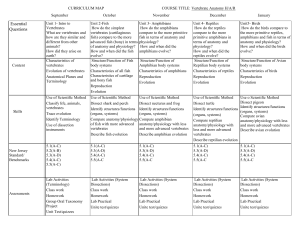

Competition/monopoly/Bertrand oligopoly/Cournot oligopoly

advertisement

Competition/Monopoly/Bertrand Oligopoly/Cournot Oligopoly/Stackelberg Oligopoly

General assumptions:

All firms produce and sell the identical product

Industry (inverse) demand curve: P = a - bQ

The AC of any firm includes a "normal" profit return on invested capital (so refers to

"excess" profits)

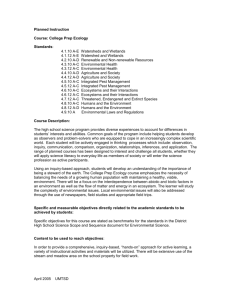

$

a

D

Slope = b/2

Slope = b

MR

(a+c)/2

(a+2c)/3

LRMC = LRAC

c

0

(a-c)/2b 2(a-c)/3b

(a-c)/b

a/b

Q

A. Competitive industry:

Extra assumptions:

"Many" firms

Every firm, actual and potential, is identical and has a U-shape AC curve with minimum

point at a AC of "c"

Implication:

Industry LR competitive supply curve is horizontal, at c

Outcome:

P=c

Q = (a-c)/b

=0

B. Monopoly:

Extra assumptions:

Single firm

Firm has LRMC = LRAC = c

Implication:

= QP - Qc = Q(a-bQ) - Qc

Maximizing outcome:

d/dQ = a - 2bQ – c = 0

Q = (a-c)/2b

P = (a+c)/2

= (a-c)2/4b

C. Bertrand Oligopoly:

Extra assumptions:

n firms (2 or more)

Each firm has LRMC = LRAC = c

Each firm chooses price as its competitive vehicle, myopically assumes that other firms will

not respond by adjusting their prices

Outcome:

Identical to competitve outcome, regardless of n

D. Cournot Oligopoly:

Extra assumptions:

n firms (2 or more)

Each firm has LRMC = LRAC = c

Each firm chooses quantity as its competitive vehicle and myopically assumes that other

firms will not respond by adjusting their quantities

Maximizing outcome (for two identical firms: 1,2):

1 = Pq1 - cq1 = (a-bQ)q1 - cq1 = (a-b[q1+q2])q1 - cq1

d1/dq1 = a - 2bq1 -bq2 - c = 0

q1 = (a-c-bq2)/2b

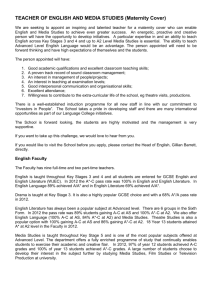

q1

(a-c)/b

Firm 2’s reaction function

(a-c)/2b

Firm 1’s reaction function

(a-c)/3b

Similarly, q2 = (a-c-bq1)/2b

q1 = q2 = (a-c)/3b

0

Q = q1 + q2 = 2(a-c)/3b

P = a - bQ = (a+2c)/3

1 = Pq1 - cq1 = (a-c)2/9b

= 1 + 2 = 2(a-c)2/9b

These results generalize, for n firms, to:

Q = n(a-c)/(n+1)b

P = (a+nc)/(n+1)

= n(a-c)2/(n+1)2b

As n gets large:

Q

(a-c)/b (the competitive quantity)

P

c (the competitive price)

0

(a-c)/3b

(a-c)/2b

(a-c)/b

q2

E. Stackelberg-Cournot Oligopoly:

Extra assumptions:

One firm (e.g., firm 1) understands the reaction function(s) of the other firm(s) and takes

them into account in making its own choice of output:

Outcome (for two firms: 1,2):

1 = Pq1 - cq1 = (a-bQ)q1 - cq1 = (a-b[q1+q2])q1 - cq1

But q2 = (a-c-bq1)/2b

By substitution, 1 = (a-b[q1+{a-c-bq1}/2b])q1 - cq1

d1/dq1 = …. = 0

q1 = (a-c)/2b

q2 = (a-c)/4b

Q = q1 + q2 = 3(a-c)/4b

P = a – bQ = (a + 3c)/4

1 = Pq1 – cq1 = (a-c)2/8b

2 = Pq2 – cq2 = (a-c)2/16b

= 1 + 2 = 3(a-c)2/16b