Where are oil and gas prices going? - Deccan Herald- July

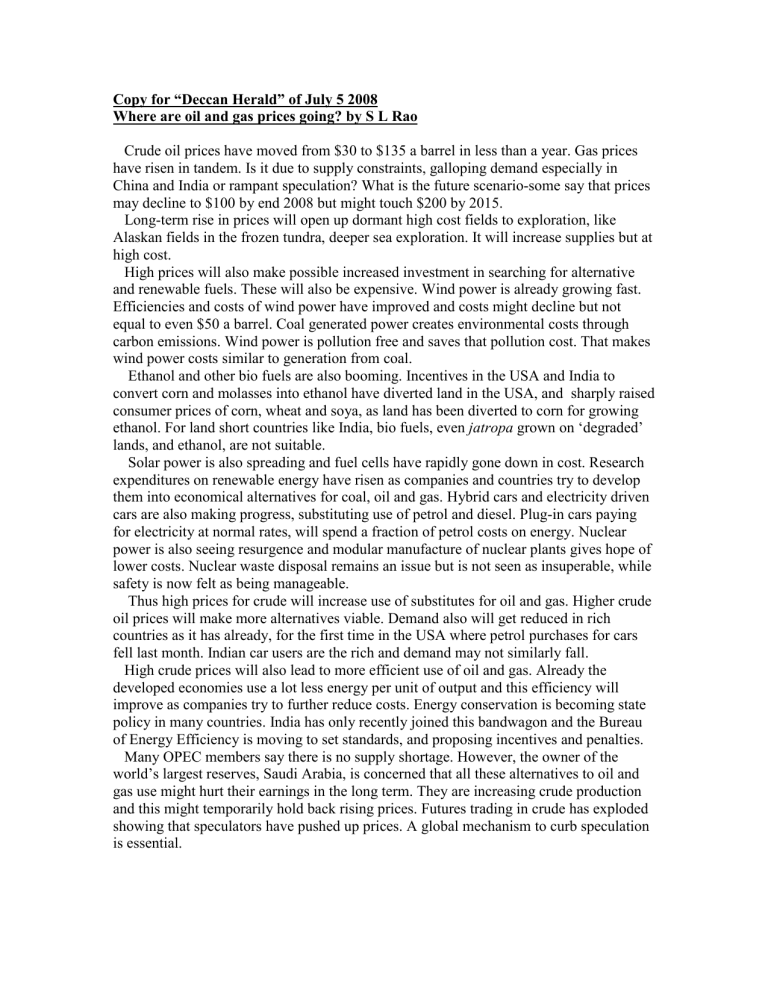

Copy for “Deccan Herald” of July 5 2008

Where are oil and gas prices going? by S L Rao

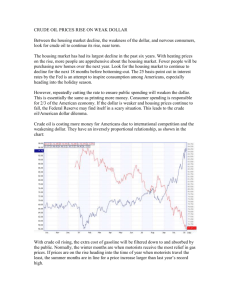

Crude oil prices have moved from $30 to $135 a barrel in less than a year. Gas prices have risen in tandem. Is it due to supply constraints, galloping demand especially in

China and India or rampant speculation? What is the future scenario-some say that prices may decline to $100 by end 2008 but might touch $200 by 2015.

Long-term rise in prices will open up dormant high cost fields to exploration, like

Alaskan fields in the frozen tundra, deeper sea exploration. It will increase supplies but at high cost.

High prices will also make possible increased investment in searching for alternative and renewable fuels. These will also be expensive. Wind power is already growing fast.

Efficiencies and costs of wind power have improved and costs might decline but not equal to even $50 a barrel. Coal generated power creates environmental costs through carbon emissions. Wind power is pollution free and saves that pollution cost. That makes wind power costs similar to generation from coal.

Ethanol and other bio fuels are also booming. Incentives in the USA and India to convert corn and molasses into ethanol have diverted land in the USA, and sharply raised consumer prices of corn, wheat and soya, as land has been diverted to corn for growing ethanol. For land short countries like India, bio fuels, even jatropa grown on ‘degraded’ lands, and ethanol, are not suitable.

Solar power is also spreading and fuel cells have rapidly gone down in cost. Research expenditures on renewable energy have risen as companies and countries try to develop them into economical alternatives for coal, oil and gas. Hybrid cars and electricity driven cars are also making progress, substituting use of petrol and diesel. Plug-in cars paying for electricity at normal rates, will spend a fraction of petrol costs on energy. Nuclear power is also seeing resurgence and modular manufacture of nuclear plants gives hope of lower costs. Nuclear waste disposal remains an issue but is not seen as insuperable, while safety is now felt as being manageable.

Thus high prices for crude will increase use of substitutes for oil and gas. Higher crude oil prices will make more alternatives viable. Demand also will get reduced in rich countries as it has already, for the first time in the USA where petrol purchases for cars fell last month. Indian car users are the rich and demand may not similarly fall.

High crude prices will also lead to more efficient use of oil and gas. Already the developed economies use a lot less energy per unit of output and this efficiency will improve as companies try to further reduce costs. Energy conservation is becoming state policy in many countries. India has only recently joined this bandwagon and the Bureau of Energy Efficiency is moving to set standards, and proposing incentives and penalties.

Many OPEC members say there is no supply shortage. However, the owner of the world’s largest reserves, Saudi Arabia, is concerned that all these alternatives to oil and gas use might hurt their earnings in the long term. They are increasing crude production and this might temporarily hold back rising prices. Futures trading in crude has exploded showing that speculators have pushed up prices. A global mechanism to curb speculation is essential.

The explosion of demand in developing economies like India and China makes it essential that they pursue renewable energy sources and improve efficiencies in energy use. This can reduce dependence on imported crude oil and gas.

The USA last month saw a doubling of retail petroleum prices and a 1% decline in purchase of petrol for cars. Declining USA demand would push crude prices down.

China and other Asian countries have sharply raised retail prices. Even India has raised prices modestly. All this will depress demand further and act to press down crude prices.

The declining dollar also led to rising oil prices. Oil producers sell in dollars and make up for the falling value of the dollar by asking for higher dollar prices. As the dollar rallies because of measures by the American Federal Reserve and government, crude oil prices might moderate. Expanded supplies, energy alternatives and greater efficiency in energy use will also prevent prices rising.

Thus in the short-term, by the end of 2008, prices could fall to $100 a barrel because of depressed demand, a stronger dollar, expanded supplies and more alternative energy use.

In the long-term oil and gas are finite in supply and more can come only from more expensive exploration and production. Demand in developing countries will keep growing rapidly as more users of cow dung, wood, and forest produce, etc, move to use oil, gas and electricity. The long term price trend will therefore be upwards. How high prices will go will depend on progress in using energy more efficiently, developing renewable alternatives, more nuclear energy and a global mechanism to curb speculation.

(814)