Solutions Unitron

advertisement

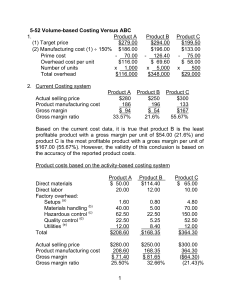

Solutions Unitron Question 2 There are two basic accounting methods for allocating joint cost to the five joint products: the "physical units" or "average cost" method, and the "relative sales value" (RSV) or "net realizable value" (NRV) method. Question 1 says the period began with zero inventories. The objective is to assign the joint cost to the 400,000 units produced and for which we have sales demand information. The physical units method is straightforward: joint cost of $200,000 divided by 400,000 total units produced = $0.50 per unit. All rectifiers are assigned identical unit costs. Since sales prices increase with increasing technical attributes across the five categories, gross margins will also increase from the low to high end products (negative 25% for 401 to 50% for 405). The case says that no production costs are assigned to the by-product. This is one alternative for dealing with by-products. We also assume here that any revenue from by-product sales is credited to miscellaneous income, rather than being offset against the $200,000 manufacturing cost. Otherwise, given the uncertainly about by-product revenues in the case, even the average cost calculation becomes very complex. If the “by-product” units (400s) are considered a joint product, the average cost is $.40 per unit ($200,000 ÷ 500,000 units). The RSV method has a number of twists that can result in many different unit costs for the five products. For inventory costing purposes, any systematic cost allocation system will do. The basic idea of the relative sales value scheme is that all sales should show gross margin percent equal to the average gross margin percent across the full joint product set. This average is 19% [(246 - 200) ÷ 246)]. This does imply 5 different costs for the 5 different products, based on the 5 different selling prices. As long as no product switching occurs, the basic idea is easily preserved. Note here that the relevant designation for a product is the sales designation. Anything sold as a 401 will carry 401 cost. Here are the resulting unit cost numbers: 401 402 $0.50 $0.50 Physical units method Relative sales value method [Sales price x (1-.19) $0.40 x .81 .32 $0.60 x .81 $0.70 x .81 $0.80 x .81 $1.00 x .81 Unit Costs 403 404 $0.50 $0.50 405 $0.50 .49 .57 .65 .81 Question 3 Costing Method Physical Unit Revenue ($.40/unit x 6,000 units) Costs: ($.50/unit x 6,000 units) Gross Margin Relative Sales Value $2,400 3,000 $(600) $2,400 Method A: 3000 x .32 3000 x .49 2,430 Method B: 2400 x .81 Method A: Method B: 1,944 $(30) $456 A problem arises under RSV costing when there is product switching (402’s sold as 401’s). Now, there is a choice: 1. Stay with the 5 different costing numbers, which means the 402’s sold as 401’s still carry 402 costs. The result, however, is consistent application of the rule and violation of the basic idea. For sales of $2400 (6000 401’s) the basic idea is clear—reported gross margin should be 19% or $456, since 19% is the average gross margin percent, and this is a normal sale. 2. In order to achieve the desired result (gross margin of $456), it is necessary to consider all 6000 of the items shipped to be 401’s. This means violating the costing rule. Use a 401 cost, not a 402 cost, for the 402’s shipped as 401’s. Question 4 The toy company may be forcing Unitron to change its long-term view on joint products and by-products. The “seconds” are already large to be considered a by-product (sales of at least 35,000 units a year). They are only exceeded by the 402 product line in number of units produced annually. At a selling price of $0.25 per unit, the “seconds” have a relatively low sales value per unit. And even this low selling price doesn’t have many takers. Only 35% of the units produced were sold, so far. The key is what is the customer value associated with these “seconds”? The mid-1970s were the start of the electronic toy market. There may be more future demand from toy makers for “seconds” at the lower price. Even Texas Instruments got into the toy business about this time with “Speak and Spell.” At the even lower selling price of $.15 per unit, the Toy Company’s 48,000 “seconds” will generate $7,200 incremental revenue and gross profit. Based on RSV, 401’s generate only $7,480 gross profit annually. Even the high tech 404’s and 405’s combined generate only $9,724 ($5,984 + $3,740) gross profit. What does a product have to do to be called a joint product? However, giving “seconds” the status of a joint product does not significantly change the overall picture. Assume 83,000 units sold at $.15/unit, sales value = $12,450 (35,000+48,000) Total joint products sales revenue=$246,000+12,450 = $258,450 Total joint production costs = 200,000 Gross profit = $ 58,450 Gross profit percent of sales value 23% (versus 19% now) But, whether 400’s are considered joint products or by-products doesn’t really change the economics of the toy company offer. The “Relevant Cost” for the “seconds,” for purposes of evaluating this offer is Opportunity Cost. If I sell them now for $.15, will I lose an opportunity to sell them later for enough more than $.15 to make up for the time value of the foregone cash inflow? Annual output is 100,000 units and inventory on hand is 65,000. This is 13 batches, or 32+ weeks supply. That is, we have not sold any for 160 days at the $.25 price. I would grab the order quickly!! It is also probably true that once the toy company becomes a regular customer for 50,000 or so units a year, the 400 will be reclassified a joint product. This really doesn’t affect management decisions.