E-Form - Skidmore College

Skidmore College

Institutional Review Board

Research Proposal

1. Title of Proposal : (Scenarios) Risk Perception and Affective Rationality

2. Principal Investigator (PI): Anita Miller, Ph.D.

3. PI Department: Psychology

4. PI Contact Information : 354 Dana; 518-580-8307; amiller@skidmore.edu

5. Faculty Sponsor and Contact Information (if PI is a student): NA

6. Other Investigators : Hugh Foley, Ph.D., hfoley@skidmore.edu

7. Date of this Submission: March 17, 2006

8. Proposed Duration of the Project : March 20, 2006

– May 2, 2006

9. Background Information and Research Questions/Hypotheses :

Primary Aims

The current study examines reasoning and decision making processes. In particular, the research explores the impact of analytic and experiential contextual frames on risk perception. The guiding hypothesis is that affective rationality, or systematic empiricism guided by an affective context, facilitates adaptive choices and decreases biased risk perception. This perspective suggests that participants may best be able to assess risk and perceive safety needs when they can use both analytic/statistical information as well as experiential/affective processes.

Background Information

Risk perception i nvolves people’s subjective judgments about risks. The phrase risk perception commonly refers to views of financial propositions, saftety threats, health hazards, and environmental damage (Wikipedia, 2006). Risk perception inherently concerns a person’s assessment of a situation’s relative harm and benefit.

Amos Tversky and Daniel Kahneman (1974) conducted early psychometric research about risk perception. For example, they performed a series of gambling experiments to examine how people evaluate probabilities of monetary gains and losses.

They found that people often use heuristics to evaluate information. For example, the availability heuristic refers to the phenomenon that people judge events that they can easily bring to mind or imagine as being more likely than events that they cannot easily imagine. Another example is gain-loss asymmetry (i.e., losses loom larger than gains).

People tend to be risk averse regarding gains (preferring a certain gain over a risk involving potential greater gain or no gain) but risk-seeking regarding losses (preferring to

hope for the chance to lose nothing rather than taking a sure, but smaller, loss). The way that a choice problem is framed affects the choices people make (Tversky & Kahneman,

1981). Kahneman and Tversky showed that heuristics often provide useful shortcuts for thinking, but such shortcuts can sometimes lead to inaccurate judgments and systematic biases (Kahneman, 2003). In 2002, Daniel Kahneman was awarded the Nobel Prize in economic sciences for his pioneering work with the late Amos Tversky.

A growing body of research focuses on how human judgment takes shortcuts that systematically deviate from basic principles of probability. Evidence suggests that both analytic and experiential factors influence risk perceptions and decision making (Slovic,

Finucane, Peters, & MacGregor, 2004). Current cognitive and neuroscience models posit dual-factor feedback systems. For example, Slovic and his colleages (2004) propose:

The “analytic system” uses algorithms and normative rules, such as probability calculus, formal logic, and risk assessment. It is relatively slow, effortful, and requires conscious control. The “experiential system” is intuitive, fast, mostly automatic, and not very accessible to conscious awareness. The experiential system enabled human beings to survive during their long period of evolution and remains today the most natural and most common way to respond to risk. It relies on images and associations, linked by experience to emotion and affect (a feeling that something is good or bad). This system represents risk as a feeling that tells us whether it is safe to walk down this dark street or drink this strange-smelling water.

Proponents of formal risk analysis tend to view affective responses to risk as irrational. Current wisdom disputes this view. The rational and the experiential systems operate in parallel and each seems to depend on the other for guidance.

Slovic’s model shares principles from the risk-as-feelings hypothesis, that highlights the role of affect experienced at the moment of decision making (Loewenstein, Weber, Hsee,

& Welch, 2001). Studies suggest that analysis-based and experience-based decision making each have advantages, biases, and limitations. For instance, Hertwig and his associates (2004) showed that decisions based primarily on descriptions or experiences lead to dramatically different choice behaviors, reflecting overweighting or underweighting the probability of rare events, respectively.

Affective rationality is a guiding principle of a dual-factor feedback system (DuFFS) model of risk perception. In particular, rational decision making may fundamentally involve integrated analytic and experiential feedback systems. Our brains may embody such interactive feedback mechanisms. On the one hand, the human brain contains a largely subcortical system for near instantaneous experiential responses to harm or benefit (LeDoux, 1996). In addition, a slower, more complex cortically-based system also processes information and prepares for actions. The cortical system contains a rich array of processing mechanims for representation, memory, expectancy, judgement, and language. The orbital prefrontal cortex uniquely integrates connections from sensory, motor, and visceral brain areas, and neurological patients with orbital frontal damage show marked affective reasoning deficits (Damasio, 1994). According to Damasio’s somatic marker hypothesis, the impaired decision making following orbital frontal lesions reflects damage to a system involved in learning how feelings signify experiential meaning. This essentially “tags” perceptual, motor, and symbolic representations with relevant visceral or somatic markers in order to guide thought and behavior. Such multimodal parallel connections of the prefrontal cortex may provide mechanisms for analytic-

experiential integration. In addition, neuromodulatory transmitters and hormonal processes may coordinate dynamic adaptive changes in more widespread brain areas.

Regardless of the precise mechanisms, analytic-experiential interactions raise important practical challenges for adaptive problem solving (Slovic et al., 2004). How can integrated decision making, or affective rationality, inform novel approaches to risk management?

One approach involves using affective rationality to promote accurate risk assessment. Purely emotional processes reflect an affect heuristic that can introduce biased assessments in some circumstances. For example, research documents that risks and benefits tend to be positively correlated in the world, suggesting that many situations have the potential for both harmful and beneficial outcomes. However, people’s judgments of risk and benefit for specific situations are generally negatively correlated, reflecting dicotomous views (Fischhoff et al., 1978). Alhakami and Slovic (1994) showed that the inverse risk-benefit relation is linked to the strength of self-rated positive or negative affect about a target situation (e.g., using pesticides). In particular, if people report favorable feelings about a situation, then they are more likely to judge risk as low and benefits as high. However, if they report unfavorable feelings about an activity, then they tend to judge the opposite: high risk and low benefit (Slovic et al., 2005). Finucane et al. (2000) showed that the inverse relation bewteen perceived risks and benefits increases greatly under time pressure, when opportunities for analytic deliberation are reduced. Finucane also found that judgements of risk and benefit can be changed by providing information that modifies emotional appraisals of a situation. Such observations support the risk-as-feelings hypothesis suggesting that affect can precede and direct judgments of risk and benefit.

The capacity to change risk perception has practical implications. For example,

Slovic and his colleaguse (2005) documented the importance of affective processes for comunicating the risks and benefits of cancer prevention actions and treatment options.

Consistent with early work by Tversky and Kahneman (1981), framing influences the interpretation and use of information in decision making, and this principle can inform communicating with oncology patients about cancer screening and chemotherapy

(Edwards, Enigwe, Elwyn, & Hood, 2003). The issue here is that such medical challenges inherently involve affective processes, and perhaps affect can be directed in a way that facilitates informed, adaptive problem-solving. Recent studies document that framing effects are relevant not only to cognitive processes, but to affective processes as well. In fact, studies suggest that statistical information about health risks and benefits may have little meaning or utility (i.e., systematic biases persist) unless the information makes an affective connection in the patient (Slovic et al., 2005).

The Current Study Design

An important goal for risk perception research is to understand how information can best be presented in a meaningful and useful way for making applied decisions and choices. The current study addresses this core goal with a 2x4 independent groups factorial design. The study includes 10 risk-related vignettes (e.g., cigarette smoking and cancer risks, gambling and monetary risks), and participants make decision ratings on an

11-point scale. The target dependent variable is the aggregate self-rated decisions for

each participant. One independent variable is Gender, and participants include equal numbers of males and females in each condition. The second independent variable is

Framing, and the design includes four levels:

The No-Frame condition includes target vignettes without a contextual frame.

The Analytic-Frame condition includes the target vingnettes along with statistical risk information.

The Experiential-Frame condition includes the target vingnettes along with vivid, affect-laden scenarios with implied antecedents.

The Analytic+Experiential-Frame condition includes both the statistical information and the affect-laden scenarios.

The main hypothesis is that participants will give the most balanced risk:protective ratings in the analytic+experiential condition, relative to the other three conditions. They may also more clearly perceive the need for safty precautions in highly risky situations.

Comparisons will be made across framing groups and between genders.

The study includes exploratory questionnaires to facilitate data interpretation. In particular, a risk questionnaire adapted from previous work by Savadori and colleagues

(2004) asks participants to rate vignette qualities such as novelty, threat, control, harm, benefit, and risk. In addition, In order to explore possible male-female differences in cognitive-emotional style, the study includes two supplemental questionnaires by Simon

Baron-Cohen (2003) that measure individual differences in systemizing and empathy.

The study results have implications for understanding basic risk perception processes and for facilitating practial applications, such as health counseling and adovocacy.

10. Human Participants :

A. Who are the participants?

PS306 students and others associated with them

B. How many participants do you plan to have in your study? 136

C. How will the participants be contacted or recruited?

PS306 students will participate during the lab meeting, and each student will recruit 3 additional participants.

D. Will the participants be compensated for participating? No

11. Procedures :

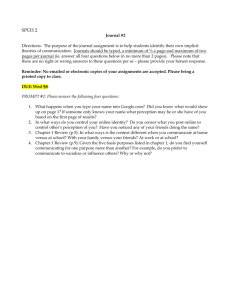

Participants will complete a self-report packet of questions during the PS306 lab meeting or during student-scheduled meetings. Each packet includes four scales

(see attachments).

1. Senarios. This 4-version instrument includes 10 vignettes and ratings of risk perception and protective tendencies for each. The core of vignettes 1, 2, 3, and

10 were adapted from previous risk perception studies (Denes-Raj & Epstein,

1994; Hsee & Kunreuther, 2000; Slovic & Lichtenstein, 1968; Slovic, Peters,

Finucane, & MacGregor, 2005). The others were written by the PI. The four

versions of the senarios reflect the study’s four framing conditions: the No-Frame condition (no contextual frame), the Analytic-Frame condition (statistical risk information), the Experiential-Frame condition (vivid, affect-laden scenarios with implied antecedents), and the Analytic+Experiential-Frame (both statistical information and the affect-laden scenarios).

2. Senarios Questions. This instrument includes questions that further specify participants’ responses to the 10 target scenarios. The questions were adapted by the PI from prior research by Savadori and colleagues (2004). Participants reread the core part of a vignette and rate qualities such as novelty, threat, control, harm, benefit, and risk.

3. The Cambridge Personality Questionnaire (Baron-Cohen, 2003). This instrument assesses systemizing. Systemizing reflects the ability to understand and build systems by specifying, relating, and organizing input-operation-output relationships. Participants rate the degree to which they agree or disagree with 60 statements. For example, “When I listen to a piece of music, I always notice the way it’s structured.” Prior studies indicate that males, on average, score higher than females.

4. The Cambridge Behaviour Scale (Baron-Cohen, 2003). This instrument assesses empathy, or the ability to read the emotional atmosphere. It involves the natural and spontaneous process of tuning into others’ feelings and thoughts. The scale includes 60 items, such as “I can easily tell if someone else wants to enter a conversation.” Previous research suggests that females, on average, score higher than males.

12. Consent:

All participants will provide written, informed consent to participate in the study

(see attached Consent Form).

13 . Risks and Debriefing:

Participants will be debriefed after completing the questionnaire packet (see attached Debriefing Form).

14 . Privacy and Storage of Data :

As described in the Consent Form, study records will be kept private. The paper questionnaires and results will be stored in a locked filing cabinet in a secure laboratory room at Skidmore College. Participant names will not be written on any of the questionnaires. Age and ethnicity information will only be used to summarize the sample as a whole and will not be linked to specific participant responses. Datafiles with individual parti cipants’ data will identify gender, but they will not include information about participants’ names, ages, or ethnicities.

Datafiles will be stored on password-protected college computers. Any sort of report that is published or presentation that is given will not include any information that will make it possible to identify a participant.

References

Baron-Cohen, S. (2003). The essential difference: Male and female brains and the truth about autism. New York, NY: Basic Books.

Damasio, A. (1994). Descarte s’ error: Emotion, reason, and the human brain. New

York, NY: Penguin Putnam.

Denes-Raj, V. & Epstein, S. (1994). Conflict between intuitive and rational processing: When people behave against their better judgment. Journal of Personality and Social Psychology, 66, 819-829.

Hertwig, R., Barron, G., Weber, E.U., & Erev, I. (2004). Decisions from experience and the effect of rare events in risky choice.Psychological Science, 15, 534-539.

Hsee, C.K. & Kunreuther, H. (2000). The affection effect in insurance decisions.

Journal of Risk and Uncertainty, 20, 141-159.

Kahneman, D. (2003). A perspective on judgment and choice: Mapping bounded rationality. American Psychologist, 58, 697-720.

LeDoux, J. (1996). The emotional brain: The mysterious underpinnings of emotional life. New York, NY: Simon & Schuster.

Loewenstein, G.F., Weber, E.U., Hsee, C.K., & Welch, N. (2001). Risk as feelings.

Psychological Bulletin, 127, 267-286.

Savadori, L., Savio, S., Nicotra, E., Rumiati, R., Finucane, M., & Slovic, P. (2004).

Expert and public perception of risk from biotechnology. Risk Analysis, 24, 1289-1299.

Slovic, P., Finucane, M., Peters, E., & MacGregor, D.G. (2004). Risk as analysis and risk as feelings: Some thoughts about affect, reason, risk, and rationality. Risk

Analysis, 24, 311-322.

Slovic, P. & Lichtenstein, S. (1968). Importance of variance preference in gambling decisions. Journal of Experimental Psychology, 78, 546-554.

Slovic, P., Peters, E., Finucane, M.L., & MacGregor, D.G. (2005). Affect, risk, and decision making. Health Psychology, 24, S35-S40.

Tversky, A., & Kahneman, D. (1974). Judgment under uncertainty: Heuristics and biases. Science, 185, 1124-1131.

Tversky, A. & Kahneman, D. (1981). The framing of decisions and the psychology of choice. Science, 211, 453-458.

Wikipedia (2006). Risk perception. Retrieved 3/13/06 from http://en.wikipedia.org/wiki/Risk_perception .