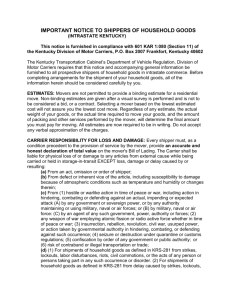

Here - Santos Moving

advertisement

INSURANCE INFORMATION This section explains your insurance rights and our responsibilities of liability Santos Moving is licensed, insured and bonded. All customers must declare a value of goods being transported. Whether you choose valuation or insurance you must let us know prior to your move date. Santos Moving Movers are very carefull and safety of our men and your belongings is our first concern; however we are nonetheless human and mistakes do happen on occasion. We want to make sure you fully protect your move, so when moving with us you can choose to purchase a moving valuation or insurance option that covers your shipment. Our superlative track record has allowed us to build and maintain an excellent relationship with our insurance provider. As a result, we are able to offer our moving valuation and insurance options at very reasonable rates. Any and all claims must be filed with Santos Moving by phone and in writing within 15 business days of completion of a paid in full move with supporting documents of repair or proof of value. In the event that no appraisals are available the burden of proof will be upon the owners of the goods to provide proof of value. No claim can be addressed until payment is received in full. We will take pictures of the item in question. Moving valuation & cargo insurance is NON-REFUNDABLE once purchased. Please contact your move coordinator to determine the appropriate total value of your shipment and the corresponding premium or for additional details on valuation. Insurance for your goods is referred to as cargo protection. Moving companies carry many forms of insurance coverage, one of them being cargo insurance. The other is valuation. What movers offer you is an option to be compensated for any loss or damage to your goods while in transit with them. They are not selling you insurance. They are selling a coverage and accepting a degree of liability in return for a premium paid. Only insurance companies sell insurance. The movers ask you if you want to be protected under their policy or not and to what degree. The protection levels vary between valuation and insurance, as does the cost. We offer a few options for insuring your goods. All intrastate household goods shipments move under limited liability, which is required by law. However, you may purchase additional liability coverage from your mover. Here are a few options to protect your move: 1. Declared Value - Accept the "limited liability" coverage provided by your mover – it's free, but it doesn't provide much protection. 2. Declared Value - “Added Value Protection” coverage provided by your mover - will cost a little more, but it varies depending on the increase in value. 3. Pay a bit more and get a higher level of protection through your mover, known as "full-value replacement protection" / Cargo Insurance. 4. Buy an insurance policy through a third-party insurer. Call your insurance agency or look for information on line. 5. Rely on any coverage you might have from your homeowners insurance company (but do NOT assume you're automatically covered). Declared Value - Customer must select one of the following valuations prior to start of move and sign on the bill of landing acknowledging the section. In the event customer does not select an option the carrier’s legal responsibility will be limited to the MA. State mandated $.60 per pound per article. This is a tariff level of carrier liability – it is not insurance. Basic Carrier Liability Liability-Released Value Released Value of 60 Cents Per Pound Per Article is the most economical option available. As a licensed carrier, we provide limited liability coverage required by federal law at no extra charge. This level of protection provides minimal protection. Under this option, the mover assumes liability for no more than 60 cents per pound per article for loss or damage. For example, if damage or loss occurs to an item weighing 50 pounds, then the carrier's (movers) liability is $ 0.60 X 50 lbs = $ 30.00. This is fine for items that are cheap and heavy, but not so good for a $ 500.00 lamp weighing 15 pounds! Obviously this will not replace the lamp, so think carefully before agreeing to this level of coverage. If you agree to this option for the protection of the furnishings and boxes in your shipment you will be asked to sign a statement of agreement on the Bill of Lading (which is the document that releases your goods to the mover). Added Value Protection - Declared Value With this option, you declare a lump sum value for your shipment. The minimum amount of value you can declare with Declared Value Protection is equal to $1.25 times the total weight of your shipment (if a total loss) or times the individual item that was damaged. Depreciation is considered by Santos Moving when evaluating liability for loss or damage under this option. You will either receive cash payment, or the item may be repaired (if repairable) or replaced, whichever is less to restore the item to its condition before the loss. For Example, if damage or loss occurs to an item weighing 50 pounds - Added Value Coverage @ $1.25 per pound x 50 pounds. The charge is $40 per $1000 declared value = $ 62.50 is the mover’s maximum liability for this item. Full (Replacement) Protection / Cargo Insurance This is the most comprehensive plan available for protection of your goods. When you select this option, articles that are lost, damaged or destroyed will, at the mover's option, be either repaired, replaced with articles of like kind and quality, or a cash settlement will be made for the repairs or for replacement of the articles at their current market value. Also, the mover can protect himself from loss or damage to highvalue items. Items with an individual value of over $100 per pound are considered “Extra Ordinary Value Items" – Please see the section below for more information. An additional charge applies to this option. Costs vary depending on the mover, but choosing a higher deductible can lower the cost. Moving insurance works similar to other types of property coverage and involves paying out a deductible and then our moving insurance policy would pay out any damage claims above the deductible. You won’t have the option to have full replacement coverage on anything less than your entire shipment. Prices for different levels of Cargo Insurance Protection Vary – Call for details Cargo protection can get a bit pricey. Not only that, but each kind of policy will have some sort of deductible to go along with it. Full replacement coverage is not an inexpensive option but it is an added benefit of security if you would like the reassurance that should something happen to your belongings you would be covered. Extraordinary Value You will have to declare items of extraordinary value. Items in your shipment with a value greater than $100 per pound per article are considered has having "high" or "extraordinary value." For examples, you may have paintings, sculptures, jewelry, furs, antiques, crystal, silverware, gems, precious metals, art and coin collections, oriental rugs, tapestries, collectibles or antiques worth a fair amount. The idea is, that despite all the cargo coverage there will be a limit on the amount the insurance company will pay out on one given item. If you have any item in your place that is of extraordinary value you must tell the mover prior to the move. You must advise your van line agent in writing that they are in your shipment to be considered for replacement value protection. The item(s) of extraordinary value will be noted on the bill of lading and you will be covered unless they are specifically mentioned that they are not property that is covered. This process was designed to fully protect your special items. Be aware that the valuation coverage option you select will determine the method used in any claims settlement. Before any settlement, you will be required to furnish verification of ownership and proof of value. When you pack your own goods, do not seal any cartons which contain high value items since the driver loading your shipment must be able to verify that the items listed on the High Value Inventory form are contained in the carton. On moving day, the driver will seal the carton and assign an inventory number in your presence. What is never insured There are things that are not insured, even if you pay for coverage! The most common example would be jewelry. Best to pack them up and take them yourself. Other items not normally insured are coins, stamps, documents, and food. There are no insuring items of sentimental value. For example, a photograph will only be covered up to the cost of the film. The same goes for software data. The loss of data is not covered, so back up your disks before moving! Generally, the interior workings of appliances, televisions, stereos, etc., are not covered by the mover unless the mover does some obvious physical damage to the piece. If the item was handled properly and something does not work after the move, it's your responsibility. Again, contents of boxes are not covered under cargo protection policies unless the mover has packed and unpacked the cartons. Usually, the mover will cover goods (up to the coverage you selected) for clear mishandling of the carton. If there is obvious damage to the exterior, generally the mover will compensate you. Sets of furniture and appliances are not covered. That is, if you have a matching couch, love seat, and chair, and the chair gets ripped, the mover is only liable to repair or replace (up to your coverage selection) the one piece and does not have to cover the matching pieces, even though they may not match after repair, recovering, or replacement of the one piece. Items listed are not covered under our insurance a. b. c. d. e. f. g. h. i. j. k. l. m. n. Accounts, bills, currency, money, coins, securities, checks, drafts, notes, commercial papers, deeds, evidences of debt, letters of credit, blueprints, mechanical drawings, manuscripts, records, passports, stamps, lottery tickets, railroad or airplane tickets or other documents of value. Gold, silver, platinum or nay other precious metals, pearls, precious or semi-precious stones. Paintings, etchings, drawings (including frames, glasses and shadow boxes), rare books, manuscripts, maps, historic documents, rugs, tapestries, sculptures, statuary and other bona fide works of art, rarity, historic value or artistic merit. Lamps, lampshades, artwork, pictures, mirrors, artificial plants, chandeliers and statues which are not boxed by Santos Moving. Jewelry, watches, furs or garments trimmed with fur. Live animals, birds or fish. Live plants. Any marble, glass, granite or slate which is not crated or boxed by Santos Moving. Furniture Pressboard or particle board furniture; previously damaged and repaired items; previously damaged or loose veneer, furniture where original glue has dried out. Property transported gratuitously or as an accommodation. Cigarettes, cigars or any other type of finished tobacco product Distilled spirits and other types of alcoholic products. Software data. Missing hardware for disassembled items, unless Santos Moving disassembles them. Any small, loose items such as keys, remote controls, etc, which are not in a box. Mechanical or electrical derangement of musical instruments, including but not limited to piano, harpsichord, organ, television, radio, refrigerator, freezer, washing machine, dryer, sound recording or playing equipment, including parts or components thereof, electronic or mechanical games, computers, or like similar articles, unless evidenced by external damage. Boxes already packed by the customer If you do the packing, you nullify any insurance compensation from the movers for contents in those boxes. General rule is, if you pack it (or unpack it) you nullify any insurance coverage. A mover and its insurance company cannot insure contents of boxes that they have never seen. They also don't know if the contents were packed properly. As a result, if you pack it, you take the risk. If the carton shows visible damage, it should be noted on the inventory or bill of landing and the carton(s) and damaged items must be retained for our inspection. Dangerous Goods Do not pack an item classified as dangerous goods. If any damage resulted from a dangerous good, your insurance would be void. You wouldn't even get $0.60 per pound. Ask your moving consultant where your local disposal site is. fuels/oils paints/varnishes/paint thinners\ aerosol cans insecticides liquid bleach cleaning chemicals matches/candles propane perishable goods / food in glass jars live plants fire arms or ammo Rely on Your Homeowners Insurance Policy Some homeowner’s insurance policies cover household goods while in transit. Check with your homeowners insurance company to find out what coverage you may have. Before you choose to purchase additional valuation coverage or moving insurance, make absolutely sure that your homeowner’s or renter’s policy does not cover the transportation of your household items. Many insurance companies will cover claims for losses from fire or natural disaster when your items are being moved by a professional mover. Most often, these types of policies will not cover your damages if they’re caused by the movers. You should review your particular situation with your insurance agent before finalizing the details with your moving company. You also might not want any claims for moving damage to have an effect on your homeowners insurance policy, in which case a separate insurance policy for your move might make sense. Please be aware that Santos Movings Cargo Insurance Protection excludes inherent vice, climatic conditions and cartons that are packed by owner or a third party. Inherent Vice/Mechanical Condition Unknown - This means that the carrier is not responsible for any damages which are inherent to the item being shipped. The mechanical condition of appliances or electronics cannot be established prior to a move, therefore unless there is exterior damage noted about the items or cartons; it is assumed that it is in working condition. Climatic Condition – Any damages which are the direct result of change in temperature or humidity are beyond the carrier’s control. In the moving industry, the words valuation and insurance are used in a way that can be confusing to the average consumer. Understanding the difference between the two terms will help you get the right coverage for your move. The choice is yours; however why would you choose anything other than full value protection coverage? Your Santos Moving representative can explain these valuation coverage’s in detail so that you make the decision that’s right for your family.