KENYA POST OFFICE SAVINGS BANK

advertisement

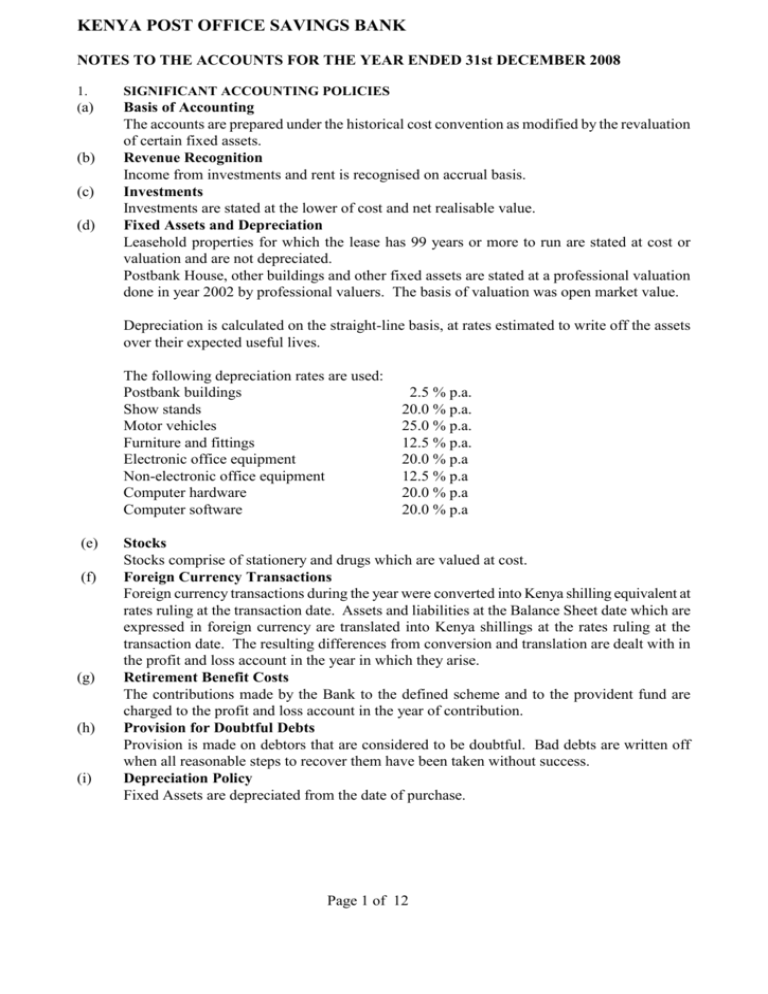

KENYA POST OFFICE SAVINGS BANK NOTES TO THE ACCOUNTS FOR THE YEAR ENDED 31st DECEMBER 2008 1. (a) (b) (c) (d) SIGNIFICANT ACCOUNTING POLICIES Basis of Accounting The accounts are prepared under the historical cost convention as modified by the revaluation of certain fixed assets. Revenue Recognition Income from investments and rent is recognised on accrual basis. Investments Investments are stated at the lower of cost and net realisable value. Fixed Assets and Depreciation Leasehold properties for which the lease has 99 years or more to run are stated at cost or valuation and are not depreciated. Postbank House, other buildings and other fixed assets are stated at a professional valuation done in year 2002 by professional valuers. The basis of valuation was open market value. Depreciation is calculated on the straight-line basis, at rates estimated to write off the assets over their expected useful lives. The following depreciation rates are used: Postbank buildings Show stands Motor vehicles Furniture and fittings Electronic office equipment Non-electronic office equipment Computer hardware Computer software (e) (f) (g) (h) (i) 2.5 % p.a. 20.0 % p.a. 25.0 % p.a. 12.5 % p.a. 20.0 % p.a 12.5 % p.a 20.0 % p.a 20.0 % p.a Stocks Stocks comprise of stationery and drugs which are valued at cost. Foreign Currency Transactions Foreign currency transactions during the year were converted into Kenya shilling equivalent at rates ruling at the transaction date. Assets and liabilities at the Balance Sheet date which are expressed in foreign currency are translated into Kenya shillings at the rates ruling at the transaction date. The resulting differences from conversion and translation are dealt with in the profit and loss account in the year in which they arise. Retirement Benefit Costs The contributions made by the Bank to the defined scheme and to the provident fund are charged to the profit and loss account in the year of contribution. Provision for Doubtful Debts Provision is made on debtors that are considered to be doubtful. Bad debts are written off when all reasonable steps to recover them have been taken without success. Depreciation Policy Fixed Assets are depreciated from the date of purchase. Page 1 of 12 KENYA POST OFFICE SAVINGS BANK NOTES TO THE ACCOUNTS FOR THE YEAR ENDED 31st DECEMBER 2008(continued) 2. INVESTMENT IN TREASURY BILLS & BONDS East African Development Bank Bonds Barclays Bank of Kenya medium term note Government Bonds and Treasury Bills 2008 Kshs. 66,000,000 38,100,000 8,675,483,803 8,779,583,803 3. FUNDS ON CALL AND SHORT NOTICE 2008 Kshs. Funds on call and short notice 284,100,000 2007 Kshs. 77,000,000 10,703,300,001 10,780,300,001 2007 Kshs. 59,100,000 Funds on call and short notice represent short term deposits with commercial banks and financial institutions while interest on deposits held in non performing banks and financial institutions has been suspended as follows:- 4. 2008 Kshs. 2,055,637 13,540,000 27,390,225 42,985,862 2007 Kshs. 2,055,637 13,540,000 27,390,225 42,985,862 Less: Provision for diminution in market value of quoted /unquoted investments 13,356,388 29,629,474 13,174,013 29,811,849 OTHER INVESTMENTS Quoted investments Unquoted investment Investment in property (i) The quoted investments were valued at Kshs.885,250 (2007 Kshs. 1,067,625) using the stock market price for the same category. Thus a diminution in market value of Kshs.182,375. (ii) The unquoted investment represents 80% of deposits in City Finance Bank converted into shares following the restructuring of the Bank in year 2000. However, 90% of the unquoted investment i.e Ksh.12,186,000 was provided for in year 2003 to reflect the market value of these shares. (iii) The investment in property represents a piece of land with a building taken over by the Bank from Thabiti Finance Ltd which was holding deposits for the Bank but failed to pay the same on maturity. Title to the property is in dispute. The current occupant of the premises is claiming allotees interest absolutely. The case is in court and the Bank expects a favourable outcome since it has a vesting right in the property and is holding it with an intention of selling. Page 2 of 12 KENYA POST OFFICE SAVINGS BANK NOTES TO THE ACCOUNTS FOR THE YEAR ENDED 31st DECEMBER 2008(continued) 5. DEBTORS, PREPAYMENTS AND OTHER ASSETS 2008 Kshs. PCK KP&TC Accrued interest Directors loans Staff loans Trade debtors – Personal Development Loan Staff Imprest Visa Card debtors MTS Trade Debtors Stocks of stationery & drugs ATM settlement Account receivables Fixed deposits in ailing financial institutions GoK Pension Reserve Fund Commission Receivable Pension Receivable from GoK Prepaid GoK Pension – Payroll Citibank GoK Pension Cheques Receivable Premium on Treasury Bonds (Prepaid) Other Debtors and Prepayments Provision for bad and doubtful debts: Trade Amounts due from subsidiary and deposits in ailing financial institutions 2007 Kshs. 1,050,421,672 405,238,134 460,258,272 16,999,166 396,888,435 166,286,092 4,446,863 130,723,672 -37,720,338 32,460,002 -1,381,759 540,409,141 -630,052,450 63,163,800 222,479,227 712,772,228 159,079,364 99,698,574 539,160,805 4,961,376,846 1,066,145,187 405,231,359 418,315,248 17,341,942 362,178,311 126,215,728 3,075,831 122,662,283 30,421,712 24,433,946 0 540,409,141 222,479,227 63,706,800 0 990,911,629 6,684,738 103,365,240 362,944,540 4,866,522,862 -537,512,406 -646,955,445 -668,252,820 -668,252,820 3,755,611,619 3,551,314,597 The ailing financial institutions refer to those institutions placed under statutory management of CBK (receivership and in liquidation). Accrual of interest on KP&TC excess deposits was suspended with effect from July 2005. 6. DEFERRED ASSET 2008 Kshs. Balance brought forward Receipts from Treasury Balance carried forward 153,998 0 153,998 2007 Kshs. 153,998 0 153,998 This amount represent accumulated losses which by virtue of section 13 (1) of the Kenya Post Office Savings Bank Act Cap 493B are recoverable from the Central Government Consolidated Fund. 7. CAPITAL WORK IN PROGRESS 2008 2007 Kshs. Kshs. Capital Work in Progress 9,420,832 16,693,342 The amount represents cost of computer software and renovation of branches. Page 3 of 12 KENYA POST OFFICE SAVINGS BANK NOTES TO THE ACCOUNTS FOR THE YEAR ENDED 31ST DECEMBER 2008 (Continued) 8. FIXED ASSETS Cost or Valuation LAND BUILDINGS At 1 Jan. 2008 143,000,000.00 679,734,193.15 3,100,000.00 44,763,936.00 163,321,644.99 115,113,487.45 56,225,296.37 - 25,853,505.65 - - 8,020,830.03 3,927,676.50 910,495.12 - - - - 133,854.20 147,478.99 143,000,000.00 705,587,698.80 3,100,000.00 44,763,936.00 171,208,620.82 DEPRE.31.12.07 - 100,215,839.21 3,100,000.00 41,119,862.00 CHARGED 31.12.2008 - 17,208,800.71 - 3,644,074.00 DISPOSALS - - - DEPRE.31.12.08 - 117,424.639.92 3,100,000.00 44,963,936.00 NBV 31.12.2008 143,000,000.00 588,163,058.88 - - ADDITIONS DISPOSALS COST 31.12.2008 LEASEHOLD BUILDINGS MOTOR VEHICLES FURNITURE & FITTINGS ELECTRONIC OFFICE EQPMT NON ELECTRONIC OFFICE EQPMT COMPUTER HARDWARE 318,001,390.39 28,073,338.22 COMPUTER SOFTWARE TOTAL 316,579,792.37 16,706,703.12 1,839,838,740.72 83,492,548.64 897,000.00 7,500.00 - 1,185,833.19 118,893,684.96 56,238,791.49 346,066,228.61 333,286,495.49 1,922,145,456.17 61,167,972.78 43,212,643.05 33,235,135.54 171,348,592.92 236,156,862.69 689,556,908.19 20,742,162.72 18,981,732.22 6,674,059.73 52,666,971.32 30,065,376.58 149,983,177.28 147,478.99 782,500.00 7,500.00 - 1,038,727.56 81,808,886.93 62,046,896.28 39,126,695.27 224,008,064.24 266,222,239.27 838,501,357.91 89,399,733.89 56,846,788.68 17,112,096.22 122,058,164.37 67,064,256.22 1,083,644,098.26 DEPRECIATION NBV 31.12.2007 143,000,000.20 579,518,353.94 - - 3,644,074.00 101,248.57 102,153,672.21 71,900,844.40 23,051,060.83 146,652,797.47 80,422.929.68 1,150,343,732.53 Disclosure Note. The Bank had a fleet of thirty (30) motor vehicles whose book value was nil as at 31/12/2008. They have not been re-valued since most of them have outlived their useful economic value and are in the process of being replaced. Valuation will be carried out for purposes of disposal. Page 4 of 12 KENYA POST OFFICE SAVINGS BANK NOTES TO THE ACCOUNTS FOR THE YEAR ENDED 31st DECEMBER 2008 (continued) 8. (b) LAND AND BUILDING (continued) 2008 COST OR VALUATION Land Buildings Show Stand Total Kshs. Kshs. Kshs. Kshs. Long-term leasehold 122,000,000 634,700,000 756,700,000 Short-term leasehold 21,000,000 32,900,000 3,100,000 57,000,000 143,000,000 667,600,000 3,100,000 810,600,000 2007 Total Kshs. 756,700,000 57,000,000 810,600,000 Included in short-term leasehold land and building is a property purchased in Mombasa. It is valued at Kshs.45 million subject to extension of lease period by another 45 years from the current 10 years. Procedures towards extension of the lease are in progress. The figures used in the fixed assets schedule relate to 2002 valuation report carried out by professional valuers. In the valuation report, freehold and long-term leasehold is combined as the Bank does not possess freehold land and buildings. 9 CREDITORS Trade creditors PCK Services rendered- OSS PCK Encashed Warrants Payable Transitorial Accounts - Postbank Transitorial Accounts - Pension Warrants (PCK) Transitorial Accounts - GoK Payroll (PCK) Other creditors and accrued charges 2008 2007 Kshs. Kshs. 129,596,873 459,320,479 462,078,751 435,145,912 170,953,266 927,712,883 525,216,280 3,110,024,446 74,522,674 364,626,194 462,078,751 700,483,642 170,953,266 1,079,948,373 530,744,613 3,383,357,532 PCK Services rendered- GoK Pension refers to amount claimable by Postal Corporation of Kenya on disbursement of pension to pensioners. This has now been transferred to PCK Encashed Warrants Payable. Transitorial account is a holding account for money held by the Bank and PCK on behalf of third party pending disbursement. 10 CUSTOMER SAVINGS AND DEPOSIT ACCOUNTS 2008 Postbank Savings Scheme Bidii Savings Account STEP Account Pension accounts (BST) Premium Savings Scheme Fixed Deposit Scheme Save-As-You-Earn Page 5 of 12 2007 Kshs. Kshs. 6,067,238,131 1,225,595,585 53,187,223 799,547,385 854,271,169 207,162,864 274,444,106 7,796,809,361 1,976,384,870 18,178,745 153,661,440 666,654,164 229,469,379 247,823,856 KENYA POST OFFICE SAVINGS BANK NOTES TO THE ACCOUNTS FOR THE YEAR ENDED 31st DECEMBER 2008(continued) Staff Salary Account Postbank Junior Account Salary Account Non Scheme Account Bidii Plus Account Premium Plus Account Bidii Junior Account 11. 2008 2007 Kshs. Kshs. 50,890,819 14,837,674 29,491,757 -2,859,735 1,480,308 76,340,603 604,350 9,652,232,239 BEARER BONDS 0 1,060 -56,911 0 0 0 0 11,088,925,963 2008 2007 Kshs. Kshs. 220,002,615 220,002,615 These were collections from the public for sales of Bearer Bonds on behalf of Central Bank of Kenya (CBK). The funds were banked in Postbank Credit Limited (PCL) for onward transmission to the CBK. PCL was closed and put under liquidation by the CBK before the money was paid over to the latter. The amount will be paid over to the CBK once these are received from the Liquidator. 12. RESERVES Balance brought forward Profit/(Loss) for the year Balance carried forward Capital Reserves Kshs. 471,403,491 Revenue Reserves Kshs. 1,473,050,528 71,065,514 471,403,491 1,544,116,042 TOTALS 2008 Kshs. 1,944,454,019 71,065,514 2,015,519,533 TOTALS 2007 Kshs. 1,581,863,174 190,862,180 1,944,454,019 Capital reserve arose out of revaluation of land and buildings done in 2002 (see note 8a). 13. FEES & COMMISSIONS 2008 Account maintenance fees/Ledger fees Salary crediting fees Continuation fees Premature withdrawal fees Maintenance fees Withdrawal fees Visa fees Card fees MTS- Inbound & Intrabound commission Statement Charge Closure Fee Upcountry Cheque Deposit Charge Postage Fee Commission from Higher Education Loans Board Page 6 of 12 2007 Kshs. Kshs. 237,459,286 38,602,458 3,334,661 17,126,910 116,445,342 38,877,651 15,406,451 36,061,234 97,485,560 491,193 4,364,064 7,569,857 2,558,405 2,074,680 457,996,337 49,670,416 11,196,163 20,252,041 177,998,611 40,923,411 13,954,689 33,936,620 133,931,668 669,018 5,172,816 12,330,114 4,681,558 4,471,920 KENYA POST OFFICE SAVINGS BANK NOTES TO THE ACCOUNTS FOR THE YEAR ENDED 31st DECEMBER 2008 (continued) 2008 Kshs. Citibank commission Pension commission Miscellaneous fees & commission (others) 14. 5,450,490 105,260,250 58,405,826 786,980,319 Kshs. Rental income- notional Dividend income Write back on Provision Interest on bank accounts Bonus from Western Union Realised gain/loss on sale of Forex Consultancy fees Agency based commission Tender fees Appreciation/Diminution in value of quoted investments Write back on Dormant Account Loss/Gain on call deposit Others 16. 1,204,005 106,372,950 47,654,518 1,122,416,857 OTHER LOSSES/ INCOME 2008 15. 2007 Kshs. DIRECT EXPENSES Interest on:Postbank Savings Accounts Bidii Savings Account Premium Savings Account Fixed Deposit Savings Account Save As You Earn Account Step Account Pension Account Customer Salary Account Postbank Junior Account Premium Plus Account 20,563,770 37,500 5,084,110 1,194,479 38,986,760 32,671,072 673,634 325,673 177,000 -182,375 426,900 0 3,222,329 103,382,786 2008 Kshs. 82,702,791 29,040,832 15,953,126 6,292,856 2,486,200 0 0 0 0 0 136,475,805 2,348,999 1,267,255,157 13,786,444 74,674 63,855,752 5,582,110 14,427,119 Page 7 of 12 2007 Kshs. Kshs. Directors fees Staff costs Printing and stationery Debt collections Postage, telephone and telegram Computer charges Motor Vehicle Expenses Kshs. 20,563,770 1,047,808 4,330,910 561,386 12,290,252 -7,828,009 580,626 1,152,472 1,959,620 -61,500 889,035 -7,876,128 2,335,781 29,946,022 69,460,973 28,668,157 24,335,617 4,975,610 6,823,732 198,817 28,852 63,931 38,339 257,874 134,851,903 2008 ADMINISTRATION EXPENSES 2007 2007 Kshs. 2,871,231 1,242,434,768 11,402,300 196,065 48,418,869 7,406,327 10,131,056 KENYA POST OFFICE SAVINGS BANK NOTES TO THE ACCOUNTS FOR THE YEAR ENDED 31 ST DECEMBER 2008 (continued) 2008 2007 Kshs. Audit fees Donations and subscriptions Legal and professional fees Electricity and water Cleaning and Sanitation Special Projects Launching Newspapers and Periodicals Procurement Costs Transportation Costs Symbols Implementation Miscellaneous expenses 17. Kshs. 2,000,000 2,762,267 4,319,311 18,854,966 9,798,276 353,903 557,523 0 59,000 27,645 512 1,406,063,661 3,500,000 3,173,363 3,782,247 11,425,262 7,735,265 2,989,502 664,761 1,828,793 0 0 0 1,357,959,810 2008 ESTABLISHMENT EXPENSES Kshs. Security and Escort Insurances Office rent Land rent and rates Repairs and maintenance Service charge Agency fees - PCK/Others Licences Flower maintenance 18. 81,010,851 12,215,893 93,189,947 1,347,606 64,694,823 12,348,625 -46,691,502 29,728,831 49,370 247,894,444 SELLING EXPENSES 2008 Kshs. Publicity and advertising ASK show expenses 19. 47,094,506 1,578,459 48,672,945 FINANCIAL EXPENSES 2008 Bank charges Interest on overdraft Interest on borrowed funds (EADB) 20. BAD AND DOUBTFUL DEBTS - PROVISIONS 2007 Kshs. 37,144,939 1,149,371 38,294,310 2007 Kshs. 37,579,756 2,825,088 0 40,404,844 29,255,667 870,439 5,946,150 36,072,255 2008 3,050,369 0 38,963,271 42,013,640 Page 8 of 12 Kshs. 57,844,619 30,394,252 69,530,717 1,200,000 49,922,340 12,284,426 123,859,649 37,785,693 13,370 382,835,067 Kshs. Kshs. Visa card debtors PCK debt General 2007 2007 Kshs. 3,187,979 31,750,000 53,133,406 88,071,385 KENYA POST OFFICE SAVINGS BANK NOTES TO THE ACCOUNTS FOR THE YEAR ENDED 31ST DECEMBER 2008(continued) 21. PROFIT/(LOSS) FOR THE YEAR The profit for the year is stated after charging Directors fees Audit fees Depreciation Provident fund contribution Pension scheme contribution Diminution in value of quoted investments and after crediting: Dividends 22. CASH AND CASH EQUIVALENTS 2008 2007 Kshs. Kshs. 2,349,000 2,000,000 149,845,083 3,235,627 99,468,135 182,375 2,871,231 3,500,000 134,447,788 3,518,524 111,397,356 61,500 37,500 1,047,807 2008 2007 Kshs. Bank and cash balances (net) Deposits in banks and Financial Institutions Treasury Bills and Bonds 1,361,306,002 284,100,000 8,263,477,362 9,909,883,364 Kshs. 1,056,973,813 59,100,000 10,541,082,081 11,734,155,844 For the purposes of the cash flow statement, cash and cash equivalents refer to: 1. 2. 3. 23. Bank and cash balances net of bank overdraft. Deposits in banks and financial institutions less amounts not likely to be received within 12 months of the balance sheet date, and Treasury Bills and bonds including EADB bonds as at the balance sheet date. CONTINGENT LIABILITIES (i) Kenya Post Office Savings Bank Employees Pension Trust Fund. An actuarial valuation of the Bank’s funded Pension Trust Fund as at 31st December 2006 was carried out by Alexander Forbes Financial Services (EA) Limited. The report by the actuaries revealed a past service deficit of Kshs.467.9 million as at 31st December 2006. Though the Bank has converted to a defined contribution scheme, the defined benefit scheme has not been closed until the above deficit has been paid in full. Page 9 of 12 KENYA POST OFFICE SAVINGS BANK NOTES TO THE ACCOUNTS FOR THE YEAR ENDED 31ST DECEMBER 2008 (continued) (ii) KP &TC Charges for Services Rendered The KP&TC was claiming Kshs.35,240,661.18 owing as at 30th June 1999 (at the time it split into Telkom (K) Ltd, Communication Commission of Kenya and Postal Corporation of Kenya. The provision in the accounts then was Kshs.14,868,291.35. No provision has been made in these accounts for the difference (Kshs.20,372,370.45) as discussions are in progress to resolve the dispute, and the directors are of the opinion that the Bank will obtain a favourable result. 24. CAPITAL COMMITMENTS Authorised and contracted for Authorised but not contracted for 2008 Kshs 28,675,742 0 28,675,742 2007 Kshs 24,669,525 0 24,669,525 Capital Commitments relate to computer hardware, software, ATM sites and new branches. Page 10 of 12 KENYA POST OFFICE SAVINGS BANK NOTES TO THE ACCOUNTS FOR THE YEAR ENDED 31st DECEMBER 2008 (Continued) 25. LIQUIDITY RISK The table below analyses assets and liabilities into relevant maturity groupings based in the remaining period as at 31 December 2008 to the contractual maturity date. A. Assets Bank and Cash Balances Matured Matured in less than a month 1 months less than 3 months 1,361,306,002 - Investment in T/bills + Bonds - - Funds on call and short notice - 284,100,000 Other Investment - 3 months less than 6 months 1 year less than 3 years 3 years less than 5 years over 5 years Total - - - - - 1,361,306,002 110,000,000 905,000,000 375,725,000 3,104,200,000 2,903,850,000 8,720,825,271 - - - - - - 284,100,000 - - - - - - 29,629,474 29,629,474 373,076,199 203,336,844 57,961,269 132,718,911 287,876,406 146,341,619 343,766,585 2,210,533,786 3,755,611,619 Deferred Assets - - - - - - - 153,998 153,998 Capital W.I.P - - - - 9,420,832 - - - 9,420,832 Fixed Assets - - - - - - - 1,083,644,098 1,083,644,098 Total Assets 1,734,382,201 487,436,844 1,380,011,540 242,718,911 1,202,297,238 522,066,619 3,447,966,585 6,227,811,356 15,244,691,294 1,630,811,570 896,332,035 346,124,205 236,756,636 - - - - 3,110,024,446 7,889,300 - - - - - - - 7,889,300 7,550,173,498 805,698,506 401,609,112 371,205,923 233,491,343 290,053,857 - - 9,652,232,239 Bearer Bonds - - - - 220,002,615 - - - 220,002,615 Reserves - - - - - - - 471,403,491 471,403,491 Retained profits - - - - - - - 1,544,116,042 1,544,116,042 9,427,897,529 1,702,030,541 747,733,317 607,962,559 453,493,958 290,053,857 - 2,015,519,533 15,244,691,294 (7,693,515,328) (1,214,593,697) 632,278,223 (365,243,648) 748,803,280 232,012,762 3,447,966,585 4,212,291,823 - Debtors, Prepayments and other Assets - 6 months less than 1 year 1,322,050,271 B. Liabilities and Reserves Creditors Premium Bonds Customer Savings and Deposit accounts Total Liabilities and Reserves A - B Liquidity GAP Customers Savings and deposits accounts relate to Savings and fixed account balances. Although classified under this band, previous experience has shown these to be stable and of long term in nature. Page 11 of 12 KENYA POST OFFICE SAVINGS BANK NOTES TO THE ACCOUNTS FOR THE YEAR ENDED 31st DECEMBER 2008 (Continued) 26. CONSOLIDATION Consolidated Accounts are not prepared as the bank’s wholly owned subsidiary, Postbank Credit Limited, is under liquidation. 27. TAXATION Kenya Post Office Savings Bank is exempt from Corporation Tax under Income Tax Act Cap 470 of the laws of Kenya. 28. COMPARATIVES Where necessary, comparative figures have been adjusted to conform to reporting under International Accounting Standards. 29. EMPLOYEES The average number of employees during the year was 1,180 (2007 -1,210). 30. INCORPORATION The bank is incorporated under the Kenya Post Office Savings Bank Act (Cap 493 B) of the laws of Kenya. 31. CURRENCY The accounts are presented in Kenya Shillings (Kshs.) Page 12 of 12