mary anne

advertisement

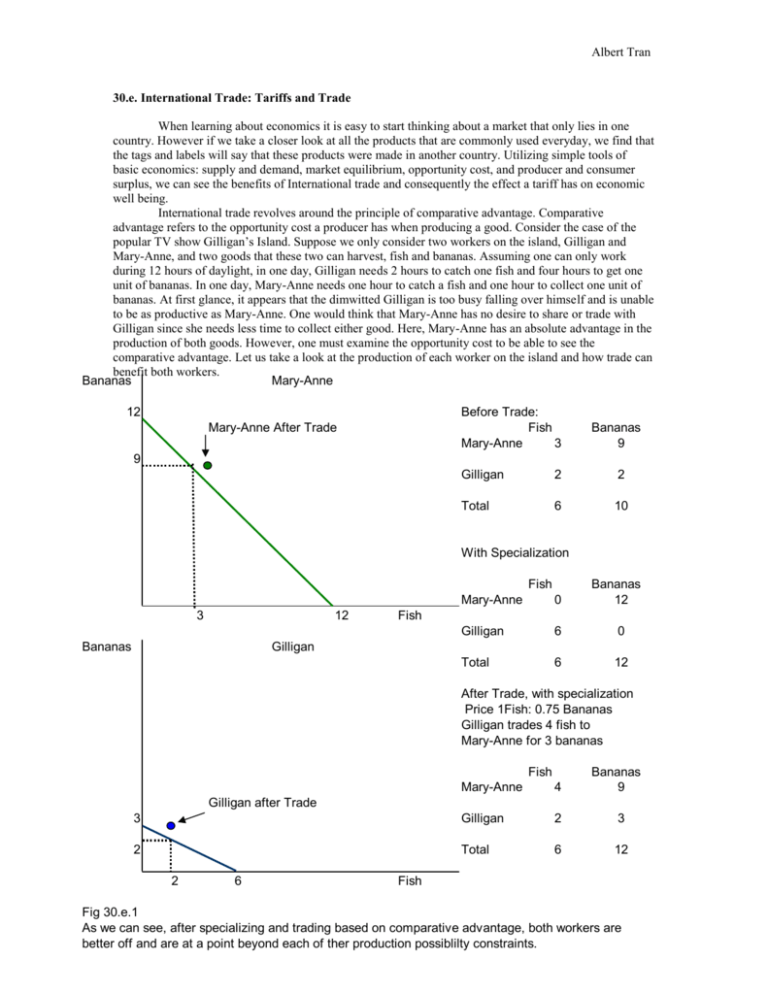

Albert Tran 30.e. International Trade: Tariffs and Trade When learning about economics it is easy to start thinking about a market that only lies in one country. However if we take a closer look at all the products that are commonly used everyday, we find that the tags and labels will say that these products were made in another country. Utilizing simple tools of basic economics: supply and demand, market equilibrium, opportunity cost, and producer and consumer surplus, we can see the benefits of International trade and consequently the effect a tariff has on economic well being. International trade revolves around the principle of comparative advantage. Comparative advantage refers to the opportunity cost a producer has when producing a good. Consider the case of the popular TV show Gilligan’s Island. Suppose we only consider two workers on the island, Gilligan and Mary-Anne, and two goods that these two can harvest, fish and bananas. Assuming one can only work during 12 hours of daylight, in one day, Gilligan needs 2 hours to catch one fish and four hours to get one unit of bananas. In one day, Mary-Anne needs one hour to catch a fish and one hour to collect one unit of bananas. At first glance, it appears that the dimwitted Gilligan is too busy falling over himself and is unable to be as productive as Mary-Anne. One would think that Mary-Anne has no desire to share or trade with Gilligan since she needs less time to collect either good. Here, Mary-Anne has an absolute advantage in the production of both goods. However, one must examine the opportunity cost to be able to see the comparative advantage. Let us take a look at the production of each worker on the island and how trade can benefit both workers. Bananas Mary-Anne 12 Before Trade: Fish Mary-Anne 3 Mary-Anne After Trade Bananas 9 9 Gilligan 2 2 Total 6 10 With Specialization Fish 3 12 Bananas Bananas 12 Mary-Anne 0 Gilligan 6 0 Total 6 12 Fish Gilligan After Trade, with specialization Price 1Fish: 0.75 Bananas Gilligan trades 4 fish to Mary-Anne for 3 bananas Fish Bananas 9 Mary-Anne 4 3 Gilligan 2 3 2 Total 6 12 Gilligan after Trade 2 6 Fish Fig 30.e.1 As we can see, after specializing and trading based on comparative advantage, both workers are better off and are at a point beyond each of ther production possiblilty constraints. Albert Tran The opportunity cost for Mary-Anne is one fish for one banana. For Gilligan, the opportunity cost for one fish is half a unit of bananas, and the cost of one banana for Gilligan is 2 units of fish. What this means, is that for every fish Gilligan goes after, he only forgoes half a unit of bananas. Mary-Anne on the other hand, has to give up one whole unit of bananas for every fish she catches. Here, Gilligan has the comparative advantage in fishing. If Gilligan were to trade with Mary-Anne, for a price such as one fish for 0.75 units of bananas, both workers will be better off. Gilligan will get ¾ a banana instead of the ½ he normally gets for one unit of fish, and Mary-Anne only has to pay ¾ a unit of banana for one fish instead of the normal one banana for one fish price she pays. Since Mary-Anne has a comparative advantage in harvesting bananas, and Gilligan has the comparative advantage in harvesting fish, both end up better off in the end due to the benefits of trade. Now, after seeing how trade can benefit all parties involved, let us apply this to a country in international trade. Consider the market for grapes in the nation of Grapeland. First we must assume that Grapeland is a very small nation with a small economy compared to the rest of the world. This implies that Grapeland is a price taker in the world economy. That is, Grapeland must take the price of grapes as dictated by the equilibrium forces in the world economy, meaning Grapeland can import grapes and buy grapes at the given world price or sell their grapes and export grapes at the world price. Whether Grapeland will be an importer or exporter of grapes will depend on the world price of grapes in comparison to the domestic price of grapes. If the domestic price of grapes is less than the world price of grapes, this means that Grapeland is capable of producing grapes at a lesser cost compared to the rest of the world, meaning Grapeland has a comparative advantage in producing grapes and will export grapes to the rest of the world. Once free trade is allowed to occur, equilibrium will shift, since no seller of the good would sell for less someone a unit of grape for less than the world price when they can sell to the rest of the world for more, and likewise no buyer of grapes will pay more for grapes when they can go and buy grapes for the world price. Thus a new equilibrium is established. P A Domestic Supply World Price World Price 1 B D P before trade Consumer Surplus Before Trade A+B After Trade A Change B Producer Surplus C C+B+D B+D A+B+C A+B+C+D D C Total Surplus Domestic Demand Net Export of Good Qdemanded Qsupplied Quantity Fig 30.e.2 After international trade at the world price, the producers of Grapeland are better off, earning additional surplus of B+D, while consumers are worse off losing area B. However as a whole, the nation is better off by gaining area D, as trade raises the economic well being of the nation due to the simple fact that the winners gained more than what the losers lost. Likewise, if the domestic price of grapes is higher than the world price, this suggests that Grapeland produces grapes at a higher cost compared to the rest of the world and would be better off buying and importing grapes from the rest of the world. Albert Tran P Domestic Supply Consumer Surplus Before Trade A After Trade A+B+D Change B+D Producer Surplus C+B C B A+B+C A+B+C+D D A Price Before Trade B D Total Surplus World Price World Price 2 C Imports Domestic Demand Qsupplied Qdemanded Quantity Fig 30.e.3 Similar to the case of exports, here Grapeland an import grapes at a lower price than the domestic price. Consumers are better off by areas B and D, while producers are worse off by area B. Again, as a nation, Grapeland is better off since the winners gained more than the losers, totalling a net gain of area D. After seeing all the benefits and effects of international trade on the small nation of Grapeland, we see how international trade improves the well being of the economy as a whole. In both the exporting and importing scenarios, the gains of the winner exceed the losses of the losers, and thus the economy benefits. However, as in all things in this world, nothing comes for free. In examining the effects of a tariff, a tax on goods imported into Grapeland, one can see that this will have a great affect on the economy and free trade. A tariff on imported goods into Grapeland will only matter if Grapeland needs to import grapes. Therefore we will examine the scenario in which Grapeland is a grape importer. Domestic Supply Price Fig30.e.4 The tariff imposed by Grapeland reduces the total quantity imported by the nation and moves the market closer A to that of the equilibrium without international trade. There is a deadweight loss of areas DF due to the tariff B C E Tariff D F Imports with G tariff Qs1 Qs2 Qd2 Qd1 Domestic Demand Quantity Imports without tariff Consumer Surplus Before Tariff ABCDEF With Tariff AB Change (CDEF) Producer Surplus G GC C Govt Revenue none E E Total Surplus ABCDEFG ABCEG (DF) Albert Tran Figure 30.e.4 illustrates the change in the market for grapes in the nation of Grapeland due to the effects of a tariff. In the figure, the tariff raises the price of grapes higher than the world price by the amount of the tariff. The price of steel now, both imported and domestic, is raised by the tariff. The change in price has an effect on both buyers and sellers of grapes in Grapeland. With the price of grapes now higher in Grapeland, consumers will want to buy fewer quantities of grapes. The quantity demanded for grapes will fall from Qd1 to Qd2. For producers of grapes in Grapeland, the tariff raises the price of imported grapes, allowing the producers of grapes in Grapeland to be able to sell their grapes for a higher price. This raises the amount of grapes supplied domestically in Grapeland from Qs1 to Qs2. The net result of the tariff is a reduction in the amount of grapes imported. In examining the gains and losses due to the tariff, we simply look at the areas and consider consumer and producer surplus. Prior to the tariff, consumers were able to buy grapes at the world price. Their consumer surplus therefore totaled areas ABCDEF. Producers prior to the tariff were able to sell at the world price, and therefore producer surplus was only area G. Since there is no tax on imports, the government of Grapeland gets no revenue from free trade. After the tariff is imposed, consumers will demand a lower quantity of grapes. This drops the consumer surplus to areas AB. Producers of grapes in Grapeland will be able to sell more of their grapes since the domestic price is now slightly higher, increasing producer surplus to areas GC. The government now earns revenue due to the tariff. For every unit imported, the government earns the amount of the tariff, so total revenue gained by the government is the quantity of imports multiplied by the tariff, area E. Total surplus of Grapeland is now areas ABCEG. Examining the change in total surplus of Grapeland prior to and during the tariff, we see that total surplus decreased by areas D and F. Areas D and F represent the deadweight loss in the economy of Grapeland due to the tariff imposed on imports. This should not be a surprise, since a tariff is essentially a tax, and like any tax on goods, incentives to produce and consume in the economy is distorted as resources are not allocated in their most efficient ways. In our example, the deadweight loss can be traced to two sources. Due to the tariff, producers of Grapes are selling more than they would without the tariff, at a price higher than the normal world price of grapes. This inefficiency shows an overproduction of grapes in Grapeland. Similarly for consumers, with the tariff, consumers are buying a smaller quantity of grapes than they normally would with the normal world price. This shows an under consumption of grapes by consumers. Together, these two inefficiencies result in a deadweight loss of areas D and F caused by the tariff.