FIVE WAYS TO STOP A LEVY

advertisement

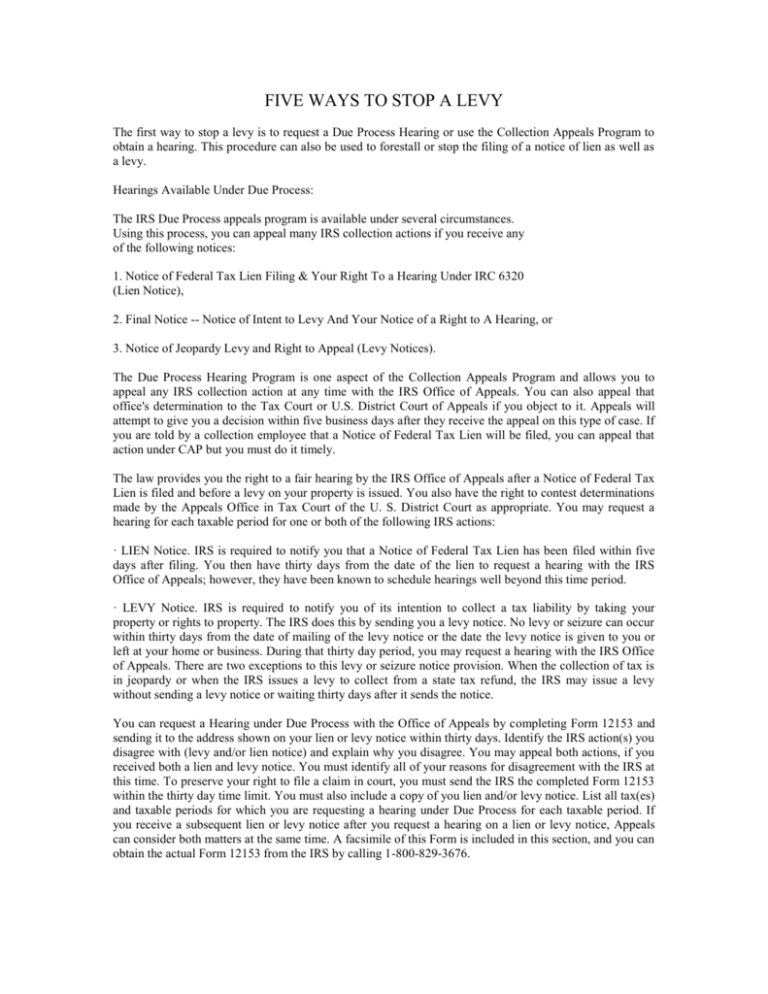

FIVE WAYS TO STOP A LEVY The first way to stop a levy is to request a Due Process Hearing or use the Collection Appeals Program to obtain a hearing. This procedure can also be used to forestall or stop the filing of a notice of lien as well as a levy. Hearings Available Under Due Process: The IRS Due Process appeals program is available under several circumstances. Using this process, you can appeal many IRS collection actions if you receive any of the following notices: 1. Notice of Federal Tax Lien Filing & Your Right To a Hearing Under IRC 6320 (Lien Notice), 2. Final Notice -- Notice of Intent to Levy And Your Notice of a Right to A Hearing, or 3. Notice of Jeopardy Levy and Right to Appeal (Levy Notices). The Due Process Hearing Program is one aspect of the Collection Appeals Program and allows you to appeal any IRS collection action at any time with the IRS Office of Appeals. You can also appeal that office's determination to the Tax Court or U.S. District Court of Appeals if you object to it. Appeals will attempt to give you a decision within five business days after they receive the appeal on this type of case. If you are told by a collection employee that a Notice of Federal Tax Lien will be filed, you can appeal that action under CAP but you must do it timely. The law provides you the right to a fair hearing by the IRS Office of Appeals after a Notice of Federal Tax Lien is filed and before a levy on your property is issued. You also have the right to contest determinations made by the Appeals Office in Tax Court of the U. S. District Court as appropriate. You may request a hearing for each taxable period for one or both of the following IRS actions: · LIEN Notice. IRS is required to notify you that a Notice of Federal Tax Lien has been filed within five days after filing. You then have thirty days from the date of the lien to request a hearing with the IRS Office of Appeals; however, they have been known to schedule hearings well beyond this time period. · LEVY Notice. IRS is required to notify you of its intention to collect a tax liability by taking your property or rights to property. The IRS does this by sending you a levy notice. No levy or seizure can occur within thirty days from the date of mailing of the levy notice or the date the levy notice is given to you or left at your home or business. During that thirty day period, you may request a hearing with the IRS Office of Appeals. There are two exceptions to this levy or seizure notice provision. When the collection of tax is in jeopardy or when the IRS issues a levy to collect from a state tax refund, the IRS may issue a levy without sending a levy notice or waiting thirty days after it sends the notice. You can request a Hearing under Due Process with the Office of Appeals by completing Form 12153 and sending it to the address shown on your lien or levy notice within thirty days. Identify the IRS action(s) you disagree with (levy and/or lien notice) and explain why you disagree. You may appeal both actions, if you received both a lien and levy notice. You must identify all of your reasons for disagreement with the IRS at this time. To preserve your right to file a claim in court, you must send the IRS the completed Form 12153 within the thirty day time limit. You must also include a copy of you lien and/or levy notice. List all tax(es) and taxable periods for which you are requesting a hearing under Due Process for each taxable period. If you receive a subsequent lien or levy notice after you request a hearing on a lien or levy notice, Appeals can consider both matters at the same time. A facsimile of this Form is included in this section, and you can obtain the actual Form 12153 from the IRS by calling 1-800-829-3676. At the hearing, you may raise an relevant issue relating to the unpaid tax including the 1. Appropriateness of collection actions; 2. Collection alternatives such as installment agreement, offer in compromise, posting a bond or substitution of other assets; 3. Appropriate spousal defenses; 4. The existence or amount of the tax, but only if you did not receive a notice of deficiency or did not have an opportunity to dispute the tax liability. You may not, however, raise an issue that was raised and considered at a prior administrative or judicial hearing, if you participated meaningfully in the prior hearing or proceeding. Before you formally appeal a lien or levy notice by sending us Form 12153, you may be able to work out a solution with the Collection function that proposed the action. To do so, contact the IRS employee whose name appears on the lien or levy notice and explain why you disagree with the action. This contact, however, does NOT extend the thirty day period in which you can request an appeal. Unless the IRS has reason to believe that collection of the tax is in jeopardy, they will stop the collection action during the thirty days after the levy notice and, if you appeal is timely, during the appeal process. They will also suspend the collection statute of limitations, which is ten years, from the date they receive a timely filed Form 12153, until the date the determination become final. Your appeal is timely if you mail your request for a hearing on or before the thirtieth day after the date on which the IRS lien or levy notice was postmarked. If you appeal request is not timely, you will be allowed a hearing, but there will be no statutory suspension of collection action and you cannot go to court if you disagree with the determination reached at Appeals. The Appeals Office will contact you to schedule a hearing, either in person or by telephone. At the conclusion of the hearing, Appeals will issue a written determination letter. If you agree with the decision reached by the Appeals office, both you and the IRS are required to comply with the terms of the decision. If you do not agree with Appeals' decision, you may request judicial review of the decision by initiating a claim in federal court (or Tax Court depending on the circumstances) on or before the thirtieth day after the date of Appeals' decision. Once the Court rules, its decision will be binding on you and the IRS. The IRS Office of Appeals will retain jurisdiction over its determinations and how they are administered. You may also return to Appeals if your circumstances change and impact the original decision; however, you must exhaust your administrative remedies first. You may also represent yourself at your Due Process hearing or you may be represented by an attorney, certified public accountant or a person enrolled to practice before the IRS. If you want your representative to appear without you, you must provide a properly completed Form 2848, Power of Attorney and Declaration of Representative. Request for a Collection Due Process Hearing FORM 12153 Use this form to request a hearing with the IRS Office of Appeals only when you receive a Notice of Federal Tax Lien Filing & Your Right To A Hearing Under IRC 6320, a Final Notice - Notice Of Intent to Levy & Your Notice Of a Right To A Hearing, or a Notice of Jeopardy Levy and Right of Appeal. Complete this form and send it to the address shown on your lien notice for expeditious handling. Include a copy of your lien or levy notice(s) to ensure proper handling of your request. (Print) Taxpayer Name(s): _______________________________________ (Print) Address: ________________________________________________ Daytime Telephone Number: ______________ Type of Tax/Tax Form Number(s): _________ Taxable Period(s): ___________________________________________ Social Security Number/Employer Identification Number(s): _________________ Check the IRS action(s) with which you do not agree. Provide specific reasons why you don't agree. If you believe that your spouse or former spouse should be responsible for all or a portion of the tax liability from your tax return, check here [___] and attach Form 8857, Request for Innocent Spouse Relief, to this request. ____ Filed Notice of Federal Tax Lien (Explain why you don't agree. Use extra paper if necessary.) __________________________________________________________________________________ ____ Notice of Levy/Seizure (Explain why you don't agree. Use extra paper if necessary.) __________________________________________________________________________________ I/we understand that the statutory period of limitations for collection is suspended during the Collection Due Process Hearing and any subsequent judicial review. Taxpayer's or Authorized Representative's Signature and Date: ____________________________________, ________________ Taxpayer's or Authorized Representative's Signature and Date: ____________________________________, ________________ IRS Use Only: IRS Employee (Print): ________________ IRS Received Date: ____________ Employee Telephone Number: ___________________ ======================================================================= Instructions for Completing Form 12153 Where to file your request It is important that you file your request using the address shown on your lien or levy notice. If you have been working with a specific IRS employee on your case, you should file the request with that employee. How to Complete Form 12153 1. Enter your full name and address. If the tax liability is owed jointly by a husband and wife, and both wish to request a Collection Due Process Hearing, show both names. 2. Enter a daytime telephone number where we can contact you regarding your request for a hearing. 3. List the type(s) of tax or the number of the tax form(s) for which you are requesting a hearing (e.g., Form 1040, Form 941, Trust Fund Recovery Penalty, etc.) 4. List the taxable periods for the type(s) of tax or the tax form(s) that you listed for item 3 above (e.g., year ending 12-31-98, quarter ending 3-31-98). 5. Show the social security number of the individual(s) and/or the employer identification number of the business(s) that are requesting a hearing. 6. Check the IRS action(s) that you do not agree with (Filed Notice of Federal Tax Lien and/or Notice of Levy/Seizure). You may check both actions if applicable. 7. Provide the specific reason(s) why you do not agree with the filing of the Notice of Federal Tax Lien or the proposed Notice of Levy/Seizure action. One specific issue that you may raise at the hearing is whether income taxes should be abated because you believe that your spouse or former spouse should be responsible for all or a portion of the tax liability from your tax return. You must, however, elect such relief. You can do this by checking the indicated box and attaching Form 8857 to this request for a hearing. If you previously filed Form 8857, please indicate when and with whom you filed the Form. 8. You, or your authorized representative, must sign the Form 12153. If the tax liability is joint and both spouses are requesting a hearing, both spouses, or their authorized representative(s), must sign. 9. It is important that you understand that we are required by statute to suspend the statutory period for collection during a Collection Due Process Hearing. Administrative Collection Appeal Rights: The IRS Collection Appeal Program (CAP) is available under more circumstances than the Due Process hearing procedure. It is important to note that you cannot obtain judicial review of Appeals' decision following a CAP hearing. IRS Collection Actions You Can Appeal · Notice of Federal Tax Lien -- You may appeal before or after IRS files a lien. You may also appeal denied requests to withdraw a Notice of Federal Tax Lien, and denied discharges, subordinations, and nonattachments of a lien. If IRS files a Notice of Federal Tax Lien, you may have additional Due Process appeal rights. See the preceding information regarding Hearing Available Under Due Process. · Notice of Levy -- You may appeal before or after the IRS places a levy on your wages, bank account or other property. Before a levy is issued, you may have additional Due Process appeal rights. See the preceding information regarding Hearing Available Under Due Process. · Seizure of Property -- You may appeal before the IRS makes a seizure. However, if you request an appeal after IRS makes a seizure, you must appeal to the Collection manager within ten (10) business days after the Notice of Seizure is provided to you or left at your home or business. · Denial or Termination of Installment Agreement -- You may appeal when you are notified that IRS intends to deny you an installment agreement or terminate your installment agreement. How to Appeal One of These IRS Collection Actions If Your Only Collection Contact Has Been A Notice or Telephone Call 1. Call the IRS at the telephone number shown on your notice. Be prepared to explain which action(s) you disagree with and why you disagree. You must also offer your solution to your tax problem. 2. If you cannot reach an agreement with the IRS employee, tell the employee that you want to appeal their decision. The employee must honor your request, and will refer you to a manager. The manager will either speak with you then, or will return your call with twenty four hours. 3. Explain which action(s) you disagree with and why you disagree to the manager. The manager will make a decision on the case. If you do not agree with the manager's decision, the IRS will send your case to an Appeals Officer for review. How to Appeal One of These IRS Collection Actions If You Have Been Contacted By A Revenue Officer 1. If you disagree with the decision of the revenue officer, and wish to appeal under CAP, you must first request a conference with a collection manager. 2. If you do not resolve your disagreement with the collection manager, you may request Appeals consideration by completing Form 9423, Collection Appeal Request. 3. On the Form 9423, check the action(s) you disagree with and explain why you disagree. You must also explain your solution to resolve your tax problem. The IRS must receive your request for an appeal within two days of your conference with the collection manager or they will resume collection action. Normally, the IRS will stop collection action related to the IRS action(s) with which you disagree until the Appeals Officer makes a determination, unless they have reason to believe that collection of the amount owed is at risk. You may represent yourself at your appeals conference or you may be represented by an attorney, certified public accountant or a person enrolled to practice before the IRS. If you want your representative to appear without you, you must provide a properly completed Form 2848, Power or Attorney and Declaration of Representative. You can obtain Form 2848 from your local IRS office or by calling 1-800-829-3676. Once the Appeals Officer makes a decision on your case, that decision is binding on both you and the IRS. This means that both you and the IRS are required to accept the decision and comply with its terms. You cannot obtain judicial review of Appeals Officer decisions following a CAP hearing. If you provide false information, fail to provide all pertinent information, or engage in fraud, the appeals' decision will be void. The second way to stop a levy involves filing Form 911, Application for Taxpayer Assistance Order. It's not necessary to use the official form if you indicate on your correspondence that you are applying for a taxpayer assistance order. This form is used to apply for relief from a significant hardship after your efforts to get this relief from the collector have failed. This means that if you are unable to provide the necessities of life for you or your family, you will have good chance of getting an order after a hearing. You can submit this form to the Problem Resolution Office in the district in which you live. These locations are provided earlier in this book. You should receive a response within one week of your submission of this completed form. You can also fax it to the phone number that I have listed with each address. The form must be attached to the front of whatever else you are sending into the agency. The most important elements of this request are that you give a clear and concise description of the actions taken by the agent that are causing you significant hardship. If you know it, you should include the name of the person, office, telephone number, and/or address of the last contact you had with the IRS regarding this problem. Be specific. If your remaining income after paying expenses is too little to meet an IRS payment, give the details, then describe the action you want the IRS to take. This is one way to arrange to make an installment agreement, but the IRM 5200 requires the agents to refuse to accept the agreement until you file returns. It's been my experience that this is not always true, so I would guess that not all agents have read their manual. Also, the chapter on Effective Letter Writing will give you a great deal of detail about the best way to make your application. I've included guidelines found in the agency's own internal operating manual. The third way to stop a levy is by filing a bankruptcy. It is enough to merely file a suggestion of bankruptcy and make the first installment payment to the clerk for the filing fee. This is the least expensive way to go if you do not plan on following through with a discharge. The notice to creditors will cause the IRS to stop collections and suspend your IMF from that date and six months following your withdrawal from bankruptcy. I.R.C. § 6503(b) suspends the collection statute until six months after dismissal of the proceeding. You can withdraw your petition sometime before the creditors meeting so as to preserve your right to file again if you need more time. If you do this with the intention of not following through, you should work diligently at preparing, either an Application for Taxpayer Assistance Order or an Offer In Compromise as explained next. Either way, you must have filed tax returns (unless you're just submitting the application for taxpayer assistance order). That's not to say that you're required, but when you ask for a privilege, you have to play the game. Don't waste your time or the court's time thinking that you can go into bankruptcy court and expose the entire fraud and get the court to allow you to proceed without filing returns. The purpose of having the debtor file tax returns is so that the government can meaningfully determine his tax liabilities and file appropriate proofs of claim. It's also so that the court can determine tax claims litigation, if need be, before the confirmation hearing. If the debtor fails to file his tax returns and thereby delays confirmation, the taxing authority is prejudiced because the automatic stay prevents it from collection activities despite the fact that the debtor is delaying the resolution of his dispute with the IRS or other taxing authority. The delay in the resolution of the dispute delays payment to the taxing authority if there is a tax liability. This delay will prejudice all other creditors, as well, because no distribution to any creditor may be made until a plan is confirmed, 11 U.S.C. § 1326(a)(2). If you don't intend to file returns, you can use the court to forestall the enforced collection until you can get some help, but that's about it. If the rules of bankruptcy were amended to protect the government from being prejudiced, we could force the bankruptcy court to discontinue its policy of requiring the filing of tax return. The fourth way to stop a levy is to submit a good faith Offer In Compromise. You will need to obtain Form 656 which contains the instructions and forms you'll need to complete one. You'll also need Form 433-A for individuals and Form 433-B for businesses. This method is recommended only when you've already filed tax returns. The two criteria under which it might be accepted are 1) doubt as to collectibility and 2) doubt as to liability. The easiest claim to establish is doubt as to collectibility. Most people don't know enough to argue doubt as to liability so the latter is a better bet. Generally, I've found that when someone knows this subject well enough, he's usually able to avoid the situation of having to file an offer in the first place. If you're considering it, then work to establish the latter. Keep in mind that with the submission, there is a waiver to the statute of limitations normally imposed against the IRS, which tolls the time pending the review of the submission Section 462 of the Legal Reference Guide for Revenue Officers (1991) states that: "An offer submitted by a taxpayer on Form 656 to compromise his/her liabilities contains a collection waiver provision which suspends the normal statute of limitations for collection of taxes included in the offer for the period of time that the offer is pending and for one year thereafter. The period commences to run on the date the acceptance of the waiver is signed by the District Director, not the date of receipt of the offer. In situations involving cumulative offers, or other statute problems involving offers, the advice of District Counsel may be sought." I don't recommend this unless you've already filed returns. This is governed by Section 6305(i) of the Code. When you make an offer based upon doubt as to liability, you will be required to submit a statement supporting your conclusions as to why you doubt having a liability. Don't try and be a legal historian or scholar, just make an ambiguous statement which makes no sense but satisfies the requirement. If you try and expose the fraud, it will more than likely cause the agent to deny your offer just because he can or because he simply may not agree with you. In other words, be smart and act ignorant. Remember that the IRS is in the record keeping business and the only reason for requesting your "opinion' is to make a record of it for future reference. They may use it against you, maybe in court or by labeling you a tax protester, even though it's now illegal. The fifth way to stop a levy involves writing letter of inquiry or complaint directed to the Problem Resolution Officer, first by facsimile, and then by certified mail the same day. This however is dependent upon whether or not your dispute warrants their attention, it must be a legitimate inquiry. Therefore, your ability to make your problem known in the least number of words is crucial. Please review the chapter on Effective Letter Writing for better detail on these elements. The following language contains the criteria necessary to cause the Problem Resolution Office to take some action. "No resolution has yet been reached and there are no other established administrative or formal procedures which could be used in the resolution of this dispute, nor has your agency previously responded to this particular matter. Its resolution is not the sole responsibility of another federal, state or local agency. This dispute does not involve any non-tax administrative matter with your agency such as inspection, disclosure or personnel. The CID is not involved and this dispute is not concerned with any "tax protester" issues. I have not indicated that I cannot or will not pay any alleged tax liability. If you would like to learn more about how Due Process has been successful at stopping levies, please order the 1999 Edition of Paper Forms And Political Piracy or send us an email.