Chp 1: Introduction to Estate Planning

advertisement

TRUSTS & ESTATE OUTLINE

Professor Thomas

Chp 1: Introduction to Estate Planning

A. Intro

3 Basic Functions of having a will

1) Provides evidence of transfer of title to the new owner

2) Protects creditors (this way creditors can make claim in probate court)

3) Distribute decedent’s property to the people who were intended to receive it after the

creditors have been paid

A. POWER TO TRANSMIT PROPERTY AT DEATH: ITS JUSTIFICATION AND LIMITATIONS

Shapira v. Union National Bank, p. 24

Facts: Under testator’s will, his son Daniel could only inherit if the was married to a Jewish

woman whose both parents were Jewish at the date of Shapira’s death or within 7 years

thereafter. If he did not satisfy the conditions his share was to be given to the State of Israel.

Daniel sought a declaration that the will was unconstitutional since it restricted his right to marry

or that such a clause violated public policy

Issue: Does the court’s enforcement of the provision (requiring him to marry a Jewish girl whose

both parents are Jewish or forfeit the money) constitute sufficient state action in order to be

deemed a violation of the 14th Amendment?

Held: No. The court’s enforcement of the provision does not constitute sufficient state action to

be deemed a violation of the 14th Amendment. There is no state action here – the court is simply

enforcing an inheritance

Rationale: The court held that it’s not acting in the capacity of the state in this instance. Instead

it’s acting only to probate a will. In the court’s view that doesn’t constitute state action for 14th

Amendment purposes

Court distinguishes situation this from property cases dealing restrictive covenants:

(1) This is unlike property cases where owners of neighboring properties sought to enjoin blacks

from occupying properties which they had bought. In the case at bar, the court isn’t being

asked to enforce any restriction upon Daniel’s constitutional right to marry. Rather, this court

is being asked to enforce the testator's restriction upon his son’s inheritance. The aid of the

court is not sought to enjoin Daniel’s marrying a non-Jewish girl

(2) Daniel argued that although the restriction may not be a total prohibition on his right to

marry, he doesn’t have a big selection of Jewish women from which to chose. Court rejects

Daniel’s argument about pool of women being too small because:

(a) Daniel’s attorney failed to present evidence of how small the pool of Jewish

women was. if his lawyer had presented such evidence the result might have been

different

(b) Court said that Daniel wasn’t restricted to marrying a Jewish woman from this

community; that he could marry a Jewish woman from anywhere

(3) Court treats restriction on race more critically than one on religion

-1-

(4) This situation is very limited in scope. Dealing with a condition in one person’s will that

deals with a bequest to one individual. The only thing that might happen here if the court

enforces the condition is that Daniel won’t get his inheritance

(5) Court tries to balance the father’s interest in this case. Dad put this provision in for the “wellbeing of his family.” In contrast, there’s no good reason to include a racial covenant

Need to break the above arguments into policy v. constitutional arguments ?????

Note: The court lucked out in being able to decide this way and not having to get into dicey issue

of trying to see if Daniel’s girl meets the definition of being a Jewish girl

HYPO: What if Daniel marries someone who’s a Reformed Jew as opposed to an Orthodox Jew?

Would this meet the condition in the will?

▪ This scenario puts the court in the difficult position to determine what Jewish is

▪ This is a decision that the court really isn’t equipped to make; this is a religious

argument. Having to decide this issue would put the court in a very precarious position

Restatement (Second) of Property, ON RESTRAINTS ON MARRIAGE: that a restrain to induce a

person to marry within a religious faith is valid “if, and only if, under the circumstances, the

restraint doesn’t unreasonably limit the transferee’s opportunity to the transferee’s opportunity to

marry if a marriage permitted by the restraint is not likely to occur. The likelihood of marriage is

a factual question, to be answered from the circumstances of the particular case.” The motive or

purpose of the testator is irrelevant

HYPO: What if Daniel were gay? Would the get-married provision in his Dad’s will be

enforceable?

Analysis

1) Does Daniel have a constitutional argument here? No, because there is no state action.

Without state action Daniel can’t make a 14th Amendment argument

2) Does Daniel have a public policy argument? Daniel could make the public policy argument

that it would be against public policy to enter into a sham marriage for the sole purpose of

getting an inheritance

3) Restatement Analysis?? Most courts would hold against the restraint because “the marriage

permitted by the restraint is unlikely to occur

Point: There are limits on what you can do with your money after you die (i.e. – you can’t use

your money to support something that is against public policy). The court is going to try to

enforce what you do with your property but only to a certain extent

A will or trust provision is ordinarily invalid if it’s intended or tends to encourage

disruption of a family relationship. Thus, provisions encouraging separation or divorce have

usually been held invalid, unless the dominant motive of the testator is to provide support in the

event of separation or divorce

HYPO: What if Dad leaves you money on the condition that you get a divorce?

The court isn’t going to enforce this because it’s against public policy to make the break

up of marriage a condition of receiving an inheritance

In re Estate of Donner - Upholding father’s trust deny daughter trust income or principal

until age 65 unless her husband’s death or divorce should earlier occur on the ground that

the decedent had a reasonable economic basis to withhold support unless the daughter

became breadwinner of the family

-2-

Girard Trust Co. v. Schmitz – Court held invalid a condition that the testator’s brothers

and sisters must not communicate (either orally or in writing), with a brother and sister

disliked by the testator. The court said that it wouldn’t “lend its hand to help the testator

use the power of his wealth to disrupt the family. . . Society condemns all act, be they

contractual or testamentary, which tend to disturb the peace and harmony in preserving

Estate of Romero – Voiding condition discouraging youthful children from living with

their mother, the testator’s former wife

Destruction of Property: Court will not enforce a destructive condition where the testator who

made the decision will not suffer the economic loss.

HYPO: You put provision in your will that after your death you want your house

torn down. Will the court enforce this condition?

No. The court will not enforce this condition

Justice Black’s Notes – He wanted his notes of conference destroyed after his death

rather than being published. This would probably be enforced because there would be

valid reasons to protect those communications (i.e. – if notes were going to be published

might impact what Justice is willing to say in them

B. Professional Responsibility

Simpson v. Calivas (SCT of NH, 1994), p. 49

Facts: Simpson makes a will. In will gives wife (Roberta) a life estate in a “homestead.” Left all

other land to Robert Jr. In the Probate Court the issue was what “homestead” meant. Robert Jr.

argued that homestead meant just house and little parcel around house. Wife argued that

“homestead” meant whole parcel. Probate court didn’t admit notes of lawyer which clearly

indicated that term homestead meant just the house and surrounding yard. Probate court didn’t

admit lawyer’s note. Probate court admitted some evidence that didn’t contradict the plain

meaning of the language in the will. Probate court construed “homestead” as the entire parcel. It

concluded that she had a life estate in the whole parcel. Robert Jr. wasn’t happy ended up buying

out his stepmother.

Procedural History: He sued the attorney, in TC, bc he is not happy with the way that the

attorney drafted the will. TC found that the attorney didn’t owe any duty to the beneficiary of the

will (privity of contract concept: only relationship was between the attorney & testator). TC ruled

that bc the attorney owed no duty to Robert Jr. he had no basis to bring a malpractice claim

against him. TC also points out that the probate court already interpreted the will. TC ruled that

the probate court’s construction of the will collaterally estops Robert Jr. for suing the attorney for

malpractice. Robert Jr. appeals

Issue 1: Did the attorney owe a duty to the intended beneficiary of the will?

Held 1: The attorney did owe a duty to the intended beneficiary of the will. NH recognizes an

exception to the privity rule for intended beneficiary of a will on the rationale that otherwise the

attorney would be able to draft wills without any accountability. (A number of other states also

recognize an exception to the privity rule in this situation where there’s an intended

beneficiary of a will)

Issue 2: Is the beneficiary of the will collaterally estopped from bringing this claim?

Held 2: Not collaterally estopped bc the two courts were dealing with two different issues. This is

bc the functions of the two courts are different. Probate court determines the expressed intent by

-3-

examining language in will and extrinsic evidence. In short the probate court determines the

expressed intent. TC determines the actual intent Actual Intent

Judgment: Reverses on both rulings

Point: Be careful in the language that you chose you’re drafting a will. Attorney has to makes

sure that what he writes in the draft will match up with what the testator wants to do with his

property. As in this cases, beneficiaries may be allowed to sue when bc of sloppy drafting they

don’t get what they’re supposed to get

Simpson case is an illustration of sloppy drafting: : If the attorney had used simpler language

in the will here he would have avoided this problem (for instances if he used simpler language as

he did in his notes such as house & yard). This case dealt with where the language doesn’t match

up with what the testator intended bc of the lawyer’s sloppy drafting

Note: Some states only go so far as letting an intended beneficiary sue for negligence if the

negligence is apparent from the face of the will. (NH doesn’t recognize this limitation – in NH

it’s okay to look at extrinsic evidence)

Hotz v. Minyard (SCT SC 1991), p. 66

Facts: Minyard (testator) owned two dealerships at which his children, at which his children

Tommy and Judy worked. Dobson, an attorney and accountant, worked for the Minyard family

and their business. In 1984, he drafted two wills for Minyard. He asked Dobson not to reveal the

terms of the 2nd will, which was nearly the same as the first except that it gave the real estate

outright to Tommy. Dobson discussed the terms of the 1st will with Judy and told her that she

would be receiving an equal share of the dealerships with her brother even though her first will

was actually revoked. After a failing out with her brother over the operation of the business Judy

filed suit against her brother. Minyard then cut her out of the will entirely. Dobson also served as

Judy’s lawyer. After her father’s death, Judy filed suit against Dobson for misleading her about

her status under the will. TC granted summary judgment to Dobson on the issue of his duty to

Judy. Judy appealed.

Rationale: Although Dobson represented Minyard and not Judy w/r/t the will, he did have an

ongoing legal relationship with Judy. Thus while he had no duty to disclose the 2nd will, Dobson

owed a duty to deal with her in good faith and not actively misrepresent the situation.

Judgment: Reversed and remanded

C. Is Probate Necessary? (p. 44)

Probate is not always necessary

Red flag: Any thing that’s worth a substantial amount of money should clue us in that the

survivor should probably go through probate (see p. 46)

Problem 1: Aaron Green died 3 weeks ago. His wife has come to your law firm with

Green’s will in hand: The will devises Green’s entire estate “to my wife, Martha, if she

survives me; otherwise to my children in equal shares.” The will names Martha Green as

executor. An interview with Mrs. Green reveals that the Green family consists of 2 adult

sons and several grandchildren and hat Green owned the following property:

Furniture, furnishings, other items of tangible

personal property (estimated value)

Savings account in name of Aaron Green

-4-

$ 10,000

5,000

Joint checking account on which Aaron and

Martha Green were both authorized to write

checks

Employer’s pension plan, naming Martha

Green for survivor’s benefits

Government bonds, payable to “Aaron or

Martha Green”

Ordinary life insurance policy naming Martha

Green as primary beneficiary

Ford Car

1,500

Life Annuity

5,000

25,000

7,500

Green owned no real property; he and his wife lived in a rented apartment. Green debt’s consisted

of last month’s utility bills ($40) plus the usual consumer charge accounts: Visa card ($300

balance), the local dept store ($125), Exxon ($35). There is also a funeral bill ($1,225) and the

cost of a cemetery lot ($300). Mrs. Green wants your advice: What should she do with the will?

Must it be offered for probate? Must there be an administration of her husband’s estate?

Probably Mrs. Green shouldn’t probate the will because this is a small family situation.

Car: In most states she’ll only need an affidavit to get title to the car

Bank Account: In most states she’ll only need an affidavit to get title to the bank account

Stocks: Where amount is small statutes in all states permit heirs to avoid probate (p. 46)

Furnishings: She already has possession of the furnishings. No problem here? Barring no

dispute from relatives or creditors no problem

(5) Life Insurance: She’s a beneficiary on the life insurance so no problem there

(6) Bonds: The bonds were payable to her or her husband so no problem there

(1)

(2)

(3)

(4)

(7) Debts: Her husband didn’t have many debts (credit cards, cemetery payments). There is a

slim chance of unknown creditors coming out of the woodwork. But even if there were

unknown creditors she can probably cover it with the money she’s getting out of the life

insurance or by writing checks out of the savings account.

Conclusion: We have a small family situation. They can probably sit down and decides who gets

what. Also, don’t need probate here to collect assets for distribution (i.e. pay-off creditors). So

there is no advantage of going through probate. Also don’t need the title clearing benefit of

probate here because she access to all the personal property. Note that if her husband owned real

property in his own name probably would need probate bc of its title clearing function

Variation # 1: What if Aaron was the sole proprietor of a small business?

She should go through probate in order to put creditors on notice. She should do this bc her

husband may have creditors that she doesn’t know about. You would want to have the advantage

of probate so that creditors could come forward and get satisfied in whole or in part.

Variation # 2: What if there were huge debts?

This is the scenario where she knew about the creditors but the amount owed to them was more

than she could pay off from the estate. In this scenario she would want to go through probate bc

there is a “homestead exception” (in some states the home can’t be used to satisfy the creditors).

So in the case of extremely large debts she also probably would want to go through probate

-5-

Problem 2: Same facts in Problem 1 except that Green died intestate and the state’s

statue of descent and distribution provides that where a decedent is survived by a

spouse and children, one-half of his real and personal property shall descend to the

spouse, and the remaining one-half shall descend to the children

Again we have a situation where the family should try to work this out without going

through probate. Under statutes in most states, certain percentage of estate goes to

spouse, remainder goes to children. In this situation, it would make sense of the children

not to challenge the mother’s right to have all these assets (so that they can get something

after she dies). On the other hand, if this is a dysfunctional family, might need probate to

determine how everything is going to be distributed

Problem 4: Suppose Green comes to you and tells you that he doesn’t have a will. He

describes his family situation and the assets owned by him (the assets listed in problem

1). His question: In view of his family situation and his modest estate, does he really

need a will?

You should advise him that it’s a very good idea to have a will because: (1) the family

dynamics could change, (2) his situation could change (i.e. – he could win the lottery),

and (3) it’s always better to get his intentions in writing what he wants done with his

property when he dies

AN ESTATE PLANNING PROBLEM (p. 49)

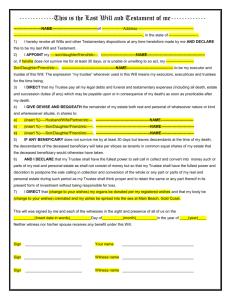

First Article: “Just Debts Clause”

A “Just Debts Clause” is a pretty typical clause: it directs that all his just debts be paid as soon as

practicable.

Issue: What constitutes a “Just Debt”?

▪ What constitutes a “just debt” will depend upon the jurisdiction. You need to know what

constitutes a “just debt” in your jurisdiction before you put this language in because effect the

advise you give to your client

▪ Does a mortgage constitute a “just debt”? This will depend on the jurisdiction. For this

reason. you need to know what constitutes a “just debt” in the jurisdiction because it will alter

the advise that you your client

▪ Does a claim that may be barred by the Statute of Limitations a “just debt”? You don’t have

to worry about these because you’re not required to pay something in death that you couldn’t

be required to pay while you’re alive

▪ Does a prenuptial agreement constitute a “just debt”? Depends on you’re jurisdiction. Some

jurisdictions say that this does qualify as a just debt but the law is still evolving in that area.

[This is the scenario where you say that a just debt is owed to me (the amount specified in the

prenuptial agreement) and I am not covered by the will]

▪ Point: What is or isn’t a “just debt” isn’t always clear. A just debt can be something other

than a bill or money owned to creditors

Second Article: Howard names his wife to be the executor of his estate

Howard makes an assumption here that you shouldn’t make. Howard is assuming that he is going to

die before his wife. But even if that assumption is true, he is making another assumption that he

shouldn’t make – namely that his wife is going to be competent at that time. He makes no provision

for the fact that Wendy might not be competent (i.e. – she could get Alzheimer’s). This is something

else that Howard should have thought about

-6-

Fifth Article: Empowers the executor to sell property and convert it into cash

Here Howard does something that is pretty smart. He has empowered the executor to sell property

without getting power from the court. When you (testator) name an executor, you want to give the

executor as much power as possible. That way, if the executor has to sell the property, the executor

won’t have to waste additional money and time to get court approval to sell the property. Any power

that you don’t give the executor is going to require another trip to court!!!

Fourth Article: Howard leaves everything to his wife Wendy

This may or may not be appropriate. What happens if Wendy and Howard die in a common disaster

(i.e. – plane crash)? Under this provision all of Howard’s property will go to Wendy upon his death.

Because Howard has made provision of the contingency of simultaneous death the property will have

to go through probate twice. Having to go through probate twice will be expensive and it’s not the

most practicable way to do this

Point: There are many things that Howard didn’t incorporate in his will either because he didn’t

anticipate them or think about them

Some Steps Howard should take

1) Put in common disaster provision

2) Name an alternate executor

-7-

Chp. 2. Intestacy: An estate plan by default

A. Basic Scheme

1. Intestacy: An estate plan by default: If a person does not have a will or does not

dispose of all his property by nonprobate transfers his property will pass by the laws of

intestacy

What do the laws of intestacy try to do? To carry out the probable intent of the average

intestate decedent

Governing law: Distribution of the probate property of a person who dies w/out a will,

or whose will does not make a complete disposition of the estate is governed by the

statute of descent and distribution of the pertinent state. Each state’s laws of intestacy are

different

a. Personal Property: The law of the state where the decedent was domiciled at death

governs the disposition of personal property

b. Real Property: The law of the state where the decedent’s real property is located

governs the distribution and disposition of real property

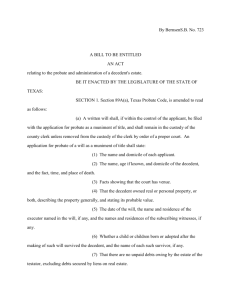

UPC § 2-101 Intestate Estate

(a) Any part of a decedent’s estate not effectively disposed of by will passes by intestate

succession to the decedent’s heirs as prescribed in this Code, except as modified by

the decedent’s will

(b) A decedent by will may expressly exclude or limit the right of an individual or class

to succeed to property of the decedent passing by intestate succession. If that

individual or a member of that class survives the decedent, the share of the

decedent’s intestate estate to which that individual or class would have succeeded

passes as if that individual or each member of that class had disclaimed his or her

intestate share

What happens to property not mentioned in a will absent a “catchall” clause? If

there is no “catchall clause” in a will, property not mentioned in the will will pass by the

laws of intestacy

UPC § 2-102 Share of Spouse, p. 72

The intestate share of a decedent’s surviving spouse is:

(1) Entire intestate estate if

(i)

no descendent or parent of the decedent survives the decedent; or

(ii)

all of the decedent’s surviving descendents are also descendants of the

surviving spouse and there is no other descendant of the surviving spouse

who survives the decedent

-8-

(2) Parent. If no descendant of the decedent survives, but a parent of the decedent

survives the intestate share of the decedent’s spouse is $200,000 + ¾ of any

balance of the intestate estate

(3) Children from Marriage & Surviving Spouse has Children. If all of the

decedent’s surviving descendants are also descendants of the surviving spouse

and the surviving spouse has one (or more) surviving descendants who are not

descendants of the decedent $150,000 + ½ of any balance of the intestate

estate

(4) Decedent has children. If one or more of the decedent’s surviving descendants

are not descendants of the surviving spouse $100,000 + ½ of any balance of

the intestate estate

Why does the legislature make the distributions in § 2-102(3) and § 2-102(4)

different?

Legislature presumes that surviving spouse will leave money to his/her children and not

the decedent’s children from previous marriage. Legislature gives decedent’s kids

money upfront insure that they get it. As for the surviving spouse, the legislature

presumes that children from the marriage or children from the surviving spouse’s

previous marriage will take by laws of intestacy/will

UPC § 2-103 Share of heirs other than surviving spouse, p. 73

Any part of the intestate estate not passing to the decedent’s surviving spouse under § 2102, or the entire estate if there is no surviving spouse, passes in the following order to

the individuals designated below who survive the decedent

1. decedent’s descendants by representation (children / grandchildren)

2. decedent’s parent(s)

3. descendants of the decedent’s parents (siblings)

4. decedent’s grandparents or their descendants by representation (grandparents)

Note: This list shows the order in which people take. If there is more than one person in a

group they take equal shares. For example, if decedent dies w/out descendants and is

survived by both her parents then the parents get equal shares

UPC § 2-105 No taker, p. 74

If there is no taker under the provisions of this Article, the intestate estate passes to the

state.

Why does the legislature put children first?

Legislature presumes that parents always want to give money to their kids (societal

value). There’s a belief that it benefits society to give the money to the younger

-9-

generation because there is a higher probability that the money will go back into the

economy

2. Shares of Surviving Spouse

Single most common statutory provision: Under current law, the single most

common statutory provision is to give the surviving spouse a ½ share if only one

child or issue of one child and a 1/3 share if more than one child or issue a

deceased child survive

Other statutory provisions: Some statutory provisions give the surviving spouse

½ or 1/3 regardless of the number of children or descendants or giving the

surviving spouse a child’s share

UPC § 2-102 Share of Spouse, p. 72

(1) The intestate share of a decedent’s surviving spouse is the entire intestate

estate if

(i)

no descendent or parent of the decedent survives the decedent; or

(ii)

all of the decedent’s surviving descendents are also descendants of

the surviving spouse and there is no other descendant of the

surviving spouse who survives the decedent

(2) If no descendant of the decedent survives, but a parent of the decedent

survives the intestate share of the decedent’s spouse is $200,000 + ¾ of

any balance of the intestate estate

(3) If all of the decedent’s surviving descendants are also descendants of the

surviving spouse and the surviving spouse has one (or more) surviving

descendants who are not descendants of the decedent the intestate share of the

decedent’s spouse is $150,000 + ½ of any balance of the intestate estate

(4) If one or more of the decedent’s surviving descendants are not descendants of

the surviving spouse the intestate share of the decedent’s spouse is

$100,000 + ½ of any balance of the intestate estate

Note: This UPC provision for the surviving spouse is considerably more generous than

are the current provisions for the surviving spouse under most state intestacy laws

PROBLEM 1: Howard has two children by Wendy. Wendy has two children by Howard

and a child by a previous marriage. If Howard dies before Wendy intestate, what will be

Wendy’s share under UPC § 2-102?

UPC § 2-102(2) The intestate share of a decedent’s surviving spouse is:

“$150,000 + ½ of the balance of the intestate estate, if all of the decedent’s

surviving descendants are also descendants of the surviving spouse and the

surviving spouse has one or more surviving descendants who are not descendants

of the descendent”

UPC § 2-102(2) is the applicable section here bc Howard has no children from a

previous marriage but does have children from his marriage from Wendy thus “all

- 10 -

of the decedent’s surviving descendants of the surviving spouse.” And bc Wendy

has a child from a previous marriage it’s the case here that the “surviving spouse

has a surviving descendant who is not a descendant of the descendent.” Thus

Wendy gets $150,000 + ½ of the remainder. Wendy and Howard’s 2 children

share ½ of the remainder

What assumption are the drafters of the UPC making in § 2-102(2)? In cutting

Wendy’s share to $150,000 plus half the remainder, the UPC is assuming that H would

want his money to go his kids. The result of this is that the children end up with unequal

distributions. Wendy’s kid gets nothing, and the two kids from W & H’s marriage get an

equal share of half the remainder. Belief that Wendy can fix any problems that arise as a

result of this property distribution by writing her own will

PROBLEM 2: Howard has two children by Wendy. Wendy has two children by Howard

and a child by a previous marriage. If Wendy dies before Howard intestate, what will be

H’s share under UPC § 2-102?

UPC § 2-102(4) The intestate share of a decedent’s surviving spouse is $100,000

+ ½ of the balance of the intestate estate, if one or more of the decedent’s

surviving descendants are not descendants of the surviving spouse

§ 2-102(4) is the applicable section here bc “one or more of the decedent’s

surviving descendants are not descendants of the surviving spouse.” Thus

Howard gets $100,000 plus ½ of the remainder. Wendy’s child from the previous

marriage gets the other ½ of the remainder.

Why the difference in outcome in Problem 1 and Problem 2? This difference comes

about bc trying to give decedent’s child, who is not a child of the surviving spouse, more

money up front. Legislature assumes that the deceased spouse’s child might not be the

natural object of the surviving spouse’s bounty. Legislature assumes that children of the

surviving spouse on the other hand will be taken care of later by laws of intestacy or by

will.

PROBLEM 3: Howard dies intestate and Wendy does not have a child by a previous

marriage. What is Wendy’s share under UPC § 2-102?

Wendy takes all of Howard’s estate under § 2-102(1)(ii)

PROBLEM 4: Howard and Wendy have been married one year. Howard dies, survived by

Wendy and a brother, but no parent. What is Wendy’s share?

Under § 2-102(1)(ii) Wendy gets everything

PROBLEM 5: Howard and Wendy have been married one year. Howard dies, survived by

Wendy and a brother, but no parent. What if Howard made a will and decided that he was

going to leave Wendy 50 cents? Is Wendy limited to getting that 50 cents?

- 11 -

No, Wendy is not limited to getting the 50 cents she can choose to take an elective

share since Howard has made a will.

State Elective Share Provisions: Each state has elective share provisions that

allow the surviving spouse to take his/her elective share instead of taking what

he/she gets under the will

UPC Elective Share Provisions: Under the UPC there is a sliding scale that goes

up incrementally every year of marriage

What would Wendy’s elective share be under the UPC?

▪ § 202(a): gives surviving spouse of a one-year marriage only 3% of the

decedent’s estate if the decedent leaves a will and the spouse elects to take

against the will

▪ Conclusion: Under § 2-202(a) Wendy’s share would be 3% because she has

only been married one year

How do we justify that if there is no will Wendy gets everything and that if there is a

will and she elects to take against it she only gets 3% of Howard’s estate?

Under the laws of intestacy, the legislature is trying to guess the intent of the husband.

Legislature assumes that most individuals would choose to leave their entire estate to

his/her spouse if he/she does not have kids and is not survived by his/her parents. But

when there’s a will we don’t have to guess the testator’s intent. With an elective share

we hare saying as a society that the distribution the spouse has made is unfair. Society is

doing what it thinks is fair based upon the amount of time that the couple was married

Can you cut your spouse entirely out of the will?

No. You can cut everyone else out of the will except your spouse. If you leave your

spouse a very small amount the spouse can elect to take an elective share in accordance

with the laws of the state.

Situations in which you have a couple living together but not married

a. Bigamous marriages: Does the second wife get a share of the estate?

HYPO: Henry dies intestate. Anne, with whom he has been living claims

a spouse’s share. Is Anne entitled to such if she married Henry but the

marriage is bigamous?

Anne has problems. She make a few arguments to support her

case, particularly if she didn’t know about Henry’s other wife

(wife # 1). Some states will protect Anne and give her a share of

the estate

b. Male-Female Couple just co-habitats: On what basis may a co-habitant

collect?

- 12 -

Common law marriages: Some states recognize common law marriages.

A co-habitant who is considered to be married by “common law marriage”

provisions acquires the same rights he/she would have acquired had they

gone through a marriage ceremony. In such a state such a person would

be considered a spouse and therefore would be entitled to take under the

laws of intestacy. If a co-habitant is in a state that does not recognize

common law marriages, there is no possibility that the co-habitant will be

considered a spouse and thus no possibility that the co-habitant can take

under the laws of intestacy.

Contracts to make will: In some states, a co-habitant can bring a claim

under a contract theory. The law in this area is developing and changing

c. Same Sex Couples: On what ground can a surviving partner seek to collect?

Contract theory: A surviving partner of a same sex partner may want to

try to collect under a contract theory

Reciprocal Beneficiaries: Some states, such as Hawaii, persons who are

forbidden to marry can register with the state as “reciprocal beneficiaries.”

Reciprocal beneficiaries are given many of the benefits of surviving

spouses, including the right to inherit under the intestacy statute the same

share as a legal spouse receives and the right to an elective share

3. Uniform Simultaneous Death Act

Uniform Simultaneous Death Act (USDA): Provides that where “there is no

sufficient evidence” of the order of deaths, the beneficiary is deemed to have

predeceased the benefactor. (Note it’s not clear what “sufficient evidence” means.

See Janus case below)

What’s the effect of the Uniform Simultaneous Death Act? It prevents an

estate from having to go through probate twice (very costly)

What triggers the presumptions of the simultaneous death act? If the will

does not provide for what happens if both the spouses dies in a common disaster

then the simultaneous death act comes into play and the property is distributed in

accordance with its presumptions

HYPO: Couple dies in a common disaster. H and W have reciprocal wills. H

leaves everything to W except if W is dead then it goes to X. W leaves

everything to H, if H is dead then everything goes to X. What happens if we can’t

tell who died first?

H: Under the USDA, assuming that there is no sufficient evidence of the

order of deaths, we presume that H’s beneficiary predeceased him. Thus the

estate will go directly to X w/out having to be probated through W’s estate

first

- 13 -

W: Under the USDA, assuming that there is no sufficient evidence of the

order of deaths, we presume that W’s beneficiary predeceased her, so the

estate goes directly to X w/out having to be probated trough H’s estate first

Issue: What constitutes “sufficient evidence” under the Uniform Simultaneous

Death Act?

Janus v. Tarasewicz (IL App Ct, 1985), p. 78

Facts: H and W both ingest Tylenol laced with cyanide. H is pronounced dead at

hospital. W is placed on life support for almost 2 days. On 2nd day, W if

pronounced dead. Claiming that there was no sufficient evidence that W survived

H, H’s mother brought an action for the proceeds of H’s $100,000 life insurance

policy which named W has primary beneficiary and H’s mother as the contingent

beneficiary. H’s mother argued that there wasn’t sufficient evidence to show that

H and W weren’t brain dead when they reached the hospital

Issue: Was there sufficient evidence that W survived H?

What constitutes sufficient evidence? The court in this case equates “sufficient

evidence” with “some evidence.” Court follows preponderance standard?

Held: There was sufficient evidence that W survived H and therefore the

presumptions of the Uniform Simultaneous Death Act do not come into play

Rationale: Court looks at the hospital records and says there certainly is some

evidence that W was in better shape than H

Criticisms of the Janus case: This case liberalizes the definition of “sufficient

evidence” where it would perhaps have been more appropriate to have had

everything decided under the Uniform Simultaneous Death Act. By liberalizing

the definition, the court is inviting litigation.

Key to Janus case: This case illustrates that the court’s standard for “sufficient

evidence” can influence: (1) the outcome of the case, and (2) a party’s willingness

to pursue litigation w/r/t to the order of death issue

Liberal interpretation of “sufficient evidence” invites litigation: The more

liberally a court interprets the word “sufficient” the less likely it is that there is

going to be an easy and orderly disposition of the estate because the chances are

much higher that the order of death issue is going to be litigated

How does the standard has an impact on whether people decide to litigate the

issue?

In most cases the medical records are never going to be completely clear. In most

situations the respective parties are going to be able to find experts who will

interpret those records in the way that they want

▪ Lower standard: If there’s a lower standard of w/r/t what “sufficient

evidence” constitutes such that you need to show by a preponderance of the

evidence that W survived H (i.e. - a little bit of evidence such a blink of an

eye) there’s going to be litigation

- 14 -

▪

Higher standard: If the standard higher (i.e. – there has to be clear and

convincing evidence that W survived H) then it is much less likely that people

are going to litigate the matter – instead if the standard is high enough they

will be more inclined to let the matter be decided by the Uniform

Simultaneous Death Act

Clear & Convincing Standard: People will be less inclined to pursue litigation

bc the burden of proving that W survived H or vice versa. If the court follows this

high standard the parties will be more inclined to let the matter be decided by the

Uniform Simultaneous Death Act

Preponderance of the Evidence Standard: If the court follows this standard,

people will be more inclined to pursue litigation because the burden of proving

that W survived H or vice versa is much easier to meet (i.e. – under this standard,

showing that W blinked might be deemed by the court to be ‘sufficient’ evidence

that W survived H)

Key Point: How liberally or narrowly the court interprets “sufficient” has an

impact on the outcome

HYPO: H and W both drown in a boating accident. The evidence shows that W

was a better swimmer and in better health than H. In addition, the autopsy shows

W drowned after a violent struggle while H passively submitted to death. Is there

sufficient evidence of W’s survival?

In this case, the court held that there wasn’t sufficient evidence that W

survived H because there were a number of alternative explanations that

could have explained the autopsy results. The very fact that alternative

explanations existed meant that there wasn’t sufficient evidence that W

survived H.

HYPO: H and W are killed in the crash of a private airplane. An autopsy reveals

W’s brain is intact and there is carbon monoxide in her blood-stream; H’s brain is

crushed and there is no carbon monoxide in his blood-stream. Is there sufficient

evidence of W’s survival?

In this case, the court held that there was sufficient evidence that W

survived H. Nature of injuries sufficient evidence to suggest that W lived

longer than H

Can a person get around the problem created by the Uniform Simultaneous

Death Act? Yes. A person can get around the interpretational problems created

by the USDA by putting a provision in his will such as the following: “if any

person dies with me in a common disaster, any property given to such person by

this will shall pass as if such person predeceased me.”

- 15 -

4. Shares of Decedents

In all jurisdictions, after the spouse’s share is set aside, the children and the issue

of the deceased children take the remainder of the property to the exclusion of

everyone else

Taking by Representation: This is the case where one of the decedent’s children

has predeceased him/her but the deceased child is survived by issue. Under the

doctrine of representation, the deceased child’s issue are allow to represent the

deceased child (i.e. – take his/her share). They’re 3 different views about what

taking by representation means.

Illustration: The intestate decedent, A has 3 children: B, C, and D. C

predeceased A. C is survived by a husband and 2 children F and G. A is survived

by two children B and D. D has two kids H and I. B has one child E. How are

A’s assets going to get distributed?

If all three of A’s children were alive each would get a 1/3 share of A’s

estate.

Because C is not alive C’s children (F and G) take C’s share by

representation. These get to split C’s 1/3 share so that each gets a 1/6

share. C’s husband gets nothing because son-in-laws and daughter-inlaws are excluded as intestate successors in virtually all states. D and B

(A’s surviving children) each get their 1/3 share. D’s children (H and I)

and B’s child (E) take nothing because their parents are living.

A

B

C (leaves husband)

E

F

G

D

H

I

(Survivors are underlined; all others are dead)

What would happen if C did not have any issue? The estate would just

be divided up between B and D as if C didn’t exist

Starting Point: Where do you start to divide up the pot into shares?

Why is determining where you begin to divide up the pot so important? This

is key because the level at which you start to divide the pot into shares will

determine the distribution

- 16 -

a. Class Per Stripes Distribution

Classic Per Stripes Distribution: divides the property into as many

shares as there are living children of the designated person and deceased

children who have living descendant.

Where do you start to divide the pot? At the level of the living

decedent’s children or at the level of the deceased children’s living

decedents

Hypo: A, decedent, had 2 children (B & C). B and C are dead. B had one

child D. D is still alive. C had two children E and F. E and F are dead.

E’s two children (G and H) are alive. F’s child I is alive. How does A’s

estate get distributed under the classic per stripes distribution scheme?

The pot gets divided at the level of A’s children (B & C). Because A had 2

kids the pot gets divided into 2 pieces. Thus if B and C were alive they

would each get ½ of A’s estate. But B and C are not alive so we must look

at generational levels to below B and C to see if they have any living

decedents who can take by representation. B’s issue D is alive, so D takes

B’s ½ share by representation. C’s issue E and F are not alive, so we

must go down to the next generational level to see if E and F have any

living decedents who can take by representation. If E and F were alive

they would have split C’s ½ share equally so that they would have each

gotten ¼. F is survived by issue I: I will take F’s ¼ share by

representation. E is survived by issue G and H. G and H will take E’s ¼

share by representation such that they each get half of it – G gets 1/8 and

H gets 1/8.

A

B

C

D (½)

E

G (1/8) H(1/8)

(Survivors are underlined; all others are dead)

- 17 -

F

I (¼)

b. Modern Per Stripes Distribution

Modern Per Stripes Distribution: Divides the decedent’s estate into shares

at the generational level nearest decedent where one or more descendants of

the decedent are alive and provide for representation of any deceased

descendant on that level by his/her descendants (p. 87)

Where do you begin to divide up the pot? Go down the generational tree

until we find someone alive and then start the distribution process

HYPO: A, decedent, had 2 children (B & C). B and C are dead. B had one

child D. D is still alive. C had two children E and F. E and F are dead. E’s

two children (G and H) are alive. F’s child I is alive. How does A’s estate get

distributed under the modern per stripes distribution scheme?

Neither B or C (A’s children) are alive so we move down to the next

generational level to see if there is anyone alive. In the next level (level of

A’s grandchildren) D is alive so we start dividing the pot at this level. We

divide into as many pieces as there are living children and/or deceased

children with living descendants. We divide the pot into 3 because there are 3

people at this generational level (note that the two who are dead have living

descendants). D takes 1/3 share. If E were alive he would get 1/3 share but

he is not so we look to the next generational level to see if he has any living

descendants who can take his share by representation. E has two living

descendants – G and H. G and H take E’s 1/3 share by representation,

splitting it equally between them such that they each get a 1/6 share. F would

get a 1/3 share if he were alive. But because F is not alive we need to look to

the next generational level to see if F has any living descendants who can take

F’s 1/3 share by representation. F has one living descendant – I. I will take

F’s 1/3 share by representation.

A

B

C

D (1/3)

E

G (1/6) H(1/6)

(Survivors are underlined; all others are dead)

- 18 -

F

I (1/3)

c. UPC § 2-106 Distribution Method

§ 2-106 Representation, p. 88

If, under § 2-103, a decedent’s intestate estate or a part thereof passes “by

representation” to the decedent’s descendant, the estate or part thereof is

divided into as many equal shares as there are:

(i)

surviving descendents in the generation nearest to the descendant

which contains one or more surviving descendants and

(ii)

deceased descendants in the same generation who left surviving

descendants, if any. Each surviving descendant in the nearest

generation is allocated one share

The remaining shares, if any, are combined and then divided in the same

manner among the surviving descendants of the deceased descendants as if the

surviving descendants who were allocated a share and their surviving

descendants had predeceased the decedent.

Where do you begin to divide the pot? Start dividing the pot at the first

generational level where there is someone alive. This differs from modern per

stripes distribution in that you divide up the pot where there is someone alive,

give that person his share, then move the remaining as a whole down to the

next generational level where there are living descendants and split that

remaining share as whole among those living descendants

Note: UPC § 2-106 ties to put into effect what most people want. By not

dividing the pot until you hit a generational level that tries to treat all the great

grandchildren the same (i.e. – give them equal shares). Most people assume

that if they die intestate all their great children will get equal shares, however,

that will only happen under the UPC § 2-106 distribution scheme

HYPO: A, decedent, had 2 children (B & C). B and C are dead. B had one

child D. D is still alive. C had two children E and F. E and F are dead. E’s

two children (G and H) are alive. F’s child I is alive. How does A’s estate get

distributed under the distribution scheme in UPC § 2-106?

Under UPC § 2-106 we first begin to divide the pot at the first generational

level where we find someone alive. Neither of A’s children, B or C are alive

so we look to the next generational level to see if either of them has any living

descendants. B’s issue D is alive. There are two others at that generational

level, C’s issue E and F. So the pot gets divided into 3. Because D is alive

and ready to take he gets a 1/3 share. 2/3 of the pot remains. Because

neither E or F is alive, the remaining 2/3 share gets dropped down to the next

generational level as a whole. We then split the 2/3 share equally between the

living descendants. E has two living decedents: G and H. F has one living

descendant – I. Thus there are a total of 3 living descendants at the

- 19 -

generational level of (A’s great grandchildren). The three great grandchildren

(G, H, and I) get to split the 2/3 share equally between them. Thus G, H, and I

each get a 2/9 share.

The 2/3 remaining

A

in the pot moves down

B

C

D (1/3)

E

G (2/9) H(2/9)

F

as a WHOLE to the

next generational level

where there are living

descendants and then

split equally among

those in that

generational level

I (2/9)

(Survivors are underlined; all others are dead)

Things to remember

Under all 3 methods, do not go beyond somebody who is alive. Once you find

someone alive stop there!!!!!

These distribution schemes come into play only if you don’t have a will

Sometimes you will end up with the same result under all 3 distribution

schemes but that is not always the case

5. Negative Disinheritance

Traditional Rule: An old rule of American inheritance law says that

disinheritance is not possible by a declaration in a will that “my son John shall

receive none of my property.” To disinherit John, T would have to devise his

entire estate to other persons. If there is a partial intestacy for some reason, John

will take an intestate share notwithstanding such a provision in a will.

UPC § 2-101(b) authorizes a negative bequest. The barred heir is treated as if

he disclaimed his intestate share, which means that he is treated as having

predeceased the intestate.

UPC § 2-101(b) A decedent by will may expressly exclude or limit the

right of an individual or class to succeed to property of the decedent

passing by intestate succession. If that individual or a member of that

class survives the decedent, the share of the decedent’s intestate estate

to which that individual or class would have succeeded passes as if that

individual or each member of that class had disclaimed his or her

intestate share (p. 72)

CAUTION: You need to know whether UPC § 2-101(b) has been enacted in

your jurisdiction to know whether you can specifically disinherit someone in your

will

- 20 -

6. Shares of Ancestors and Collaterals

Collateral kindred: All persons who are related by blood to the decedent but

who are not descendants or ancestors

1st line collateral: Descendants of the decedent’s parents, other than the

decedent and the decedent’s issue (i.e. – siblings, nieces, nephews)

2nd line collateral: Descendants of the decedent’s grandparents, other than the

decedent’s parents and their issue (i.e. – aunts, uncles, cousins)

What does the table of consanguinity do? It categorizes your relatives in degree

of their relationship to you

How does the table of consanguinity work: You start at the top row of the first

column and work your way down to see if there is a direct decedent to take. If

there is no one in that column then you go to the top of the 2nd column and work

your way down to see if there are 1st line collateral to take. If there are no 1stline collateral to take, then there are several different systems to determine which

relative should take (see below).

When do we use the table of consanguinity? The table of consanguinity comes

into play when we are trying to determine which collateral relative(s) should take.

Thus if there are direct decedents who are ready and willing to take we do not use

the table of consanguinity

- 21 -

Table of Consanguinity (p. 92)

Direct

descendants

First line

Second line

Third line

Fourth line

Great-great

grandparents

3

Great

grandparents

5

Great-grand

uncles/aunts

2

Grandparents

4

Great

uncles/aunts

6

1st cousins

twice removed

1

Parents

3

Uncles

Aunts

5

1st cousins once

removed

7

2nd cousins once

removed

2

Brothers

Sisters

4

1st cousins

6

2nd cousins

8

3rd cousins

1

Children

3

Nephews

Nieces

5

1st cousins once

removed

7

2nd cousins once

removed

9

3rd cousins once

removed

2

Grandchildren

4

Grand nephews

Grand nieces

6

1st cousins twice

removed

8

2nd cousins twice

removed

10

3rd cousins twice

removed

3

Great-grand

children

5

Great-grand

nephews / nieces

7

1st cousins thrice

removed

9

2nd cousins

thrice removed

11

3rd cousins

thrice removed

Person deceased

If there are no 1st line collateral, there several different systems to determine

who is next in line of succession

a. Parentelic system: The intestate estate passes to grandparents and their

descendants, and if none to great-grandparents and their descendants, and if

none to great-grandparents and their descendants, and so on down each line

(parentela) descended from an ancestor until an heir is found

Keep moving through these lines to the right until you find a

category where there is somebody alive who is ready and willing

to take

b. Degree-of-relationship system: The intestate estate passes to the closest of

kin, counting degrees of kinship

How do you determine the degree of the relationship of the

decedent to the claimant? To ascertain the degree of relationship

of the decedent to the claimant you count the steps (counting one

- 22 -

for each generation) up from the decedent to the nearest common

ancestor of the decedent and the claimant, and then you count the

steps down to the claimant from the common ancestor. The total

number of steps is the degree of the relationship

Under this system your estate goes to your closet kin by counting

the degrees of relationship on the chart (that’s what the numbers

are for). You can’t move horizontally across these rows. Follow

the lines + count the steps (i.e. – parents are 1st degree,

grandparents are 2nd degree, great grandparents are 3rd degree)

c. UPC system: Is the most restrictive system w/r/t collateral relatives. The

UPC system excludes the last two columns of the table of consanguinity.

Under this system only collateral relatives in the first two columns are

entitled to take (i.e. – it does not permit inheritance by intestate succession

beyond grandparents and their descendants). The consequence of this is that if

decedent doesn’t have a collateral relative in the first two columns who can

take (i.e. – he only has a great-grand parent or a descendant thereof who can

take), the decedent’s estate escheats to the state

§ 2-103 Share of heirs other than surviving spouse, p. 73

Any part of the intestate estate not passing to the decedent’s

surviving spouse under § 2-102, or the entire estate if there is no

surviving spouse, passes in the following order to the individuals

designated below who survive the decedent

1. decedent’s descendants by representation (children /

grandchildren)

2. decedent’s parent(s)

3. descendants of the decedent’s parents (siblings)

4. decedent’s grandparents or their descendants by

representation (grandparents)

§ 2-105 No Taker: If there is no taker under the provisions of this

Article, the intestate estate passes to the state (p. 74)

Problems (p. 96)

7. Half-Bloods

UPC § 2-107: Half-bloods (i.e. half-sister) are treated the same as whole-blood relatives

[This is the approach taken by the majority of jurisdictions]

Majority view: In the majority of jurisdictions, half-bloods (i.e. half-sister) are treated

the same as whole-blood relatives

Minority positions

a. Half-share: In a few states a half-blood is given a half share (Virginia)

- 23 -

b. Take only when no whole-blood relative of same degree: In a few states, a halfblood takes only when there are no whole-blood relatives of the same degree

(Mississippi)

Caution: You need to be aware of the what the rules are in your particular jurisdiction to

determine who gets what in this situation

HYPO : M has 1 child (A) by her 1st marriage and 2 children (B & C) by her 2nd

marriage. M and her second husband die. Then C dies intestate, unmarried and w/out

descendants. How will C’s property be distributed? (p. 97)

The way in which C’s property will be distributed will depend upon the intestacy

laws of the state:

1) UPC: The UPC makes no distinction between half-blood and whole-blood

relatives. Thus under the UPC both A and B will get ½ of A’s estate since C has

no spouse or descendants

2) Virginia: Under the intestacy laws of Virginia, a half-blood is given a half share.

Thus A is entitled to get half of what's B entitled to get under the laws of

intestacy. Thus A only gets half as much as B

3) Mississippi: Under the intestacy laws of Mississippi, a half-blood takes only

when there are no whole-blood relatives of the same degree. Thus A gets nothing

because there is a whole-blood relative of the same degree (B) to take.

B. Transfers to Children

1. Meaning of Children

Issue: What does it mean for somebody to be your child?

a. Posthumous Children

Rebuttable presumption: Courts have established a rebuttable presumption that

the normal period of gestation is 280 days. This means that if the child is born

w/in that 280 gestation-period the child is presumed to be the man’s child and

thus is entitled to a share of the estate. If the child claims that the conception

dated more than 280 days before birth, the burden of proof is usually upon the

child to prove that he is the man’s child. (p. 97)

b. Adopted Children

Hall v. Vallandingham (Md. App 1998), p. 98

Facts: Earl Vallandingham died in 1956 survived by his widow (Elizabeth) and

their four children. Two years later, Elizabeth married Jim Killgore. Jim adopted

Elizabeth’s children. In 1983 (25 years after the adoption of Earl’s children by

Killgore), Earl’s brother died childless, unmarried, and intestate. His only heirs

were his surviving brothers and sisters and the children of brothers and sisters

who predeceased him. Earl’s four kids brought suit alleging that they were

- 24 -

entitled to take by representation the distributive share of their uncle’s estate that

their father would receive if he were alive

Held: Because kids had been adopted by their step-father they lost all rights to

inherit from the relatives of their natural father under Maryland law

Rationale: Maryland legislature enacted a statute in 1963 that, “Upon entry of a

decree of adoption, the adopted child shall lose all rights of inheritance from its

parents and from their natural collateral or lineal relatives.” Court reasons that

because the statute eliminates the adopted child’s right to inherit from the natural

parent it concomitantly abrogated the right to inherit through the natural parent by

way of representation. The court points out that prior to the enactment of the 1963

statute, a child could inherit from both adoptive relatives and natural relatives

Note: Under Maryland law the an adopted child can inherit from his adopted

relatives but not from his natural relatives

Criticism: Although the statute as a whole seems equitable, the result doesn’t

seem equitable under these circumstances because the kids still have ties to their

natural father’s family.

What’s the policy behind letting an adopted inherit from his adopted

parent’s relatives but not from his natural relatives?

There’s an equity concern. Legislature doesn’t want to put an adopted

child into a better position than a child that is just born into the family

(you can inherit under the laws of intestacy from two parents max; not 3)

UPC § 2-113 Individuals Related to Decedent through Two Lines (p. 101)

An individual who is related to the decedent through two lines of relationship is

entitled to only a single share based on the relationship that would entitle the

individual to the larger share

UPC § 2-114 Parent & Child Relationship (p. 101)

(a) Except as provided in subsections (b) and (c), for purposes of intestate

succession by, through, or from a person, an individual is the child of his [or

her] natural parents regardless of their marital status. The parent and child

relationship may be established under [the Uniform Parentage Act]

[applicable state law] [insert appropriate statutory reference]

(b) An adopted individual is the child of his [or her] adopting parent or parent(s)

and not of his [or her] natural parents, but adoption of a child by the spouse of

either natural parents has no effect on:

(i)

relationship between the child and that natural parent or

(ii)

right of the child or a descendant of the child to inherit from or

through the other natural parent

(c) Inheritance from or through a child by either natural parent or his [or her]

kindred is precluded unless that natural parent has openly treated the child as

his [or hers], and has not refused to support the child

- 25 -

States generally adopt one of the following statutory schemes that pertain to

the inheritance rights of an adopted child

1) Adoptive child inherits only from adoptive parents and their relatives:

In some states, an adopted child inherits only from adoptive parents and

their relatives (Maryland)

2) Adoptive child inherits from natural and adoptive parents/relatives:

In other states, an adopted child inherits from both adoptive parents and

natural parents and their relatives (Texas)

3) UPC § 2-114(b): Under the UPC, an adopted child inherits from adoptive

relatives and also from natural relatives if the child is adopted by a stepparent

Note: The result in Hall v. Vallandigham would have been different if

the state followed the UPC. If UPC 2-114(b) had been applicable in

Hall v. Vallandingham, Earl’s children, adopted by their stepfather,

would have inherited from their natural father’s brother.

Under the UPC, if a child has been adopted by a stepparent, can the natural

relatives of that child inherit from child? No. In a stepparent adoption, under

the UPC, a child can inherit from their natural relatives, but the natural relatives

cannot inherit from them

Ex: In Hall v. Vallandingham, even though Earl’s children could have inherited

from their father’s natural brother (William) under the UPC because they had

been adopted by their stepfather, William would not have been able to inherit

from Earl’s children.

When can a natural parent inherit from a child? Under the UPC § 2-114(c), a

natural parent can inherit from his natural child only when he has acknowledged

the child and has provided the child with support while the child was alive. [This

provision was designed to deal primarily with the situation where a child is born

out of wedlock]

§ 2-114(c) Inheritance from or through a child by either natural parent or

his [or her] kindred is precluded unless:

▪ natural parent has openly treated the child as his [or hers], and

▪ has not refused to support the child (p. 101)

Does UPC § 2-114(c) apply to adoptive parents? While § 2-114(c) does not

make any reference to adoptive parents but there should not be any distinction in

that case. There could be a situation where a couple adopts a child and gets

- 26 -

divorced shortly thereafter. It seems reasonable that in those circumstances § 2114(c) would apply

Doctrine of Equitable Adoption

Doctrine of Equitable Adoption: Equitable adoption occurs when a

person acts as though he has adopted a child (i.e. – hold the child out as

his own) even though a formal-court approved adoption never occurred

What sort of situation triggers the doctrine of equitable adoption?

Arises in situation where the child’s natural parents/legal guardian enters

into an oral adoption agreement with another person or persons.

Factors courts consider: Courts in states that recognize equitable

adoption examine a host of surrounding factors in making a determine that

an equitable adoption has occurred including:

▪ whether the person made a good faith attempt to adopt that failed

for some reason

▪ whether the person held the child out has actually having been

adopted

From whom can an equitably adopted child inherit? Equitable

adoption permits an equitably adopted child to inherit from his equitably

adopted parents. Courts are split as to whether an equitably adopted child

can inherit from the relatives of his equitably adopted parents.

Can equitably adopted parents and their relatives inherit from their

equitably adopted child? Equitably adopted parents and their relatives

cannot not inherit from the child. Having failed to perform the contract,

they have no claim in equity

O’Neal v. Wilkes (SCT of GA 1994), p. 109

Facts: Hattie’s mother died in 1957 when she was 8 years old. Hattie’s father

never recognized her as his daughter. After Hattie then lived with her maternal

aunt. Then she was sent to live with her paternal aunt. The paternal aunt sent

Hattie to live with Mr. Cook. Hattie lived with Cook for more than 10 years,

until she was married. Cook referred to Hattie as his daughter and her children as

his grandchildren. Cook died intestate. Hattie claimed that under the theory of

equitable adoption she should be able to inherit from just as though Cook legally

adopted her

Issue: Was there an equitable adoption here?

Rule: The theory of equitable adoption is based on contract. A contract to adopt

cannot be specifically enforced if it’s entered into by a person w/out authority to

consent to the adoption. Consent to an adoption may only be given by a child’s

parent or legal guardian.

Held: There was not a legal adoption

Rationale: Hattie’s paternal aunt who gave her to Mr. Cook was not her legal

guardian. Because she was not Hattie’s legal guardian she could did not have the

- 27 -

authority to give consent to the adoption. The adoption contract was therefore

invalid and thus Hattie’s claim for equitable adoption is defeated

Dissent (Sears): The interests of the child are unfairly and inequitably harmed

by insisting upon the requirement that a person with consent to adopt had to have

been a party to the K. That this legal requirement is held against the child is

particularly inequitable bc the child, the course of whose life is forever changed

by such Ks, was unable to insure the validity of the K when the K was made.

Furthermore, where there is no person with the legal authority to consent to the

adoption, such as here, the only reason to insist that a person be appointed the

child’s legal guardian before agreeing to a K to adopt would be for the protection

of the child. By insisting upon this requirement after the adopting parent’s death,

this court is harming the very person that the requirement would protect . . .

Equity ought to intervene on the child’s behalf in these types of cases and require

the performance of the K if it is sufficiently proven

Criticism: Court took a very technical approach to this decision. Equity looks to

fairness. Equitable remedies in contract try to do something that is fair to all the

parties despite the technicalities in the contract. Equitable adoption was created

to give some notion of fairness. But here we don’t seem to see any fairness – by

enforcing the technical aspects it’s as though the court is throwing equitable

contract remedies out the window

Note: We don’t have any indications as to Cook’s expectations. Maybe in this

community people do not go through legal adoption procedures – maybe legal

adoptions are the norm

Note: The majority was made up entirely of men; both dissenters were women

Note: This was not a clear-cut equitable adoption. But it shows you the

types of arguments that can be made on both sides

HYPO: H and W take baby A into their home and raise A as their child

but do not formally adopt A. Can A inherit from H and W under the

doctrine of equitable adoption?

Under the doctrine of equitable adoption an oral agreement to

adopt A, between H and W and A’s natural parents, is implied and

specifically enforced against H and W. As against H and W,

equity treats A as if the contract had been performed by H and W;

they are estopped to deny a formal adoption took place

Adoption by Same-Sex Couples

Issue: Who is a child adopted by a same-sex couple entitled to inherit

from?

Some courts have held that the child is entitled to inherit from both

partner

- 28 -

Adoption of Tammy (MA 1993): The child had been conceived by

artificial insemination and adopted by the mother’s lesbian partner.

Court held that a child adopted by a same sex partner would inherit

through both mothers as the child of each. (p. 105)

HYPO: Suppose that a child lives with a natural mother (impregnated

with donor sperm by artificial insemination) and his adoptive mother

(natural mother’s lesbian partner). The child’s natural mother dies. Does

the child get to inherit from his natural mother under UPC § 2-114(b)?

If you technically apply UPC § 2-114(b) there are problems.

Under UPC § 2-114(b) the only time a child can inherit from his

natural parent and natural relatives is when he has been adopted by

a stepparent. A member of a same sex couple who adopts a child is

not a stepparent!!!!!

Adult Adoption

Majority view: Most jurisdictions do not draw distinctions between adult

adoption and childhood adoption. Thus, in the majority of jurisdictions the

inheritance rights of people adopted as adults are the same of those of

people adopted as children (p. 107)

Why might a person want to adopt an adult? There are, in other words,

circumstances in which a person wants to insure that another person gets

his/her money

How can the adoption of an adult be useful in preventing a will

contest?

The only person who have standing to challenge the validity of a will are

those persons who would take if the will were denied probate. If the

testator adopts a child, the testator’s relatives cannot contest the will since

they now can inherit nothing by intestacy

Greene v. Fitzpatrick (Kentucky 1927): A wealthy bachelor adopted a married

woman who had been his secretary for many years and with whom it was

alleged that the bachelor had a sexual relationship, Court held that the adoption

could not be set aside by the persons who would have been heirs but for the

adoptions

Collamore v. Learned (MA 1898): A 70-year-old man adopted three persons of

ages 43, 39, and 25. Court held that the adoptions could not be set aside by the

persons who would have been heirs but for the adoptions. Justice Holmes

remarked that adoption for the purpose of preventing a will contests was

“perfectly property” (p. 107)

Note: Relatives may attack an adoption decree on the grounds of mental

incapacity or undue influence, and then if they succeed in setting aside the

adoption, then attack a will leaving property to the adoptee

- 29 -

In some jurisdictions the adoption of an adult love is not possible (NY)

In re Robert Paul P. (NY 1984): Court held that a homosexual male, age 57, could not

legally adopt his lover, age 50, although NY statutes permit the adoption of adults. The

court thought that a sexual relationship was incompatible with a parent-child relationship

(p. 107)

Should a person adopted when an adult be able to inherit from the adoptive

parent’s relatives as well as from the adopted parents?

Technically there is no legal problem with a person adopted as an adult inheriting

from the adoptive parent’s relatives as well as from the adopted parents. The

problem is that when a person adopts an adult it’s not very likely he/she is going

to be announcing the fact the fact that he/she is doing this – so the relatives

involved may have no notice of the adoption and therefore won’t plan for it by

making a will or by putting a provision into the will. The moral of the story is

that if you don’t have a will you need this contingency in keep in mind.

Children Born by Reproductive Technology

Issue: How does this impact a parent’s and/or child’s right to inherit?

Right now there is no clear indication. Most cases that deal with these

advances really determine whether some can be deemed a “parent” who is

“required to provide support”

Just because you donate sperm to a sperm bank does not mean that the

court will determine that you are a “parent” who is “required to provide

support”

Cases dealing with inheritances will probably follow the line of cases that

determine whether you qualify as a “parent” who is “required to provide

support.”

c. Children Born Out of Wedlock

Inheritance from mother: All jurisdictions permit a nonmartial child to inherit

from his/her mother

Inheritance from father: The rules respecting a nonmaritial child’s right to

inherit from his/her father vary from state to state

Most states permit paternity to be established by

1) evidence of the subsequent marriage of the parents

2) acknowledgment by the father

3) adjudication during father’s life

4) clear & convincing proof after the father’s death

- 30 -

Uniform Parentage Act (1973)

When a child’s father and mother do not marry or attempt to marry, a parent-child

relationship is presumed to exist between a father and a child if

1) father receives the child into his home and openly holds out the child as

his natural child while the child is a minor, or

2) father acknowledges his paternity in a writing filed with an appropriate

court or administrative agency

When must an action be brought under the Uniform Parentage Act? (p. 116)