015—Hire and Rental Industry Association [DOC 187KB]

advertisement

![015—Hire and Rental Industry Association [DOC 187KB]](http://s3.studylib.net/store/data/007850488_2-ad8964d92277d4c46c0ca2b3cf2ac7e0-768x994.png)

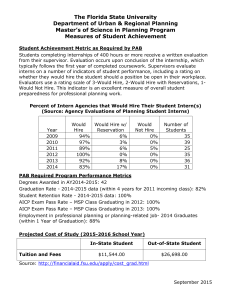

Compliance costs and risks to small businesses in Australia’s hire and rental industry Submission to Bruce Whittaker Review of the The Personal Property Securities Act 2009 Cth.(PPSA) Contacts: Phil Newby Chief Executive Officer Hire & Rental Industry Association Elevating Work Platform Association Mobile: 0417 212 627 Email: PhilNewby@ewpa.com.au Oliver Shtein Bartier Perry Level 10, 77 Castlereagh Street Sydney NSW 2000 Mobile: 0408 466 286 Email: oshtein@bartier.com.au CONTENTS 1. Background - Australia’s hire and rental industry ...................................... 3 2. The problem ................................................................................................................. 3 3. Magnification of the concerns for small business ...................................... 3 4. Specific concerns ...................................................................................................... 4 5. Possible solutions..................................................................................................... 8 6. General / other comments ..................................................................................... 9 ATTACHMENT A ............................................................................................................. 11 Example showing complexity of the PPSR and potential consequences of getting it wrong ..........................................................................................................................11 ATTACHMENT B ............................................................................................................. 12 Cross hire - example showing how hire businesses are at risk when hiring to each other to meet customer needs ..........................................................................12 ATTACHMENT C ............................................................................................................. 13 PPSA compliance costs for typical hire business ....................................................13 Summary of costs: ...................................................................................................................18 1. Background - Australia’s hire and rental industry The hire industry is represented by two peak national bodies, the Hire and Rental Industry Association (HRIA) and the Elevating Work Platform Association (EWPA). Together the associations represent over 1,100 businesses, or 66 per cent of all hire employer enterprises. Australia’s $6.6 billion hire and rental industry provides a critical service to the construction and mining sectors by facilitating flexible access to earthmoving and heavy equipment, medium to small equipment for trade contractors, cranes and access equipment, mining related equipment, scaffolding, forklifts and portable accommodation. The industry employs over 18,000 people across a range of businesses, from large players such as Coates Hire and Kennards Hire to a majority of small and medium enterprises, many of which are family owned. The industry is driven by the preference of large numbers of construction and mining firms to hire equipment, rather than purchasing it, based on a desire to remain flexible, reduce capital and maintenance expenditure and gain access to the latest technologies. Indefinite hire is a significant feature of the industry providing flexibility to customers. Whilst many hires are indefinite to accommodate the needs of customers and minimize the need for documentation, hires are predominantly short term. The associations estimate that the average hire period of their members is about 8 days. We note however that hire periods are variable depending on the type of equipment and the kinds of use to which equipment is applied. For example goods such as road barriers or portable buildings are typically hired for longer periods and may be hired for more than a year. Goods such as scissor lifts (‘motor vehicles’ under the current definition) are not typically hired for more than a year but one of our members advises that about 20% of their fleet may be on hire for periods approaching or exceeding a year. These hires may be longer because in those cases the goods are part of the ‘core’ of hired access equipment used in a major construction project such as construction of a hospital. Scissor lifts that are not part of the customer’s ‘core’ requirement may come and go from the project site offering flexibility and economy to the project. 2. The problem PPSA has had a number of unintended and detrimental effects for the hire and rental industry. The industry has two major concerns: a) Property owned by hire companies can be lost when a customer defaults or becomes insolvent. This drastic sanction is out of proportion to any policy gain which the industry can perceive from the PPSA. b) PPSA is extremely complex and the regulatory, financial and administrative burden imposed on hire businesses to ensure that they are correctly registered on the PPSR, in order for their assets to be afforded limited protection, is excessive and onerous. 3. Magnification of the concerns for small business The associations submit that whilst the concerns above are common across the industry they are magnified for small business for the following reasons: a) Small hire businesses cannot afford to generate or obtain expertise about PPSA. A small family business cannot be compared with a finance company or bank with access to the legal advice, precedents and systems necessary to navigate the PPSA - which is unquestionably highly complex. 3 b) Small hire businesses are generally exposed to significantly greater credit risk: Their customer base may comprise smaller companies in the construction industry They will have few credit assessment and credit protection skills They may have greater customer concentration – i.e., exposure to the possible insolvency of one customer compared to an industry major with a large and diversified customer base. The history of PPSA in New Zealand and Australia demonstrates that the winners in PPSA disputes tend to be the banks and finance companies. Cases such as NZ Bloodstock and Portacom come to mind where the large and well-advised institution prevailed over the hire business. These outcomes have been replicated in Australia cases such as Spiers Earthworks and in the as yet uncounted number of cases where hire businesses have been confronted by controllers appointed by banks and other financiers claiming title. Typically in these contests there is no reason to think that the presence of hired equipment deceived the bank as to the financial condition of the business. The gains appear to have been windfalls delivered by PPSA. In the circumstance where a hire business loses its capital to its customer’s creditors because of PPSA imperfection of the hire, the .institution that lends to the hire business will normally have other security in the form of personal guarantees or real property security over directors’ assets to fall back on. This pushes the loss to the individuals owning the hire business. The associations submit that the overall pattern of outcomes occurring and expected to occur under PPSA will be to deliver windfall gains to large financiers and banks at the expense of hire businesses which as noted above are, in the associations’ experience, typically small businesses. 4. Specific concerns These are outlined below: a) Complexity Small hire businesses do not fully understand the system and the legislation allows no leeway to individuals and businesses who cannot grasp its legal complexity. Attachment A shows a number of understandable errors or (even slight) delays that could lead to loss of ownership of a hire business’s assets if a customer becomes insolvent. The .financing statement has been framed with no sympathy at all for the unsophisticated user or anyone who is less than thoroughly conversant with PPSA principles. Many questions appear to be unnecessary but the wrong answer may be fatal to the registration. Hire industry personnel must have an understanding of at least the following: The wording of the ‘PPS lease’ definition and subtle differences between security interests which arise at inception of the hire and those that become subject to PPSA subsequently PMSIs and priority concepts in finance law and the exceptions to what is a PMSI. A lay person would instinctively think that a hire was nothing to do with ‘purchase money’ The way to identify trusts and the workings of the ABN and ACN/ ARBN identifiers – ABNs have previously only been the province of Federal tax law and the 4 workings of trusts and ABNs are not widely understood outside the tax and accounting professions The difference between transitional and non-transitional security interests The collateral classes and the definition of ‘motor vehicle’ in particular Sound drafting principles in the framing of collateral descriptions so that they are wide enough to cover the hired goods but not unduly wide (which will lead to additional administration costs in answering questions from third parties dealing with the customer) What are ‘proceeds’ and why they are described in the financing statement as ‘All present and after-acquired property’ – which is also a collateral class What the term ‘inventory’ means under section 10 of the PPSA (for PMSI purposes) but also under Part 9.5 (which is actually the relevant issue for the inventory box in the financing statement) The additional timing requirements under section 588FL of the Corporations Act if (as usual) the customer is a company The documentation requirements in section 20 of the PPSA. b) PPSA is imposing large compliance costs on the industry and impeding businesses. For those hire businesses who seek to defuse the effect of PPSA if their customer becomes insolvent, PPSA demands that those businesses act like financial institutions, fully document hires and confront a piece of highly complex financier-driven legislation to assure their ownership. Businesses willing to hire urgently and be flexible are forced to take risks with their capital. A list of typical compliance steps and costs is provided in Attachment C. c) Indefinite hires, which form a key aspect of flexibility within the industry, carry the most risk for hire businesses under the PPSA system. Construction businesses typically need equipment for indefinite periods and often very urgently. Construction businesses are also more prone to insolvency than many other businesses so the risk of loss to the hire business is heightened. The drafting of the PPSA makes it clear that any ‘indefinite’ hire, whether lasting for 10 minutes or 10 years, is a PPSA ‘security interest’ from its inception. The drafting of the PPSA leaves uncertainty as to whether a hire that is of uncertain duration but within an overall time cap is ‘indefinite’ or not. But even if this uncertainty were resolved, the concept of an ‘indefinite’ hire as automatically requiring a security interest entraps hire businesses who, unaware of the dangers, try to help their customers by offering flexibility and inadvertently enter into indefinite hires or fail to document hires that are finite. See paragraph (e) below. d) Sub-hire, also called cross-hire, is another substantial part of the industry where PPSA has created a complex problem making hire businesses take on risk in dealing with each other. Hire businesses hire to each other to ensure that customers’ needs are met. Under the PPSA system a hire business can lose its equipment even if it registers under PPSA if its industry colleague doesn’t protect the equipment. A typical sub-hire example is provided in Attachment B. The system has effectively forced a hire business to run a credit and insolvency risk when providing equipment to an industry colleague. If the colleague has made errors in 5 PPSA compliance and suffers insolvency as a result, the hire businesses will lose capital assets, and it will not matter that it made the appropriate PPSA registrations against the industry colleague. The problem appears to the industry to be an intractable structural problem arising out of the policy decision to extend security interest concepts to things that are not really security interests – notably the PPS lease. The associations expect that your review will have submissions from financiers to the hire industry expressing similar concerns. The associations note that it is impracticable for hire businesses to monitor or audit the PPSA compliance practices and financial condition of their industry colleagues who are also typically their competitors. e) Indefinite hire should not be a PPS lease The associations state emphatically that they do not understand the argument that inclusion of indefinite hire is a necessary integrity or anti-avoidance measure in the PPSA. See the example at paragraph g) below as to the absurdity that flows from treating indefinite hire as a security interest. The Government has proposed in the Explanatory Memorandum to the Personal Property Securities Amendment (Deregulatory Measures) Bill 2014 that hire businesses put in a ‘longstop’ date in hire agreements so that there is a maximum term of one year. However this would not be the actual hire term. It is questionable whether such a longstop prevents the application of section 13(1)(b) of the PPSA which includes as a PPS lease any hire: b) for an indefinite term (even if the lease or bailment is determinable by any party within a year of entering into the lease or bailment); The ‘longstop’ suggestion seems to contemplate the parties settle on an artificial hire period not knowing what the actual hire period will be, even if they may know it will almost certainly be less than a year. Such a course of action will necessarily result in hires that have ‘nominal’ terms or end dates that are not connected to the actual intentions of the parties – opening the door to the argument that the stated or ‘long stop’ term should be disregarded and the real term construed as truly ‘indefinite’ because it is not known. The argument that hire businesses should document the longstop in effect also amounts to the promotion of red tape. A short term documented hire is safe. A short term undocumented hire is not. Hire businesses will be unable to do flexible and accommodating business with customers and may trip over the requirements. Example: HireCo hires a scissor lift to FredCo for 9 months. There is a longstop of 12 months in the hire terms. Near the end of the 9 months FredCo rings HireCo and asks if FredCo can keep the lift for a bit longer because FredCo is using it in a construction job that has been held up by site conditions. A helpful employee of HireCo emails FredCo’s principal as follows: ‘Fred – just confirming you can keep the lift as long as you need it’. A liquidator would no doubt argue that the hire became indefinite at that point. There are many other ways in which a hire business can trip up over the documents and requirements. For example using a hire or delivery docket that has outdated or incomplete contractual terms on it will be argued to give rise to new separate contract without the longstop. New business may have to be signed up urgently – this is a typical 6 occurrence when hired goods are delivered early in the morning or late at night when sites are available. One justification offered for the ‘indefinite hire PPS lease’ was that it provided certainty to hire businesses that they could not be accused of making unjustified registrations against customers. Some large industry players took the view that they should amend their customer terms so that every hire became indefinite. Reviewing each customer account to assess if there really was a security interest was simply too time-consuming for them. The practical effect was that these hire businesses made registrations against literally all their customer base – thousands or tens of thousands of customers in some cases. Consequently they have to incur the costs of answering queries every time a customer sells other equipment, refinances, sells its business etc. In the general hire industry this problem cannot be solved by improved collateral descriptions since the range of general hire equipment is very wide. In any event the legislation only requires a collateral description of ‘Other Goods’ or ‘Motor Vehicle’. The associations submit this was an extraordinary imposition of red tape not only on the hire businesses who felt compelled to make the registrations and now have to attend to enquiries about them but to all the small and large businesses and government bodies who now add hire companies to the list of businesses registering against them. The irony here is that most of the hires in question would not breach the one year time threshold (or even the 90 day threshold currently under amendment). Accordingly a large administrative burden was created for no sound policy reason. f) The PPSA assumption that leases of more than a year are equivalent to security interests should not be accepted The Explanatory Memorandum to the Personal Property Securities Amendment (Deregulatory Measures) Bill 2014 states: Whether other lease arrangements meet the definition of a security interest can be more difficult to determine. Generally, short term leases of personal property will be unlikely to meet the definition, but as lease terms becomes longer, especially as they begin to approximate the useful life of the leased property, they become increasingly likely to be a security interest. The associations estimate that the typical useful life of most hired equipment, in terms of its retention by the hire business, is 8 years. However this is variable and will depend on the kind of equipment and the locations it is used at, and the intensity of use. But it will be a multiple of the PPS lease thresholds provided for in the legislation. The typical period of a finance lease (in substance security interest) for equipment that would be considered eligible for finance leasing is in our experience four to six years. On this basis the associations submit it would have made sense for the PPS lease threshold to be at least two or three years. g) The PPS lease concept creates a two tier system and doubles legal complexity PPSA creates a bifurcated legal regime with some personal property in and some out of the legislation - based on arbitrary time frames and leading to outcomes which seem to make no sense in terms of the policy objectives that have been put forward in support of the PPS lease concept: Example Three different power drills (big, medium and small) are on hire to Joe in Joe’s yard. They are all owned by Fred’s Hire. All the drills are brightly painted and 7 engraved ‘Property of Fred’s Hire’. Fred has not made an effective PPSR registration against Joe. The big drill was hired for 350 days and has been in Joe’s yard for 9 months. The medium drill was hired for 350 days but has been there for 366 days with Fred’s consent. The small drill was hired ‘For as long as you need it Joe’ and had been in Joe’s yard for three days. Joe goes broke. Fred’s Hire: loses the small drill (deemed a security interest as indefinite hire) loses the medium drill (deemed a security interest as hire more than a year) keeps the big drill – not deemed a security interest Note that in this example the small drill had been ‘apparently owned’ by Joe (PPSA takes no account of the engraving or markings) for only a period of three days. The example also demonstrates the absurdity that flows from treating an indefinite hire – in this case one that only lasted a few days as equivalent to a security interest. In the above example an insolvency practitioner or owner would also need to contend with two separate systems. Some goods will be under PPSA and a whole different law will apply to them as compared to other goods which will be subject to the ‘traditional’ concepts of ownership. Equally this means that to know the legal position hire businesses will need to grapple with two systems. This position can be contrasted with retention of title or other ‘in substance’ security interests where the particular business practice will always fall clearly into the PPSA. h) PPSA is partially based on the assumption that commercial lenders are attracted to providing credit to businesses based on false assumptions about the ‘apparent’ wealth of businesses or ‘apparent’ ownership of equipment that is actually under hire. The reality is that the nature of the sectors which hire equipment (construction and mining) mean that people are aware that significant numbers of assets will be under hire. With hire being absolutely ubiquitous in the industry there is no assumption that construction or mining companies own all of their assets. Even if this evil of apparent wealth were a reality it would not be a consideration demanding the extraordinary sanction of loss of capital assets. Whatever may have been the case in North America there has been no demonstrated policy imperative to upset the well-accepted assumption of the primacy of ownership. PPSA has turned these concepts upside down for no discernible benefit and will cost hire businesses their equipment and undoubtedly, in the most unfortunate cases, their livelihoods and life savings, 5. Possible solutions The associations propose an amendment excluding hires from the PPSA provided they are part of an 'ordinary hire' business. This proposed amendment need not affect 'in substance' security interests such as finance leases – to which the PPSA could still apply. To accommodate the policy concern about ‘apparent ownership’ the exclusion could be drafted so as to apply only to ordinary hire business activities and perhaps only where the equipment is marked as the property of a hire business at the inception of the hire. 8 It has been said that the PPS lease concept is needed as a ‘bright line’ as otherwise there will be uncertainty as to what is caught as an in substance interest. The associations accept that in some cases this can be a difficult question in some contexts. But these cases are rare in the hire industry. Hire businesses are not financiers and their business model is to stick to the shorter term hires that are the core of their industry. What the existing PPS lease concept does do however is draw a ‘bright line’ right where it causes uncertainty for ordinary hire businesses and forces them to negotiate complex definitions and two different legal systems of property. Whilst our preferred approach is to exclude ‘ordinary hire’ businesses from the PPSA, an alternative approach would be to extend the PPS lease threshold period to 3 years. The PPS lease would only arise if the contractual term were 3 years or once the actual term got to three years. This would only provide relief to the industry if indefinite hire were no longer deemed to be a PPS lease. 6. General / other comments We also have some other comments on less structural issues, and which are not all directed particularly at hire industry or small business issues: A. The Act has been drafted to be most unforgiving despite its extreme complexity. Annexure A to this submission illustrates the complexity and pitfalls. Illustrated there are only some of the ways that an understandable mistake can lead to loss of assets. B. The Act does not answer the question whether PMSI priority can be obtained in the case of an arrangement that falls into section 13(1)(d) and is not registered in the time provided for in section 62. For example take a lease for a stated term of 320 days and the lessee is allowed to keep the goods for another 50 days (370 days in total). At inception there is no PPS lease because it was not for more than one year. But at day 366 it falls into para (d). If the lessor makes a registration only once it realises there is going to be a security interest can the lessor get PMSI priority? On the face of it no - because under section 62 there has to be a registration 'before the end of 15 business days after the day the grantor, or another person at the request of the grantor, obtains possession of the collateral'. (In some cases the 15 business day grace period doesn’t apply.) In this example the lessee got possession 320 or more days earlier. C. The financing statement asks a question about whether the collateral is ‘inventory’ which is impossible to answer. The legislation provides that this question is authorized for the purposes of Part 9.5. There is widespread misunderstanding even amongst lawyers that the term ‘inventory’ has the meaning given for it in section 10 of the Act. In fact it has the meaning given for it in Part 9.5. How does a hire business or retention of title supplier answer this question which is only authorised by the Act to be asked for the purposes of Part 9.5 – a transitional provision at the end of the PPSA which is only about charges? What purpose does the question serve anyway? D. There is a vesting rule in section 588FL of the Corporations Act. It operates in circumstances (failure to register within 20 business days of the ‘security agreement’) which are different to the vesting rule in the PPSA itself. There are no flag posts at all in the PPSA to alert a reader to the existence of section 588FL. Even if there were, section 588FL (like the PPSA itself) would be utterly indecipherable to typical hire business principal. 9 The associations submit that the application of this rule to hire of any kind is inappropriate. Hire businesses should not be expected to master such arcane rules. The Corporations Act charges provisions never previously applied to threaten hire businesses and that Act should, in the associations’ view, never have been extended to affect hires as it now does. We look forward to any comments or questions. Phil Newby Chief Executive Officer Hire and Rental Industry Association Elevating Work Platform Association 10 ATTACHMENT A Example showing complexity of the PPSR and potential consequences of getting it wrong The following example illustrates how a hire business (‘HireCo’) could be ruined by PPSA and complexities with the PPSR. Footnotes have been included which refer to the legislation. The example presents a series of typical situations. In April 2012 GrantCo gives Opportunity Bank a security over all its assets. Opportunity Bank registers this security interest against GrantCo on the PPS Register. In August 2012 GrantCo takes a generator on hire for 2 years from HireCo. A 2 year hire is a ‘security interest’. GrantCo uses the generator to provide a service to its customers1. HireCo registers its security interest against GrantCo on the PPSR. In December 2012 GrantCo enters insolvency. HireCo will lose its machine to Opportunity Bank if any of the following occurred (this list is not exhaustive): 1. HireCo failed to tick the box ‘purchase money security interest applies’ on the online PPS Register form2 2. HireCo registered its security interest even a day after the generator was delivered to GrantCo3 3. HireCo registered its security interest before the generator was delivered but the registration was made more than 20 business days after the date of the hire agreement between GrantCo and HireCo4 4. When it registered, HireCo wrongly ticked the box indicating the registration was ‘transitional’ when the hire agreement was post 30 January 2012 and the security interest in fact was non-transitional5 5. In the HireCo registration, GrantCo was identified by its ACN. However, GrantCo’s credit application stated that GrantCo was trustee of the Grant Family Trust. The financing statement at www.ppsr.gov.au asked ‘Does the grantor have an ACN’ and HireCo (understandably) answered ‘Yes’. HireCo did not realise that it should have answered ‘No’ and registered against the ABN of the trust6. The generator that HireCo has lost was very expensive and financed on lease from Big Bank. Big Bank terminates the lease. GrantCo becomes insolvent. 1 So it is deemed to be ‘inventory’ under paragraph (b) of the definition in PPSA s.10 PPSA s.62(2)(c). Note that if HireCo had bought the equipment from GrantCo this would be a sale and leaseback and if the PMSI box was ticked that would equally be a fatal defect. 3 PPSA s.62(2)(b) 4 Corporations Act 2001 s.588FL – which has its own vesting rule about PPSA security interests. Former Corporations Act provisions did not apply to hires at all. 5 PPSA s.337A – transitional registration can’t protect non-transitional interest. There can be real doubt in many cases whether an interest is or is not transitional. 6 Under the regulations to the PPSA about identifying the grantor where it is a company that is trustee of a trust with an ABN. There could be other permutations, including where documentation gives rise to doubt as to whether a grantor is acting in a trust capacity. 2 11 Big Bank calls on the personal guarantees given to it by Grant and Mary the directors of GrantCo. They are bankrupted and lose their home. ATTACHMENT B Cross hire - example showing how hire businesses are at risk when hiring to each other to meet customer needs Example – HireCo hires a cement mixer to Grant for 366 days. This is a PPS lease and so is deemed to be a ‘security interest’. HireCo makes an effective PPSR registration against Grant. Grant sub-hires the mixer to SubCo. But Grant does not make an effective registration against SubCo. SubCo becomes insolvent. SubCo is Grant’s biggest customer and SubCo’s liquidator takes all the equipment that SubCo has on hire from Grant including the mixer. This forces Grant into insolvency. HireCo's rights to the mixer are lost. It can sue Grant but he is broke. 12 ATTACHMENT C PPSA compliance costs for typical hire business The following sets out typical time and expense for a small to medium hire business $2-5 million turnover - less than 20 employees. The hired equipment is assumed to include some equipment within the definition of ‘motor vehicles’ as well as other equipment such as tools, road barriers etc. The ‘motor vehicles’ could be excavators, trucks, trailer mounted compressors or generators etc but could also be very slow moving and low powered equipment such as trailers?, walkie stackers, scissor lifts or boom lifts. 13 Step Comments Cost or time Estimated Cost $ Obtain an understanding of PPSA Attend seminars or training. Usually more than one due to the complex and novel nature of the PPSA for hires. 6 hours or more if regionally located Course Cost = $350 Management cost 6 hour @ $120.00 per hour = $720 Confirm the key implications of PPSA for the business Specialist legal advice is inevitably needed. Typical small law firms traditionally servicing hire businesses do not often have the necessary expertise. Advice will normally include: Review of documentation and contractual processes to ensure the documentation standards of PPSA are met Advice on how to ‘roll out’ new agreement forms to existing customers Amendments to agreement forms to include PPSA-specific provisions Settle on collateral description, settle on approach to serial number registration Advice on transitional or non-transitional status of customers having regard to previous contractual practices Training to senior executives on the operation of the PPSR Advice on risk minimisation in sub-hire (cross-hire) 14 $5,000 - $10,000 plus time spent in considering advice and seeking clarifications and then briefing colleagues – say 20 hours Total cost $1,070 Average cost = $7,500 Management time 20 hours @ 120 per hour = $2,400 Total cost $9,900 Step Comments Cost or time Estimated Cost $ Implement PPSA procedures These typically include: Establishing secured party group on the PPSR Identity and authority of those who can do registrations and deregistrations and receive notices Procedures to ensure registrations are made: o within the timeframe for purchase money security priority o to avoid vesting under the related rules contained in the Corporations Act Procedures for linking registrations to accounts receivable information and for storing and retrieving data about registrations This depends on the number of customers. However, an example might include 160 customers with 2 registration required per customer (motor vehicles and other goods). Inevitably some time will be taken in clarifying the legal nature of the customer: Is it a company? Obtain ACN & check against ASIC register Is it trustee of a trust? What is the ABN of the trust – check against ABR Check unusual entities with adviser e.g. individual as trustee of a trust with ABN – use individual name not ABN, co-ops, incorporated associations etc the hire business will normally need to review constitution Adviser will usually recommend that for pre-PPSA customers both a transitional and non-transitional registration be made due to the uncertainty in the legislation as to what is a transitional security interest. 30 hours including meetings Management cost @ $120 per hour 30 hours = $3,600 May include additional software or procedures manual amendment Total cost $3,600 45 minutes per customer 160 registrations @ 45 minutes (120 hours) @ $40 per hour admin staff =$4,800 320 registration @ $8.00 =$2,560 Undertake general registrations against customers 15 Plus registration fees 160 customers by 2 registrations per customer = 320 registrations $8.00 per registration This was initially a consideration creating the need for 4 registrations per customer but ceases 30 January 2014 Total cost $10,960 Step Comments Cost or time Estimated Cost $ Internal training It is extremely risky to the business’s assets to approach the register (which is unforgiving) without a good understanding of all terminology and the operation of the law. But the law is highly complex. At least two people will need to understand PPSA and the operation of the register in case one person is absent. The training will include training on the function of the Australian Business Register and the ASIC register to establish the correct ABN or ACN identifier. PPSA adopts a number of different necessary customer identifiers including ACN and ABN. Hire business personnel will typically have little pre-existing understanding of the ABN system, the function and identification of trusts on the ABN, the distinctions between trusts as legal ‘non-entities’ and companies as separate legal entities and so on. When a staff member leaves more training will be required. Under PPSA for ‘motor vehicles’ (as so widely defined) full protection is only conferred if a serial number specific registration for each machine for each hire is affected. 15 hours including meetings informal discussion, double checking registrations have been recorded correctly etc Average labour cost, management and administration $80.00 @ 15 hours = $1,200 20 minutes per machine per hire Plus registration fee $8.00 Average transaction per day 20 @ $8.00 = $160 per day. 20 minutes per customer per machine per hire Plus registration fee 20 de-registrations@ $5.00 = $100. Effect serial number specific registrations Discharge serial number specific registrations at the end of each hire or when a customer ceases to deal with the business Deal with customer enquiry Due to the need for serial number registration a lot of time may be spent on deregistration for equipment such as scissor lifts, boom lifts etc but also for other kinds of equipment. Inquiries are common and can be very time-consuming. A range of enquiries are common: Customer doesn’t understand PPSA and why hire business says it has a ‘security interest’ 16 Depends on number of customers. For a medium hire business can be around 2-3 hours per week plus legal fee Annual cost 312 days = $49,920 Annual cost 312 days = $31,200 Total cost of serial number registrations= $81,120 2.5 hours management time @$120 = $300 Average cost $350 Total cost of customer Step Comments Customer refinancing with their bank and bank requires confirmation as to the nature of the security interest held by the hire business. Bank may require a letter confirming. Customer selling part of business and requires confirmation as to assets under hire. Customer may require a letter for the purchaser or its bank. Customer obtains cash-flow finance and factoring company writes to hire business claiming priority for proceeds Legal advice will often be needed to deal with enquiries. Cost or time Estimated Cost $ to clarify company rights and obligations. This is management time. enquiry $650 per occasion Task of deciding rights to complex and risk too high for admin staff to cover. Advice cannot be obtained from general legal counsel. Advice must be obtained from Expert PPSA council estimate $550 per hour Asset recovery from liquidator Liquidators are seizing assets and hire companies are needing to fight to get them back. 17 Case: Liftek long term forklift hire (machine changed over in the normal course of business so registration lost) Original cost of the forklift $27,000 Cost $9,000 (Negotiated to buy back the fork for $4,500 and legal cost to $4,500). Summary of costs: Obtain an understanding of PPSA $1,070 Confirm the key implications of PPSA for the business $9,900 Implement PPSA Procedures $3,600 Undertake general registrations against customers $10,960 Internal training $1,200 Total Normal Cost $26,730 Effect serial number specific registrations $49,920 Discharge serial number specific registrations at the end of each hire or when a customer ceases to deal with the business $31,200 Total Cost of Serial No Registration $81,120 Including normal costs $26,730 Total Cost of Serial No Registration including Normal Costs $107,850 $650 per enquiry Deal with customer enquiry Asset recovery from liquidator $9,000 18