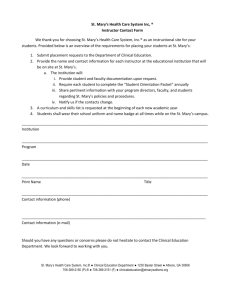

[Click here and type recipient`s Name]

advertisement

![[Click here and type recipient`s Name]](http://s3.studylib.net/store/data/007711646_2-10f88eb26d81a32d9227422ec3cfaf0b-768x994.png)

Launching a new generation e-phone © 2004 by Stefan Scholtes (Cambridge) LAUNCHING A NEW GENERATION E-PHONE* Background ePhone is preparing to launch an innovative mobile phone that the company has developed over the past two years. The new model allows a far better integration of web-based applications with traditional telecom services. To prepare for the launch decision, Paul in the production department has been working on a proposal for a production facility that will allow 5 Mio units to be produced over the next 5 years. He estimates fixed costs of production to be on the order of $ 60 Mio. Mary is in charge of the marketing side of the launch preparation. From past experience with such high-tech products she estimates that demand will be fairly price-inelastic and will allow ePhone to achieve a unit margin of $20 per mobile phone. On the total demand side, however, she is less optimistic. Will there be the critical mass of high-end customers in the market necessary for the new technology to pick up in a big way? Is it really a good idea to launch the ePhone now or should they defer the launch decision and first gather some more information about the market? ePhone is one of the most innovative firms in the industry and its marketing department has considerable experience with launches of new high-tech products. The marketing people at ePhone like to think in three scenarios: Success, Survival, or Failure. Mary has put a lot of energy into projecting sales volumes for the two scenarios from past data and the results of a preliminary customer survey. She estimates that a market success will allow the company to sell the full capacity of 5 Mio units of the new phone worldwide, whilst a survival market will only demand 2 Mio units, dropping to an estimated 800,000 units in the case of failure. In the past the company has on similar occasions introduced their product first in a national test market before committing to the large expense necessary for an international launch. The Netherlands have proved particularly useful in this respect. Mary estimates that the cost of a Dutch test market, including setting up a small production facility, would be $ 5 Mio. Her projections are that in a successful test market they should be able to sell 150,000 units in the short amount of time for the test. Sales will drop to a projected 60,000 units in a survival market and 24,000 units in a failed test market. She has commissioned a customer survey in the Netherlands upon which she is able to estimates the probability of a successful test market to be 40%, of a survival test market to be 50% and of a failure to be 10%. To extend the test market results to better estimates of the international market, Mary uses historical company data on the predictive power of test markets. The data suggests that if the test market is successful, there will be a 60%, 30%, and 10% chance of success, survival, and failure, respectively, in international market. If the test market is a survival market, these probabilities will be 15%, 70%, and 15%, respectively, and if the test market fails, the probabilities will be 10%, 30%, and 60%, respectively. * This case will be used as a basis for class discussion and is not an illustration of effective or ineffective managerial decision-making. Launching a new generation e-phone © 2004 by Stefan Scholtes (Cambridge) A) Mary feels intuitively that the company should postpone the international launch and do a test market analysis first to learn more about the market. Can you help Mary make a case for a pre-launch test? B) In discussions with Paul, Mary reveals that her sales estimate in a successful market is based on the assumption of a production capacity of 5 Mio. She actually estimates that there will be about 2 Mio units excess demand in a successful market that they will not be able to satisfy within the capacity constraints. A closer look at the $ 60 Mio set-up costs for production shows that about $ 10 Mio are fixed costs, independent of the size of the plant, and the remaining $ 50 Mio are largely variable with the capacity of the plant. Paul wonders whether it might be a good idea to produce a second proposal with an increased capacity. C) After his meeting with Mary, Paul kept on thinking about the level in demand uncertainty that he had been unaware of. An alternative to cope with such uncertainty might be to stage the project. If the company bought a parcel of land close to the planned production site, then future expansion would be feasible. The price for the parcel of land is about $5 Mio. An expansion takes 3 months with another $10 Mio fixed costs, independently of the expansion capacity. Variable costs of capacity are the same as before. Mary believes that they will have a very good idea about the realised market scenario some nine months after the launch. That would be a good time to decide on expansion, which, if approved, will come on line after another three months. Mary reminds Paul that the company may miss out on demand if they start small; they typically realise about 20% of the overall demand in their first year. Can you help Paul to make a case for a staged launch?

![AIR NEW ZEALAND [73], 1990's](http://s3.studylib.net/store/data/008457729_1-10b884e09a0c669f9df5cccbc94777e2-300x300.png)