_____ 1

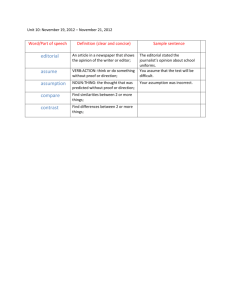

advertisement

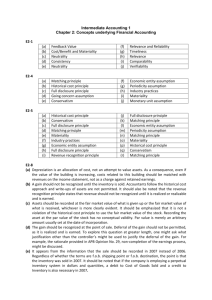

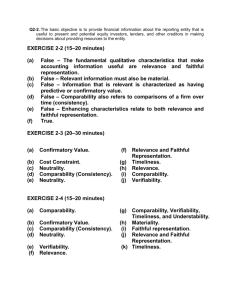

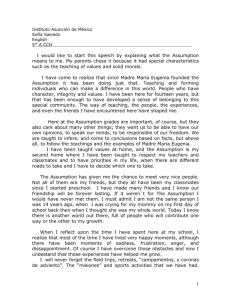

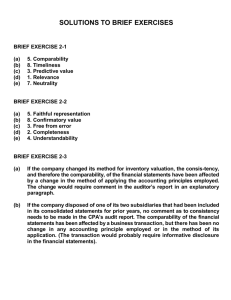

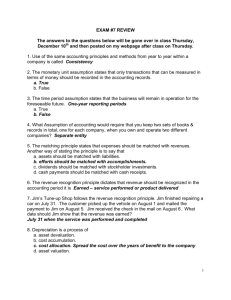

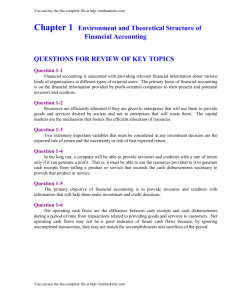

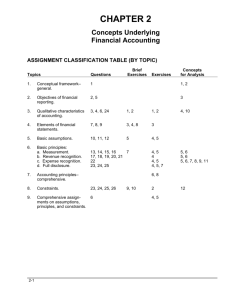

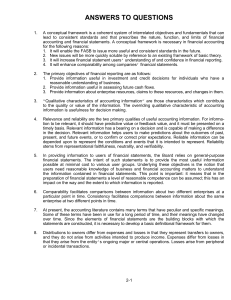

NAME____________________________________ REVIEW OF ACCOUNTING CONCEPTS Written Assignment Answer the following questions by placing the letter of the BEST response in the blank space to the left of the question number. _____ 1. a. b. c. d. _____ 2. a. b. c. d. _____ 3. a. b. c. d. _____ 4. a. b. c. d. _____ 5. a. b. c. d. _____ 6. a. b. c. d. Which of the following is not an objective of financial reporting? To provide information about economic resources, the claims to those resources, and the changes in them. To provide information that is helpful to investors and creditors and other users in assessing the amounts, timing, and uncertainty of future cash flows. To provide information that is useful to those making investment and credit decisions. To provide information that is useful to the Internal Revenue Service in allocating the tax burden to the business community. What is meant by comparability when discussing financial accounting information? Information has predictive or confirmatory value. Information is reasonably free from error. Information that is measured and reported in a similar fashion across companies. Information is timely. If the FIFO inventory method was used last period, it should be used for the current and following periods because of relevance. neutrality. understandability. consistency. The quality of information that means the numbers and descriptions match what really existed or happened is relevance. faithful representation. completeness. neutrality. Neutrality means that information provides benefits which are at least equal to the costs of its preparation. can be compared with similar information about an enterprise at other points in time. would have no impact on a decision maker. cannot favor one set of interested parties over another. In classifying the elements of financial statements, the primary distinction between revenues and gains is the materiality of the amounts involved. the likelihood that the transactions involved will recur in the future. the nature of the activities that gave rise to the transactions involved. the costs versus the benefits of the alternative methods of disclosing the transactions involved. 2 _____ 7. According to the FASB Conceptual Framework, the elementsassets, liabilities, and equitydescribe amounts of resources and claims to resources at/during a a. b. c. d. _____ 8. a. b. c. d. _____ 9. a. b. c. d. _____ 10. a. b. c. d. _____ 11. a. b. c. d. _____ 12. a. b. c. d. _____ 13. a. b. c. d. Moment in Time Yes Yes No No Period of Time No Yes Yes No Which of the following basic accounting assumptions is threatened by the existence of severe inflation in the economy? Monetary unit assumption. Periodicity assumption. Going-concern assumption. Economic entity assumption. The economic entity assumption is inapplicable to unincorporated businesses. recognizes the legal aspects of business organizations. requires periodic income measurement. is applicable to all forms of business organizations. What accounting concept justifies the usage of depreciation and amortization policies? Going concern assumption Fair value principle Full disclosure principle Monetary unit assumption The accounting principle of expense recognition is best demonstrated by not recognizing any expense unless some revenue is realized. associating effort (expense) with accomplishment (revenue). recognizing prepaid rent received as revenue. establishing an Appropriation for Contingencies account. Which accounting assumption or principle is being violated if a company reports its corporate headquarter building at its fair value on the balance sheet? Going concern. Monetary unit. Historical cost. Full disclosure. Expensing the cost of copy paper when the paper is acquired is an example of which constraint? Materiality. Cost. Conservatism. Industry practices. 3 _____ 14. a. b. c. d. _____ 15. a. b. c. d. _____ 16. a. b. c. d. _____ 17. a. b. c. d. _____ 18. a. b. c. d. _____ 19. a. b. c. d. _____ 20. a. b. c. d. According to the FASB's conceptual framework, the process of reporting an item in the financial statements of an entity is recognition. realization. allocation. matching. The footnotes to financial statements generally amplify or explain items presented in the main body of the statements, therefore they are considered an essential part of the “financial statement package.” This is an example of which concept? Matching Full disclosure Consistency Going concern When should an expenditure be recorded as an asset rather than an expense? Never. Always. If the amount is material. When future benefit exits. The FASB is beginning to require the adjustment of certain assets to fair market values on the financial statements. These requirements are an application of which accounting concept? Periodic measurement Matching Relevance Realization Valuing assets at their liquidation values rather than their cost is inconsistent with the periodicity assumption. expense recognition principle. materiality constraint. historical cost principle. Inflating expenses for the current period in order to improve future results would be a violation of this concept. Neutrality Revenue recognition Monetary measurement Materiality What is the general approach as to when product costs are recognized as expenses? In the period when the expenses are paid. In the period when the expenses are incurred. In the period when the vendor invoice is received. In the period when the related revenue is recognized.