Effects of Framing and Format on Violations of Stochastic Dominance

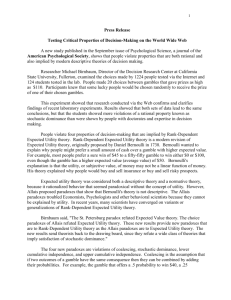

advertisement