Guidelines

advertisement

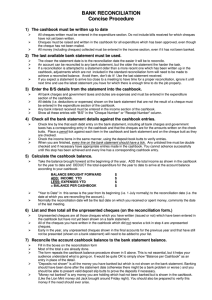

Guidelines: Year End Accounts General Information for Treasurers: Communication with HQ: The branch accounts office is available to advise and assist you with any technical questions relating to your accounts or duties. Please telephone 020 7380 4733 or email finance.branchaccounts@nut.org.uk. Please send any written correspondence to the: Branch Accounts Office, National Union of Teachers, Hamilton House, Mabledon Place, London, WC1H 9BD. Hearth: The cashbook, forms and guidelines can now be found on the Hearth website. Once you have logged into the website, go to the sub heading local officers/treasurers to find them. Training: The next treasurers training course will be held at Stoke Rochford Hall around November 2014. If you are interested in attending please contact the Organising and Membership department. Treasurers’ Handbook: A new handbook has been produced by the branch accounts office. It contains a step by step process on how to complete the cashbook and all year end forms. It also provides information on other areas such as expenses, corporation tax, budgets, grants and a section for frequently asked questions. If you require a copy please contact the branch accounts office on the details above. Amalgamation: If your association/division is amalgamating in the year, please ensure that you finalise a date for amalgamation and transfer all remaining funds into the new bank account. You should also complete a Form 106/138 showing any income or expenditure for that year and the final transfer of funds from your association. Those receiving funds should show the amounts received and the name of the association. ** NEW ** Analysis Codes In accordance with the financial regulations for branches, new analysis codes have been set up and incorporated into the Form 106 and cashbook. Please see pages 2-3 for more detail. Hardship Fund: If you have set up a hardship fund, these amounts should NOT be recorded on your Form 106/138 as this fund, by its nature, must be separate from your association accounts. A small spreadsheet showing any donations in or out of the bank account will be sufficient. If your association has made a donation out of local funds to your hardship fund, the payment(s) should be entered in Expenditure under “Donations” line 380. Help in Completing a Form 106 or Form 138: Manual Cash Book: On your enclosed Form 106/138 we would be grateful if you could enter your email address (if you have one) in the marked box at the top. As far as HQ is concerned the main headings on the Form 106/138 generally meet our needs. Significant items that are not truly reflected by existing headings may be entered into “Miscellaneous”. Please note that whereas divisions routinely send in their cash book sheets regarding claims for divisional grants, this is not required for local associations unless specifically requested for audit. Page 1 of 4 Income Local Subscriptions: This figure should be the total of local subscriptions received from headquarters only. As you will know, HQ payments via BACS or cheque sometimes include local subs, HQ grants and a yearly deduction for life members. Details of how this should be shown in your cashbook are on page 12 of the treasurers handbook. HQ Grants: As we are considering national and local association’s accounts, we are obliged to ensure that HQ payments are identical to the amounts recorded by associations. Any other form of grant that is not from HQ should be entered as miscellaneous income, with a brief description stating who the grant was from and what it relates to. Interest Received: Bank, building society and other investment interest is usually received net of tax (after tax has been deducted by the bank). The tax deducted is usually shown on statements, which when added to the net figure provides the total gross. The income tax rate deducted from interest has been 20%. Equipment Disposals: Please record any income received for equipment now disposed of. Diary Sales: It is helpful to show sales of NUT diaries separate from the purchase of them from HQ. So kindly show income for sales here and the purchase of diaries from HQ on the expenditure side. Donations: Charitable donations must be within the aims and objectives of the Union and the association or division. Enter all donations received, either in the notes field or on a separate sheet. See also Expenditure. Other Income: Specific details must be provided under this heading rather than merely “miscellaneous” or “sundry”. This helps us allocate the items correctly Expenditure Office Costs: This is a broad heading to cover a range of general administrative costs. In former years this heading was called “printing stationery, postage and telephone” but you may include other minor admin items from now on. Some examples include cables, plugs, printer cartridges, internet fees, single items of equipment under £50 etc. Equipment Costs: New purchases should be itemised in detail on page 4 of the Form 106 and on the Form 138 for inclusion on the national inventory. New items will be included on the Form 360 next year. Occupancy Costs: This includes expenditure for those associations/divisions running an office. Clerical Assistance or Employee Costs: There is a statutory obligation to operate a PAYE scheme when employing people, which includes maintaining PAYE records. All such costs should be entered under this heading. Please note that if you run a PAYE system, from April 2010 all tax returns will have to be filed online. HMRC are now requesting Real Time Information online submissions from all branches that run a PAYE scheme. If you are not already reporting this information to them, please contact HMRC immediately. Page 2 of 4 ** NEW ** Regional Organiser Costs If you have agreed to pay a percentage of your Regional Organisers salary, an invoice will be sent to you from HQ (either for payment or deducted from your local subscriptions) and should be analysed here. ** NEW ** Work Normally Covered by Facilities Time Any amounts paid to officers for work that would normally be covered by facilities time (including any hourly fees charged by the officers) should be analysed here. ** NEW ** Any Other Work Carried out by Auditors Any time charged by an auditor that does not relate to the audit of your books, should be analysed here. Corporation Tax: If you receive interest or make a profit out of trading (e.g. sales of Union diaries, merchandise or other similar activities) you should complete a Corporation Tax return. As of April 2011 all returns are now completed online. When you set up your account you will need the 10 digit number mentioned on all correspondence and the post code of the address registered with HMRC,. The onus in law is on the tax payer to make a return. It is no defence to claim that HMRC have not requested a return. It is possible your local tax office may decide that your corporation tax liability is so small, or even nil, and therefore grant you a “Dormant” status for the future. This means you will not be required to complete future returns. HMRC normally review this status around every 5 years. Honoraria: An honorarium is subject to income tax. Bona fide reimbursement of out of pocket expenses with receipts is not and should be included under the “meetings, functions and expenses” heading (line 360) or another as appropriate. HMRC have agreed with the Union that the completion of the enclosed Form IR16 listing honoraria paid to local officers is acceptable to them, rather than the operation of a PAYE scheme locally to recover the tax. However the recipient is additionally required to declare the amount received on his or her tax return. It is important for you to note that to qualify as an honorarium the payment must be once a year only. As mentioned above, HMRC have stressed that if you employ staff then the PAYE scheme must be operated. Meetings, Functions & Expenses: This heading should include personal expenses of officers of the association attending various meetings and conferences. This will include travel, subsistence and the reimbursement of other personal out of pocket expenses. In addition you should include items of expenditure relating to meetings etc, which your association has organised. Please note that if another heading such as “campaigns” is more appropriate then please use that one. Subscriptions & Donations: Charitable donations must be within the aims and objectives of the Union and also the association. Enter all donations made, either in the notes field or on a separate sheet. Regional Council Levy: Any levies/fees paid to your local regional council should be entered into this section and not into affiliation fees/levies (to Division). Political Donations: The law prohibits trade unions from contributing to the funds of political parties or candidates in elections unless via a “political fund” specifically set up and controlled by statutory rules. Any expenditure designed to persuade voters how to vote for a candidate is restricted by this legislation and local associations must not make such contributions from their funds. Other Expenditure: As with income, details need to be provided under this heading rather than “miscellaneous” or “sundries”. This helps us allocate the amounts correctly. Page 3 of 4 Summary of Balances: Outturn: This includes total income and total expenditure and shows your profit or loss for the year. Association Funds: This figure should be the balance shown on your Form 106 for the previous year. If your records show a different figure, it could be due to old unpresented cheques. See the following section. Unpresented cheques: Uncashed (unpresented) cheques will be items shown as spent in previous years (probably last year) expenditure. If they are not cashed after a long time (6 months is usually the accepted period) you may wish to correct your books to reflect this fact. Cheques may be deemed to be cancelled at any time during the year and either of the following procedures can be used: 1. 2. Enter “Cancelled Chq/Fred Smith/Postage = £34.25” in INCOME and analyse it under “other income”. Enter “Cancelled Chq/Fred Smith/Postage = -£34.25” in EXPENDITURE (note that the amount is a negative) and analyse it, again as a negative, under “postage” thus reducing your costs for this year. Please note that if after doing this procedure you find the cheque is cashed on your bank statement some time later, just enter the cheque again as if it is a new expenditure item in the normal way. The 2 entries will cancel each other out. Bank Reconciliation: The cashbook spreadsheet available on Hearth has columns to date (rather than tick) items in this bank reconciliation process and flags immediately the amount of any error. Please read pages 16-21 of the treasurers handbook on how to complete a bank reconciliation and also see page 52 should you have any differences or errors in your reconciliation. If you still cannot get the reconciliation to balance, please contact the branch accounts office for more advice. Bank/Investment Balance: Do remember these are bank reconciliation balances, taking account of unpresented items rather than bank statement balances. Equipment & Form 360: As you will know, we are obliged to maintain an inventory of equipment held by local associations and divisions which is subject to national audit. Items in this category should be tangible single items costing in excess of £50, such as a printer, chair, etc. Items included as equipment purchases do, however, need to be included on our inventory so you are asked to provide specific details on Form 106/138. These details will then be included in the next years Form 360. Form 360 is a checklist of equipment held by an association or division as at the end of the previous year. You are requested to confirm that the items are still held or have been disposed of. Auditors: The local audit is an important part of the consolidation of our national accounts. The Form AD8 provides confirmation that the financial records have been inspected to a satisfactory level. As a result the Union’s Auditors will only personally call in and inspect a sample of around 30 associations or division accounts each year. PLEASE ENSURE THAT YOUR FORMS 106/138, IR16, AD8 AND 360 ARE RETURED TO HAMILTON HOUSE NO LATER THAN THE 31ST MARCH 2014. Page 4 of 4