You are employed as an accounting technician with Total Recall Ltd

advertisement

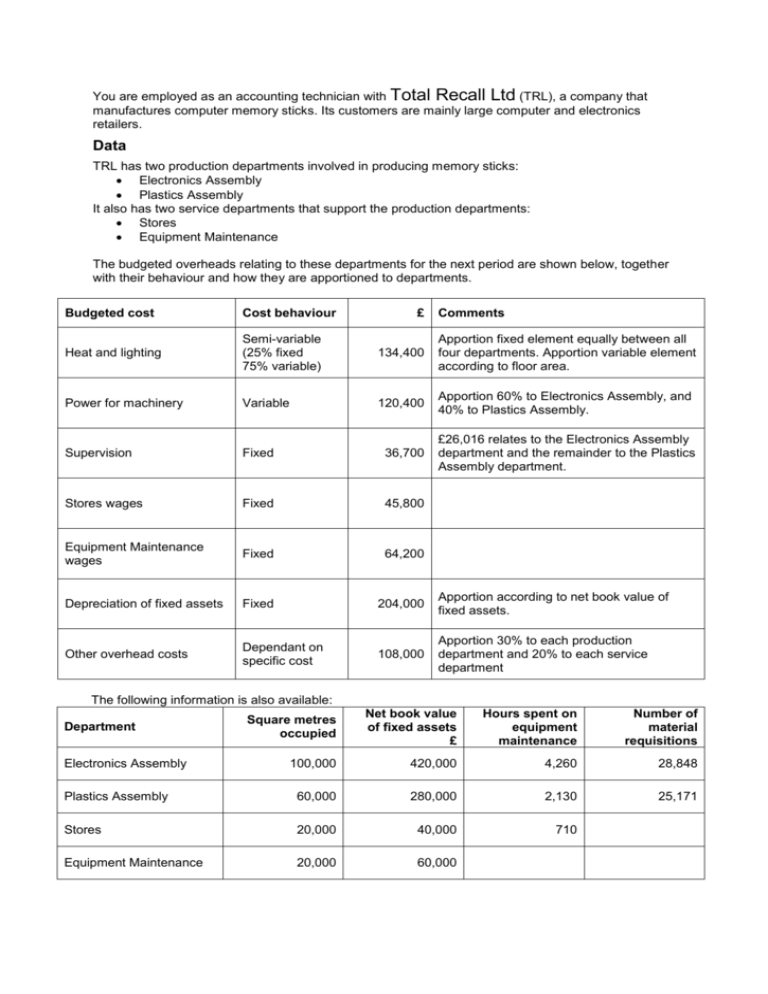

You are employed as an accounting technician with Total Recall Ltd (TRL), a company that manufactures computer memory sticks. Its customers are mainly large computer and electronics retailers. Data TRL has two production departments involved in producing memory sticks: Electronics Assembly Plastics Assembly It also has two service departments that support the production departments: Stores Equipment Maintenance The budgeted overheads relating to these departments for the next period are shown below, together with their behaviour and how they are apportioned to departments. Budgeted cost Cost behaviour £ Comments Heat and lighting Semi-variable (25% fixed 75% variable) 134,400 Apportion fixed element equally between all four departments. Apportion variable element according to floor area. Power for machinery Variable 120,400 Apportion 60% to Electronics Assembly, and 40% to Plastics Assembly. Supervision Fixed 36,700 £26,016 relates to the Electronics Assembly department and the remainder to the Plastics Assembly department. Stores wages Fixed 45,800 Equipment Maintenance wages Fixed 64,200 Depreciation of fixed assets Fixed 204,000 Apportion according to net book value of fixed assets. Other overhead costs Dependant on specific cost 108,000 Apportion 30% to each production department and 20% to each service department The following information is also available: Square metres occupied Net book value of fixed assets £ Number of material requisitions 420,000 Hours spent on equipment maintenance ((((hours) 4,260 100,000 Plastics Assembly 60,000 280,000 2,130 25,171 Stores 20,000 40,000 710 Equipment Maintenance 20,000 60,000 Department Electronics Assembly 28,848 Task 1.4 (22 minutes) Use the following table to allocate or apportion the overheads between the production departments, using the most appropriate basis. Round to the nearest £ throughout. Notes: The Equipment Maintenance department’s total costs should be apportioned on the basis of the hours spent on equipment maintenance for the other three departments. The total of the Stores department’s costs should then be apportioned according to the number of material requisitions. Overhead Heat and lighting fixed cost Heat and lighting variable cost Power for machinery Supervision Stores wages Equipment Maintenance wages Depreciation of fixed assets Other overhead costs Total of primary apportionments Reapportion Equipment Maintenance Reapportion Stores Total production department overheads Basis of allocation Electronics Assembly Plastics Assembly Stores Equipment Maintenance Total £ £ £ £ £ Data Both the Electronics Assembly and Plastics Assembly departments are highly automated and machine intensive. The following information relates to these two departments for the next period: Electronics Assembly department Plastics Assembly department 14,200 12,500 9,400 8,800 Budgeted machine hours Budgeted direct labour hours Total 26,700 13,350 18,200 Task 1.5 (8 minutes) Using the above information and your calculations from task 1.4, calculate the budgeted overhead recovery (absorption) rate, using the most appropriate basis (and rounding your answer to the nearest whole £) for: (a) the Electronics Assembly department (b) the Plastics Assembly department Data During the same period the Plastics Assembly department actually worked 13,250 machine hours, and 9,300 labour hours. This incurred an overhead cost of £300,750. Task 1.6 (14 minutes) (a) Using the information above and your answers from task 1.5, calculate the actual overhead absorbed in the period (to the nearest whole £). (b) Calculate the under or over absorbed overheads for the period (to the nearest whole £). Clearly state whether the overheads were under or over absorbed. (c) Identify TWO factors that could have caused the under or over absorption in (b).