Clergy Compensation Committee recommendations

advertisement

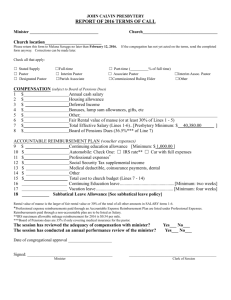

1 CLERGY COMPENSATION COMMITTEE REPORT PRESBYTERY OF HUDSON RIVER WHEREAS the Committee on Ministry of the Presbytery of Hudson River is charged with the responsibility of reviewing terms of call and changes to terms of call for the Pastors of the churches of the Presbytery; and the Clergy Compensation Committee is charged with the task to review these terms of call for clergy and CLP members of Presbytery, WHEREAS, the Clergy Compensation Committee has reviewed the current minimum terms of call for this Presbytery, collected and reviewed terms of call used in nearby Presbyteries, collected and reviewed certain demographic data from counties in the Presbytery, NYS Department of Labor Occupational Employment Survey data and information from the Board of Pensions PC(USA) and the Social Security Administration COLA index, WHEREAS the compensation level for clergy in Hudson River Presbytery continues to be the lowest of all surrounding Presbyteries despite a recent review in April of 2005, in which the minimum cash salary was raised from $23,097 to $31,000, with subsequent COLA adjustments approved by Hudson River Presbytery, NOW THEREFORE, The Clergy Compensation Committee makes the following recommendations for changes in the minimum terms of call for Pastors in this Presbytery and for determining the compensation package for newly called Pastors. RECOMMENDATION NO. 1 The Clergy Compensation Committee recommends that the mandated minimum cash salary of all full time Pastors in the Presbytery be adjusted from its current 2011 figure of $35,185 per annum to $35,890.00 per annum, effective January 1, 2012, for presently installed full time Pastors in this Presbytery and that the cash salary of part time Pastors is adjusted proportionately to the amount of time for which their services are contracted. It is recommended that the mandated minimum effective salary of all full time pastors (defined as 50 hours per week) in the Presbytery be adjusted from its current 2011 figure of $45,740.00 per annum to $46,657.00 per annum for 2012 EXAMPLE FOR FULL TIME INSTALLED PASTOR FOR 2012 CASH SALARY MINIMUM $35,890 based on a fiscal year of 1/112/31/2012. ANNUAL COST OF LIVING INCREASE BASED ON THE CONSUMER PRICE INDEX FROM THE U.S. BUREAU OF LABOR STASTICS, July 2012 The recommended figure for 2012 is a 3.6% increase. The Clergy Compensation Committee recommends 2% for 2012 because mileage is already reimbursed at an IRS percentage increase. HOUSING ALLOWANCE MANSE INCLUDING UTILITIES OR A CASH ALLOWANCE BASED ON THE FAIR MARKET RENTAL VALUE OF A TWO BEDROOM HOUSE OR APARTMENT IN THE AREA. If there is no Manse available, then a minimum effective salary of $46,657.00 for 2012. 2 SOCIAL SECURITY OFFSET 7.65% OF EFFECTIVE SALARY MEDICAL, PENSION, D & DISABIL. DUES 32.25 % OF EFFECTIVE SALARY. VACATION 31 CALENDAR DAYS PER YEAR INCLUDING UP TO 5 SUNDAYS 38 CALENDAR DAYS PER YEAR AFTER 10 YEARS SERVICE UP TO 6 SUNDAYS AUTO EXPENSE REIMBURSABLE AT CURRENT IRS RATE BY VOUCHER. Minimum $2,000.00 per Annum. STUDY LEAVE 14 CALENDAR DAYS PLUS $1,000. FOR EXPENSES REIMBURSABLE BY VOUCHER. THE PASTOR MAY ACCUMULATE UP TO SIX WEEKS AT THE OPTION OF THE CHURCH UP TO TWO SUNDAYS PRESBYTERY LIFE INSURANCE $204 (50K DEATH BENEFIT) MATERNITY/PATERNITY LEAVE PER PRESBYTERY POLICY NEW PASTOR ORIENTATION TIME SABBATICAL TIME 3 DAYS EXPENSES REIMBURSED BY VOUCHER 3 MONTHS EVERY 7 YEARS (OPTIONAL) DEFERRED COMPENSATION OPTIONAL PASTORAL EXPENSE REIMBURSEMENT OPTIONAL (BY VOUCHER IF PROVIDED) RECOMMENDATION NO. 2 The Clergy Compensation Committee recommends that, in those churches where current full-time Pastors earn a cash salary less than $35,890.00 per annum, and an effective salary of $46,657.00 per annum that the churches, in conference with the Committee on Ministry of this Presbytery develop and implement a plan by which the current cash salary of the Pastor will be increased to the recommended minimum over a period of time; the annual COLA to be in addition to the needed adjustment in the cash salary on a per annum basis according to the percentage established annually by Presbytery. If this is not possible, our recommendation is that the congregation consider a parttime call for the pastor in negotiation with the Committee on Ministry. RECOMMENDATION NO. 3 The Clergy Compensation Committee recommends the use of the most current teachers’ salaries to calculate the effective salary for pastors based on a county by county differential. 1. The Clergy Compensation Committee has reviewed the Hayes method for calculating clergy salary compensation for new calls to the Presbytery. After thorough consideration and 3 discussion with COM personnel, use of this model has proven ineffective for this Presbytery. On the attached sheet, we are presenting a comparison of the most current teachers’ salaries for 2007/2008 with the latest updated 2008 Hayes method figures. We chose to use entry level and top range figures as a comparison, with a third column of average salaries in the region. We also are recommending a compensation discernment model based on regional salary needs, listed on the sheet as well. Though this is not a mandated requirement at this time, we strongly urge all congregations to ADOPT THESE FIGURES. 2. On the bottom of that page, our subcommittee recommends that with an M. Div degree, that churches would consider adding 10% of the figures for a Masters degree (listed by county on the bottom of the page). This practice would be concomitant with state labor board practice for teachers who obtain Master’s degrees. The State ranges their increases between eight and twelve percent from those figures for Bachelor’s degrees. 3. Annual COLA increases from these figures would be in compliance with the annual percentage voted by Presbytery. 4. The Clergy Compensation Committee recommends these formulas for Stated Supply, Temporary Supply and Interims (pro-rated on 50 hours per week as full time). RATIONALE: 1. These figures reflect the cost of living in the counties in our Presbytery by Government statistic. 2. This method of calculating the effective salary will no longer be based on the Hayes method which is a corporate personnel model, but more on a comparative basis with like professionals in our Presbytery with Masters degrees. RECOMMENDATION NO. 4 The Clergy Compensation Committee has received a recommendation from the CLP Committee and is recommending that CLP’s working full time (defined as 50 hours per week) receive a MINIMIUM of 75% of effective salaries of full-time ordained ministers as the suggested minimum salary plus the mandatory portions of the Terms of Call: 31 calendar days vacation per year up to 5 Sundays, IRS mileage allowances and $1,000.00 continuing education allowance with 2 weeks study leave being a minimum of 14 calendar days including up to 2 Sundays, pension and medical benefits. The CLP may accumulate up to six weeks at the option of the church. For CLP’s working less than 50 hours a week, salary and continuing education monetary allowances would be proportional to hours for which the person is contracted. The study leave time and the vacation time would be reduced. CLP’s working less than 20 hours per week would not be entitled to Pension and Medical benefits, but to all others terms. It is recommended that the minimum terms of call be revised to reflect the above recommendations and to clarify certain items therein as follows: EXAMPLE FOR A COMMISSIONED LAY PASTOR CASH SALARY MINIMUM $26,917 for 2012 ANNUAL COST OF LIVING INCREASE Based on the Bureau of Labor Statistics index as voted by Presbytery annually. 4 HOUSING ALLOWANCE MANSE INCLUDING UTILITIES OR A CASH ALLOWANCE BASED ON THE FAIR MARKET RENTAL CALCULATED FROM THE VALUE OF A TWO BEDROOM HOUSE OR APARTMENT IN THE AREA. If there is no Manse available, then a minimum effective salary of $34,993.00 for 2012. SOCIAL SECURITY OFFSET 7.65% OF EFFECTIVE SALARY PENSION DUES 31 % OF EFFECTIVE SALARY or by BOP estimates VACATION 31 CALENDAR DAYS PER YEAR INCLUDING UP TO 5 SUNDAYS 38 CALENDAR DAYS PER YEAR AFTER 10 YEARS SERVICE UP TO 6 SUNDAYS AUTO EXPENSE REIMBURSABLE AT CURRENT IRS RATE BY VOUCHER. Minimum $2,000.00 per Annum. STUDY LEAVE 14 CALENDAR DAYS PLUS $1,000. FOR EXPENSES REIMBURSABLE BY VOUCHER. THE PASTOR MAY ACCUMULATE UP TO SIX WEEKS AT THE OPTION OF THE CHURCH UP TO 2 SUNDAYS. PRESBYTERY LIFE INSURANCE $204. (50K DEATH BENEFIT) MATERNITY/PATERNITY LEAVE PER PRESBYTERY POLICY NEW PASTOR ORIENTATION TIME SABBATICAL TIME 3 DAYS EXPENSES REIMBURSED BY VOUCHER 3 MONTHS EVERY 7 YEARS (OPTIONAL) DEFERRED COMPENSATION OPTIONAL PASTORAL EXPENSE REIMBURSEMENT OPTIONAL (BY VOUCHER IF PROVIDED) If a manse is NOT provided the housing allowance is based on 30 % of the cash salary plus utilities. Social security offset is based on effective salary. If no manse, the housing allowance is based on the fair rental value of the manse determined annually through appropriate means. Rationale: a) Cash salary has been discussed herein and requires no further discussion. b) The annual cost of living adjustment is that used by this Presbytery and applies the same to CLP’s as pastors. c) The minimum cash allowance under housing allowance is recommended to be based on the fair rental value of a two bedroom apartment or house in the area of employment as a starting place in determining the cash allowance. The key word is minimum. This is the same as for installed pastors. 5 d) Pension dues are updated to reflect the new Board of Pensions percentage. If the CLP is retired, then there needs to be discussion as to Pension dues with the BOP. e) It is recommended that vacation be increased to 38 days after ten years in recognition og service by the CLP the same as installed pastors. f) Mileage reimbursement is the same figure set by the Internal Revenue Service for pastors. g) It is recommended that up to six weeks of study leave may be accumulated at the option of the church, the same as for pastors. h) There is no change in the Presbytery life insurance. i) Maternity/paternity/sabbatical time has been added to reflect the policy of Presbytery. j) New Pastor Orientation time has been added to emphasize the orientation and to provide that time which is needed to attend. k) Deferred Compensation has been added as optional so people are aware that it is an option and not a mandatory item. l) Pastoral Expense has been added as optional so people are aware that it is optional and not mandatory. RECOMMENDATION NO. 5 The Clergy Compensation subcommittee recommends a change in the form to be submitted to congregations for salary review for clergy. (see attached) This form has been re-crafted in conjunction with changes recommended by the BOP with its new form ENR-111. If anyone needs additional training in how to fill out this new form, please contact the Rev. Dave Mason, 845-5620954; masondbd@minister.com or Elder Ed Roque Garcia, 845-735-6013; garcia6013@aol.com. Submitted by The Clergy Compensation Committee September, 2008 Dates and dollar amounts updated for 2012 on 6/18/2012 6 DOCUMENTS COMPARISON OF TEACHERS SALARIES TO RANGES FROM THE CURRENT HAYES METHOD. THESE FIGURES ARE FROM THE STATE LABOR BOARD STATISTICS AND ARE THE MOST CURRENT. HAYES LEVEL FIVE IS A RANGE WITH MORE THAN BEGINNING EXPERIENCE WHICH MOST OF OUR CLERGY IN HUDSON VALLEY HAVE, AND IS BEING USED AS A COMPARISON SET OF FIGURES. HAYES RANGE 5 CRITERIA: 1. LEVEL 5 IS FOR AN ADVANCED SET OF SKILLS WITH 3-5 YEARS EXPERIENCE WITH CONTINUING EDUCATION CREDITS, ALSO A GRADUATE DEGREE IN COUNSELING IF APPROPRIATE FOR THE CALL. 2. PROBLEM SOLVING CRITERIA WOULD BE RANGED FROM HIGHLY COMPLEX SITUATIONS, A MULTI-LINGUAL CONGREGATION, MULTI-RACIAL OR HIGH RATE OF TURN OVER IN THE COMMUNITY. Teachers 2007-8 County 2008 Hayes Level 5 5th 43,851 43,136 50,641 40,050 46,223 25th 52,651 53,000 67,598 48,165 55,699 Average 64,782 64,621 81,407 60,592 67,813 Rockland 47,537 Westchester 53,874 61,640 68,769 77,790 84,513 Dutchess Orange Putnam Sullivan Ulster County Dutchess Orange Putnam Sullivan Ulster With M. Div (10%) 5th 48,236 47,450 55,705 44,055 50,845 Rockland 52,291 Westchester 59,261 25th 57,916 58,300 74,358 52,982 61,269 Average 71,260 71,083 89,548 66,651 74,594 67,804 75,646 85,569 92,964 Minimum 47,824 47,824 47,824 47,824 47,824 Mid-point 59,782 59,782 59,782 59,782 59,782 Maximum 60,044 60,044 60,044 60,044 60,044 68,805 68,805 85,399 85,399 102,478 102,478 7 PASTORAL TERMS OF CALL WORKSHEET AND REPORT Period Beginning Day___Month____Year____ Period Ending Day_______Month_____Year_____ (Effective date normally is January 1st of the current year.) This report is required annually of all churches in January and is normally based on the Annual Meeting of the Congregation at which it is approved. The Terms of Call Report should be forwarded immediately, but no more than five (5) days following the Congregational Meeting, to Presbytery for approval. Please note: The Minister’s signature is also required as well as the Clerk of Session’s.Due date is March 1. Please do not use any other form in order to simplify our records. Church name:_________________________ Location (city):______________________________________ Minister’s name(s)_________________________________________________________________________ Terms of Call/Employment for:________________________________________________________________ Date of Installation in current position: ________________ Date of Ordination: _________________________ Pastor___ Assoc. Pastor____ Stated Supply___ Interim___ Temporary___ Designated___ Certified Christian Educator___Commissioned Lay Pastor______ Full-time___ Part-time___ If Part-time, # of hours weekly_________ If this is an annual update of terms, has a recent performance appraisal and a formal compensation review been completed? Yes ___ If yes, on what date? __________ No _____ If no, please explain_________________________________________________________________________ Is maternity/paternity/sabbatical leave anticipated in current year yes/no (defin. and pol. available HRP) Compensation included in Effective Salary 1. Annual Cash Salary with min. 4.0% increase Prior Year (2008) Terms $______________ New (2009) Terms $______________ (inc. ee contrib.. to 403b 9 plans, tax sheltered annuities ,unvoucherd book, car, study allow., vacation pay, overtime) minimum: 2008 $33,364.75 2009 $34,700.00 2. Housing All. (ministers who rent/own home) $______________ $______________ ( Minimum $10,410. for 2009 which equals 30%. ) 3. Employer contributions to 403b9 plans, annuities $ ______________ $ ______________ (eff. 1/1/08 matching contributions to the BOP Retirement savings plan should NOT be included) 4. Bonuses (will be included for the current year only $_______________ Year in which bonus is paid________________ $_______________ 5.Other allowances (including copayment, medical, furnishings and utility allow. and reimbursements of SECA in excess of 50%) NO VOUCHERED EXPENSE $________________ $_________________ 6. MANSE amount (must be at least 30% of lines 1-5) $_______________ $_________________ 7.Total Effective Salary-Sum of lines 1-6 $________________ $_________________ 8.Benefit Plan Dues (For 2009, annualized at 31.5% of line 7) $__________ $ _________________ (Medical 19.5%, Pension, 11%, D and Disability 1%) 9.SECA Allowance 7.65 % (of 1 and 2) $________________ $_________________ The minimum increase for cash+housing+ utilities for 2009 is _________. The total SECA tax for the year 2009 is 15.3%. Churches are required to give an allowance up to one half of the total tax, i.e. 7.65% to the clergy. This is taxable income to the employee and subject to SECA, but payment up to 50% of the Pastor’s total SECA obligation is exempt from Pension and Benefit dues. It is therefore not included in Total Effective Salary, which is the basis for dues calculations. Any allowance in excess of 50% of the SECA obligation is both taxable and included in Total Effective Salary. Only that part of the SECA allowance above 50% would go on line 5. 8 PASTORAL TERMS OF CALL WORKSHEET AND REPORT Period Beginning Day___Month____Year____ Period Ending Day_______Month_____Year_____ Items NOT NORMALLY INCLUDED in Effective Salary or Taxable Income Accountable reimbursement plan (supported business expenses) 2008 2009 10.a. Continuing education (minimum $1000 for 2009) $_______________ $__________________ b. Automobile exp. (min. $1500. reim. .585 cents $______________ $__________________ c. Business and professional expenses $ _______________ $__________________ d. Utilities paid by church $________________ $__________________ e. Presbytery Group Life Insurance $ 213 $ 213 Total 10 a, b, c, d &e $________________ $__________________ Church’s TOTAL cost (Items 7, 8, 9, & 10) $________________ $__________________ (Out of pocket cost less than total cost if manse provided on line 6) Other Items to be covered by Terms of Call 12. Please indicate the amount of Vacation Time (minimum 31 calendar days including up to 5 Sundays) Weeks ___________ Sundays__________ 13. Study Leave (minimum 14 calendar days, including up to 2 Sundays) Weeks ___________ Sundays__________ 14. Relocation Allowance, if any? (For new call only: approx. $ figure) $__________________ (Always get three movers to bid.) 15. Is there a Shared Equity arrangement? If so, details______________________________________ 11. Reminder: Annualized figures for Effective Salary on line 7 should be in agreement with those reported to the Presbyterian Pension Board on form ENR-111. I confirm that the Terms of Call/Employment was approved by a vote of the Congregation on ____________________ and the figures as shown above have been entered into the minutes of that meeting. _________________________________ Minister ______________________ Date _________________________________ Clerk of Session ______________________ Date Return one copy to the Presbytery office NO MORE THAN FIVE (5) DAYS AFTER THE MEETING OF THE CONGREGATION at which the Terms were approved. A copy should also be furnished to the individual. Please submit no later than March 1, 2009. Send to: TERMS OF CALL/EMPLOYMENT Committee on Ministry Hudson River Presbytery 655 Scarborough Road Scarborough, NY 10510 Please see page 3 for instructions covering pages 1 & 2. TERMS OF CALL: Worksheet & Report Period Beginning Day___Month____Year____ Period Ending Day_______Month_____Year_____ 9 COMPENSATION INCLUDED IN EFFECTIVE SALARY Line 1: Annual cash salary- To meet Hudson River Presbytery salary requirements, Cash Salary will include Base Salary plus Other Direct Payments such as Life Insurance Premiums. For 2009, the minimum full-time salary has been set by the Presbytery at $34,700.00 for 2009. Line 2: Housing Allowance- Amount designated annually by the Session in advance of payment. Includes an allowance for UTILITIES. The minimum housing allowance is 30% of line 1, which is $10,410 for 2009. Line 5: Furnishing Allowances paid to ministers should be included on this line. Manse utilities should be in the name of the church and paid directly by the church and are NOT included in the minister’s Effective Salary. Line 3: Deferred Compensation includes tax-sheltered annuities, 403(b) plans, Keogh and Retirement Savings plans, housing equity allowances, and other forms of funded or unfunded deferred compensation agreements. Line 4,5: Bonuses, unvouchered allowances, gifts, etc. are the year-end and other bonuses, unvouchered allowances (such as expenses that are not paid through an Accountable Reimbursement Plan), down payment grants for the purchase of a home, savings from interest-free or interest-reduced loans (not loan principal), and gifts paid by the employing organization. (Gifts from private donors and honoraria are NOT included.) Line 5: Other allowances includes all other forms of compensation not otherwise covered on lines 1-5, including medical deductible and expense reimbursement allowances not paid through a group benefit plan (for example, dental plan), insurance premiums for additional insurance coverage provided for individual employees (premiums for group plan coverage are not included), salary reduction contributions to flexible health spending accounts, and cafeteria plans, etc. Line 5: If an allowance is provided to reimburse for Self-Employment Contribution Act (SECA) tax obligations, any amount in excess of 50% of the minister’s SECA tax obligation must be included on this line. Please see bottom of page 1 for worksheet to calculate the figure. Amounts less than or equal to 50% of minister’s SECA tax are excluded from Total Effective Salary, which is used as the basis for Benefits and Pension Dues, and is entered on line 10. However, any SECA payment is taxable income to the Minister and does count when determining if the Terms of Call meet the Presbytery minimum. Line 6: Manse amount- For purposes of determining Effective Salary, the Benefits Plan provides that the manse rental value must be at least 30% of other compensation (i.e. lines 1-7 above). The Presbytery standard is that the rental value of the manse should be the greater of the fair rental values as determined within the past 2 years or 30% of effective salary. If a utility or other housing-related allowance is paid to the minister, the allowance should be reported on lines 2 or 3. In other words, the church must pay the utilities through its checking account in order for such payments to stay out of Effective Salary and Taxable Income. Line 8: Benefit Plan Dues-The cost of medical will increase to 19.5%, and are payable monthly. Total dues for Pension, Life Insurance, and Health Benefits are 31.5% of Total Effective Salary. Treasurers are urged to pay electronically via Board Link. COMPENSATION NOT NORMALLY INCLUDED IN EFFECTIVE SALARY Accountable Reimbursement Plan a. Continuing education reimbursements: the amount the church or employing organization agrees to reimburse for money actually spent or to be spent for job-related continuing education purposes. Payment must be supported under an Accountable Reimbursement Plan or paid under a Section 127 plan. All other allowances should be included on Line 5. b. Automobile expenses must be either a) reimbursed at the per mile rate (IRS rate for 2009 is $0.585 per mile subject to change as fuel prices change), or b) a car with full expenses provided. Record on line 11b the amount budgeted to reimburse the minister or to pay the expenses of operating a church-owned vehicle. All payments must be documented with actual expenses or miles driven. Allowances for which no substantiation is required should be included on line 5. c. Business and professional expenses include such items as books, subscriptions to magazines, supplies, business meals, etc. and should be reimbursed as spent and supported by the minister. 10