PROVINCIAL LAND TAX ACT

advertisement

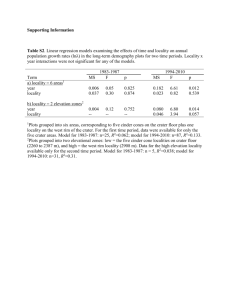

ONTARIO REGULATION 114/04 made under the PROVINCIAL LAND TAX ACT Made: April 26, 2004 Filed: April 26, 2004 Printed in The Ontario Gazette: May 15, 2004 Amending O. Reg. 439/98 (TAX RATES UNDER SECTION 21.1 OF THE ACT FOR 1998 AND SUBSEQUENT YEARS) 1. Ontario Regulation 439/98 is amended by adding the following section: 5. (1) Despite subsection 2 (1), the tax rates set out in Table 4 to this Regulation are prescribed for 2004 for the territories set out in that Table for the residential property class and the multi-residential property class, as prescribed under the Assessment Act. (2) Despite subsection 2 (2), the tax rate equal to 25 per cent of the tax rate for the residential property class set out opposite the name of a territory in Table 4 to this Regulation is prescribed for 2004 as the tax rate for that territory for the farm property class and the managed forests property class, as prescribed under the Assessment Act. 2. The Regulation is amended by adding the following Table: TABLE 4 TAX RATES FOR THE RESIDENTIAL PROPERTY CLASS AND THE MULTI-RESIDENTIAL PROPERTY CLASS FOR 2004 Territory Nipissing, District of Timiskaming Board of Education Nipissing Combined School Boards Parry Sound, District of South River Township School Authority West Parry Sound Board of Education East Parry Sound Board of Education Manitoulin, District of Manitoulin Locality Education Sudbury, District of Sudbury Locality Education Espanola Locality Education Chapleau Locality Education Foleyet DSA Locality Education Gogama DSA Locality Education Asquith Garvey DSA Locality Education Timiskaming, District of Kirkland Lake Locality Education Timiskaming Locality Education Cochrane, District of Kap SRF and District Locality Education Cochrane-Iroquois Falls Locality Education James Bay Lowlands Locality Education Algoma, District of Sault Ste. Marie Locality Education Thunder Bay, District of Nipigon Red Rock Locality Education Lake Superior Locality Education Lakehead Locality Education Auden DSA Locality Education Rainy River, District of Fort Frances/Rainy River Locality Education (assessment roll numbers Tax Rate — Expressed as a Fraction of Assessed Value Residential Property Class Multi-Residential Property Class 0.00222760 0.00128576 0.00280219 0.00025996 0.00233883 0.00159798 0.00381296 0.00473248 0.00131597 0.00077257 0.00019033 0.00152035 0.00474499 0.00100000 0.00264656 0.00256932 0.00240632 0.00055382 0.00086526 0.00397989 0.00049714 0.00107252 0.00196346 0.00020518 0.00202913 0.02335163 0.00848862 2 beginning with “590”) Fort Frances/Rainy River Locality Education (assessment roll numbers beginnng with “5903”) Atikokan Locality Education Kenora, District of Kenora Locality Education Dryden Locality Education (assessment roll numbers beginning with “6060”) Dryden Locality Education (assessment roll numbers beginning with “6093”) Red Lake Locality Education Dryden Locality Education (assessment roll numbers beginning with “6096”) 0.00150434 0.00085430 0.00116123 0.00140993 0.00233502 0.00180685 0.00270841 0.00182264 0.00294191 3. This Regulation shall be deemed to have come into force on January 1, 2004. Made by: GREGORY SORBARA Minister of Finance Date made: April 26, 2004. Back to top