chap016Answers

Monetary Policy

CHAPTER SIXTEEN

MONETARY POLICY

ANSWERS TO END-OF-CHAPTER QUESTIONS

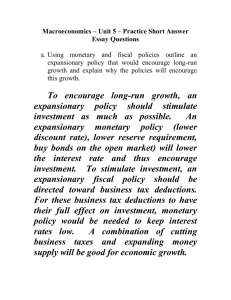

16-1 What is the basic determinant of (a) the strength of the transactions demand for money and (b) the amount of money demand for assets? How is the equilibrium interest rate in the market for money determined? Use a graph to show the impact of an increase in the total demand for money on the equilibrium interest rate (no change in the money supply). Use your general knowledge of equilibrium prices to explain why the previous interest rate is no longer sustainable.

(a) The level of nominal GDP. The higher this level, the greater the amount of money demanded for transactions. (b) The interest rate. The higher the interest rate, the smaller the amount of money demanded as an asset.

The equilibrium interest rate is found where money supply and money demand intersect (See

Figure 16.1c). i e2 i e1

D m2

D m1

Amount of money demanded and supplied

An increase in money demand from D m1

to D m2

will increase the equilibrium interest rate from i e1 to i e2

.

When money demand increases, the interest rate i e1

is no longer sustainable because the quantity of money demanded exceeds the quantity supplied at that interest rate. This will put upward pressure on interest rates as prospective borrowers compete for the limited funds available.

16-2 Assume that the following data characterize a hypothetical economy: money supply = $200 billion; quantity of money demanded for transactions = $150 billion; quantity of money demanded as an asset = $10 billion at 12 percent interest, increasing by $10 billion for each

2-percentage-point fall in the interest rate. a. What is the equilibrium interest rate? Explain. b. At the equilibrium interest rate, what are the quantity of money supplied, the total quantity of money demanded, the amount of money demanded for transactions, and the amount of money demanded as an asset?

194

Monetary Policy

(a) The equilibrium interest rate is 4% where the quantity of money supplied is equal to the total quantity demanded.

(b) At the equilibrium interest rate the quantity of money supplied is 200 and the asset demand for money is 50, the transactions demand for money is 150 and the total quantity of money demanded is 200.

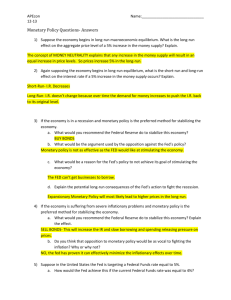

16-3 What is the basic objective of monetary policy? State the cause-effect chain through which monetary policy is made effective. What are the major strengths of monetary policy?

The basic objective of monetary policy is to assist the economy in achieving a full-employment, non-inflationary level of total output.

Cause-effect chain: Changes in the money supply affect interest rates, which affect investment spending and therefore aggregate demand. Changes in aggregate demand affect output, employment, and the price level.

The major strengths of monetary policy are its speed and flexibility compared to fiscal policy, the

Board of Governors is somewhat removed from political pressure, and its successful record in preventing inflation and keeping prices stable. The Fed is given some credit for prosperity in the

1990s.

16-4 What is the impact of each of the following transactions on commercial bank reserves? a. The New York Federal Reserve Bank purchases government securities from private businesses and consumers. b. Commercial banks borrow from the Federal Reserve Banks. c. The Fed reduces the reserve ratio.

(a) If the private businesses and consumers deposit the proceeds from their sale of government securities to the Fed, commercial bank reserves will rise. If they hold the proceeds as cash, no change in reserves will occur.

(b) Reserves will rise if commercial banks borrow from the Fed.

(c) Reducing the reserve ratio will not directly change the reserves of commercial banks. It will, however, change some of the bank reserves from required to excess reserves. To the extent that it also encourages greater lending, the increase in the money supply will generate more reserves.

16-5 Why do changes in bank reserves resulting from open-market operations by the Fed produce multiple changes in checkable deposits (and therefore money) in the economy?

When the Fed buys government securities from a commercial bank, for example, it increases the reserves of that bank. Assuming these new reserves are excess reserves, the bank can then loan them out, creating new money. As this new money is deposited, it creates additional excess reserves, which can then also be loaned out to create new money. The process can continue as long as there are excess reserves to be lent and deposits to be made, and it all started with the purchase of government securities from a single commercial bank.

The same process works if the Fed buys securities from the public, and the process works in reverse if the Fed is selling securities.

16-6 Suppose that you are a member of the Board of Governors of the Federal Reserve System. The economy is experiencing a sharp and prolonged inflationary trend. What changes in (a) the

195

Monetary Policy reserve ratio, (b) the discount rate, and (c) open-market operations would you recommend?

Explain in each case how the change you advocate would affect commercial bank reserves, the money supply, interest rates, and aggregate demand.

(a) Increase the reserve ratio. This would increase the size of required reserves. If the commercial banks were fully loaned up, they would have to call in loans. The money supply would decrease, interest rates would rise, and aggregate demand would decline.

(b) Increase the discount rate. This would decrease commercial bank borrowing from the Fed.

Actual reserves of the commercial banks would fall, as would excess reserves and lending.

The money supply would drop, interest rates would rise, and aggregate demand would decline.

(c) Sell government securities in the open market. Buyers of the bonds would write checks to the Fed on their demand deposits. When these checks cleared, reserves would flow from the banking system to the Fed. The decline in reserves would reduce the money supply, which would increase interest rates and reduce aggregate demand.

16-7 Why is monetary policy easier to undertake than fiscal policy in a highly divided national political environment?

Monetary policy is easier to undertake for a number of reasons. Decisions are made by a small number of (generally like-minded) people (the Board of Governors and FOMC). Fiscal policy decisions require the support of Congress, the Senate, and the President, all with their own agendas and constituents to satisfy. The objectives of monetary policy are more narrowly defined and generally agreed upon (economic growth with price stability). Fiscal policy involves the Federal budget, which is driven by many priorities, some unrelated or even antithetical to the objective of macroeconomic stability. Even when fiscal policy makers are focused exclusively on macroeconomic objectives, there is more room for disagreement as to what policies to implement. Tax cuts and spending packages go to generally well-defined groups; it is far less clear who will gain or lose from a particular monetary policy change.

16-8 What do economists mean when they say that monetary policy can exhibit cyclical asymmetry?

Why is this possibility significant to policy makers?

Cyclical asymmetry refers to the condition that a tight monetary policy is relatively potent at contracting economic activity, while an easy money policy is relatively weak at stimulating an economy. The weakness in easy money policy results when, even though the Fed increases liquidity (reserves) in the system, potential borrowers are unwilling to spend (often because of uncertainly over general weakness in the economy). The significance to policy makers is that an easy money policy along may be inadequate to bring the economy out of a recession.

16-9 Distinguish between the Federal funds rate and the prime interest rate. Which of these two rates does the Fed explicitly target in undertaking its monetary policy? In 2004 and 2005 the Fed used open-market operations to significantly increase the Federal funds rate. What was the logic of those actions? What was the effect on the prime interest rate?

The Federal funds interest rate is the interest rate banks charge one another on overnight loans needed to meet the reserve requirement. The prime interest rate is the interest rate banks change on loans to their most creditworthy customers. The Fed explicitly targets the Federal funds rate.

The Fed wanted to encourage banks to raise their prime interest rates, slowing growth in investment, consumption, and aggregate demand to a noninflationary pace. The tight money policy successfully raised the prime interest rate.

196

Monetary Policy

16-10 What is inflation targeting, and how does it differ from the current Fed policy? What are the main benefits of inflation targeting, according to its supporters? Why do many economists oppose it?

An inflation targeting policy would have the Fed announce each year a target range for the rate of inflation. Fed policy would then be geared to pursue that objective, and failure to meet the target would require the Fed to explain what went wrong.

Supporters of inflation targeting argue that it increases the transparency and accountability of

Fed policy. It would also keep the Fed focused on what should be its primary objective – stable prices. Some supporters would also argue that the success of past Fed action does not ensure that it will always make the right decision, especially if it attempts to pursue multiple objectives simultaneously.

Opponents of inflation targeting believe that the Fed needs the discretion and flexibility to adapt policy to conditions that are changing (sometimes rapidly). They also believe that past success in inflation targeting is partially the result of ideal economic conditions, and opponents question its effectiveness during more economically difficult times.

197