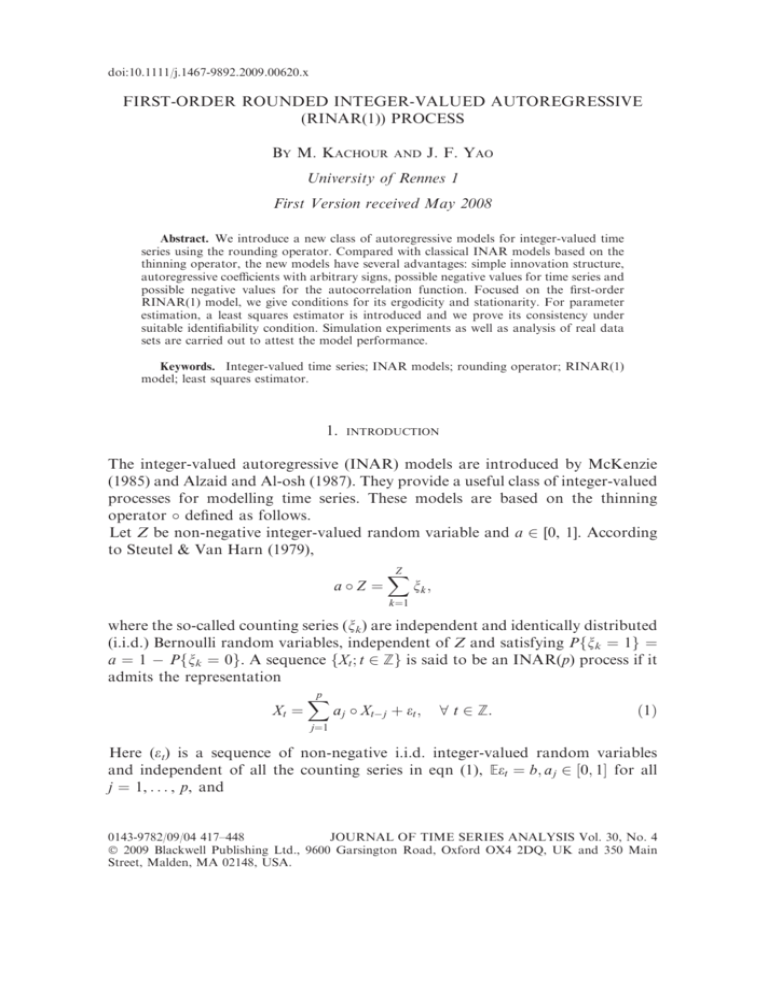

doi:10.1111/j.1467-9892.2009.00620.x FIRST-ORDER ROUNDED INTEGER-VALUED AUTOREGRESSIVE (RINAR(1)) PROCESS By M. Kachour and J. F. Yao University of Rennes 1 First Version received May 2008 Abstract. We introduce a new class of autoregressive models for integer-valued time series using the rounding operator. Compared with classical INAR models based on the thinning operator, the new models have several advantages: simple innovation structure, autoregressive coefficients with arbitrary signs, possible negative values for time series and possible negative values for the autocorrelation function. Focused on the first-order RINAR(1) model, we give conditions for its ergodicity and stationarity. For parameter estimation, a least squares estimator is introduced and we prove its consistency under suitable identifiability condition. Simulation experiments as well as analysis of real data sets are carried out to attest the model performance. Keywords. Integer-valued time series; INAR models; rounding operator; RINAR(1) model; least squares estimator. 1. INTRODUCTION The integer-valued autoregressive (INAR) models are introduced by McKenzie (1985) and Alzaid and Al-osh (1987). They provide a useful class of integer-valued processes for modelling time series. These models are based on the thinning operator defined as follows. Let Z be non-negative integer-valued random variable and a 2 [0, 1]. According to Steutel & Van Harn (1979), aZ ¼ Z X nk ; k¼1 where the so-called counting series (nk) are independent and identically distributed (i.i.d.) Bernoulli random variables, independent of Z and satisfying Pfnk ¼ 1g ¼ a ¼ 1 Pfnk ¼ 0g. A sequence fXt ; t 2 Zg is said to be an INAR(p) process if it admits the representation p X Xt ¼ aj Xtj þ et ; 8 t 2 Z: ð1Þ j¼1 Here (et) is a sequence of non-negative i.i.d. integer-valued random variables and independent of all the counting series in eqn (1), Eet ¼ b; aj 2 ½0; 1 for all j ¼ 1, . . . , p, and 0143-9782/09/04 417–448 JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 2009 Blackwell Publishing Ltd., 9600 Garsington Road, Oxford OX4 2DQ, UK and 350 Main Street, Malden, MA 02148, USA. 418 M. KACHOUR AND J. F. YAO aj Xtj ¼ Xtj X njk ðtÞ k¼1 with a suitable array of counting series fnjk ðtÞ; t 2 Z; j; k 2 Ng. A delicate technical point here concerns the choice of the counting series. For p ¼ 1, the INAR(1) model is studied by Alzaid and Al-osh (1987). Many of its properties mimic those of the real process AR(1). In particular, the function of autocorrelation and predictors in the sense of least squares is the same. For p ¼ 2, we distinguish two INAR(2) specifications. To find a maximum of parallelism between INAR(2) and AR(2), Du & Li (1991) propose a specification, denoted as INAR(2)-DL, where the counting series fnjk ðtÞ; t 2 Z; j; k 2 Ng are chosen such that all the thinned variables fa1 Xtj ; a2 Xtj ; j 2 N; t 2 Zg are independent. The process can be interpreted as a multitype branching process with immigration. The INAR(2)-DL process is stationary as long as a1 þ a2 < 1 and its autocorrelation function is identical to the AR(2) model. In addition, the one-step ahead forecast, at time T, based on the conditional expectation, is linear and is given by X^T þ1 ¼ EðXT þ1 j F T Þ ¼ a1 XT þ a2 XT 1 þ b; ð2Þ where F T ¼ rfXT ; XT 1 ; . . .g. Thus, the one-step ahead forecast for the previous models is beset by the problem that forecast values obtained will be real rather than integer valued in all but very rare cases. A mapping into the discrete support of the series is readily obtained by applying Gaussian brackets (integer part of) or by rounding to the nearest integer; the latter will be employed throughout this paper. The INAR(2)-AA model is also introduced by Alzaid and Al-osh (1990). Unlike the first-order process, the similarity between the real AR(2) and the INAR(2)-AA processes does not extend beyond the form. The main difference from the Du & Li (1991) specification described above lies in the treatment of the thinning operations a1 Xt1 and a2 Xt1. More precisely, the counting series fnjk ðtÞ; t 2 Z; j; k 2 Ng are chosen such that for each delayed time tj and conditionally to Xtj, the vector (a1 Xtj,a2 Xtj,Xtja1 Xtj a2 Xtj) follows a trinomial distribution with parameters (Xtj; a1,a2,1 a1 a2). To ensure the stationarity of the process, a1 þ a2 < 1 is required. This is a natural multivariate extension of the equivalent assumption in the INAR(1) process where (a Xt1 j Xt1) follows a binomial distribution with parameters a and Xt1. An important consequence arises from this choice of the counting series: a moving average structure is induced and the autocorrelation function of the process is similar to that of a ARMA(2,1) process. Secondly, as opposed to the INAR(1) model, the conditional mean (regression) function EðXT þ1 j F T Þ is generally nonlinear. For a recent review on discrete variate time-series models, we refer to McKenzie (2003). Recent related works on INAR models is given by Freeland and McCabe 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 RINAR(1) PROCESS 419 (2004, 2005) where authors examine the asymptotic properties of the maximum likelihood estimator as will as the CLS estimator for the Poisson INAR(1) model. Specifically, we would mention a recent integer-valued generalized autoregressive conditional heteroskedastic (GARCH) process introduced by Ferland et al. (2006) which again relies on the thinning operator . Doukhan et al. (2006) examines a simple integer-valued bilinear model. The class of INAR models has many limitations. Their innovation structure is complex, depending not only on the noise process (et), but also on the counting variables (njk(t)). The severest limitation is undoubtedly the fact that by construction the autoregressive coefficients are between 0 and 1. In the case of an INAR(1) model for example, the autocorrelation function equals ak1 ; k ¼ 0; 1; . . . as for a real AR(1) model. The restriction of a1 to the interval [0, 1] thus excludes the modelling of a series with some negative autocorrelations. In this work, we introduce the following model * + p X Xt ¼ aj Xtj þ k þ et ; t 2 N; ð3Þ j¼1 where hÆi represents the rounding operator to the nearest integer, (et) is a sequence of centred i.i.d. integer-valued random variables, defined on a probability space ðX; A; PÞ; k and (aj) are real parameters. We call this model RINAR(p) (for rounded integer-valued autoregression). The RINAR(p) model is a direct and natural extension on Z of the real AR(p) model. In fact, the rounding operator is considered as a censoring function on the real AR(p) model. Moreover, RINAR(p) has many advantages compared with the previous INAR models. Its innovation structure is simple, generated only by the noise (et). Its onestep ahead least squares predictor is given by * + p X X^T þ1 ¼ EðXT þ1 j F T Þ ¼ aj Xtj þ k ; ð4Þ j¼1 which is integer valued by construction. We shall also see that its stationarity is ensured under general conditions on the parameters (aj) which are similar to a real AR(p). In particular, (aj) can be of any sign. Furthermore, the RINAR(p) model can produce autocorrelation functions as rich as those of real AR(p), including negative autocorrelations in particular (see the example of the O’Donovan data examined in Section 6). From its construction, the RINAR(p) model can be used to analyse a time series with negative values, a situation not covered by any INAR model. It is also interesting to note that hÆi is in fact the operation often used in the collection of integer-valued series from real data (see the example of the annual population increases swedish examined in Section 7). In this article, we focus on the simplest RINAR(1) model. First in Section 2, we give conditions ensuring the stationarity and the ergodicity of the model. In 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 420 M. KACHOUR AND J. F. YAO Section 3, we introduce the least squares estimator for the estimation of the model parameters. This estimator is proved consistent under suitable conditions on the model. Because of the discontinuity of the rounding operator, particular care is needed for both the formulation of the model identifiability condition and the computation of the least squares estimator. A specific algorithm for the last problem is introduced in Section 4. We then present a small simulation experiment in Section 5 to access the performance of the estimator. In Sections 6 and 7, we analyse two real data sets with a RINAR(1) model. The first series shows some negative autocorrelations, while the second series has itself some negative values so that none of them can be fitted with the classical INAR(1) model. The proofs of all forthcoming results are postponed to Section 8. 1.1. Some notations The following notations and properties will be used throughout this paper. First, let us define N ¼ fx 2 Z : x 0g; Z>0 ¼ fx 2 Z : x > 0g and Z ¼ fx 2 Z : x 0g. Now, we introduce several useful properties of the rounding operator hÆi. Note that hai is clearly defined anywhere, unless if a ¼ k þ 12 where k 2 Z. By convention, we take hk þ 12i ¼ k þ 1; k 2 N and hk 12i ¼ k 1; k 2 Z . Note that a ! hai is an odd function. Let fag be the fractional part of a 2 R; fag 2 ½0; 1½. Here, the fractional part of a negative number is positive as fag ¼ fag ¼ fjajg, for example f1.23g ¼ f1.23g ¼ 0.23. Let s be the sign function defined by 1; if a 0, sðaÞ ¼ 1; if a < 0. Then, for all a 2 R, we have: a ¼ hai þ sðaÞfag sðaÞ1fag1=2 : ð5Þ Let [a] be the integer part of a 2 R, for example [2.8] ¼ 2 and [6.3] ¼ 6. Then, for all a 2 R, we have: a ¼ ½a þ sðaÞfag: Lemma 1 is a direct consequence of eqns (5) and (6). Lemma 1. 1. 2. 3. 4. 5. Let x 2 R and a, b 0. jhxi xj 12. jhxij ¼ hjxji jxj þ 12. ha þ bi ¼ c þ hfag þ fbgi; where c ¼ hai þ hbi 1fag1=2 1fbg1=2 . fa þ bg ¼ ffag þ fbgg. hai ¼ [a] þ hfagi. 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 ð6Þ 421 RINAR(1) PROCESS 2. ERGODICITY AND STATIONARITY OF THE RINAR(1) PROCESS We consider the RINAR(1) model defined by Xt ¼ haXt1 þ ki þ et ; t 2 N; ð7Þ where hÆi represents the rounding operator to the nearest integer, (et) is a sequence of centred i.i.d. integer-valued random variables. The process (Xt) forms an homogeneous Markov chain with state space E ¼ Z and transition probability function pðx; yÞ ¼ Pfe1 ¼ y hax þ kig; x; y 2 E: ð8Þ The following proposition gives the conditions which ensure the ergodicity and the stationarity of the RINAR(1) process. Proposition 1. Suppose that: (i) The Markov chain (Xt) is irreducible. (ii) For some k > 1; Ejet jk < þ1. (iii) jaj < 1. Then (1) The RINAR(1) process (Xt) has a unique invariant probability measure l which has a moment of order k. (2) For all x 2 E and f 2 L1(l) we have n 1X f ðXk Þ ! lðf Þ; n k¼1 Px a:s:; where Px denotes the conditional probability Pð j X0 ¼ xÞ. The assumptions of Proposition 1 are all natural. The assumption (i) of irreducibility is ensured, for example, if the law of e charges all points of E, i.e. 8k 2 Z; Pfe1 ¼ kg > 0. 3. ESTIMATION OF PARAMETERS The RINAR(1) model can be written in the following form Xt ¼ haXt1 þ ki þ et ¼ f ðXt1 ; hÞ þ et ; ð9Þ with f(x;h) ¼ hax þ ki and h ¼ ða; kÞ 2 R2 . In this section, it is assumed that h belongs to a compact parameter space Q, subset of 1; 1½R. Let X0, X1, . . . , Xn be observations from the RINAR(1) process. For the estimation of the parameter h, we consider the least squares estimator defined by 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 422 M. KACHOUR AND J. F. YAO h^n ¼ arg min un ðhÞ; ð10Þ h2H where un ðhÞ ¼ n 1X ½Xt f ðXt1 ; hÞ2 : n t¼1 ð11Þ Some notations are necessary. The acual value of the parameter is denoted by h0 ¼ (a0, k0) and Ph0 stands for the probability distribution of the chain (Xt) under the actual model. Moreover, any convergence !a:s: means an a.s. convergence under Ph0 ; x , which holds independently of the initial state x. Let us make the following assumptions. Assumptions [H]. (1) Under Ph0 , the Markov chain (Xt) is irreducible; (2) for some k 2; Ejet jk < þ1; (3) a0, the actual value of a, is in the interval ]1,1[; (4) the parametric space Q, is a compact subset of 1; 1½ R. Suppose that assumption H holds. Then, under Ph0 and from Proposition 1, (Xt) has an unique invariant measure lh0 such that lh0(j Æ jk) < 1 for some k 2. It follows that the double chain (Yt) with Yt ¼ (Xt1, Xt) has similar properties. Its transition kernel Ph0 equals Ph0 ðYt ; Ytþ1 Þ ¼ Ph0 ððx; zÞ; ðx0 ; z0 ÞÞ ¼ ph0 ðz; z0 Þ1z¼x0 ; ðx; zÞ; ðx0 ; z0 Þ 2 E2 ; where ph0 is the transition probability of (Xt) under the true model. The chain (Yt) has also an unique invariant measure rh0 ¼ lh0 ph0, i.e. ðx; zÞ 2 E2 : rh0 ððx; zÞÞ ¼ lh0 ðxÞph0 ðx; zÞ; As lh0(jÆjk) < 1, it follows that rh0(jj Æ jjk) < 1 for any norm jj Æ jj on E 2. Let the functions gðy; hÞ ¼ ½z f ðx; hÞ2 ; 8 y ¼ ðx; zÞ 2 E2 and h 2 H: KðhÞ ¼ rh0 gð; hÞ; 8 h 2 H: First, we identify the limit of the least squares estimating function. Proposition 2. Suppose that assumption H holds. Then, for any h 2 Q, a:s: (1) un ðhÞ ! KðhÞ; (2) K(h) K(h0) ¼ lh0([f(Æ;h) f(Æ;h0)]2). Moreover, we have a:s: sup jun ðhÞ KðhÞj ! 0: h2H 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 ð12Þ ð13Þ 423 RINAR(1) PROCESS Next, we examine the consistency problem of the least squares estimator. Because of rounding operations, the identifiability of RINAR(1) model has a non-standard behaviour. Namely, when the autoregressive coefficient a0 is rational, there is a small lack of identifiability on the offset parameter k0. Next, we use the distance dðh; h0 Þ ¼ maxfja a0 j; jk k0 jg; 8 h; h0 2 H: ð14Þ 3.1. Strong consistency of the least squares estimator when a0 is irrational Propositions 3 and 4 study precisely the question of identifiability of the parameters of RINAR(1) defined by eqn (9) for the case where a0, the actual value of a, is irrational. We recall, the following function f ðx; hÞ ¼ hax þ ki; 8 h ¼ ða; kÞ 2 H; where hÆi is the rounding operator and Q is a compact subset of 1; 1½R. Proposition 3. Suppose that assumption H holds. If a0 2 RnQ, then f ðx; hÞ ¼ f ðx; h0 Þ () h ¼ h0 : 8 x 2 E; Proposition 4. Suppose that assumption H holds. If a0 2 RnQ, then for all (sufficiently small) e > 0, we have inf jKðhÞ Kðh0 Þj > 0; h2He where Qe ¼ fh : d(h, h0) eg. Theorem 1. (1) (2) (3) (4) Assume that a0, the actual value of a, is an irrational number in the interval ]1,1[; under Ph0 , the Markov chain (Xt) is irreductible; for some k 2; Ejet jk < þ1; the parametric space Q, is a compact subset of ]1,1[R. Then, the least squares estimators are strongly consistent estimators of the actual values of the parameters. 3.2. Strong consistency of the least squares estimator when a0 is rational Before treating the identifiability problem of the RINAR(1) model, where the actual value a0 is rational, some explanations are necessary. 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 424 M. KACHOUR AND J. F. YAO Let a0 ¼ p=q; p 2 Z and q 2 Z>0 ; p and q are taken to be coprime. Recall that, fÆg represents the fractional part operator. It follows, for all x 2 Z; fa0 xg takes one of the following values: 1 q1 : 0; ; . . . ; q q If q is even, 12 is one of the previous values. The subdivision of [0, 1[ into (1/q)length intervals shows that 12 is a boundary point; in other words, there will be q/2 intervals before and after 12 (see Figure 1). Let a, b 2 [0, 1[. We assume, a 6¼ b and both belongs to the same interval, we get 8 x 2 Z; hfa0 xg þ ai ¼ hfa0 xg þ bi: ð15Þ If q is odd, 1 62 2 1 q1 0; ; . . . ; : q q So, the subdivision of [0, 1[ into (1/q)-length intervals, shows that here 12 is the middle point of (see Figure 1). hq=2i 1 hq=2i ; q q Therefore, the equality of eqn (15) may not be true. For example, for q ¼ 5, let a; b 2 ½15 ; 25 ½ such that a ¼ 0.23 and b ¼ 0.36. Then, for x0 ¼ 1, hfa0 x0 g þ ai ¼ h15 þ 0:23i ¼ 0 6¼ hfa0 x0 g þ bi ¼ h15 þ 0:36i ¼ 1: Now, we introduce a new subdivision of [0, 1[ into q þ 1 intervals. The first one is 1 0; ; 2q the q 1 next intervals are Figure 1. Upper row: the subdivision of [0,1[ with step length 14. Bottom row: the subdivision of [0,1[ with step length 15. 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 RINAR(1) PROCESS 425 Figure 2. The new subdivision of [0,1[, with q ¼ 7. 1 3 q2 1 1 qþ2 2q 3 2q 1 ; ; ; ; ; ;...; ;...; 2q 2q 2q 2 2 q 2q 2q and the last one is 2q 1 ;1 : 2q This subdivision shows that 12 is again a boundary point. It means, there will be (q þ 1)/2 intervals before and after 12 (one of length 1/2q and the others of length 1/q, see Figure 2). If a 6¼ b and both belong to one of the q þ 1 intervals, then eqn (15) is still verified. Equation (15) must be verified in both cases (q is even or odd), to prove propositions. Proposition 5. Suppose that assumption H holds. If a0 ¼ p/q, where p 2 Z; q 2 Z>0 ; p and q are taken to be coprime, then 8 x 2 E; f ðx; hÞ ¼ f ðx; h0 Þ () a ¼ a0 and k 2 I0 : I0 is a (1/q)-length interval or (1/2q)-length interval where k0 2 I0. The length of I0 depends on the parity of q and the position of fk0g: • If q is even, then I0 is a (1/q)-length interval. If q is odd, then we distinguish two subcases: If 1 2q 1 ;1 ; fk0 g 2 0; [ 2q 2q then I0 is a (1/2q)-length interval. If 1 2q 1 ; fk0 g 2 ; 2q 2q then I0 is a (1/q)-length interval. Proposition 5 shows that for rational a0 ¼ 1/q, h0 is not the unique point that minimizes the limiting contrast function K(h) defined by eqn (13). Next, to simplify the notations, we consider just the case where q is even. 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 426 M. KACHOUR AND J. F. YAO Then, from the above discussions, there exists k0 2 f0,1, . . . ,q 1g such that k0 k0 þ 1 ; : fk0 g 2 i0 ¼ q q We define, I0 ¼ fk : hki ¼ hk0 i and fkg 2 i0 g and A0 ¼ fh : a ¼ a0 and k 2 I0 g: ð16Þ Proposition 6. Suppose that assumption H holds. If a0 ¼ p=q; p 2 Z and q 2 Z>0 ; p and q are coprime, q is even, then for all (sufficiently small) e > 0, we have inf jKðhÞ Kðh0 Þj > 0; h2H0e where H0e ¼ fh : dðh; A0 Þ eg. Theorem 2. Assume that (1) a0, the actual value of a, is a rational number in the interval ]1,1[, where a0 ¼ p=q; p 2 Z and q 2 Z>0 ; p and q are coprime and q is even; (2) the Markov chain (Xt) is irreductible; (3) for some k 2; Ejet jk < þ1; (4) the parametric space Q, is a compact subset of 1; 1½ R. ^n ; A0 Þ ! 0; Ph a:s: In other words, ^an is strongly consistent Then we have dðh 0 while ^ kn converges to an interval of length 1/q containing k0. In the case where q is odd, Theorem 2 still holds where I0 (therefore A0) is replaced by the corresponding intervals as mentioned above. 4. A NUMERICAL METHOD TO CALCULATE ^hn First, some recalls are necessary. Let X0, X1, . . . , Xn be observations from the RINAR(1) process, defined by eqn (9). Our aim is to find a numerical method to calculate ^ hn , defined by eqns (10) and (11). The main difficulty in calculating ^ hn comes from the discontinuity of the autoregression function f. The classical algorithms of gradient type then become unworkable. We propose the following minimization algorithm. Its initialization step is given by the method of Yule–Walker as if the series of observation was real. The algorithm continues through successive dichotomous search steps. 4.1. Initialization As RINAR(1) mimics the real AR(1) model, we propose, for the initial value ^ h0 ¼ ð^ a0 ; ^ k0 Þ, the Yule–Walker estimator of h ¼ (a, k) as in a real AR(1) model: 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 RINAR(1) PROCESS ^ ^ð1Þ and a0 ¼ q 427 ^ k0 ¼ Xn ð1 ^a0 Þ: ^ð1Þ is the first empirical autocorrelation function and Xn the sample mean. Here q 4.2. Successive dichotomy search steps ^k Þ to ð^ The transition from ð^ ak ; k akþ1 ; ^ kkþ1 Þ, for k ¼ 0, 1, . . . , is carried out in two phases. We apply a successive dichotomy search, first for a and second for k. Then in the first phase ^ kk begin fixed, a dichotomy search of a leads to the new value ^ akþ1 . Note that this procedure uses [1, 1[ as the initial search interval for a (i.e. left ¼ 1 and right ¼ 1). For this phase, the objective function un defined by eqn (11) is evaluated for every step of the search at three different points: ^ak and their middle left (mid_left) and middle right (mid_right) points. According to the minimum value of un(ak, kk), un(mid_left, kk) and un(mid_right, kk), ^ak , left and right change their actual value. For example, if un(ak, kk) is the minimum then left takes the value of the mid_left and right takes the value of the mid_right. This process stops when range ¼ jrigth leftj 0.001. The following pseudo-code defines the used dichotomous search of a. left 1; right 1; range 2; mid_left (left þ previous_alpha)/2; mid_right (leftþprevious_alpha)/2; while range > 0.001 do begin V_1 Phi_n (alpha_k,lambda_k); V_2 Phi_n (mid_left,lambda_k); V_3 Phi_n (mid_right,lambda_k); i j such that V_j is min (V_1, V_2, V_3) case i of 1 : begin left mid_left ; right mid_right end, 2 : begin right alpha ; alpha mid_left end, 3 : begin left alpha ; alpha mid_right end, range abs (right left) end; In the second phase, ^ akþ1 begin fixed, a similar search in k leads to the new ^kkþ1 . For this dichotomous search of k, the initial search interval is defined to be ^ k0 5j^ k0 j, which seems large enough in most situations. This is the end of the (k þ 1)th iteration. The search stops when the results from two consecutive iterations are very close. More precisely, we stop at the kth iteration if: dðð^ ak ; ^ kk Þ; ð^ akþ1 ; ^ kkþ1 ÞÞ ¼ maxfj^ akþ1 ^ak j; j^kkþ1 ^kk jg 0:001: ð17Þ 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 428 M. KACHOUR AND J. F. YAO In the general case, this stopping criterion is satisfied after few iterations. At the end of the iterations, we get a couple ð^ an ; ^kn Þ which minimizes our objective function un(a, k). It is worth mentioning that the Yule–Walker estimate ð^a0 ; ^k0 Þ provide a very good initial guess for our minimization algorithm. In particular, the initial barcket ^ k0 5j^ k0 j for the search of ^ kk s is more than sufficient. Clearly, without such a good initial estimate, one may employ a more sophisticated strategy as the one suggested, e.g. Press et al. (2007). 5. SIMULATION STUDY Let h0 ¼ (a0, k0) be the actual value of h ¼ (a, k). To an error variable, say e1, we consider two i.i.d. Poisson random variables Z1 and Z2, and we take e1 ¼ Z1 Z2. We simulate n ¼ 500 observations of RINAR(1) model and we compute the least squares estimator ^ hn . After 500 independent replications, we calculate the average and standard deviation of the sequence of the estimates obtained and draw their histograms. Three different values of h0 have been used in the simulation. The following table 1 gives averages and standard deviations of the estimates in the three different cases. Their histograms are displayed in Figure 3. Note that inevitably, the a0s used for simulations are rational. Therefore, as predicted by Theorem 2, the consistency of the least squares estimator ^hn has to be judged within some inevitable fluctuations of ^ k0 . Cases A B C a0 Mean(^a) rð^aÞ k0 ^ Mean(k) rð^kÞ 0.4 0.2 0.3 0.4075 0.2038 0.3032 0.0454 0.0545 0.0426 1.44 2.96 5.65 1.3988 2.9953 5.6105 0.1626 0.1861 0.3459 We note that: For case A, a0 ¼ p/q where p ¼ 2 and q ¼ 5 is odd. We have 3 5 ; fk0 g 2 i2 ¼ and I2 ¼ ½1:3; 1:5½: 10 10 We note that the fractional part of the average of the estimates of k also belongs to i2. For case B, a0 ¼ p/q where p ¼ 1 and q ¼ 5 is odd. We have 9 ;1 and I3 ¼ ½2:9; 3½: fk0 g 2 i3 ¼ 10 We note that the fractional part of the average of the estimates of k also belongs to i3. For case C; a0 ¼ p=q where p ¼ 3 and q ¼ 10 is even. We have 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 429 RINAR(1) PROCESS 12 3.0 10 2.5 8 2.0 6 1.5 4 1.0 2 0.5 0 −0.55 −0.50 −0.45 −0.40 −0.35 −0.30 −0.25 −0.20 0.0 0.8 9 2.5 1.0 1.2 1.4 1.6 1.8 2.0 2.2 8 2.0 7 6 1.5 5 4 1.0 3 2 0.5 1 0 −0.40 −0.35 −0.30 −0.25 −0.20 −0.15 −0.10 −0.05 −0.00 10 0.0 −4.0 −3.8 −3.6 −3.4 −3.2 −3.0 −2.8 −2.6 −2.4 1.5 9 8 7 1.0 6 5 4 0.5 3 2 1 0 0.15 0.20 0.25 0.30 0.35 0.40 0.45 0.0 4.6 4.8 5.0 5.2 5.4 5.6 5.8 6.0 6.2 6.4 6.6 6.8 Figure 3. Histograms of the estimates ^a (left column) and ^k (right column). Top to bottom: cases A, B, C (500 replications of series of length 500). fk0 g 2 i1 ¼ 6 7 ; 10 10 and I1 ¼ ½5:6; 5:7½: We note that the fractional part of the average of the estimates of k also belongs to i1. 6. ANALYSIS OF THE O’DONOVAN DATA SET The methods introduced in this article are applied to 70 observations of consecutive readings from a batch chemical process from O’Donovan (1983). The observed counts (see Figure 4) vary from 17 to 66. The sample mean is 49.6857 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 430 M. KACHOUR AND J. F. YAO and the sample variance is 84.7403. The sample autocorrelation function (ACF) and partial autocorrelation function (PACF) are given in Figure 5. From the sample ACF, we can see that only the first sample autocorrelation is significant. However, the second sample autocorrelation is nearly significant, (^ qð1Þ ¼ 0:588 ^ð2Þ ¼ 0:272). There is an alternation of the signs of sample autocorrelations, and q and they tend to zero quickly afterwards. From the sample PACF, we can see that only the first sample partial autocorrelation is siginificant. This strongly suggests an AR(1) model. 6.1. The real AR(1) model of O’Donovan O’Donovan fitted a real AR(1) model Xt 2 R; Xt ¼ aXt1 þ b þ et : In order to compare this model with the RINAR(1) model below, we reserved the 60 initial observations as a learning set (i.e. to estimate the parameters) and the 10 latest observations as a test set for forecasting. The Yule–Walker estimates as suggested by O’Donovan are ^ b ¼ Xn ð1 ^ aÞ ¼ 80:5067 ^ð1Þ ¼ 0:6242; ^ a¼q (from the 60 observations); ^ð1Þ is the first-order sample autocorrelation function and Xn is the sample where q mean. Model diagnostics based on the obtained residuals such as their ACF and Ljung–Box statistics confirm well with this model fit. The one-step least squares ahead forecast X~T þ1 of XTþ1 equals Series O’Donovan 70 60 50 40 30 20 10 0 10 20 30 40 50 Time Figure 4. Plot of O’Donovan data. 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 60 70 431 RINAR(1) PROCESS Series O’Donovan Series O’Donovan 1.0 0.2 0.0 ACF Partial ACF 0.5 0.0 –0.2 –0.4 –0.5 –0.6 0 5 10 15 5 10 Lag 15 Lag Figure 5. Sample simple and partial autocorrelation functions of 70 consecutive readings of a chemical process. X~T þ1 ¼ ^ aXT þ ^b: ð18Þ In general, X~T þ1 is real valued. A mapping into the discrete support of the series is obtained by rounding to the nearest integer, then X~T þ1 ¼ h^ aXT þ ^bi: ð19Þ For the 10 latest observations of the series, the forecasts AR(1) are as follows: XTþ1 X~T þ1 48 54 44 51 49 53 44 50 49 53 69 50 40 37 54 56 58 47 49 44 6.2. Fit of a RINAR(1) model Now, we use the algorithm of Section 4 to fit a RINAR(1) model with ^hn ¼ ð^ an ; ^ kn Þ ¼ ð0:62281; 80:604975Þ. The one-step least squares ahead forecast X^T þ1 of XTþ1 equals here: X^T þ1 ¼ h^ an XT þ ^kn i: ð20Þ The results for the last 10 observations are XTþ1 X^T þ1 48 54 44 51 49 53 44 50 49 53 69 50 40 38 54 56 58 47 49 44 6.3. Comparison and comments As the first sample autocorrelation is negative, this time series cannot be modelled by an INAR(1) model. Compared with the real AR(1) model 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 432 M. KACHOUR AND J. F. YAO (followed by a rounding step), forecasts are identical except the seventh where RINAR(1) improves the prediction of an unit. A numerical explanation for this equivalent prediction performance is that the parameters estimations ^hn of RINAR(1), calculated by the algorithm of Section 4, is actually very close to its initialization value ^ h0 which is indeed the Yule–Walker estimate of the real AR(1) model. 7. ANALYSIS OF THE ANNUAL SWEDISH POPULATION RATES DATA Figure 6 shows the time series of annual Swedish population increases (per thousand population), denoted Pt, for 1750–1849 as reported in Thomas (1940). Although such population increases should be real valued, the recorded rates are rounded values on the one thousand scale. The rates vary from 27 to 16, with a sample mean of 6.69 and a sample variance of 34.5594. The sample ACF and PACF are given in Figure 7. The geometric decrease in the sample autocorrelations and the clear cut-off after lag 1 in the partial autocorrelations justify an AR(1) fitting. In order to compare the models proposed for fitting the present data, we reserve the first 80 observations as a learning set and the last 20 observations as a test set for forecasting. Series Swedish population rates 20 15 10 5 0 −5 −10 −15 −20 −25 −30 0 10 20 30 40 50 60 70 80 90 Time Figure 6. Plot of Swedish population rates (1750–1849). 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 100 433 RINAR(1) PROCESS Series Swedish_population_rates Series Swedish_population_rates 1.0 0.4 0.8 Partial ACF 0.3 ACF 0.6 0.4 0.2 0.0 0.2 0.1 0.0 −0.1 −0.2 −0.2 0 5 10 15 2 Lag 4 6 8 10 12 14 Lag Figure 7. Sample simple and partial autocorrelation functions of the Swedish population rates series (in 1000s) from 1750 to 1849. 7.1. Fit of a real AR(1) model We propose a real AR(1) model Pt 2 R; Pt ¼ aPt1 þ b þ et : The Yule–Walker estimations are ^ð1Þ ¼ 0:4505; ^ a¼q ^ b ¼ Pn ð1 ^aÞ ¼ 3:3382; ^ð1Þ is the first-order sample autocorrelation function and Pn the sample where q mean. The one-step ahead forecast, at time T, followed by a final rounding step, equals P~T þ1 ¼ h^ aPT þ ^bi: For the latest 20 observations of the series, the mean-squared error of the forecasts on the test set is 11.95. 7.2. Fit of a RINAR(1) model Now, to analyse the present data, we propose the RINAR(1) model defined by Pt ¼ haPt1 þ ki þ et : Using the algorithm of Section 4, we get the estimates ^hn ¼ ð^an ; ^kn Þ ¼ 0:469; 3:559Þ. The one-step least squares ahead forecast P^T þ1 of PTþ1 equals here: P^T þ1 ¼ h^ an PT þ ^kn i: 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 434 M. KACHOUR AND J. F. YAO For the latest 20 observations of the series, the mean-squared error of the forecasts on the test set is 11.5. 7.3. The approach of McCleary & Hay McCleary and Hay (1980) have analysed both the Swedish Harvest Index time series and the above population rates series. Actually, the Harvest Index series, considered as a crude measure of food production, has a high influence on the subsequent population rates. For both series, the authors proposed a real MA(1) model. For the population rates series, the proposed model is Pt l ¼ b1 et1 þ et ; with some real parameters l and b1. To estimate the parameters of the MA(1) model, using the software R, we get ^ ¼ 0:4307 and l ^ ¼ 6:075 (sample mean for the 80 observations). b 1 The one-step ahead least squares predictor PT þ1 of PTþ1 of MA(1) model is a ^, and by a final rounding step, it equals constant, l PT þ1 ¼ h^ li ¼ 6: ð21Þ The mean-squared error of the forecasts on the test set is 18.75. 7.4. Comparison and comments The time series at hand has negative values so that it cannot be fitted by an INAR model. 16 14 12 10 8 6 4 RINAR(1) forecast values True values AR(1) forecast values 2 0 0 5 10 15 20 Figure 8. The last 20 observations of the Swedish population rate series and their forecasts based on RINAR(1) and AR(1) fits. 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 435 RINAR(1) PROCESS Figure 8 shows the forecast results of RINAR(1) and AR(1) for the last 20 observations. Compared with the AR(1) model, the forecasts are different at seven data points, (see Figure 8). The mean-squared error of the 20 forecasts decreased from 11.95 to 11.5. On the other hand, the RINAR(1) model yields much better forecasts than the MA(1) model proposed by McCleary and Hay (1980), the mean-squared error of the 20 forecasts decreased from 18.75 to 11.5 (39% decrease). APPENDIX: PROOFS Proof of proposition 1. For all x0 2 E ¼ Z, we define the empirical measure ln by: 1 ln ðÞ ¼ ½p1 ðx0 ; Þ þ þ pn ðx0 ; Þ; n where pn denotes the n-step transition probability of the Markov chain. The idea is to prove that this sequence of probability distribution (ln) has a sub-sequence converging to some probability distribution l. By construction, this limit will automatically be a stationary probability distributions of the Markov chain (Xt). Let the function V : E ! Rþ such that V(x) ¼ jxjk. As V is positive and limjxj!1V(x) ¼ 1, V is a Lyapunov function. Under the assumptions, (Xt) verifies the Lyapunov criterion, with V(x) ¼ jxjk as Lyapunov function (see Duflo, 1997, Prop. 2.1.6, p. 41) Moreover, we have lim sup ln V l < 1: n!1 As a result (ln) is tight and for any limit point l, we have lV l < 1. It follows that l is a measure p-invariant. Therefore, (Xt) is positive recurrent and l is unique. Conclusion (2) follows the classical ergodic theorem for Markov chains. h Next, we consider jjÆjj the norm on the space E2 ¼ Z2 defined by 8y ¼ ðx; zÞ 2 E2 ; kyk ¼ jxj þ jzj: ð22Þ k We assume, for some k 2; Ejet j < þ1. Recall that Assumption H holds. Then, lh0 and rh0 [the respective unique invariant probability measure of the chain (Xt) and the double chain Yt ¼ (Xt1,Xt)] both have a moment of order k2. Here, we recall the following functions: f(x;h) ¼ hax þ ki,8x 2 E, where hÆi represents the rounding operator, g(y;h) ¼ (z f(x;h))2,8y ¼ (x,z) 2 E2, and K(h) ¼ rh0g(.;h). In all the following proofs, we denoted a generic constant c whose exact value can change during the mathematical development. Lemma 2 will be useful for the proof of Proposition 2. Lemma 2. For all h 2 Q, we have jf(.;h)j2 2 L1(lh0). jg(.;h)j 2 L1(rh0). 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 436 M. KACHOUR AND J. F. YAO Proof of Lemma 2. Note that, for all a 2 R, we have jhaij jaj þ 12. We have, using the compactness of Q, for all x 2 E ¼ Z, jf ðx; hÞj ¼ jhax þ kij jax þ kj þ 12 jajjxj þ jkj þ 12 cð1 þ jxjÞ; then, jf(x; h)j2 c(1 þ jxj2). So, because k 2 and lh0(jÆjk) < 1, the first assertion follows. For the second assertion, note that for all y ¼ ðx; zÞ 2 E2 ¼ Z2 jz f ðx; hÞj ¼ jz hax þ kij cð1 þ ðjxj þ jzjÞÞ ¼ cð1 þ kykÞ; and then, jgðy; hÞj ¼ jz f ðx; hÞj2 cð1 þ kyk2 Þ: ð23Þ k Because k 2 and rh0(jjÆjj ) < 1, the second assertion follows. h Proof of Proposition 2. (1) First, we identify the limit of un, the least squares estimating function, defined by eqn (11). Note that un equals: un ðhÞ ¼ n n 1X 1X ðXt f ðXt1 ; hÞÞ2 ¼ gðYt ; hÞ: n t¼1 n t¼1 ð24Þ From Lemma 2, we have g(.; h) 2 L1(rh0). So, by the ergodic theorem for the double Markov chain Yt ¼ (Xt1, Xt), we get a:s: un ðhÞ ! rh0 gð:; hÞ ¼ KðhÞ: (2) Our aim is to prove that the function K(h) satisfies KðhÞ Kðh0 Þ ¼ lh0 ððf ð:; hÞ f ð:; h0 ÞÞ2 Þ: So, we have KðhÞKðh0 Þ¼ X rh0 ði;jÞðgðði;jÞ;hÞgðði;jÞ;h0 ÞÞ: ði;jÞ2E2 ¼ X ði;jÞ2E2 ¼ X lh0 ðiÞðf ði;hÞ2 f ði;h0 Þ2 Þ2 i2E ¼ X X X lh0 ðiÞðf ði;hÞ2 f ði;h0 Þ2 Þ2 X rh0 ði;jÞjðf ði;hÞf ði;h0 ÞÞ: ði;jÞ2E2 lh0 ðiÞðf ði;hÞf ði;h0 ÞÞ i2E i2E ¼ X rh0 ði;jÞðf ði;hÞ2 f ði;h0 Þ2 Þ2 X ph0 ði;jÞj: j2E lh0 ðiÞðf ði;hÞf ði;h0 ÞÞf ði;h0 Þ: i2E lh0 ðiÞðf ði;hÞf ði;h0 ÞÞ2 : i2E ¼lh0 ððf ð:;hÞf ð:;h0 ÞÞ2 Þ: (3) Our aim is to prove that a:s: sup jun ðhÞ KðhÞj ! 0: h2H 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 437 RINAR(1) PROCESS Some notations are necessary. Let Pn be the empirical measure generated by the observations Y1, . . . ,Yn Pn ðyÞ ¼ n 1X 1Y ¼y ; n i¼1 i y ¼ ðx; zÞ 2 E2 ¼ Z2 : It follows, from eqn (24), that the contrast function un equals: un ðhÞ ¼ Pn gð:; hÞ: ð25Þ Then, from equation (23), we have jgðy; hÞj AðyÞ; 8y ¼ ðx; zÞ 2 E2 and h 2 H; ð26Þ where AðyÞ ¼ cð1 þ kyk2 Þ; ð27Þ c is a constant: 1 So, G ¼ ðgð:; hÞÞh2H have A as the envelope function, where A 2 L (rh0). Let q > 0 be fixed. It follows, jun ðhÞ KðhÞj ¼ jðPn rh0 Þgj ¼ jðPn rh0 Þg1kyk<q þ ðPn rh0 Þg1kyk>q j jðPn rh0 Þg1kyk<q j þ Pn ðjgj1kyk>q Þ þ rh0 ðjgj1kyk>q Þ jðPn rh0 Þg1kyk<q j þ Pn ðAðyÞ1kyk>q Þ þ rh0 ðAðyÞ1kyk>q Þ: We denote, for any y 2 E2, py ¼ rh0(y) and pyn ¼ Pn ðyÞ. Moreover, X n jðPn rh0 Þg1kyk<q j ¼ gðy; hÞðpy py Þ kyk<q X n AðyÞjpy py j: kyk<q This means that sup jun ðhÞ KðhÞj ¼ sup jðPn rh0 Þgj h2H h2H X AðyÞjpyn py j þ ðPn þ rh0 ÞðAðyÞ1kyk>q Þ: kyk<q When n ! 1, we have pyn ! py almost surely, then the finite sum X AðyÞjpyn py j ! 0; a:s: kyk<q Therefore, lim sup sup jðPn rh0 Þgj 0 þ 2rh0 ðAðyÞ1kyk>q Þ; n!1 a:s: h2H By making q ƒ 1, we get almost surely, limsup sup jðPn rh0 Þgj ¼ 0: n!1 h h2H Q is compact. Then, for all h ¼ (a,k) 2 Q, there exist two positive constants A and B such that jaj A and jkj B. We recall, that fÆg represents the fractional part operator. For all a 2 R, fag 2 [0,1[ and fag ¼ fjajg. 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 438 M. KACHOUR AND J. F. YAO Proof of Proposition 3. Our aim is to prove that if a0 2 RnQ, 8x 2 E; ! hax þ ki ¼ ha0 x þ k0 i a ¼ a0 and k ¼ k0 : The idea is to prove that if h 6¼ h0 then there exists x0 2 E such that f(x0; h) 6¼ f(x0; h). We get, using the compactness of Q, for all x 2 E ¼ Z, jf ðx; hÞ f ðx; h0 Þj ¼ jhax þ ki ha0 x þ k0 ij ja a0 jjxj 2B 1: If a 6¼ a0, there exists x0 2 E such that j f(x0, h) f(x0, h0)j > 0; this is a contradiction. For x0 ¼ 0, f(0;h) ¼ f(0;h0) implies hki ¼ hk0i. Therefore, without using the fact that a0 2 RnQ, we have a ¼ a0 and hki ¼ hk0i. We assume, without loss of generality, a0 > 0, k k0 0 and fkg; fk0 g 2 ½0; 12 ½. It follows that k k0 ¼ fkg fk0g and f ðx; hÞ ¼ f ðx; h0 Þ; 8x 2 E ) hfa0 xg þ fkgi ¼ hfa0 xg þ fk0 gi; 8x 2 E: ð28Þ We have, a0 2 RnQ. Then, ðfa0 xgÞx2Z is dense in [0,1[. If fkg 6¼ fk0g, there exists x0 2 Z such that fa0 x0 g þ fk0 g < 12 and fa0 x0 g þ fkg 12 : h This is a contradiction with eqn (28). Lemma 3 will be useful for the proof of Proposition 4. Lemma 3. Let x0 2 Z>0 be fixed, the function a ! fax0g, defined in R, is continuous at a0 if a0 2 RnQ. Proof of Lemma 3. Let x0 2 Z>0 be be fixed, fax0g ¼ jax0j [jax0j], where [Æ] is the integer part function. Then the function fg : R ! ½0; 1½, defined by a ! fax0g, is discontinuous at a if ax0 2 Z. Then, if a0 2 RnQ, then a ! fax0g is continuous at a0. u Some recalls are necessary. We consider d, the distance on the parametric space Q, defined by dðh; h0 Þ ¼ maxfja a0 j; jk k0 jg; 8h ¼ ða; kÞ and h0 ¼ ða0 ; k0 Þ 2 H: From Proposition 2, we have KðhÞ Kðh0 Þ ¼ lh0 ððf ð:; hÞ f ð:; h0 ÞÞ2 Þ: Proof of Proposition 4. small) e > 0, we have ð29Þ Our aim is to prove that if a0 2 RnQ then, for all (sufficiently infh2He jKðhÞ Kðh0 Þj > 0; where Qe ¼ fh:d(h,h0) eg. As h has two components a and k which play different roles, we need to distinguish among three situations for the event Qe. Note that Qe ¼ C1 [ C2 [ C3, where 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 439 RINAR(1) PROCESS C1 ¼ fh 2 H : ja a0 j eg; C2 ¼ fh 2 H : ja a0 j < e; jk k0 j e; hki 6¼ hk0 ig; and C3 ¼ fh 2 H : ja a0 j < e; jk k0 j e; hki ¼ hk0 ig: We prove infh2Ci jKðhÞ Kðh0 Þj > 0; i ¼ 1; 2; 3: The idea of the proof is based on eqn (29). Then, the aim is to find x0 2 E such that jf ðx0 ; hÞ f ðx0 ; h0 Þj > 0; uniformly on Ci ; i ¼ 1; 2; 3: (1) We consider the first case, h 2 C1. As Q is compact implies that jaj A and jkj B for constants A and B. We have, jf ðx; hÞ f ðx; h0 Þj ja a0 jjxj 2B 1 ejxj 2B 1: Therefore, there exists x0 > 0 such that 8jxj x0, we have e jf ðx; hÞ f ðx; h0 Þj jxj; uniformly on C1 : 2 It follows, since the support of lh0 is not bounded, inf jKðhÞ Kðh0 Þj h2C1 Z e 2 x lh0 ðdxÞ > 0: jxjx0 2 (2) For h 2 C2, we have jf ð0; hÞ f ð0; h0 Þj ¼ jhki hk0 ij 1: Because, if two real numbers do not have the same integer part, their absolute difference is at least 1. Therefore, inf jKðhÞ Kðh0 Þj > 0: h2C2 (3) For h 2 C3, we assume, without loss of generality, a0 > 0 and k0 0. We distinguish four cases depending on the position of the fractional part of k0 and k: (a) Case A: fk0 g 2 ½0; 12 ½ and k k0. (b) Case B: fk0 g 2 ½0; 12 ½ and k k0. (c) Case C: fk0 g 2 ½12 ; 1½ and k k0. (d) Case D: fk0 g 2 ½12 ; 1½ and k k0. Case A. fk0 g 2 ½0; 12 ½ and k k0. Here, it is simple to verify that 1 fkg 2 ½0; ½ and k k0 ¼ fkg fk0 g e: 2 The aim is to find an x0 2 N for which 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 440 M. KACHOUR AND J. F. YAO fa0 x0 g þ fk0 g < 12 ; ð30Þ and for a sufficiently close to a0 and all k such that jk k0j e 1 fax0 g þ fkg : 2 ð31Þ Let e sufficiently small, such that : fk0 g þ e < 12. As ðfa0 xgÞx2N is dense in [0,1[, there exists x0 2 N such that: fa0 x0 g 1 fk0 g e < e : ð32Þ 2 2 4 Then, inequality (30) is immediately verified. In addition, for this x0 2 N fixed, as a ! fax0g is continuous at a0 (Lemma 3), there exists g ¼ g(e,a0,k0) e such that 8ja a0j g, it arises e ½ax0 ¼ ½a0 x0 : : ð33Þ jfax0 g fa0 x0 gj 4 Therefore, from eqns (32) and (33), we have fax0 g þ fkg ¼ fax0 g fa0 x0 g þ fkg fk0 g þ fa0 x0 g þ fk0 g e 1 e e 1 þeþ ¼ : 4 2 2 4 2 So, inequality (31) follows. Finally, 8h 2 C03 ¼ fh 2 C3 : ja a0 j gðe; a0 ; k0 Þ; hki ¼ hk0 ig; we get f ðx0 ; hÞ f ðx0 ; h0 Þ ¼ hax0 þ ki ha0 x0 þ k0 i ¼ h½ax0 þ hki þ fax0 g þ fkgi h½a0 x0 þ hk0 i þ fa0 x0 g þ fk0 gi ¼ ½ax0 þ hki þ hfax0 g þ fkgi ½a0 x0 hk0 i hfa0 x0 g þ fk0 gi ¼ hfax0 g þ fkgi hfa0 x0 g þ fk0 gi ¼ 1: Case C. fk0 g 2 ½12 ; 1½ and k k0. We distinguish two cases: (1) If fkg 2 ½12 ; 1½. It is simple to verified that k k0 ¼ fkg fk0 g e: Here, the aim is to find a x0 2 N for which 3 fa0 x0 g þ fk0 g < ; 2 ð34Þ and for a sufficiently close to a0 and all k such that jk k0j e 3 fax0 g þ fkg : 2 ð35Þ Let e sufficiently small, such that fk0g þ e < 1. As ðfa0 xgÞx2N dense in [0,1[, there exists x0 2 N such that: 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 RINAR(1) PROCESS 441 fa0 x0 g 3 fk0 g e < e : 2 2 4 ð36Þ Then, inequality (34) is immediately verified. In addition, for this x0 2 N fixed, as a ! fax0g is continuous in a0 (Lemma 3), there exists g ¼ g(e,a0,k0) e such that 8ja a0j g it arises e ½ax0 ¼ ½a0 x0 : : ð37Þ jfax0 g fa0 x0 gj 4 Then, from eqns (36) and (37), we get fax0 g þ fkg ¼ fax0 g fa0 x0 g þ fkg fk0 g þ fa0 x0 g þ fk0 g e 3 e e þeþ 4 2 2 4 3 ¼ : 2 So, inequality (35) follows. Therefore, 8h 2 C03 ¼ fh 2 C3 : ja a0 j gðe; a0 ; k0 Þ; hki ¼ hk0 ig; we have f(x0;h) f(x0;h0) ¼ 1. (2) If fkg 2 ½0; 12 ½. It follows that k k0 ¼ 1 þ fkg fk0 g e and ½k ¼ ½k0 þ 1; ð38Þ where [Æ] is the integer part operator. For the same x0 of the case above, we get eqns (36) and (37). Finally, from eqn (38), we get Then, fax0 g þ fkg ¼ fax0 g fa0 x0 g þ fkg fk0 g þ fa0 x0 g þ fk0 g e 3 e e þe1þ 4 2 2 4 1 ¼ : 2 f ðx0 ;hÞ f ðx0 ;h0 Þ ¼ hax0 þ ki ha0 x0 þ k0 i ¼ h½ax0 þ ½k þ fax0 g þ fkgi h½a0 x0 þ ½k0 þ fa0 x0 g þ fk0 gi ¼ ð½ax0 ½a0 x0 Þ þ ð½k ½k0 Þ þ ðhfax0 g þ fkgi hfa0 x0 g þ fk0 giÞ ¼ 1: The other cases: Case B: fk0 g 2 ½0; 12 ½ and k k0. Case D: fk0 g 2 ½12 ; 1½ and k k0. can be treated in a similar way, with a suitable choice of x0, and a sufficiently close to a0, and if necessary with inequalities (30) and (31) or inequalities (34) and (35) reversed. Then, we deduce that there exists g ¼ g(e,a0,k0) e and a constant e0 > 0, uniformly on C03 we have jf(x0;h) f(x0;h0)j e0 > 0. For h 2 C003 ¼ C3 n C03 ¼ fh 2 C3 : ja a0 j > g; hki ¼ hk0 ig the same argument for C1 can be applied here and then there exists d0 > 0 such that 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 442 M. KACHOUR AND J. F. YAO inf jKðhÞ Kðh0 Þj d0 > 0: h h2C003 Proof of Theorem 1. The conclusion ^hn ! h0 almost surely results from Propositions 2 and 4 by standard arguments of the theory of M-estimators (see, e.g. Van Der Vaart, 1998, Thm 5.7). h Some recalls are necessary. a0 ¼ p/q, p 2 Z and q 2 Z>0 , p and q are taken to be coprime. fÆg represents the fractional part operator. For all x 2 Z, fa0xg takes one of the following values: 1 q1 : 0; ; . . . ; q q Proof of Proposition 5. The aim is to prove that if a0 ¼ p/q, p 2 Z and q 2 Z>0 , p and q are taken to be coprime, then 8 x 2 E; hax þ ki ¼ ha0 x þ k0 i ) a ¼ a0 and k 2 I0 : The idea is to prove that if h 2j A0 then there exists x0 2 E such that f(x0;h) 6¼ f(x0;h0). First, we have a ¼ a0 and hki ¼ hk0i, we refer to the proof of Proposition 3. Let us consider the case where q is even. Assume that, without loss of generality, a0 > 0 and k k0 0. Here, we consider the subdivision of [0,1[ into (1/q)-length intervals. We know that fk0g belongs to the same interval. Therefore, there exists k1 2 f0, . . . ,q1g, such that k1 k1 þ 1 ¼ i0 : ; fk0 g 2 q q Now, we identify for this case, the interval I0. k1 k1 þ 1 ; I0 ¼ fk : hki ¼ hk0 iandfkg 2 i0 g ¼ ½k0 þ ; ½k0 þ q q where [Æ] represents the integer part operator. Recall that, hki ¼ hk0i and k k0 0. Assume that j 0. We distinguish fkg 2i three cases: (1) If i0 0; 12 . Then, fkg 2 0; 12 and fkg > fk0g. So, there exists n q o x0 2 1;; 1 such that f ðx0 ;hÞf ðx0 ;h0 Þ ¼hfa0 x0 gþfkgihfa0 x0 gþfk0 gi ¼1: 2 1 (2) If i0 2 ;1 and fkg 2 12 ;1 . Then, fkg > fk0g and there exists nq o x0 2 þ 1; ; q 1 such that f ðx0 ; hÞ f ðx0 ; h0 Þ 2 ¼ hfa0 x0 g þ fkgi hfa0 x0 g þ fk0 gi ¼ 1: 1 (3) If i0 2 ; 1 and fkg 2 0; 12 . Therefore, [k] ¼ [k0] þ 1. So, for any x 2 N, we have f ðx; hÞ f ðx; h0 Þ ¼ hfa0 xg þ fkgi hfa0 xg þ fk0 g 1i: We know that if q is even, then there exists x0 2 Z such that fa0 x0 g ¼ 12. So, f ðx0 ; hÞ f ðx0 ; h0 Þ ¼ 1: 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 RINAR(1) PROCESS 443 If fkg 2 i0, then eqn (15) is verified. Therefore, we get 8x 2 Z; f ðx; hÞ f ðx; h0 Þ ¼ hfa0 xg þ fkgi hfa0 xg þ fk0 gi ¼ 0: Thus, if q is even, we have f ðx; hÞ ¼ f ðx; h0 Þ; 8 x 2 Z () a ¼ a0 and k 2 I0 : Now, let us consider the case where q is odd. Here, we consider the new subdivision of [0,1[ into q þ 1 intervals discussed in Section 3.2. We distinguish three cases: (1) If 1 2q 1 [ ;1 ; fk0 g 62 0; 2q 2q then there exists k2 2 f1,3, . . . ,2q 3g such that fk0 g 2 k1 k1 þ 1 ¼ i0 : ; q q (2) If 1 ; fk0 g 2 0; 2q then we consider that 1 : i0 ¼ 0; 2q (3) If fk0 g 2 2q 1 ;1 ; 2q then we consider that 2q 1 i0 ¼ ;1 : 2q Respectively, I0 is defined by I0 ¼ fk : hki ¼ hk0 i and fkg 2 i0 g: These three cases can be treated in a way similar to the case when q is even. Therefore, if fkg2i j 0, we can find x0 2 Z such that j f(x0;h) ¼ f(x0;h0)j > 0. If fkg 2 i0, then eqn (15) is verified and finally f ðx; hÞ ¼ f ðx; h0 Þ; 8 x 2 Z () a ¼ a0 and k 2 I0 : h Recall that d, the distance on the parametric space Q, is defined by dðh; h0 Þ ¼ maxfja a0 j; jk k0 jg; 8 h ¼ ða; kÞ and h0 ¼ ða0 ; k0 Þ 2 H: Proof of Proposition 6. We have, a0 ¼ p/q, p 2 Z and q 2 Z>0 , p and q are taken to be coprime and q is even. Therefore, there exists k0 2 f0,1, . . . ,q 1g such that 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 444 M. KACHOUR AND J. F. YAO k0 k0 þ 1 : ; fk0 g 2 i0 ¼ q q We recall, I0 ¼ fk : hki ¼ hk0 i and fkg 2 i0 g and A0 ¼ fh : a ¼ a0 and k 2 I0 g: Our aim is to prove that for all (sufficiently small) e > 0, we have inf jKðhÞ Kðh0 Þj > 0; h2H0e where H0e ¼ fh 2 H : dðh; A0 Þ eg. As h has two components a and k which play different roles, we need to distinguish among three situations for the event H0e . We note that Qe ¼ C1[C2[C3, where C1 ¼ fh : ja a0 j eg; C2 ¼ fh : ja a0 j < e; dðh; I0 Þ e; hki 6¼ hk0 ig; and C3 ¼ fh : ja a0 j < e; dðh; I0 Þ e; hki ¼ hk0 ig: We are going to prove inf jKðhÞ Kðh0 Þj > 0; h2Ci i ¼ 1; 2; 3: From Proposition 2, we have KðhÞ Kðh0 Þ ¼ lh0 ðf ð:; hÞ f ð:; h0 ÞÞ2 : So, the aim is to find x0 2 E such that f ðx0 ; hÞ f ðx0 ; h Þ > 0; 8 h 2 Ci ; i ¼ 1; 2; 3: (1) For h 2 C1[C2, by the same arguments on the equivalent subsets in the proof of Proposition 4, we have inf jKðhÞ Kðh0 Þj > 0: h2C1 [C2 (2) For h 2 C3, again, without loss of generality, we assume that a0 > 0, k0 0. Note that dðh; A0 Þ ¼ dðk; I0 Þ ¼ inf jk k j; k 2I0 where k0 k0 þ 1 ; I0 ¼ ½k0 þ ; ½k0 þ q q [Æ] represents the integer part operator. We distinguish four depending on the position of the fractional part of k0 and k: cases (a) Case A: i0 0; 12 and k k0. (b) Case B: i0 0; 12 and k k0. 1 (c) Case C: i0 2 ; 1 and k k0. (d) Case D: i0 ½12 ; 1½ and k k0. 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 445 RINAR(1) PROCESS Case A. i0 ½0; 12 ½; k k0. For this case, we note that q 4. Because, if q ¼ 2 and d(h,A1) e, hki 6¼ hk0i then h 2 C2. It is simple to verify that n o 1 q k0 þ 1 : fkg 2 0; ; k0 2 0; 1; . . . ; 2 and fkg 2 2 q Therefore, dðh; A0 Þ ¼ inf fkg fk g e: ð39Þ k 2I0 There exists n o q l 2 k0 þ 1; . . . ; 1 2 such that fkg 2 l lþ1 ; : q q Let x0 ¼ (q/2) l fixed. For all fk g 2 i0 we have fa0 x0 g þ fk g < 12 ; ð40Þ fa0 x0 g þ fkg 12 þ e: ð41Þ and from eqn (39) we get In addition, for x0 ¼ (q/2) l, the function a ! fax0g is continuous in a0 ¼ (p/q) (this function is discontinuous in a0 if x0 ¼ mq; m 2 N). There exists g ¼ g(e,a0,k0) e such that 8ja a0j g it arises ½ax0 ¼ ½a0 x0 ; ð42Þ jfax0 g fa0 x0 gj e: From eqns (42) and (41) we get fax0 g þ fkg ¼ ðfax0 g fax0 gÞ þ ðfax0 g þ fkgÞ e þ ð12 þ eÞ ¼ 12 : Then for all h 2 C03 ¼ fh 2 C3 ; ja a0 j gg we have f(x0;h) f(x0;h ) ¼ 1. Case C. i0 ½12 ; 1½ and k k0. We distinguish two cases: (1) fkg 2 ½12 ; 1½. For this case, we note that q 4. Because, if q ¼ 2 and d(h,A0) e,hki ¼ hk0i then h 2 C2. Here, it is simple to verified that nq o k0 þ 1 ;...;q 2 and fkg : k0 2 2 q Therefore, dðh; A0 Þ ¼ inf fkg fk g e: fk g2i0 ð43Þ There exists x0 2 nq 2 o þ 1; . . . ; q 1 such that for all fk g 2 i0 we have fa0 x0 g þ fk g < 32 ; ð44Þ 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 446 M. KACHOUR AND J. F. YAO and from eqn (43) we get fa0 x0 g þ fkg 3 þ e: 2 ð45Þ In addition, for this x0 fixed, the function a ! fax0g is continuous in a0 ¼ (p/q) (this function is discontinuous in a0 if x0 ¼ mq; m 2 N). There exists g ¼ g(e,a0,k0) e such that 8ja a0j g it arises ½ax0 ¼ ½a0 x0 ; ð46Þ jfax0 g fa0 x0 gj e: From eqns (46) and (45) we get fax0 g þ fkg ¼ ðfax0 g fax0 gÞ þ ðfax0 g þ fkgÞ 3 3 þe ¼ : e þ 2 2 Then, for all h 2 C03 ¼ fh 2 C3 ; ja a0 j gg we have f(x0; h) f(x0; h ) ¼ 1. (2) fkg 2 ½0; 12 ½. For this case, we note that q2, then nq o ;...;q 1 : k0 2 2 Here, it is simple to verify that dðh; A0 Þ ¼ inf fkg fk g þ 1 e fk g2i0 and ½k ¼ ½k þ 1: ð47Þ There exists x0 ¼ q/2 such that for all fk g 2 i0 we have 3 1 fa0 x0 g þ fk g < ; 2 ð48Þ and from eqn (47) we get fa0 x0 g þ fkg 1 þ e: 2 ð49Þ In addition, for this x0 fixed, the function a ! fax0g is continuous in a0 ¼ (p/q) (this function is discontinuous in a0 if x0 ¼ mq; m 2 N). There exists g ¼ g(e,a0,k0) e such that 8ja a0j g it arises ½ax0 ¼ ½a0 x0 ; ð50Þ jfax0 g fa0 x0 gj e: From eqns (50) and (49) we get fax0 g þ fkg ¼ ðfax0 g fax0 gÞ þ ðfax0 g þ fkgÞ 1 1 e þ þe ¼ : 2 2 Then, for all h 2 C03 ¼ fh 2 C3 ; ja a0 j gg we have 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 RINAR(1) PROCESS 447 f ðx0 ;hÞ f ðx0 ;h Þ ¼ hax0 þ ki ha0 x0 þ k i ¼ h½ax0 þ ½k þ fax0 g þ fkgi h½a0 x0 þ ½k þ fa0 x0 g þ fk gi ¼ ð½ax0 ½a0 x0 Þ þ ð½k ½k Þ þ ðhfax0 g þ fkgi hfa0 x0 g þ fk giÞ ¼ 1: Cases B and D can be treated in a similar way, with a suitable choice of x0 and a sufficiently close to a0. Then, we deduce that there exist g ¼ g(e,a0,k0) e and a constant e0 > 0, uniformly on C03 we have jK(h) K(h0)j e0 > 0. For h 2 C003 ¼ C3 n C03 ¼ fh 2 C3 : ja a0 j > g; hki ¼ hk0 ig the same argument for C1 can be applied here and then there exists d0>0 such that jKðhÞ Kðh0 Þj d0 > 0: h Proof of Theorem 2. The conclusion ^hn ! Ak , for some k 2 f1,2,3g, almost surely, results from Propositions 2 and 6 by the same arguments used in the proof of Theorem 1. h NOTE Corresponding author: M. Kachour, IRMAR Institut de Recherche en Mathématiques de Rennes, UMR 6626/ Université Rennes 1, Campus Scientifique de Beaulieu, 263 Avenue de Général Leclerc, 35042 Rennes Cedex, France. Tel.: þ33 2 23 23 63 98; E-mail: maher.kachour@univ-rennes1.fr REFERENCES Alzaid, A. A. and Al-osh, M. (1987) First-order integer-valued autoregressive (INAR(1)) process. Journal of Time Series Analysis 8, 261–75. Alzaid, A. A. and Al-osh, M. (1990) An integer-valued pth-order autoregressive structure (INAR(p)) process. Journal of Applied Probability 27, 314–24. Doukhan, P., Latour, A. and Oraichi, D. (2006) A simple integer-valued bilinear times series models. Advances in Applied Probability 38, 1–20. Du, J.-G. and Li, Y. (1991) The integer-valued autoregressive (INAR(p)) model. Journal of Times Series Analysis 12, 129–42. Duflo, M. (1997) Random Iterative Models, Volume 34 of Applications of Mathematics. Berlin: Springer-Verlag. Ferland, R. and Latour, A. and Oraichi, D. (2006) Integer-valued GARCH process. Journal of Time Series Analysis 6, 923–42. Freeland, R. K. and McCabe, B. P. M. (2004) Analysis of low count time series data by Poisson autoregression. Journal of Time Series Analysis 25, 701–22. Freeland, R. K. and McCabe, B. (2005). Asymptotic properties of CLS estimators in the Poisson AR(1) model. Statistics and Probability Letters 73, 147–53. McCleary, R. and Hay, R. A. (1980) Applied Time Series Analysis for the Social Sciences. Beverly Hills, CA: Sage Publications. McKenzie, E. (1985) Some simple models for discrete variate time series. Water Resources Bulletin 21, 645–50. 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4 448 M. KACHOUR AND J. F. YAO McKenzie, E. (2003) Discrete variate time series. In Handbook of Statistics 21: Stochastic Processes: Modeling and Simulation (eds C. R. Rao and D. N. Shanbhag). Amsterdam: Elsevier Science, pp. 573–606. O’Donovan, T. M. (1983) Short Term Forecasting: An Introduction to the Box–Jenkins Approach. London: Wiley. Press, W. H., Teukolsky, S. A., Vetterling, W. T. and Flannery, B. P. (2007) Numerical Recipes. Cambridge: Cambridge University Press. Steutel, F. W. and van Harn, K. (1979) Discrete analogues of self-decomposability and stability. Annals of Probability 7, 893–9. Thomas, D. S. (1940) Social and Economic Aspects of Swedish Population Movements, 1750–1933. New York: Macmillan. van der Vaart, A. W. (1998) Asymptotic Statistics. Cambridge: Cambridge University Press. 2009 Blackwell Publishing Ltd. JOURNAL OF TIME SERIES ANALYSIS Vol. 30, No. 4