Local Government Pensions Scheme (LGPS) – Proposed

Local Government Pensions Scheme (LGPS) – Proposed Agreement

This briefing describes the proposals for a revised LGPS, to be implemented from

April 2014, which will apply inter alia to NUT members in non-teaching posts in local authority services who do not qualify for TPS membership.

Background to Agreement

Negotiations on the future of the LGPS carried on alongside those on other public service pension schemes. The negotiations involved the Local Government Association representing employers and GMB, Unite and Unison as the three trade unions recognised in the NJC for Local Government Services. The NUT and around 16 other trade unions with members in the LGPS were not represented in or consulted about those discussions.

There was no recommendation from the NJC unions to other unions that they should endorse the proposals or advise their members to do so, as it was acknowledged that it was for each union to reach its own decision via its own processes. It should be noted, however, that this proposal was not put to the whole LGPS Side for collective decision.

The NUT Executive has decided not to endorse the proposed LGPS agreement, because it would mean an increase in contribution rates for NUT members and an increase in the age at which members can take their pensions in full. The agreement is likely to be put into practice because it has been endorsed by GMB, Unison and Unite, the three unions which negotiated the revised scheme.

Summary of Proposals for Revised LGPS

New scheme to be introduced from April 2014

Career average basis for scheme

Normal pension age to be equal to individuals’ State Pension Age

Accrual rate of 1/49th per year

Pensions in payment, accrued pension entitlements and deferred pension entitlements prior to retirement to be increased each year by CPI inflation

Member contributions to remain at an average 6.5 per cent but changes to tiering arrangements mean higher paid employees will pay more

Pension contributions to be based on actual salary rather than full-time equivalent salary, meaning part-timer employees pay less

Employer contributions to be based on a notional 13.0 per cent contribution (but

with exact contributions varying from scheme to scheme according to its funding position)

New "5050 option” allowing members to pay half contributions for a halved accrual rate while keeping full death-in-service and ill-health benefits

Auto-enrolment of nonmembers and “50-50 option” members into the full scheme every 3 years

All benefits accrued prior to 1 April 2014 to be protected and payable linked to final salary at retirement

1

Basis of LGPS

The LGPS is different from the TPS in several important respects. Firstly, it is a funded pension scheme with actual assets as opposed to a notionally funded scheme. Secondly, it comprises a series of separate pension funds which operate according to a single set of common scheme rules. Finally, the longevity experience and other characteristics of the

LGPS, which influence the actuarial calculations governing liabilities and contributions, are significantly different to those for teaching. These differences mean that direct comparisons between the proposals for the TPS and LGPS are not always appropriate.

The LGPS negotiations have been based on actuarial calculations for a "notional scheme".

The provisions set out above on pension age, accrual rate etc will apply to all members.

The only variable will be the employer contribution from individual employers which will depend as now on the specific financial circumstances of individual LGPS pension funds.

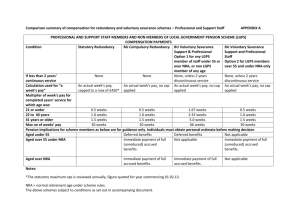

Contributions

The NJC unions' negotiators say that they placed considerable importance on keeping member contributions at the same overall level. Member contributions will remain at an average of 6.5 per cent. The contribution rate paid by the lowest paid will remain at 5.5 per cent. The current maximum contribution of 7.5 per cent payable under the existing

LGPS tiering, however, will rise significantly as the tiering will be adjusted to make those earning £43,000 or above pay more.

Current LGPS

From

Up to £13,500

£13,501

£15,801

£20,401

£34,401

To

£15,800

£20,400

£34,000

£45,500

£45,501 £85,300

More than £85,300

Contribution rate

5.5%

5.8%

5.9%

6.5%

6.8%

7.2%

7.5%

Planned 2014 LGPS

From

Up to £13,500

£13,501

£21,001

£34,001

£43,001

£60,001

£85,001

To

£21,000

£34,000

£43,000

£60,000

£85,000

£100,000

£100,001 £150,000

More than £150,001

Contribution rate

5.5%

5.8%

6.5%

6.8%

8.5%

9.9%

10.5%

11.4%

12.5%

Most NUT members in the LGPS are likely to be within the £43,000 - £60,000 band, due to pay 8.5 per cent, with some earning £60,000-£85,000 and due to pay 9.9 per cent. While these increases are clearly unwelcome, they are lower than would have resulted from the

Government’s original proposals.

A further change is that part-timers will in future pay contributions on actual pay rather than

FTE pay, reducing their contributions in many cases. This move entails an additional cost to the scheme borne by those paying the higher contributions.

As noted above, employer contributions for future service will be based on a 13.0 per cent contribution for the notional scheme, compared to employer contributions of 12.1 per cent for the proposed TPS scheme. The current average LGPS employer contribution rate for future service is 13.9 per cent. Actual employer contributions to the LGPS will, like those for the TPS, be slightly higher due to the effect of past service deficits.

2

Accrual rate and revalorisation rate

The NJC unions' negotiators opted for an accrual rate of 1/49 per year with a revalorisation rate equal to the CPI inflation rate. The TPS proposal, by comparison, provides for an accrual rate of 1/57 per year with a revalorisation rate equal to CPI plus 1.6 per cent.

The LGPS proposal means that more pension, as a fraction of pay, will be earned each year but that accrued pension will be increased by a lower amount each year prior to retirement so that the benefit of the higher accrual rate is defrayed over time. The alternative approach (within the same cost envelope) would have been be to opt for a less favourable accrual rate but a higher revalorisation rate as with the TPS proposal.

The proposed 1/49 accrual rate with CPI revalorisation will be likely to benefit those LGPS members who enter the LGPS at an older average age (including a large proportion of

NUT members moving from the TPS) since they will benefit from the higher accrual rate without feeling the impact of lower CPI revalorisation over a full career. This would, for such members, offset the higher contribution rate to some extent.

The NJC unions have not discussed the issue of this balancing effect between the accrual rate and revalorisation rate in any detail, preferring to emphasise the higher proposed accrual rate in comparison to the current 1/60 accrual rate.

50:50 option

The LGPS will contain an option for members to pay 50 per cent of their pension contribution in return for 50 per cent of the accrual (so a 1/98 accrual rate). Members taking the 50:50 option would keep the full value of death-in-service, redundancy and illhealth pension rights. Members taking the 50:50 option and those who have opted out of the LGPS would be automatically re-entered into the full LGPS after three years.

The LGPS has adopted this provision because of high opt-out rates (around 25 per cent).

It was not thought necessary to adopt this type of provision in the Teachers’ Pension

Scheme because of the much lower opt-out rate.

Transitional protection

All final salary pension rights accrued prior to April 2014 will be fully protected and able to be taken in full at the current normal LGPS pension age (already 65 in most cases) with pension based on the individual’s final salary at retirement.

NUT SSEE Department

September 2012

3