Chapter 6. Firms and Production

advertisement

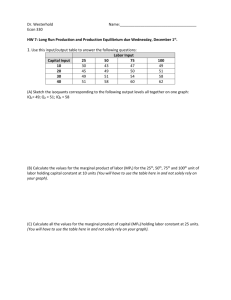

Chapter 6. Firms and Production 1. Firms and production [1] Why study firms? US national production (GDP) Firms: 84% Government: 11% Nonprofit organizations: 4% Private households: < 0.2% What is a firm: A unit or organization that convert inputs (raw material, workers, machine) into outputs. (Let’s see firm as a black box.) 3 types of firms: sole proprietorship, partnership and cooperation. Sole Proprietorship: firms owned and run by a single individual. Partnership: firms jointly owned and controlled by two or more people. The owners operate under a partnership agreement. Corporations: firms owned by shareholders in proportion to the numbers of shares of stock they hold. The shareholders elect a board of directors who run the firm. In turn, the board of directors usually hires managers who make short-term decisions and long-term plans. [2] The owner will make decisions for a firm. His objective is to maximize profit (). = Revenue – Cost Revenue = pq A necessary condition for maximizing profit is to have an efficient production process. An efficient production process is defined that the firm cannot produce more output with the existing knowledge, or that the firm cannot produce same output by using less inputs. If a firm is produced efficiently, then it cannot be maximizing its profit. There are three major categories of inputs: Capital (K): building, machine, equipments, etc. Labor (L): managers, skilled workers, or unskilled workers. Material (M): oil, water, steel, iron, etc. For simplicity, we study firms using L and K as inputs The function of a firm is summarized in its production function. q = f(L, K) Where q is the maximum amount of output produced by using L units of labor services and K units of labor. (Note: “Maximum” has implied that production function is an efficient process). [3] Time and firms’ ability to vary inputs Roughly, we divide a firm’s time frame into two time periods: long-run and short-run. Long-run: all inputs can be changed – both labor and capital. Short-run: some inputs are not changeable – capital is fixed, labor can change. This is because is generally easier to hire and fire workers instead of expand or shrink plant sizes. Equipment is fixed but you can always hire an extra hand. 2. Short-run production [1] Let’s see a short-run production function (capital is fixed): q = f(L,K) Production function with one variable input (L) A few definitions first: Marginal product of labor – the value of one extra worker MPL = q/L Average product of labor – the value of team efforts APL = q/L See the definition in Table 6.1. Note that capital is fixed at 8, while labor can be varied. The graph below shows how Total product, Marginal product, and Average product curve look like. Figure 6.1 Facts: TP 1. Initially, TP increases faster and faster as L increases. This is because specialization can increase productivity. 2. After the benefit of specialization is fully utilized, the increase in TP will slow down until an extra worker contributes negatively. MP (by definition, it is the slope of TP) 1. MP increases. 2. MP decreases but is still positive 3. MP is negative. As production increases, it will enter the range of “diminishing marginal returns.” This is called the “ law of diminishing marginal returns.” This means the extra benefit from an extra worker decreases as the number of workers increases. AP is the slope of the line from the origin to (L, q). Its relationship with MP: 1. MP > AP AP increases 2. MP < AP AP decreases 3. MP = AP (crossing point) AP at maximum Why? When L is 4, we have AP=14, which means that in average, each worker can produce 14 units of output. If we increase 1 more unit of labor, this extra labor will generate 19 units of output. If he can only generate 14 units of output, then AP will not be changed. But now 19>14, so this extra unit bids up the average product. 3. Long-run production [1] We have seen the short-run production function with a fixed capital,K. Now let’s varyK. Figure 6.2 We can see the number 24 (q=24) appears in different combinations of labor and capital. The meaning is exactly like for the indifference curves. Many combinations will give you the same output level. We can draw “isoquant” curves of production (Figure 6.2). Each curve means an output level. If the firm fixes K at 2 and increases labor units, then the output moves from e to c to f. It is a movement for short-run production. And it is a move from one isoquant to another one. If firm decreases the use of capital and increase labor while keeping on the same curve, then firm is moving on the same isoquant line, generating the same output as before. Properties (same reasons as ICs): 1. Farther is better 2. No crossing 3. Downward sloping We can see the short-run TP curve for a fixed capital in the picture of isoquants. Another way to understand the ICs and isoquants: trail maps. There are iso-height curves on the map. They trace out locations with the same altitude. Think utility levels and output levels as height, ICs and isoquants indicate the upper-left corner is the highest place in the picture. [2] Shapes of isoquants (the same as the case for indifference curves): The shape of isoquants shows whether the two inputs are substitutes or complements. Figure 6.3 Note the straight lines means perfect substitution. The dashed line in panel (b) says that it is not efficient to produce for combinations of input on that line. Firm can produce the same amount of output by using less input. Those three solid points are efficient production. The last panel is for imperfect substitutes. [3] The trade off between capital and labor (when maintaining production level) Marginal rate of technical substitution (in production): MRTS (K for L) = - K/L Same as ICs: the steeper the isoquant is, the more productive labor (horizontal axis) is. Figure 6.4 If we are given two point a and b, then we know that the change in L is 1, and change in K 18 . But what if we are asked to derive MRTS for a given K is –18, so MRTS L point, say a? Then we have to apply the next formula. [4] Substitution between inputs: MRTS and MP MPL = q/L, MPK = q/K On an isoquant, we want to decrease capital and increase labor while fixing the output. So, Loss: q = MPK *K Gain: q = MPL*L They are equal. So, MPK *K + MPL*L = 0 And MPL /MPK = - K/L = MRTS. As we move along an isoquant, it becomes flatter – diminishing marginal rate of technical substitution. This is because when the firm employs more labor, the marginal returns of labor is diminishing. – The isoquants are convex to the origin. If we go back to Figure 6.4, we can see MRTSbtoc 7 , MRTSctod 4 , and MRTSdtoe 2 . And by that, we know absolute value of MRTS is decreasing when the firm increases the input of labor. 4. Returns to scale The concept of “returns to scale” is for measuring whether a firm can produce more efficiently by expanding the production scale proportionally. For example, if a firm expands production to 3 times the original size, will the output be 3 times higher as well? This is to say f(3L, 3K) > = < 3f(L, K). We are comparing the scenario where a firm expands the plant to 3 times larger with one where there are three identical plants. In general, if a firm expands production to t times the original scale. Increasing returns f(tL, tK) > t f(L, K) Constant returns to scale f(tL, tK) = t f(L, K) Decreasing returns to scale f(tL, tK) < t f(L, K) Figure 6.5 Returns to scale relates to firms competitiveness. 1. When there is increasing returns scale, it is more efficient to produce with a larger plant. A firm will increase production scale (one large plant) to provide cheaper goods. This will drive smaller firms out of business. 2. When there is decreasing returns to scale, it is more efficient to produce with a small plant. A firm will reduce production scale (to have more plants) to provide cheaper goods. 3. When there is constant returns to scale, plant size does not matter. Example 1: q = f (x, y) = x + y This is a constant returns to scale production function. 3x+ 3y = 3q Example 2: q = f (L, K) = a L K This is a very important type of production function, which is called the Cobb-Douglas function. Let’s see f (tL, tK) = a (tL) (tK) = t+ a L K = t+ f(L, K) > = < t f(L, K) ? Depending on the value of +, >1 IRS =1 CRS <1 DRS Example 3: (Figure 6.6) Returns to scale may vary for a firm. Figure 6.6 From a to b, the firm doubles its size, and the output is 3>1*2, so we have an increasing returns to scale. From b to c, when firm doubles its size again, the output now becomes 6, which is exactly equal to double of q=3, so it is constant returns to scale. But if the firm moves from c to d, the output is less the double of previous output, which implies a decreasing returns to scale. Many production functions have increasing returns to scale for small amounts of output, constant returns for moderate amounts of output, and decreasing returns for larger amount of output. When a firm is small, increasing labor and capital allows for gains from cooperation between workers and greater specialization of workers and equipments-returns to specialization-so there are IRS. As the firm grows, return to scale is eventually exhausted. There are no more returns to specialization, so the production process has CRS. If the firm continues to grow, the owner starts having difficulty managing everyone, so the firm suffers from decreasing returns to scale.