FOODS AND INNS LTD (BSE Code 507552) CMP 950 (FACE

advertisement

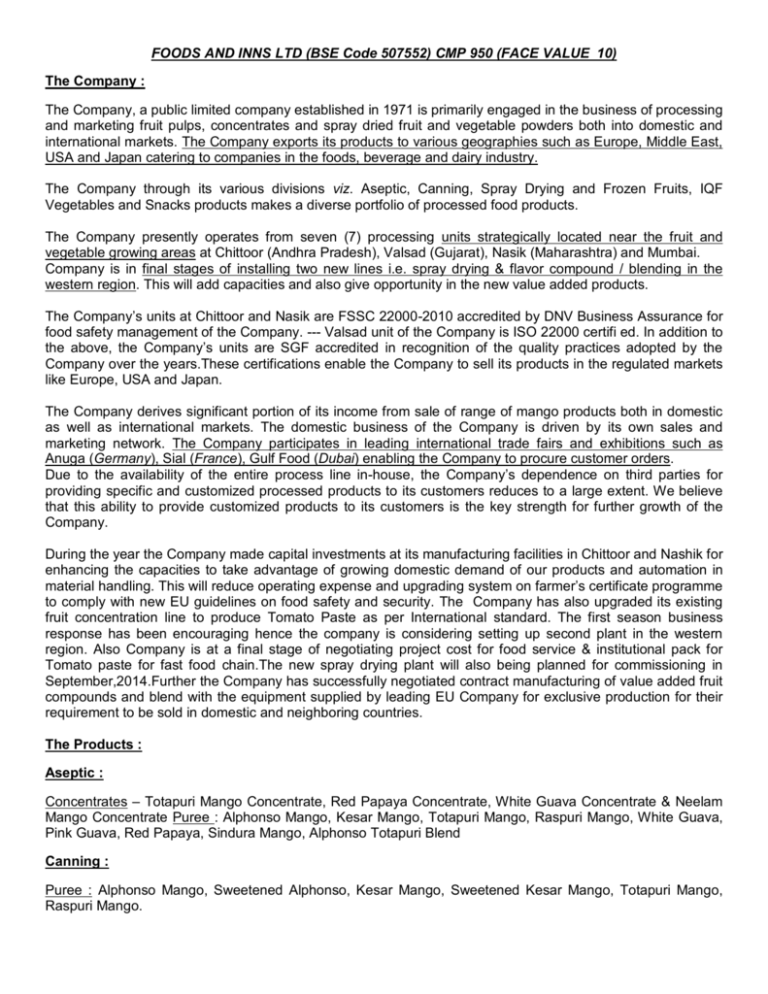

FOODS AND INNS LTD (BSE Code 507552) CMP 950 (FACE VALUE 10) The Company : The Company, a public limited company established in 1971 is primarily engaged in the business of processing and marketing fruit pulps, concentrates and spray dried fruit and vegetable powders both into domestic and international markets. The Company exports its products to various geographies such as Europe, Middle East, USA and Japan catering to companies in the foods, beverage and dairy industry. The Company through its various divisions viz. Aseptic, Canning, Spray Drying and Frozen Fruits, IQF Vegetables and Snacks products makes a diverse portfolio of processed food products. The Company presently operates from seven (7) processing units strategically located near the fruit and vegetable growing areas at Chittoor (Andhra Pradesh), Valsad (Gujarat), Nasik (Maharashtra) and Mumbai. Company is in final stages of installing two new lines i.e. spray drying & flavor compound / blending in the western region. This will add capacities and also give opportunity in the new value added products. The Company’s units at Chittoor and Nasik are FSSC 22000-2010 accredited by DNV Business Assurance for food safety management of the Company. --- Valsad unit of the Company is ISO 22000 certifi ed. In addition to the above, the Company’s units are SGF accredited in recognition of the quality practices adopted by the Company over the years.These certifications enable the Company to sell its products in the regulated markets like Europe, USA and Japan. The Company derives significant portion of its income from sale of range of mango products both in domestic as well as international markets. The domestic business of the Company is driven by its own sales and marketing network. The Company participates in leading international trade fairs and exhibitions such as Anuga (Germany), Sial (France), Gulf Food (Dubai) enabling the Company to procure customer orders. Due to the availability of the entire process line in-house, the Company’s dependence on third parties for providing specific and customized processed products to its customers reduces to a large extent. We believe that this ability to provide customized products to its customers is the key strength for further growth of the Company. During the year the Company made capital investments at its manufacturing facilities in Chittoor and Nashik for enhancing the capacities to take advantage of growing domestic demand of our products and automation in material handling. This will reduce operating expense and upgrading system on farmer’s certificate programme to comply with new EU guidelines on food safety and security. The Company has also upgraded its existing fruit concentration line to produce Tomato Paste as per International standard. The first season business response has been encouraging hence the company is considering setting up second plant in the western region. Also Company is at a final stage of negotiating project cost for food service & institutional pack for Tomato paste for fast food chain.The new spray drying plant will also being planned for commissioning in September,2014.Further the Company has successfully negotiated contract manufacturing of value added fruit compounds and blend with the equipment supplied by leading EU Company for exclusive production for their requirement to be sold in domestic and neighboring countries. The Products : Aseptic : Concentrates – Totapuri Mango Concentrate, Red Papaya Concentrate, White Guava Concentrate & Neelam Mango Concentrate Puree : Alphonso Mango, Kesar Mango, Totapuri Mango, Raspuri Mango, White Guava, Pink Guava, Red Papaya, Sindura Mango, Alphonso Totapuri Blend Canning : Puree : Alphonso Mango, Sweetened Alphonso, Kesar Mango, Sweetened Kesar Mango, Totapuri Mango, Raspuri Mango. Spray Dried : Alphonso Mango powder, Ripe Banana Powder, Tomato Juice Powder, Orange Juice Powder, Beetroot Juice Powder, Pineapple Juice Powder, Lemon Juice Powder Organic Puree : Alphonso Mango Puree The Valuation : The company having TTM sales of Rs 350 Cr, TTM EPS of Rs 167 per share, belonging to ambitious and high growth Food sector which is the flavor of the current bull market, is trading at a ridiculously cheap market cap of just 125 Cr, (Sales to Market Cap of just 0.35) that gives us PE ratio of Just over 5. Company has ROE of 18% and ROCE of 12%, which will increase significantly going forward, as new production lines have commenced for high margin value added products. (If we compare peers, Freshtrop Fruits with TTM sales of 125 crore and EPS of 7 is trading at Market cap of over 210 Crore and PE of close to 25. Another Tricom Fruits with TTM sales of less than 1 lakh rupee and negative EPS, Edelweiss bought 11% stake into it at an undisclosed amount.) While Foods & Inns is a profit making high growth company, so why cant it trade atleast at 15 PE of FY15 estimate EPS of more than 175, that brings us to fair valuation of price close to Rs 2600 per share, while this hidden gem is available at just Rs 850, giving scope of immense appreciation in medium to long term. Investors must buy and sit tightly on this stock to earn multibagger returns, before it comes into limelight of media and analyst. Capital of the company is just 1.45 Cr (1.45 million shares), out of which management holds 46%, FII 1.45, 28.55% with HNI Investors, leaving only less than 3 lakhs shares with minority shareholders. This sector has huge potential, especially when PM of India, Shri Narendra Modi himself has said many times, that to avoid wastage of fruits due to lack of warehousing and cold storage, fruit farmers should get ready market if producers of cola drinks adds 5% of fruit juice into their drinks. This will create huge demand for entire manufacturing line of fruit processing industry. Triggers : As per latest news of 20th Jan, EU has lifted ban on import of mangoes from India, this will give the company huge and lucrative high margin market of more than 28 country bloc, which follows EU guidelines, earlier on November 2014, during the visit of Shri Narendra Modi to Japan, Japanese authorities has expedited procedural obligations to step up Mango import from India. Since new government is serious to help food processing industries, many such steps are expected in future also, this will only help the company going forward, which could be huge positive for the entire industry. Company may sell off their Deonar unit and shift production to its Valsad or Nasik unit to reduce the debt, which can add atleast Rs 60 to 70 to its yearly EPS In coming budget, this particular sector is likely to get huge sops to encourage domestic food processing industries, increase in export rebate, reducing of duties and taxes, discount in interest rates, all these can add another Rs 20 to 30 to its yearly EPS Since company is loaded with high debt, falling interest rates will directly add to the bottomline from here on. Falling food inflation, Bumper harvest, Direct Fertilizer subsidy Transfer to farmers, Removing of supply side bottlenecks, will only help company to source raw material from growers at a cheaper rates. Likely to go for 10:1 Split or announce liberal bonus to widen investor base. Stock has been in Trade to Trade since last many months, likely to come out soon, which will see huge price impact on the upside, once the shackles of “T” group is removed For more Hidden Gem Picks : http://hemanghigandhi.blogspot.in/