Deferred Taxes - San Jose State University

advertisement

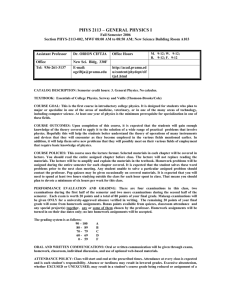

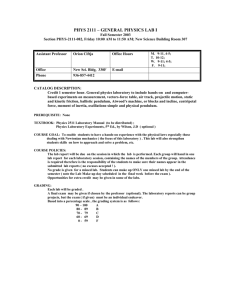

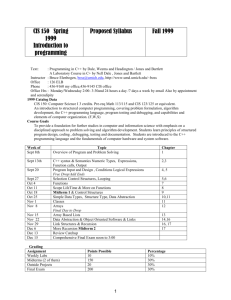

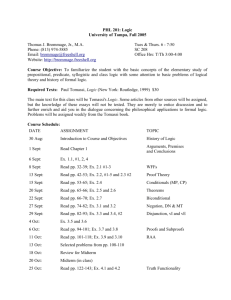

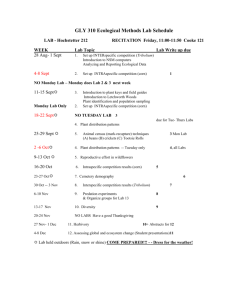

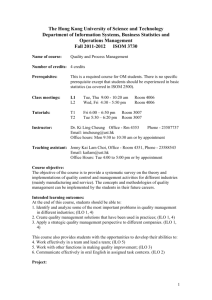

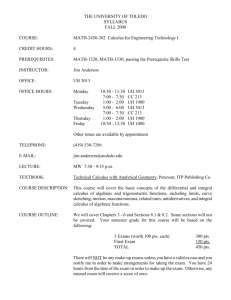

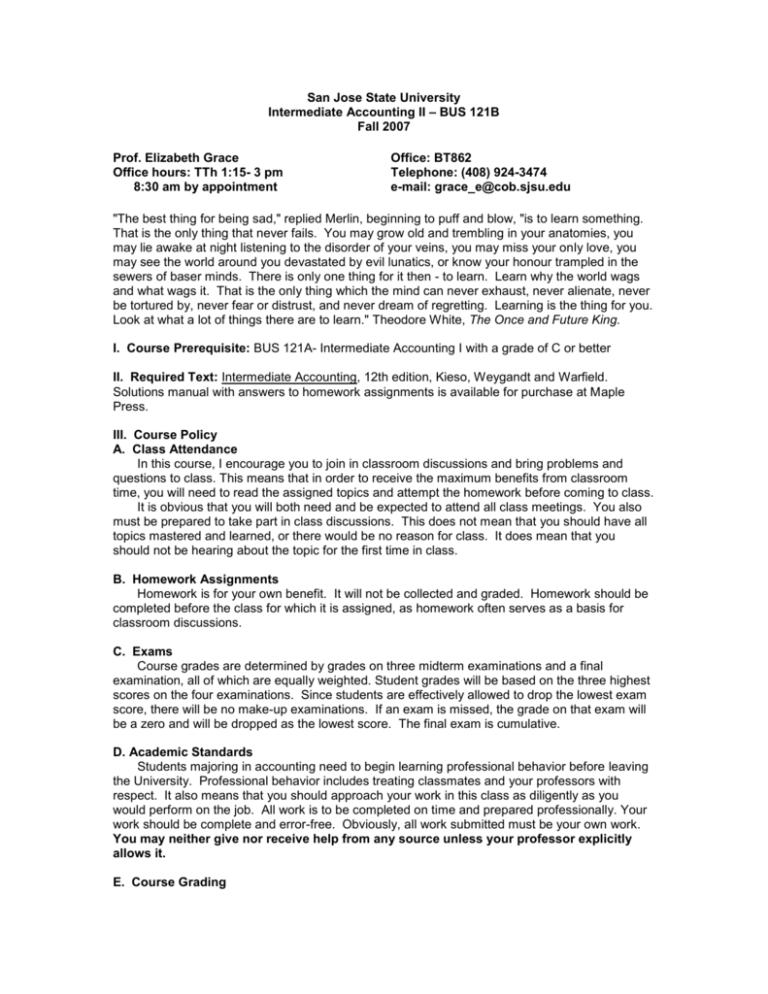

San Jose State University Intermediate Accounting II – BUS 121B Fall 2007 Prof. Elizabeth Grace Office hours: TTh 1:15- 3 pm 8:30 am by appointment Office: BT862 Telephone: (408) 924-3474 e-mail: grace_e@cob.sjsu.edu "The best thing for being sad," replied Merlin, beginning to puff and blow, "is to learn something. That is the only thing that never fails. You may grow old and trembling in your anatomies, you may lie awake at night listening to the disorder of your veins, you may miss your only love, you may see the world around you devastated by evil lunatics, or know your honour trampled in the sewers of baser minds. There is only one thing for it then - to learn. Learn why the world wags and what wags it. That is the only thing which the mind can never exhaust, never alienate, never be tortured by, never fear or distrust, and never dream of regretting. Learning is the thing for you. Look at what a lot of things there are to learn." Theodore White, The Once and Future King. I. Course Prerequisite: BUS 121A- Intermediate Accounting I with a grade of C or better II. Required Text: Intermediate Accounting, 12th edition, Kieso, Weygandt and Warfield. Solutions manual with answers to homework assignments is available for purchase at Maple Press. III. Course Policy A. Class Attendance In this course, I encourage you to join in classroom discussions and bring problems and questions to class. This means that in order to receive the maximum benefits from classroom time, you will need to read the assigned topics and attempt the homework before coming to class. It is obvious that you will both need and be expected to attend all class meetings. You also must be prepared to take part in class discussions. This does not mean that you should have all topics mastered and learned, or there would be no reason for class. It does mean that you should not be hearing about the topic for the first time in class. B. Homework Assignments Homework is for your own benefit. It will not be collected and graded. Homework should be completed before the class for which it is assigned, as homework often serves as a basis for classroom discussions. C. Exams Course grades are determined by grades on three midterm examinations and a final examination, all of which are equally weighted. Student grades will be based on the three highest scores on the four examinations. Since students are effectively allowed to drop the lowest exam score, there will be no make-up examinations. If an exam is missed, the grade on that exam will be a zero and will be dropped as the lowest score. The final exam is cumulative. D. Academic Standards Students majoring in accounting need to begin learning professional behavior before leaving the University. Professional behavior includes treating classmates and your professors with respect. It also means that you should approach your work in this class as diligently as you would perform on the job. All work is to be completed on time and prepared professionally. Your work should be complete and error-free. Obviously, all work submitted must be your own work. You may neither give nor receive help from any source unless your professor explicitly allows it. E. Course Grading Total points available in the course add to 300. Grades will be assigned as follows: Points Earned 270 – 300 240 – 269 210 – 239 195 – 209 0 – 194 Letter Grade A B C D F IV. Semester Assignment Schedule Week Of Topic Reading Assignment Homework Assignment Aug. 23 Course Administration Concepts of Present and Future Value Ch. 6 E6.3, 4, 5, 6, 10, 11, 17 Aug. 28 Debt Securities Ch. 14 E14.8, 9, 10, 12, 16, 17 Sept. 4 Debt Securities Sept. 11 Leases Sept. 18 Leases Sept. 25 Exam 1 on Sept. 25 Deferred Taxes E14.25,26: P14.1 Ch. 21 E21.1, 2, 7, 8, 9 E21.10, 11,14 Ch. 19 E19.1, 2, 3 Oct. 2 Deferred Taxes E 19.6, 7, 9 Oct. 9 Deferred Taxes E19.17, 22, 23 Oct. 16 Shareholders’ Equity Oct. 23 Shareholders’ Equity Oct. 30 Exam 2 on Nov. 3 Earnings per share Nov. 6 Earnings per Share Nov. 13 Earnings per Share Statement of Cash Flows Nov. 20 Statement of Cash Flows Thanksgiving, Nov. 22 Nov. 27 Statement of Cash Flows Dec. 4 Exam 3 on Dec. 4 Course wrap-up Ch. 15 E15. 2, 4, 6, 8 E15.13, 17, 21 Ch. 16 E16. 1, 5 E16. 8, 11, 13, 17, 18, 21 Ch. 23 E16.24, 25, 27 E23.9, 11, 12 Ch. 22 E23.13, 15 P23.4 Final exam Date: Dec. 18, 7:15 am Dec. 17, 9:45 am Class Meeting: 9am-10:30 10:30am-noon