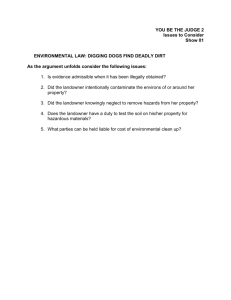

Options for Protecting Land: The Benefits for the LandOwner

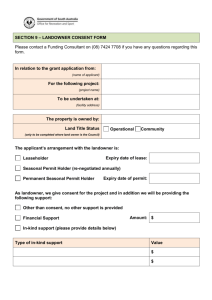

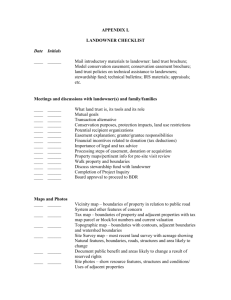

advertisement

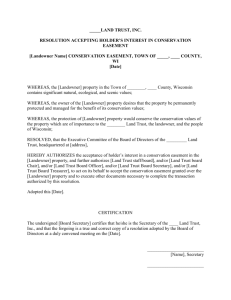

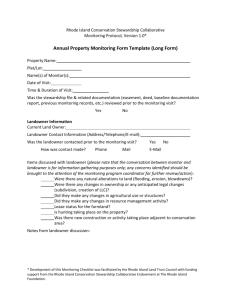

OPTIONS FOR PROTECTING LAND: Conservation Covenant: A conservation covenant is a voluntary written and legally binding agreement between a landowner and a conservation organization in which the landowner promises to protect the land in specified ways. The agreement stays on the title of the land and therefore binds future land owners. The landowner retains ownership of the land and the right to sell, but is limited in the type of uses of the land. Management Agreement: Management agreements are a contract between the owner of the land and the land trust that will steward or look after the land. This outlines how the land will protected, but does not offer long-term protection. This type of agreement is short-term, not legally binding, and easy to modify. It offers the landowner a low-commitment method of practising private land stewardship, while receiving support and guidance from the conservation organization. Profit a Prendre: This is a legal arrangement that gives someone the right to take something from the land. It prevents the landowner from using the land in a way that would interfere with the extraction rights of the profit a prendre holder. Donation: The landowner gives the property to the conservation organization. Donations can be conditional. Certain terms are agreed upon with a provision that if the terms are not met, the gift goes back to the donor or to another party. Outright Sale: The landowner deeds all the rights to the conservation organization for a sum of money. Bargain Sale: A bargain is also known as a part donation. The landowner sells the property to the conservation organization below the market value. The difference between the selling price and the market value can be considered a gift, which could lead to some income tax credit. Donation By Will/Reserved Life Estate: Donation by will lets the landowner own and control the land during their lifetime, but ensures that the land will be protected after they die. A reserved life estate is a donation of land to a conservation organization with an agreement that the landowner or the landowner’s children be allowed to stay on and live out their lives on the land. While living, the landowner holds all the rights to the land but must abide by the terms of the agreement Easements: This is the right to go on or pass across someone’s land. While this does not really protect land, it can contribute to the establishment of a greenways network. It also incurs fewer expenses for the landowner or conservation organization. CONSERVATION COVENANTS What is a Conservation Covenant? A conservation covenant is a voluntary written and legally binding agreement between a landowner and a conservation organization in which the landowner promises to protect the land in specified ways. They can be as specific or as general as needed to protect the natural values of the land. What is the purpose of a conservation covenant? A conservation covenant allows for voluntary conservation of private land. It is flexible - the landowner outlines what can and can’t be done on the property. Conservation covenants enable the ecological value of the land to be protected, while allowing for some land uses. How do conservation covenants protect the land? Conservation covenants give the holder of a covenant (usually a conservation organization) the authority to monitor and enforce the terms of the agreement. The covenant is attached to the title of the land and therefore binds future owners of the land. How do you register a conservation covenant on your land? First, contact the Land Trust to express your interest. Our staff have an in-depth understanding of the covenant procedure. A legal and environmental survey will be completed that outlines the legal boundaries and ecological values of the property. With this information, the landowner and the Land Trust will prepare the covenant. What are the benefits of establishing a conservation covenant? You retain ownership of the land and the right to sell Protection of the land as outlined in the agreement stays with the title of the land and binds future owners The covenant can protect specific values of the land but the land can still be utilized Loss of developable land can lower property value which in turn lowers property taxes For a gift of “ecologically sensitive land”, or an interest in this land, the tax receipt issued can be used as an income tax credit up to a limit of 100% of the of the donor’s net income the year of the donation. If the value of the gift is above this claim limit, the balance can be carried forward and used for up to five years into the future. What if the Greenways Land Trust ceases to exist? A covenant can specify another organization, such as the The Land Conservancy, to enforce and monitor the covenant, in the event the Land Trust ceases to exist. The crown becomes the holder of the covenant if another organization is not specified. THE BENEFITS OF CONSERVING LAND: The benefits of conserving land are many: Reduce or eliminate ownership responsibilities Ensure that the land will be protected in perpetuity Tax benefits (see below) Contribute to the community Tax and financial benefits: The tax benefits to the landowner for a donation vary and are influenced by the value of the gift and the income situation of the landowner. The tax rules regarding land conservation are complicated and changing Ecological Gift: For a gift of ecologically sensitive land*, or an interest in this land, the tax receipt can be used as a credit up to a limit of 100% of the of the donor’s net income the year of the donation. If the value of the gift is above this claim limit, the balance can be carried forward and used for up to five years into the future. Capital Gift: For a capital gift, the tax receipt can be used as a tax credit against up to 75% of the donor’s net income. If the value of the gift is above this claim limit, the balance can be carried forward and used for up to five years into the future. Lower Property Taxes: Putting a conservation covenant on the property has the potential to lower the assessed value of the land because of lost development potential. The property can then be reassessed at a lower value and the landowner pays less property tax. Other considerations: Capital Gains Tax Liability: whether land is sold or donated, the difference in value between the original cost and the current value creates a “capital gain” that the government assumes you received (whether you did or not). Tax is payable (at a rate of up to 50%) on 75% of the capital gain. * at least part of the land must be deemed ecologically sensitive for it to qualify as an ecological gift GREENWAYS What is a Greenway? A greenway is a linear corridor of greenspace. Ideally, they connect one greenspace with another. Greenways can be further defined as ecological or recreational. Ecological greenways are designed and managed to protect sensitive habitat. Human access can be limited to protect the ecological integrity of the area. Recreational greenways are designed and managed to provide recreational opportunities. Trails are ideal recreation features, as both trails and greenways are linear. Greenways can be public or private land What is a Greenways Network? A greenways network is the system of greenways and greenspaces throughout a community. It includes parks, timber lands, schools, utility corridors, golf courses, riparian corridors and private land. What is the Purpose of a Greenway? Greenways protect ecologically sensitive land and wildlife habitat, as well as providing recreational opportunities for people. They provide connections for people and wildlife to travel through urban communities without roads/vehicles. Greenways create ties between human development and natural systems. The Benefits of a Greenways Network: Helps preserve natural areas Connects parks and greenspace within and without the community Provides an alternate means for commuting Provides recreational opportunities Connects the urban and natural environment Requires less maintenance than the standard municipal park Supplies a framework for planning that considers fish and wildlife Improves the aesthetics of the community Increases the desirability and value of adjacent and nearby properties