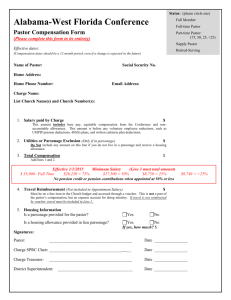

1999 Pastoral Compensation Recommendation

advertisement

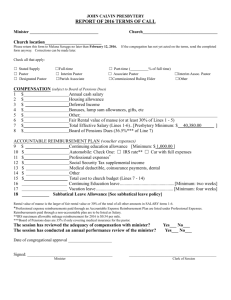

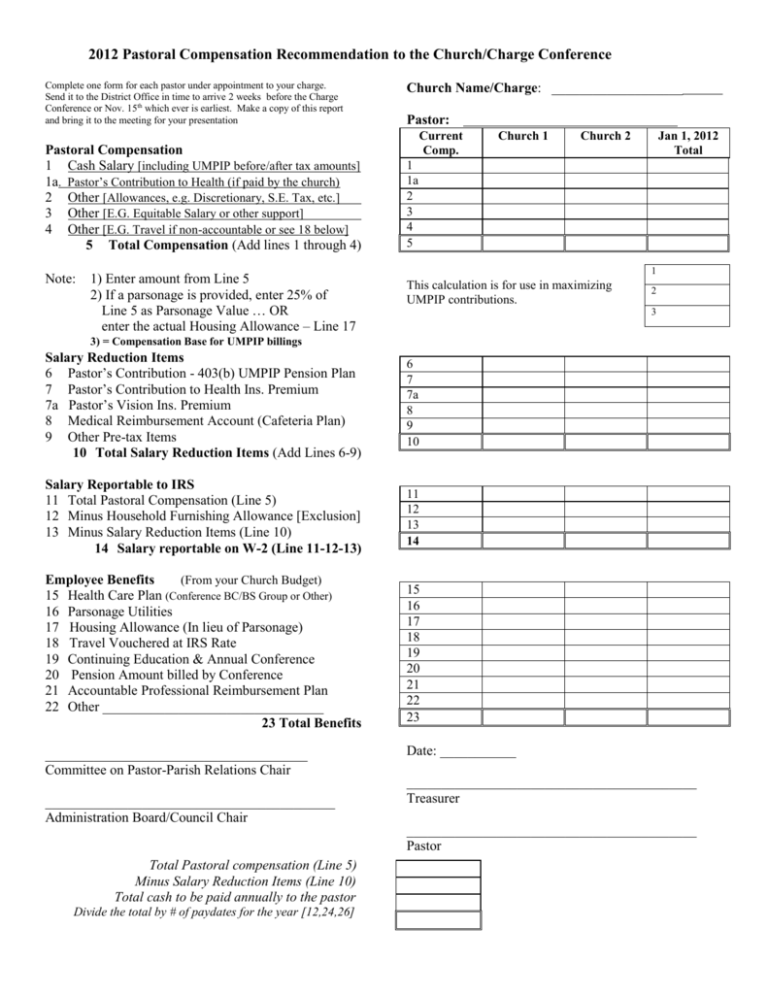

2012 Pastoral Compensation Recommendation to the Church/Charge Conference Complete one form for each pastor under appointment to your charge. Send it to the District Office in time to arrive 2 weeks before the Charge Conference or Nov. 15th which ever is earliest. Make a copy of this report and bring it to the meeting for your presentation Pastoral Compensation 1 Cash Salary [including UMPIP before/after tax amounts] 1a. Pastor’s Contribution to Health (if paid by the church) 2 Other [Allowances, e.g. Discretionary, S.E. Tax, etc.] 3 Other [E.G. Equitable Salary or other support] 4 Other [E.G. Travel if non-accountable or see 18 below] 5 Total Compensation (Add lines 1 through 4) Note: 1) Enter amount from Line 5 2) If a parsonage is provided, enter 25% of Line 5 as Parsonage Value … OR enter the actual Housing Allowance – Line 17 Church Name/Charge: ___________________ Pastor: Current Comp. Church 1 Church 2 Jan 1, 2012 Total 1 1a 2 3 4 5 1 This calculation is for use in maximizing UMPIP contributions. 2 3 3) = Compensation Base for UMPIP billings Salary Reduction Items 6 Pastor’s Contribution - 403(b) UMPIP Pension Plan 7 Pastor’s Contribution to Health Ins. Premium 7a Pastor’s Vision Ins. Premium 8 Medical Reimbursement Account (Cafeteria Plan) 9 Other Pre-tax Items 10 Total Salary Reduction Items (Add Lines 6-9) 6 7 7a 8 9 10 Salary Reportable to IRS 11 Total Pastoral Compensation (Line 5) 12 Minus Household Furnishing Allowance [Exclusion] 13 Minus Salary Reduction Items (Line 10) 14 Salary reportable on W-2 (Line 11-12-13) 11 12 13 14 Employee Benefits (From your Church Budget) 15 Health Care Plan (Conference BC/BS Group or Other) 16 Parsonage Utilities 17 Housing Allowance (In lieu of Parsonage) 18 Travel Vouchered at IRS Rate 19 Continuing Education & Annual Conference 20 Pension Amount billed by Conference 21 Accountable Professional Reimbursement Plan 22 Other ________________________________ 23 Total Benefits 15 16 17 18 19 20 21 22 23 ______________________________________ Committee on Pastor-Parish Relations Chair __________________________________________ Administration Board/Council Chair Total Pastoral compensation (Line 5) Minus Salary Reduction Items (Line 10) Total cash to be paid annually to the pastor Divide the total by # of paydates for the year [12,24,26] Date: ___________ __________________________________________ Treasurer __________________________________________ Pastor Instructions Complete one form for each pastor. Show the church/charge at the top right. Where there is more than one church contributing to the compensation of one pastor, list the amounts related to each church. Show the total compensation for the pastor in the extreme right column. Include income from all sources that are part of the ministry to which appointed (Equitable Compensation, New Church Development, local church) in the calculation of total salary. Line by line tips: 1 The annual gross amount to be paid to the pastor from local church, including UM Personal Investment Plan (UMPIP) contributions, whether before-tax or after-tax. 2 List (and name) other compensation provided (non-accountable allowances for discretionary fund, help with employer portion of SE, etc., if any). Include all taxable allowances. 3 Supplements to salary support from outside the local church (equitable compensation grants, etc.) may be subtracted from line 1 and shown separately on this line as part of taxable income for the pastor. 4 Other income amounts (travel, if given as fixed monthly amount, non-accountable). 5 Add lines 1 through 4 and enter total. Of this total amount, some special tax treatment may apply to certain portions, which will be listed in the next section. Note: Line 5 plus 25% parsonage value or actual housing allowance equals the total plan compensation base for contributions to the CRSP (Clergy Retirement Security Program). 6 If UMPIP contributions are paid to the GBOPHB account under a salary reduction plan, before tax, enter the amount. An agreement must be in place between pastor and local church, as well as enrollment at GBOPHB. A monthly billing directly to the church from GBOPHB will be generated. Specific limits on tax-sheltered contributions apply (See IRS regulations.) This amount is shown in Box 13 of the W-2 at year end. 7 The pastor’s contribution toward the group health plan premium is a pre-tax contribution; list it here. 8 A plan must be established by the local church in order to take advantage of this pre-tax “qualified” benefit. Every employer that adopts a cafeteria plan must comply with reporting and recordkeeping requirements. IRC 6039D. The local church may need to file IRS Form 5500 annually for this plan. 9 Amounts paid by the treasurer to annuity programs (other than UMPIP), if any, on behalf of the pastor. 10 Total the salary reduction items, lines 6 through 9. 11 Enter the total taxable compensation as shown on Line 5. 12 List the amount of the excludable household furnishings allowance, as set forth in the agreement between the pastor and local church (approved at church conference). 13 Enter the total salary reductions items shown on Line 10. 14 Line 11 less line 12 less line 13. This is the amount that will appear in Box 1 of the W-2 at year end. 15 List the health care plan premium (less the amount being paid by the pastor – line 7) from church budget. 16 List the parsonage utilities amount from the church budget. 17 List the housing allowance paid to the pastor, if a parsonage is not provided. 18 Travel expenses must be reported on a timely basis for reimbursement. List amount from church budget. 19 The Annual Conference recommends that the local church pay all living expenses (at the conference per diem rate) for their clergy who attend annual conference. 20 If the church has more than one pastor, divide the pension apportionment amount among the pastors. 21 Accountable Reimbursement Plans (for professional expenses) (ARPs) are established with a specific agreement, renewed annually. The initial amount is negotiated at the beginning of an appointment. Subsequent increases in compensation may be added to the ARP or to cash salary. Cash salary may not be reduced in order to raise the ARP. This recommendation is valid when signed and the amount on Line 5 has been approved by the church/charge conference. This document is not intended to give specific legal or tax advice. The Detroit Annual Conference is not engaged in rendering legal, accounting or other types of professional service. For legal or other expert assistance or advice, the services of competent legal and tax counsel should be obtained.