Chapter 2 - Delmar Cengage Learning

advertisement

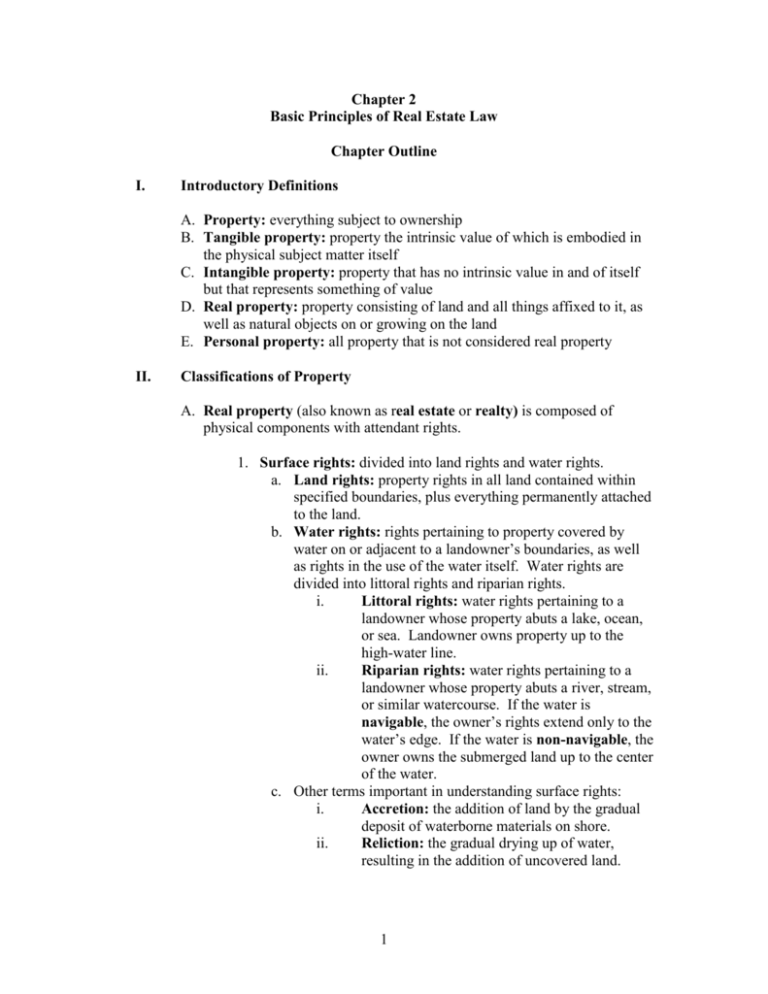

Chapter 2 Basic Principles of Real Estate Law Chapter Outline I. Introductory Definitions A. Property: everything subject to ownership B. Tangible property: property the intrinsic value of which is embodied in the physical subject matter itself C. Intangible property: property that has no intrinsic value in and of itself but that represents something of value D. Real property: property consisting of land and all things affixed to it, as well as natural objects on or growing on the land E. Personal property: all property that is not considered real property II. Classifications of Property A. Real property (also known as real estate or realty) is composed of physical components with attendant rights. 1. Surface rights: divided into land rights and water rights. a. Land rights: property rights in all land contained within specified boundaries, plus everything permanently attached to the land. b. Water rights: rights pertaining to property covered by water on or adjacent to a landowner’s boundaries, as well as rights in the use of the water itself. Water rights are divided into littoral rights and riparian rights. i. Littoral rights: water rights pertaining to a landowner whose property abuts a lake, ocean, or sea. Landowner owns property up to the high-water line. ii. Riparian rights: water rights pertaining to a landowner whose property abuts a river, stream, or similar watercourse. If the water is navigable, the owner’s rights extend only to the water’s edge. If the water is non-navigable, the owner owns the submerged land up to the center of the water. c. Other terms important in understanding surface rights: i. Accretion: the addition of land by the gradual deposit of waterborne materials on shore. ii. Reliction: the gradual drying up of water, resulting in the addition of uncovered land. 1 iii. Erosion: the gradual washing away of land from the shore by tides or currents. iv. Avulsion: the loss of land bordering water as a result of a sudden or violent natural disturbance. 2. Air rights: owning the air space above the parcel extending up to heights established by law. Up to these limits the landowner has private air rights. Beyond these limits, the air space is subject to public air rights. Private air rights may be sold as “air lots” upon which buildings can be built. They also are of value to ensure an uninterrupted view. 3. Subsurface rights: also referred to as mineral rights, which extend from the surface boundaries of a parcel of land downward. These include oil, gas, ore, and other minerals. B. Personal property (also known as chattel or personalty) pertains to property characterized by movability. 1. Property is transferred by a document called a bill of sale. This document is signed by the seller(s) and provides a detailed description of the personal property conveyed. State law dictates whether this document must be witnessed and notarized. 2. If personal property is used as part of the collateral for a loan, a UCC-1 financing statement is filed in the public records to perfect a security interest in personal property. In filing this statement, a lender is giving notice to third parties of its security interest in the personal property described in the statement. C. Fixtures are objects that at one time were personal property but, through the process of attachment to real property, have become part of the real property. 1. Whether these objects are to be treated as personal or as real property depends first and foremost on the intentions of the parties. 2. Unless a contract indicates otherwise, an item determined to be a fixture stays with the real property. 3. When drafting a fixtures provision in a contract for purchase and sale, it is important to be as specific as possible. 4. If a contract does not contain a fixtures provision and a dispute arises, four judicial tests can be used to determine whether an item must remain with the real property: a. intention of the parties, b. method of annexation, c. adaptation of the item, and d. relationship of the parties involved 2 III. Basic Ownership Rights A. Legal rights (also known as a “bundle of rights”) are conferred when real property is conveyed. B. These rights consist of 1. right of disposition: the right to dispose of one’s property by transferring rights to the property during one’s lifetime or at time of death. 2. right of use: the right to use one’s property in any lawful manner or to give a general or limited right of use of the property to another. 3. right of possession: the right to occupy one’s property in privacy. 4. right of exclusion: the right to exercise control over one’s property. IV. Methods of Acquiring Real Property A. Purchase: the most common way in which property changes hands. B. Inheritance: 1. Devise: a gift of real property made in a will. The recipient is referred to as the devisee. Generally, the devisee will take the real property subject to all encumbrances and liens unless the will makes provision for the pay-off of mortgages and other liens. 2. Descent: the passing of real property when an owner dies intestate (without a will). The property will pass according to state intestacy laws. C. Gift: a conveyance of real property without consideration paid by the recipient. 1. The person making the gift is referred to as the donor, and the recipient is referred to as the donee. 2. Typically, a gift of real property is revocable prior to the execution and delivery of a deed by the donor to the donee. 3. In addition, an oral gift of real property generally is not enforceable. Some states provide an exception if the donee has taken physical possession of the property and has made valuable improvements to the property in reliance on the gift. D. Adverse possession: the acquisition of title to real property through taking possession of land that belongs to another without the owner’s consent and 3 retaining possession for a statutorily prescribed period of time. Typically, for adverse possession to occur, the possession must be 1. hostile (without the owner’s consent). 2. actual (there must be physical control exerted over the property). 3. open and notorious (anyone would be able to determine the possession has occurred through inspection). 4. continuous (must continue for a statutorily prescribed time). (Many states allow the tacking of time periods of previous adverse possessors.) 5. exclusive (cannot share use of the land in question with its title owner). 6. In addition, some states require the adverse possessor to take possession under claim of right (with the intent to claim the land as his/her right). Some states require that the adverse possessor pay the real property taxes on the property for the requisite statutorily prescribed of possession. V. Estates and Tenancies A. The interest a person receives in real property is based on the type or estate or tenancy conveyed. The following terms denote the nature, extent, and duration of a person’s interest in real property. B. Freehold estates: estates of indeterminable duration. Created through the combination of words of purchase and words of limitation. The two most common types of freehold estates are fee simple absolute and life estate. 1. Fee simple absolute (also known as a fee simple or fee): an estate that grants the property owner each of the four basic property rights. This is the greatest estate one may hold. The majority of real property transactions convey a fee simple absolute unless words to the contrary appear on the deed. 2. Life estate: an estate in which the grantor conveys title to real property to another for a period of time measured by someone’s life. a. If grantor does not specify who takes the property once the life estate terminates, the grantor retains a reversionary interest and the property reverts to the grantor or his/her estate. b. If the grantor does specify to whom title to the property passes upon termination of the life estate, the person so indicated is referred to as a vested remainderman. c. Life estate pur autre vie is a life estate granted for the lifetime of someone other than the grantee. 4 d. The holder of the life estate has the right of possession, use and exclusion, but rarely the right of disposition. e. The holder of the life estate must not diminish the value of the property by committing waste. i. Permissive waste: the diminishment of the value of property when a life estate holder fails in the upkeep of the property. ii. Voluntary waste: the active use of property by a life estate holder in a manner that reduces its market value. iii. Ameliorative waste: the alteration of property through the addition of improvements by a life estate holder that increase the value of the property. This generally is permitted. C. Leasehold estates: estates of determinable duration. They convey the rights of use, possession, and exclusion, but not disposition. The four basic leasehold estates are the following: 1. Estate for years (also known as a tenancy for years): a tenancy that continues for a designated period. 2. Tenancy from period to period: a tenancy that continues for successive intervals until one party to the agreement provides the other party with notice of termination of the tenancy. 3. Tenancy at will: a tenancy that begins as an estate for years, with the tenant remaining on the property by agreement with the landlord after the estate for years expires. 4. Tenancy at sufferance: a tenancy occurring after the expiration of a lease, in which a tenant remains in possession of the property without the landlord’s consent. VI. Methods of Title Holding A. Ownership in severalty: ownership of real property in one’s own name as a single owner. A single or a married individual may take title in severalty. The individual’s marital status should appear on the deed nonetheless. B. Types of concurrent (joint) ownership: 1. Tenancy in common: a form of concurrent ownership in which two or more persons have undivided interests in property but which does not confer the right of survivorship. The co-owners may own equal or unequal shares. 2. Joint tenancy: a form of concurrent ownership in which two or more persons have undivided interests in property, with the right 5 of survivorship. The co-owners must own equal shares and take title at the same time under the same deed. In some states, to create a joint tenancy, the words “with right of survivorship” must appear on the deed; otherwise, a tenancy in common is presumed. 3. Tenancy by the entirety: a form of concurrent ownership by husband and wife, in which each spouse has an undivided interest and right of survivorship. The law creates a legal fiction, giving each spouse a 100% interest in the property. Neither spouse may mortgage or convey the property without the consent of the other spouse. This form of ownership is not recognized in all states. VII. Ownership by a Business Entity A. Sole proprietorship: any property acquired or sold is done in the owner’s own legal name (not in the name of the owner’s business). B. Partnership (including general partnerships, limited partnerships, and limited liability partnerships): Real property may be bought or conveyed either in the partnership name or in the names of the partners. The partnership, not the individual partners, holds title to the property. C. Corporation: Because a corporation is a separate legal entity, title to real property of a corporation is held in the name of the corporation, not in the name of the shareholders. The purchase and sale of real property must be agreed to by the board of directors, with the board adopting a resolution indicating ratification of the contract for purchase and sale. The corporate bylaws typically indicate the officers permitted to carry out the transaction on behalf of the corporation. D. Limited liability company: Acquiring and conveying title to real property are done in the name of the company. VIII. Dower and Curtesy A. Dower: the provision the law makes for a widow to lay claim to an interest in her deceased husband’s real property. B. Curtesy: the provision the law makes for a widower to make a legal claim to an interest in his deceased wife’s real property. C. elective share: a spouse’s statutory right to a fractional share of real and personal property owned by the deceased spouse at the date of death. In most states, dower and curtesy have been replaced by the concept 6 of the spousal elective share. a spouse’s statutory right to a fractional share of real and personal property owned by the deceased spouse at the date of death. D. In states that still recognize dower and curtesy, it is important to include the signature of both spouses must be recorded on all conveyances of real property. IX. Community Property A. A few states, generally founded under Spanish or French rule, recognize the concept of community property: Louisiana, California, Texas, Nevada, Arizona, Idaho, New Mexico, and Washington. B. In community property states, all property falls within one of two categories: 1. Separate property: (a) all property acquired by a spouse prior to marriage, (b) income from property acquired by a spouse prior to marriage unless commingled in a manner that makes it community property, (c) acquired solely through separate funds, or (d) acquired by gift, will, or descent, unless the gift or will clearly indicates that the property is given to both husband and wife. 2. Community property: all property, both real and personal, acquired during marriage by either spouse. C. Community property cannot be sold without the other spouse’s consent. The intestacy laws of each state govern the manner in which community property upon the death of a spouse who dies intestate. Most communityproperty states recognize prenuptial and postnuptial agreements. Absent such an agreement, community property is divided equally in the case of divorce. X. Homestead Property A. Homestead property: the primary dwelling house or residence of the head of household plus adjoining land. B. Three contexts 1. Probate laws pertaining to homestead property: When a husband or wife dies leaving a surviving spouse and minor children, the homestead property passes automatically to the surviving spouse and children. Whether the surviving spouse receives a fee simple absolute or a life estate (with the children as vested remaindermen) depends on state statutory law. 7 2. Homestead property tax exemptions: The majority of states provide, by statute, a set dollar amount that is subtracted from the assessed value of homestead property before real property taxes are calculated. 3. Protection against the claims of creditors; sometimes referred to as homestead rights: These rights may prevent a forced sale or protect a certain dollar amount of equity in the homestead property. a. Historically, some states, such as Florida, had become known as bankruptcy havens because of liberal state laws protecting homestead property, regardless of the value of the property, if mortgage payments were kept current. b. The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 placed a cap of $125,000 in equity protection in homestead property unless the bankruptcy filer has owned homestead property in the state for at least 1,215 days (40 months) prior to filing for bankruptcy. For filers who have owned homestead property in the state for 40 months or more, election of state bankruptcy protections for homestead property may be elected. 8