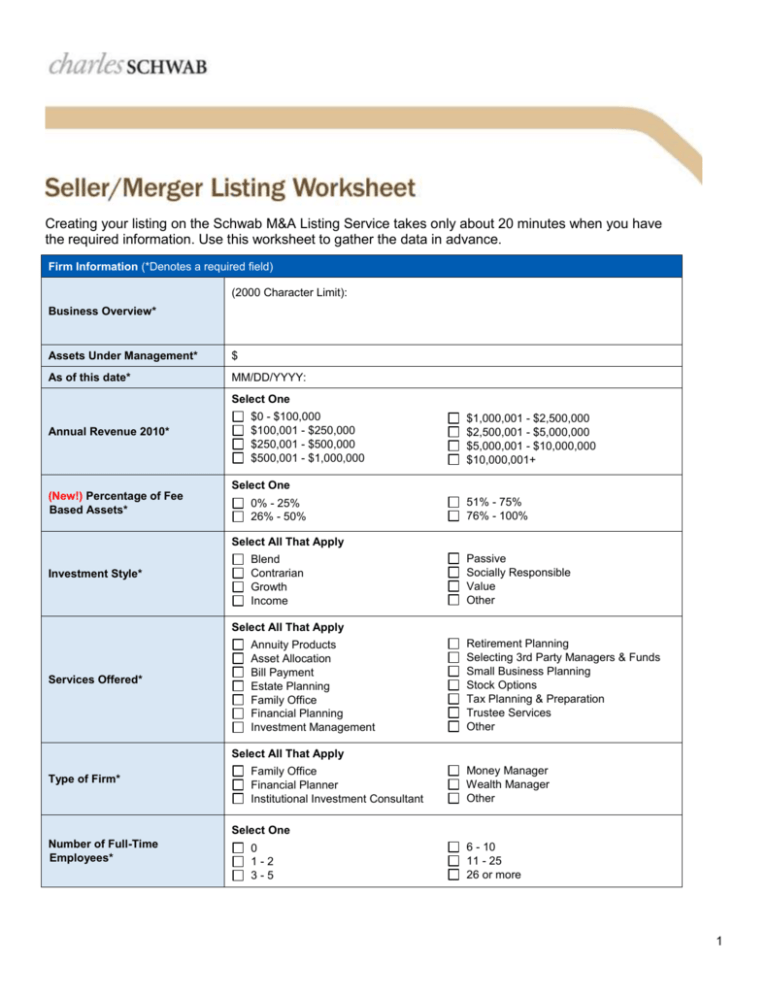

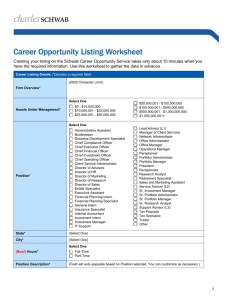

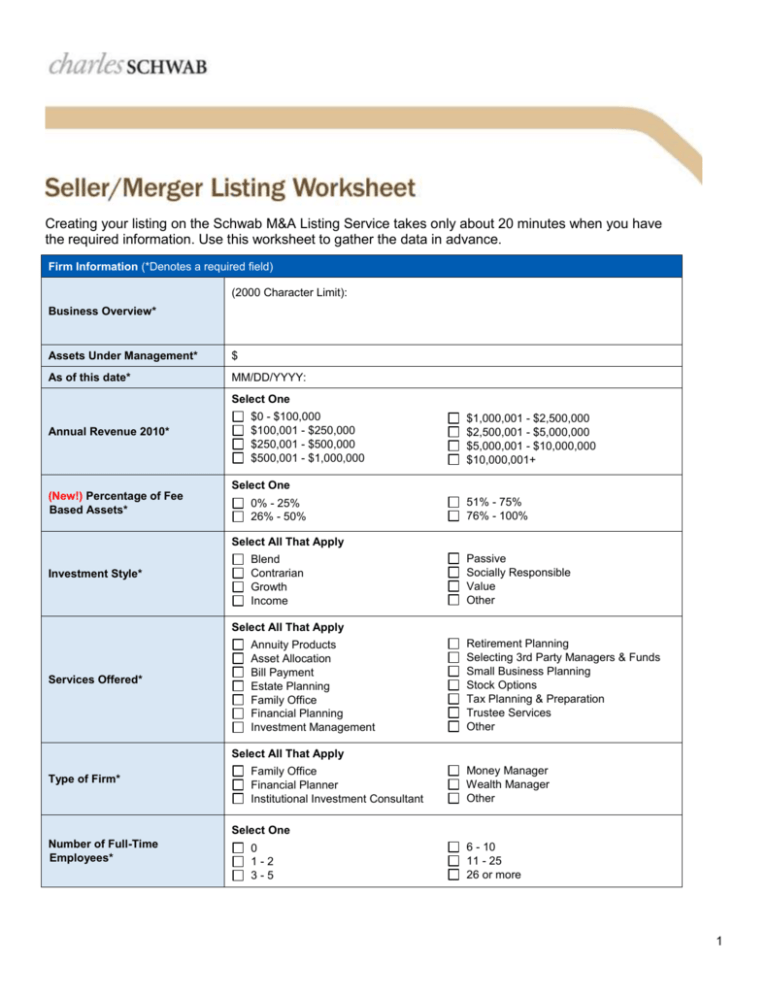

Creating your listing on the Schwab M&A Listing Service takes only about 20 minutes when you have

the required information. Use this worksheet to gather the data in advance.

Firm Information (*Denotes a required field)

(2000 Character Limit):

Business Overview*

Assets Under Management*

$

As of this date*

MM/DD/YYYY:

Select One

Annual Revenue 2010*

$0 - $100,000

$100,001 - $250,000

$250,001 - $500,000

$500,001 - $1,000,000

$1,000,001 - $2,500,000

$2,500,001 - $5,000,000

$5,000,001 - $10,000,000

$10,000,001+

Select One

(New!) Percentage of Fee

Based Assets*

0% - 25%

26% - 50%

51% - 75%

76% - 100%

Select All That Apply

Investment Style*

Blend

Contrarian

Growth

Income

Passive

Socially Responsible

Value

Other

Select All That Apply

Services Offered*

Annuity Products

Asset Allocation

Bill Payment

Estate Planning

Family Office

Financial Planning

Investment Management

Retirement Planning

Selecting 3rd Party Managers & Funds

Small Business Planning

Stock Options

Tax Planning & Preparation

Trustee Services

Other

Select All That Apply

Type of Firm*

Family Office

Financial Planner

Institutional Investment Consultant

Money Manager

Wealth Manager

Other

Select One

Number of Full-Time

Employees*

0

1-2

3-5

6 - 10

11 - 25

26 or more

1

Select One

Number of Part-Time

Employees*

0

1-2

3-5

6 - 10

11 - 25

26 or more

Select One

Number of Principals*

1

2

3

4

5

6

7

8

9

10 or more

Select One

Years in Operation*

0-5

6 - 10

11 - 25

26 or more

Select One

Number of Offices*

(New!) Office Location(s)*

0

1

2

3

4

5 or more

(Select All States That Apply)

Select One

Errors & Omissions Insurance*

Yes

No

Select All That Apply

Licenses Held by Owners and

Employees*

Series 3

Series 4

Series 6

Series 7

Series 9

Series 10

Series 11

Series 14

Series 23

Series 24

Series 26

Series 27

Series 30

Series 31

Series 51

Series 53

Series 55

Series 62

Series 63

Series 65

Series 66

Series 87

Insurance

Other

None

Select All That Apply

Designations Held by Owners

and Employees*

AAMS

AWMA

CFA

CFP

CMFC

CPA

CRPC

CRPS

CTFA

MBA

MPA

PFS

Other

None

Select One

Average Client Relationship

Size*

$0 - $100,000

$100,001 - $250,000

$250,001 - $500,000

$500,001 - $1,000,000

$1,000,001 - $2,000,000

$2,000,001 - $5,000,000

$5,000,001 - $10,000,000

$10,000,001+

2

Select One

(New!) Minimum Client

Relationship Size*

$500,001 - $1,000,000

$1,000,001 - $2,000,000

$2,000,001+

$0 - $100,000

$100,001 - $250,000

$250,001 - $500,000

Number of Client

Relationships*

Select All That Apply

Doctors

Heirs

Lottery Winners

Physicians

Retirees

Other

Attorneys

Business Owners

Entrepreneurs

Executives

Dentists

Divorcees

(New!) Target Clientele*

Investment Vehicles* (Total 100%)

Individual Securities

Mutual Funds

Separate Accounts

Totals

Equities

%

+

%

+

%

=

%

Fixed Income

%

+

%

+

%

=

%

(New!) ETFs

Alternative

%

Investments†

%

Cash/Money Market

%

Other

%

†Alternative

Investments include hedge funds, private equity funds, managed funds, managed futures, commodities and other

investment instruments.

Seller/Merger Listing Details (*Denotes a required field)

We are interested in

completing a transaction

within*

Select One

6 - 12 months

1 - 2 years

2 - 5 years

5+ years

Assets Under Management

As of 12/31/2010*

$

As of 12/31/2009*

$

As of 12/31/2008*

$

Revenue

Quarter 1 2011 Revenue

$

Quarter 4 2010 Revenue

$

Quarter 3 2010 Revenue

$

Quarter 2 2010 Revenue

$

Annual Revenue 2009*

$

Average Pricing bps

$

3

Sources of Revenue

Asset Based Fee Revenue

$

Commissioned Sales Revenue

$

Hourly Revenue

$

Other

$

Select One

Form of Ownership*

S Corp

C Corp

LLC

Partnership

Sole Proprietorship

Other

Select All That Apply

Portfolio Management System*

Advent

Albridge Solutions

Black Diamond

Bridge Portfolio

Captools

Checkfree APL

Select One

Primary Custodian

Schwab

TD Ameritrade

Fidelity

DBCams

Morningstar Office

Orion

PortfolioCenter

Proprietary

Other

Merrill Lynch Wealth Management

Other Brokerage

Bank

Other

Select One

Number of Custodians

1

2

3-5

6 - 10

11 or more

Select One

Total Salaries as a

% of Revenue

0% - 10%

11% - 20%

21% - 30%

31% - 40%

41% - 50%

51% or more

Select One

Total Overhead Expenses as a

% of Revenue

0% - 10%

11% - 20%

21% - 30%

31% - 40%

41% - 50%

51% - 60%

61% or more

Select One

Current Profit Margin†*

Less than 0%

0% - 10%

11% - 20%

21% - 30%

31% - 40%

41% - 50%

51% - 60%

61% - 70%

71% or more

Select One

New Client Relationships Last

Year*

†Before

0-5

6 - 10

11 - 25

26 - 50

51 - 100

101+

Tax, Owner’s Compensation and Exceptional Items

4

Client Age Breakdown (Total 100%)

Select One

Younger than 31 Years

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Select One

31 to 50 Years

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Select One

51 to 65 Years

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Select One

66 Years and Older

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Price

Select All That Apply

Asking Price

$0 - $100,000

$100,001 - $250,000

$250,001 - $500,000

$500,001 - $1,000,000

$1,000,001 - $5,000,000

$5,000,001 - $10,000,000

$10,000,001+

Select All That Apply

Desired Cash at Closing

0% - 25%

26% - 50%

51% - 75%

76% - 100%

For institutional use only. ©2011 Charles Schwab & Co., Inc. ("Schwab"). Member SIPC. All Rights Reserved. Schwab Advisor Services™

(formerly Schwab Institutional®) serves independent investment advisors and includes the custody, trading and support services of Schwab.

Independent investment advisors are not owned by, affiliated with or supervised by Schwab. IAN MKT61827 (0511-2634)

5