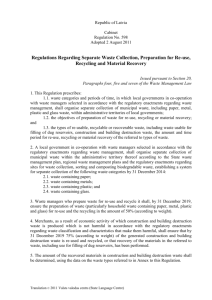

Cab. Reg. No. 282 - Using Electronic Devices and Equipment

advertisement