Saint appeal form - Didcot Railway Centre

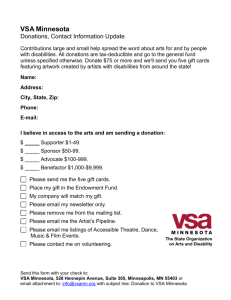

advertisement

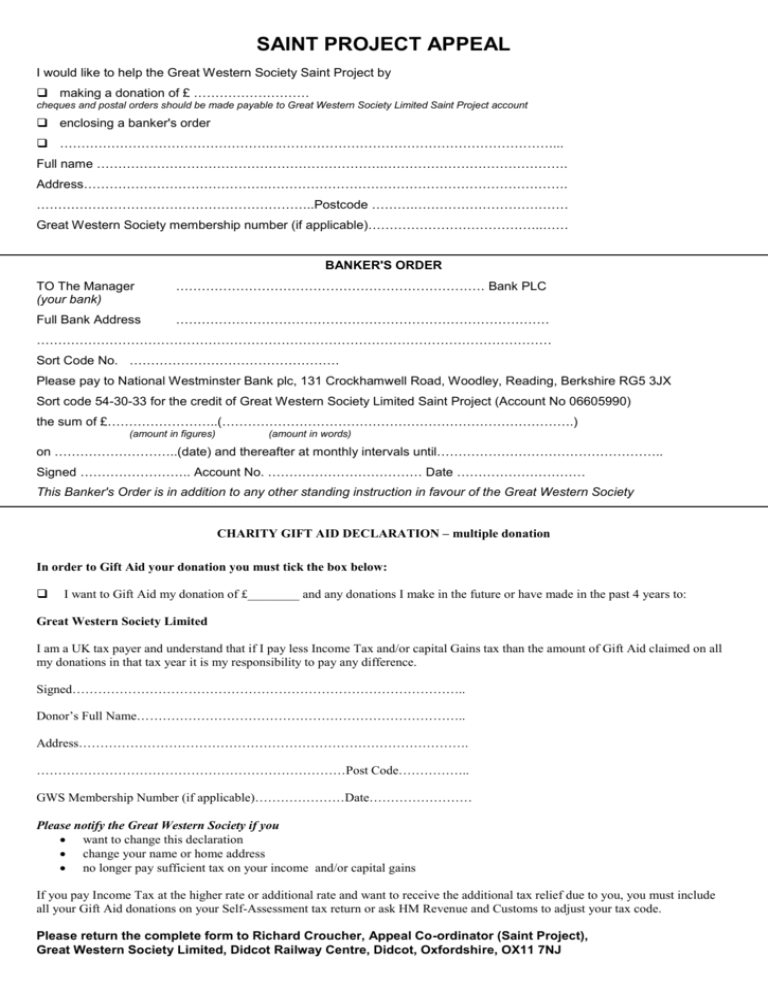

SAINT PROJECT APPEAL I would like to help the Great Western Society Saint Project by making a donation of £ ……………………… cheques and postal orders should be made payable to Great Western Society Limited Saint Project account enclosing a banker's order ………………………………………….…………………………………………………………... Full name ………………………………………………………….……………………………………. Address…………………………………….……………………………………………………………. ………………………………………………………..Postcode ……….……………………………… Great Western Society membership number (if applicable)…………………………………..…… BANKER'S ORDER TO The Manager (your bank) ……………………………………………………………… Bank PLC Full Bank Address …………………………………………………………………………… ………………………………………………………………………………………………………… Sort Code No. …………………………………………. Please pay to National Westminster Bank plc, 131 Crockhamwell Road, Woodley, Reading, Berkshire RG5 3JX Sort code 54-30-33 for the credit of Great Western Society Limited Saint Project (Account No 06605990) the sum of £……………………..(……………………………………………………………………….) (amount in figures) (amount in words) on ………………………..(date) and thereafter at monthly intervals until…………………………………………….. Signed …………………….. Account No. ……………………………… Date ………………………… This Banker's Order is in addition to any other standing instruction in favour of the Great Western Society CHARITY GIFT AID DECLARATION – multiple donation In order to Gift Aid your donation you must tick the box below: I want to Gift Aid my donation of £________ and any donations I make in the future or have made in the past 4 years to: Great Western Society Limited I am a UK tax payer and understand that if I pay less Income Tax and/or capital Gains tax than the amount of Gift Aid claimed on all my donations in that tax year it is my responsibility to pay any difference. Signed……………………………………………………………………………….. Donor’s Full Name………………………………………………………………….. Address………………………………………………………………………………. ………………………………………………………………Post Code…………….. GWS Membership Number (if applicable)…………………Date…………………… Please notify the Great Western Society if you want to change this declaration change your name or home address no longer pay sufficient tax on your income and/or capital gains If you pay Income Tax at the higher rate or additional rate and want to receive the additional tax relief due to you, you must include all your Gift Aid donations on your Self-Assessment tax return or ask HM Revenue and Customs to adjust your tax code. Please return the complete form to Richard Croucher, Appeal Co-ordinator (Saint Project), Great Western Society Limited, Didcot Railway Centre, Didcot, Oxfordshire, OX11 7NJ