here - Carney Badley Spellman, PS

___________

CARNEY

BADLEY

SPELLMAN

welch@carneylaw.com

(206) 607-8215

John R. Welch's practice focuses on construction litigation, business litigation, and business development. He worked in the construction industry as a contractor, developer, and designer. Mr. Welch has litigated issues of construction contract disputes and defective construction claims. He also advises clients regarding contract formation, construction claims and general business concerns. mercalde@carneylaw.com

(206) 607-4161

Shawn K. Mercalde concentrates her practice in the areas of alternative dispute resolution, civil litigation, collections and creditors rights and construction and development. Ms. Mercalde works with construction clients to prepare contracts to protect their rights and limit or deter future litigation. She advises clients of the options available to them when collecting monies owed by debtors, including the preparation, filing and foreclosure of any necessary liens. kettrick@carneylaw.com

(206) 607-4135

Jason M. Kettrick specializes in construction, development, and creditor/debtor law. His experience includes litigation and claims prosecution on federal, state and private construction and supply contracts, including impact and delay claims, bid protests, cost accounting and economic damage, and lien foreclosure. He also represents his clients in collection efforts and all aspects of Chapter 11,

7 and 13 bankruptcies, including preference and fraudulent transfer litigation, relief from the automatic stay, adequate protection and objections to claims.

HOW DO YOU GET PAID IN THESE DIFFICULT

ECONOMIC TIMES?

When economic indicators weaken, business owners get nervous and rightfully so. Often times their best customers get behind in their payments.

Late payments, or simply lack of payment, for product and services are often followed by business failures. These difficult times can also strain important business relationships that will be important to you in the future. So how do your ride it out through the hard times? How can you protect yourself and prevent loss of income? Here are some strategies that you may want to consider:

LIEN LAWS

Unstable real estate markets provide tough challenges for contractors, subcontractors and suppliers looking to get paid on private projects. Where a mechanics’ lien once provided reliable security for payment, in today’s market, the value of the real estate and improvements are often insufficient to make the lien claimant whole. Still, liens are powerful tools that, when properly perfected, will provide the construction professional with its best opportunity to force payment from an otherwise recalcitrant debtor.

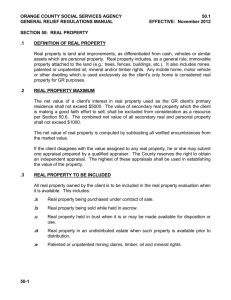

The basic mechanics of Washington’s lien laws are relatively well known. For example, all lien claimants must:

1) File their lien in the county in which the project is located within 90 days of last supplying labor, equipment and/or materials to the project;

2) Provide a copy of the lien to the owner within fourteen days of filing the lien; and

3) Commence foreclosure suit within eight months of the date of the lien.

There are, however, several lien prerequisites that may be applicable. Depending on the nature of the project and the relationship to the project owner, a construction professional may be required to provide a Disclosure Statement or a pre-lien notice to the project owner.

Carney attorneys will provide the guidance and advice needed to assure that your lien rights are properly perfected and pursued.

701 Fifth Avenue, Suite 3600 Seattle, WA 98104

Telephone: (206) 622-8020 www.carneylaw.com

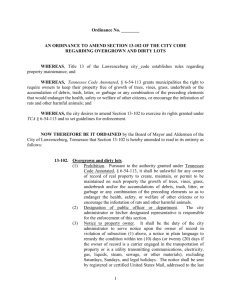

COLLECTION RIGHTS

Regardless of whether you choose to pursue your lien rights, file suit for a breach of contract, or simply negotiate payment of amounts owed to you, our firm can assist you through the entire collection process. Taking a proactive approach, Carney attorneys can help to ensure that your initial contract contains the provisions that will help protect you in a later dispute for payment.

Our attorneys can also help ensure that you are made aware of any statutory requirements that must be fulfilled by you in order to protect your lien rights.

Should it become necessary for you to pursue payment, we can help you assess the likelihood of collecting payment. Once you have determined that you would like to proceed with attempting to collect payment, we can file and serve all of the documents necessary to assert a lien on the property at issue and to assert a cause of action for breach of contract. We can also assist you in any discussions with the opposing party related to resolving the dispute short of litigation.

Whether your payment dispute ends in a settlement agreement or a judgment, Carney attorneys can help ensure that you have in place documentation that will provide you with further assurance of ultimate payment.

We can also assist you in taking the steps related to enforcing a judgment, including but not limited to the, the garnishment of wages, accounts receivables and/or bank accounts.

Collection services we can provide:

Initial review and revision of contracts

Review of relevant statutory requirements

Assessment of potential claims

Perfecting security interests

Litigation, mediation and arbitration

Negotiating settlements and payment plans

Pre-judgment and post-judgment attachments

Post-judgment execution

Garnishments

CARNEY BADLEY SPELLMAN, P.S.

701 Fifth Avenue, Suite 3600

Seattle, WA 98104-7010

Tel: (206) 622-8020 www.carneylaw.com

BANKRUPTCY

In tough economic times like these, lack of funds, rather than disagreements over amounts due, is all too often the reason for non-payment. Carney attorneys leverage their experience in construction, lien and bankruptcy law to ensure the return to their clients is maximized under any scenario.

Carney attorneys have been involved in bankruptcy matters related to marine vessels, real estate, insurance companies and major private and public construction projects. We also have represented secured and unsecured creditors and debtors, including lending institutions in non-bankruptcy workouts and in state receivership actions.

The firm’s bankruptcy practice includes all areas of creditor/debtor law with an emphasis on commercial transactions representing construction companies, developers, financial institutions, and creditor committees in bankruptcy. We have been involved in bankruptcy/matters related to marine vessels, real estate, insurance companies and major private and public construction projects. Recognizing the pitfalls of bankruptcy, when appropriate Carney also steers its clients towards non-bankruptcy workouts or state receivership actions.

Our practice includes remedies under State mechanic lien laws, public works bonding and retainage laws,

State foreclosure laws, as well as resolution of State and

Federal tax matters.

Services include:

Business evaluations

Liquidation analysis

Debt restructuring

Claim analyses

Plan feasibility

Relief from automatic stay

Adequate protection

Assumption or rejection of leases

Assumption or rejection of executory contracts

Perfection of security interests

Sales free and clear of liens

Plan confirmation

Reduction in workforce

Employment law

Fraudulent conveyances