Review 3 Solution

advertisement

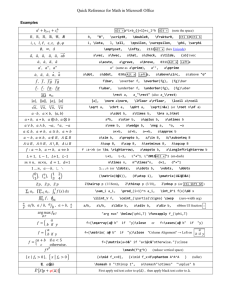

FE Practice Problems w/ Solutions 6-48 You just won the sweepstakes! You have the option of either receiving a lump sum now for $125,000 or receiving a check for $50,000 each year for three years. You would receive the first check for $50,000 immediately. At what interest rate (MARR) would you have to invest your winnings to be indifferent as to how you receive your winnings? [6.5] Choose the closest answer. (a) 15.5% (b) 20.0% (c) 21.6% (d) 23.3% Solution: Set PWall now (i') = PW3 checks (i') and solve for i' ( 125, 000 = 50, 000 + 50, 000 P , i ', 2 A P , i ', 2 = 125, 000 - 50, 000 = 1.5 A 50, 000 i ' » 21.6% ( ) ) Select (c) If the MARR > 21.6%, select $125,000 now; if MARR < 21.6%, select $50,000 at times 0, 1, and 2, and if MARR = 21.6%, you would be indifferent. D:\533560164.doc Page 1 of 8 FE Practice Problems w/ Solutions 6-49 TTA is a small feeder freight air line that started with very limited capital to serve the independent petroleum operators in the arid Southwest. All of its planes are identical, although they are painted different colors. TTA has been contracting its overhaul work to Alamo Airmotive for $40,000 per plane per year. TTA estimates that , by building a $500,000 maintenance facility with a life of 15 years and a residual (market) value of $100,000 at the end of its life, they could handle their own overhaul at a cost of only $30,000 per plane per year. What is the minimum number of planes they must operate to make it economically feasible to build this facility? The MARR is 10% per year. [6.4] (a) 7 (b) 4 (c) 5 (d) 3 (e) 8 Solution: Savings per plan = $40,000 - $30,000 = $10,000 per year Let X = number of planes operated per year. ( ) ( 500, 000 = 10, 000 ( X ) P ,10%,15 + 100, 000 P ,10%,15 A F 500, 000 - 100, 000 P ,10%,15 F X= 10, 000 P ,10%,15 A $500, 000 - $100, 000(0.2394) X= = 6.27 $10, 000(7.6061) ( ( ) ) ) X = 6.26 or 7 planes per year Select (a) D:\533560164.doc Page 2 of 8 FE Practice Problems w/ Solutions 6-50 Complet the following analysis of investment alternatives and select the preferred alternative. The study period is three years and the MARR = 15% per year. [6.4] Capital Investment Annual Revenues Annual Costs Market Value EOY 3 PW (15%) Alternative A $11,000 4,000 250 5,000 850 (a) do nothing (b) Alternative A Alternative B $16,000 6,000 300 6,150 ??? (c) Alternative B Alternative C $13,000 5,540 400 2,800 577 (d) Alternative C Solution: ( ) ( ) PWB (15%) = - 16, 000 + (6, 000 - 300) P ,15%,3 + 6,150 P ,15%,3 A F 2.2832 0.6575 = 1, 058 Select (c) - Alternative B to maximize PW D:\533560164.doc Page 3 of 8 FE Practice Problems w/ Solutions 6-51 Complet the following analysis of cost alternatives and select the preferred alternative. The study period is 10 years and the MARR = 12% per year. “Do Nothing” is not an alternative. [6.4] Capital Investment Annual Costs Market Value EOY 10 FW (12%) Alternative A $11,000 Alternative B $16,000 250 1,000 Alternative C $13,000 300 1,300 Alternative D $18,000 400 1,750 -$37,551 -$53,658 ??? (a) Alt. A (b) Alt B (c) Alt C 100 2,000 -$55,660 (d) Alt D Solution: ( FWC (12%) = - 13, 000 F ) ( ) ,12%,10 - (400) F ,12%,10 + 1, 750 P A 3.1058 17.5487 = - 45, 645 Select (a) – Alternative A to minimize costs. D:\533560164.doc Page 4 of 8 FE Practice Problems w/ Solutions 6-52 For the following table, assume a MARR of 10% per year, and a useful life for each alternative of six years, which equals the study period. The rank order of alternatives from least capital investment to greatest capital investment is DO NOTHING A C B. Conplete the IRR analysis by selecting the preferred alternative. [6.4] DO NOTHING A AC (A-C) CB (B-C) -$15,000 -$2,000 -$3,000 Capital Investment Annual Revenues Annual Costs Market Value IRR 4,000 900 460 -1,000 6,000 12.7% -150 -2,220 10.9% 100 3,350 ??? (a) DO NOTHING (b) Alt A (c) Alt B (d) Alt C Solution: IRR on (B-C) ( ) ( 0 = - 3, 000 + (460 - 100) P , i ', 6 + 3,350 P , i ', 6 A F i ' = 13.4% > 10% ) Select (c) – Alternative B D:\533560164.doc Page 5 of 8 FE Practice Problems w/ Solutions 6-53 For the following table, assume a MARR of 15% per year, and a useful life for each alternative of eight years, which equals the study period. The rank order of alternatives from least capital investment to greatest capital investment is Z Y W X. Conplete the incremental analysis by selecting the preferred alternative. “Do Nothing” is not an option. [6.4] Capital Investment Annual Cost Savings Market Value PW(15%) (a) Alt. W ZY YW WX -$250 -$400 -$550 70 90 15 100 97 50 20 200 ??? (b) Alt. X (c) Alt. Y (d) Alt. Z Solution: ( ) ( ) D PWW ® X (15%) = - 550 + 15 P ,15%,8 + 200 P ,15%,8 A F = - $ 417.31 < 0 Select (a) – Alternative W D:\533560164.doc Page 6 of 8 FE Practice Problems w/ Solutions The following mutially exclusive investment alternatives have been presented to you. The life of all alternatives is 10 years. Use this information to solve problems 6-54 through 657. [6.4] A Capital Investment Annual Expenses Annual Revenues Market Value at EOY 10 IRR B C D E $60,000 $90,000 $40,000 $30,000 #70,000 30,000 40,000 25,000 15,000 35,000 50,000 52,000 38,000 28,000 45,000 10,000 15,000 10,000 10,000 15,000 ??? 42.5% 31.5% 7.4% 9.2% 6-54 After the base alternative has been identified, the first comparison to be made in an incremental analysis should be which of the following? (a) C B (b) A B (c) D E (d) C D (e) D C Solution: Rank Order: Do Nothing→D→C→A→E→B Assuming the MARR ≤ 42.5%, Alternative D is the base alternative. The first Comparison to be made based on the rank ordering would be D→C. Select (e) 6-55 Using a MARR of 15%, the present worth of the investment in B when compaired incremently to A is most nearly: (a) -$69,000 (b) -$21,000 (c) $80,000 (d) $31,000 (e) $53,000 Solution: PWA→B(15%) = [-$90,000 - (-$60,000)] + ($12,000 - $20,000) (P/A,15%,10) + ($15,000 $10,000) (P/F,15%,10) = -$68,914 Select (a) D:\533560164.doc Page 7 of 8 FE Practice Problems w/ Solutions 6-56 The IRR for alternative C is most nearly: (a) 30% (b) 15% (c) 36% (d) 10% (e) 20% Solution: PWC (i ') = 0 ( = - 4, 000 + 13, 000 P , i ',10 A P , i ',10 = 4, 000 = 0.3077 A 13, 000 i ' = 30.8% ( ) ) Select (a) 6-57 Using a MARR of 15%, the preferred alternative is: (a) Do Nothing (e) Alt. D (b) Alt. A (f) Alt. E (c) Alt. B (d) Alt. C Solution: Eliminate Alt. B and Alt. E (IRR < 15%) ( ) ( ) ( ) ( ) ( ) ( ) PWA (15%) = - 60, 000 + 20, 000 P ,15%,10 + 10, 000 P ,15%,10 A F = $ 42,848 PWC (15%) = - 40, 000 + 13, 000 P ,15%,10 + 10, 000 P ,15%,10 A F = $ 27, 716 PWD (15%) = - 30, 000 + 13, 000 P ,15%,10 + 10, 000 P ,15%,10 A F = $37, 716 Select (b) – Alternative A to maximize PW. D:\533560164.doc Page 8 of 8