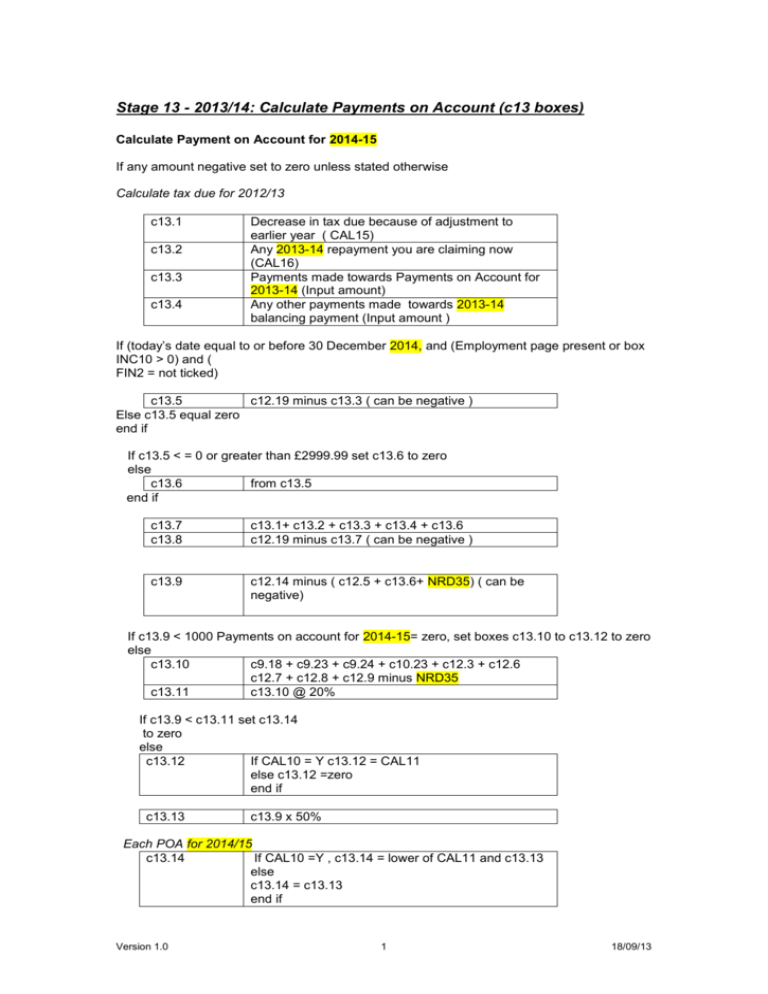

Stage 13: Calculate Payments on Account (c13 boxes)

advertisement

Stage 13 - 2013/14: Calculate Payments on Account (c13 boxes) Calculate Payment on Account for 2014-15 If any amount negative set to zero unless stated otherwise Calculate tax due for 2012/13 c13.1 c13.2 c13.3 c13.4 Decrease in tax due because of adjustment to earlier year ( CAL15) Any 2013-14 repayment you are claiming now (CAL16) Payments made towards Payments on Account for 2013-14 (Input amount) Any other payments made towards 2013-14 balancing payment (Input amount ) If (today’s date equal to or before 30 December 2014, and (Employment page present or box INC10 > 0) and ( FIN2 = not ticked) c13.5 c12.19 minus c13.3 ( can be negative ) Else c13.5 equal zero end if If c13.5 < = 0 or greater than £2999.99 set c13.6 to zero else c13.6 from c13.5 end if c13.7 c13.8 c13.1+ c13.2 + c13.3 + c13.4 + c13.6 c12.19 minus c13.7 ( can be negative ) c13.9 c12.14 minus ( c12.5 + c13.6+ NRD35) ( can be negative) If c13.9 < 1000 Payments on account for 2014-15= zero, set boxes c13.10 to c13.12 to zero else c13.10 c9.18 + c9.23 + c9.24 + c10.23 + c12.3 + c12.6 c12.7 + c12.8 + c12.9 minus NRD35 c13.11 c13.10 @ 20% If c13.9 < c13.11 set c13.14 to zero else c13.12 If CAL10 = Y c13.12 = CAL11 else c13.12 =zero end if c13.13 c13.9 x 50% Each POA for 2014/15 c13.14 If CAL10 =Y , c13.14 = lower of CAL11 and c13.13 else c13.14 = c13.13 end if Version 1.0 1 18/09/13 Total Amount Payable on 31 January 2015 c13.15 Version 1.0 c13.8 + c13.14 ( can be negative) 2 18/09/13