A. Gerali TAU Course Outline

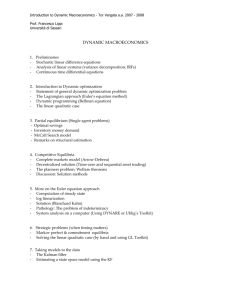

Introduction to Dynamic Macroeconomics - Tor Vergata a.a. 2006 - 2007

COURSE OUTLINE:

OPTIMIZATION, DYNAMICS & EXPECTATIONS

Lecture 1

THE "GENERIC" DYNAMIC OPTIMIZATION PROBLEM (specialized to RECURSIVE

PROBLEMS, LINEAR-QUADRATIC)

STOCHASTIC LINEAR DIFFERENCE EQUATIONS

Lecture 2

ROADMAP FOR OPTIMIZATION: (systems without Expectations)

INTRODUCING THE TOOLKIT:

Lecture 3

OPTIMIZATION IN Models with Expectations

Solution under discretion & commitment (using the Lagrangian approach) for the scalar case;

SOLVING FOR THE DISCRETIONARY EQ. (GENERAL MATRIX CASE BASED ON SW)

Lecture 4

- SOLVING THE COMMITMENT PROBLEM (general matrix case)

Lecture 5

- INTRODUCING INCOMPLETE INFORMATION: FILTERING

- THE KALMAN FILTER

Lecture 6

- ESTIMATING A MODEL USING THE KALMAN FILTER

F. Lippi

Introduction to Dynamic Macroeconomics - Tor Vergata a.a. 2006 - 2007 F. Lippi

DETAILED PROGRAM

Lecture 1

FOCUS OF THIS COURSE: OPTIMIZATION, DYNAMICS & EXPECTATIONS

ECONOMIC MOTIVATION: (1) TAYLOR

(2) EXPECTATIONS & CREDIBILITY

(3) INFORMATION VARIABLES

THE "GENERIC" DYNAMIC OPTIMIZATION PROBLEM:

Concept of State Variables

Time-varying transition equations & return fcns & finite horizon

RESTRICTION 1: RECURSIVE PROBLEMS

Time invariant transition equations & return fcns & infinite horizon

State and "proof" the equivalence between sequence and recursive problem

RESTRICTION 2: LINEAR-QUADRATIC

Specialization of recursive problems to Linear-Quadratic

Proof that the value fcn of an LQ problem is quadratic

EXAMPLE: Svensson (1997). Equations and matrices in state space form.

STOCHASTIC LINEAR DIFFERENCE EQUATIONS

The optimization part yields a solution in the form:

X(t+1) = (A + B F) X(t) + C W(t+1)

Y(t) = G X(t)

This SLDE can be studied using:

Impulse Response Functions

Conditional & Unconditional Second Moments

Prediction Theory

(1)

(2)

References:

Ljungqvist & Sargent, Recursive Macroeconomic Theory , Chapters 1-2

Hansen, Lars and Thomas Sargent, Recursive Linear Models of Dynamic Economies , manuscript, 1997,

Chapter 2

Introduction to Dynamic Macroeconomics - Tor Vergata a.a. 2006 - 2007

Lecture 2

ROADMAP FOR OPTIMIZATION:

1) systems without Expectations nor stochastic terms

2) " without Expectations but with stochastic terms

3) " with Expectations

4) " with Expectations & Incomplete Information

F. Lippi

OPTIMIZATION 1: Derivation of matrix equations for F & V (OLRP problem)

OPTIMIZATION 2: Add a stochastic term --Certainty Equivalence

INTRODUCING THE TOOLKIT:

Svensson (EER 1997) coding and examples (moments, impulse response functions, losses).

Standard Savings problem 1 (no capital): coding and analysis

Standard Savings problem 2 (Neoclassical growth model): coding and analysis

Clarida-Galì-Gertler (JEL 1999) coding and examples

References:

Ljungqvist & Sargent, Recursive Macroeconomic Theory , Chapter 4

Gerali, Andrea and Francesco Lippi, Optimal Control and Filtering in Linear Forward-Looking Economies:

A Toolkit , mimeo, Bank of Italy, 2002.

Svensson, Lars E.O. and Michael Woodford, Indicator Variables for Optimal Policy , Journal of Monetary

Economics, 50:691–720, 2003.

Papers with examples/applications of LQ methods:

Cukierman, Alex and Francesco Lippi, Endogenous Monetary Policy with Unobserved Potential Output ,

CEPR Discussion Paper No. 3763, February 2003.

Ehrmann, Michael and Frank Smets, Uncertain potential output: implications for monetary policy , Journal of

Economic Dynamics and Control, 27:1611–38, 2003.

Svensson Lars E.O., Inflation Forecast Targeting: Implementing and Monitoring Inflation Targets , European

Economic Review, 41:1111–46, 1997.

Introduction to Dynamic Macroeconomics - Tor Vergata a.a. 2006 - 2007 F. Lippi

Lecture 3

OPTIMIZATION 3: Models with Expectations

The economics & the mechanics (Gertler example of a forward vs. backward economy)

Intro to different Equilibrium notions (Discretion & Commitment)

PENCIL & PAPER EXAMPLE FROM CGG

Solution under discretion & commitment (using the Lagrangian approach)

(Contents: find the stable solution of CGG (JEL 1999) analytically (with pencil & paper) using the method of undetermined coefficients; The time inconsistency of the optimal plan)

SOLVING FOR THE DISCRETIONARY EQ. (GENERAL MATRIX CASE BASED ON SW)

References:

Ljungqvist & Sargent, Recursive Macroeconomic Theory , Chapter 18 of II edition.

Papers with a derivation of the standard New Keynesian model:

Clarida, Richard, Jordi Galì and Mark Gertler, The Science of Monetary Policy: A New Keynesian

Perspective , Journal of Economic Literature, 37:1661–1707, 1999.

Galì, Jordi,

New Perspectives on Monetary Policy, Inflation, and the Business Cycle , mimeo, December

2000.

Galì, Jordi,

The Conduct of Monetary Policy in the Face of Technological Change: Theory and Postwar U.S.

Evidence , mimeo, October 2000.

Introduction to Dynamic Macroeconomics - Tor Vergata a.a. 2006 - 2007 F. Lippi

Lecture 4

SOLVING THE COMMITMENT PROBLEM (general matrix case)

Recursify the problem using Lagrange multipliers

Solving the augmented OLRP problem (& finding the pseudo value function)

ON THE TOOLKIT:

The gains of commitment relative to discretion: example based on the multiple_experiments file of ES, which shows how the gains of commitment relative to discretion vary with the economy degree of forward lookingness and the preference for interest smoothing.

(CODING AND INTERPRETING THE EXERCISE)

Introduction to Dynamic Macroeconomics - Tor Vergata a.a. 2006 - 2007 F. Lippi

Lecture 5

INTRODUCING INCOMPLETE INFORMATION: FILTERING

The simplest filtering problem. Simple extraction form iid variables and noises; solving the scalar case to give the intuition about “signal to noise ratio”.

[ Constructing a non-recursive optimal predictor that minimizes the mean square error of the forecast (examples from Cukierman and Lippi, JEDC) ]

…. getting recursive

THE KALMAN FILTER

State space representation and measurement equation

Linear projections properties (theorem 1 and 2)

Derivation of the kalman filter

References:

Hamilton, Time Series Analysis , Chapter 13 on "The Kalman Filter"

Introduction to Dynamic Macroeconomics - Tor Vergata a.a. 2006 - 2007 F. Lippi

Lecture 6

ESTIMATING A MODEL USING THE KALMAN FILTER

THE PROBLEM OF INDETERMINACY

Papers with estimation applications:

Lippi, Francesco and Stefano Neri, “Information variables for monetary policy in an estimated structural model of the euro area”,

Journal of Monetary Economics , forthcoming