432sample 2

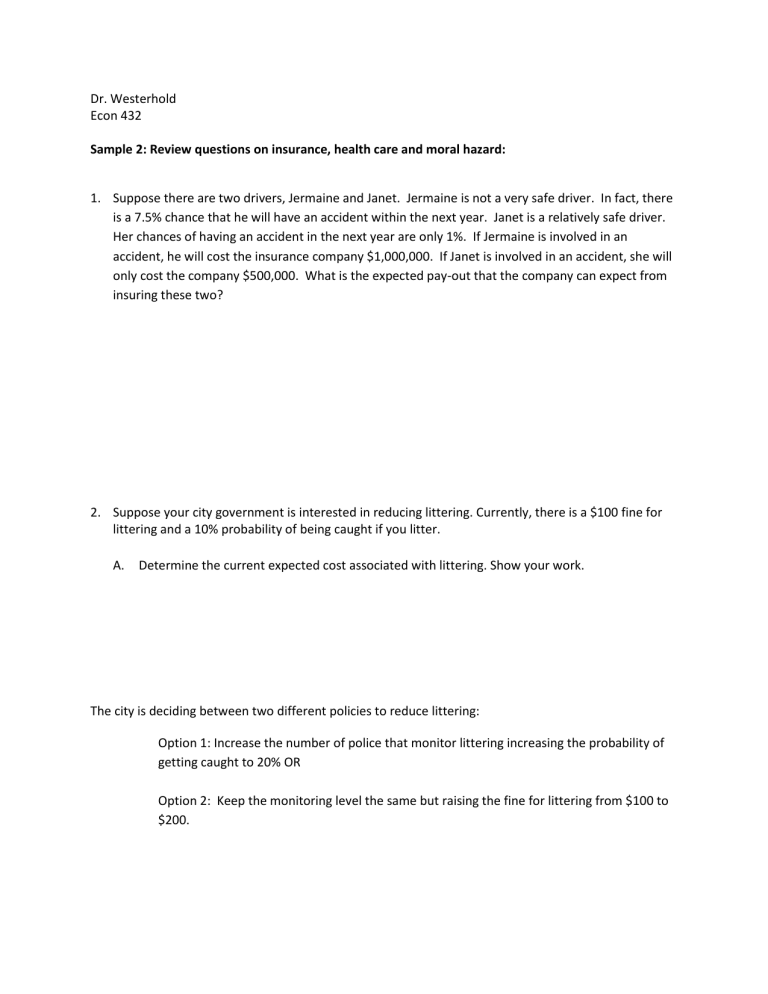

Dr. Westerhold

Econ 432

Sample 2: Review questions on insurance, health care and moral hazard:

1.

Suppose there are two drivers, Jermaine and Janet. Jermaine is not a very safe driver. In fact, there is a 7.5% chance that he will have an accident within the next year. Janet is a relatively safe driver.

Her chances of having an accident in the next year are only 1%. If Jermaine is involved in an accident, he will cost the insurance company $1,000,000. If Janet is involved in an accident, she will only cost the company $500,000. What is the expected pay-out that the company can expect from insuring these two?

2.

Suppose your city government is interested in reducing littering. Currently, there is a $100 fine for littering and a 10% probability of being caught if you litter.

A.

Determine the current expected cost associated with littering. Show your work.

The city is deciding between two different policies to reduce littering:

Option 1: Increase the number of police that monitor littering increasing the probability of getting caught to 20% OR

Option 2: Keep the monitoring level the same but raising the fine for littering from $100 to

$200.

B.

Calculate the expected cost to a citizen of littering under Option 1 vs. Option 2? Show your work.

C.

Standard economic theory suggests that the marginal utility of income is diminishing. Given this assumption, if consumers are risk averse which option do you think they will derive higher expected utility? (In other words, which option is better for the consumer). Briefly explain your answer.

3.

Suppose you typically earn $30,000 per year but there is a 5% chance that in the next year you will get sick and lose $20,000 in income due to medical costs.

A.

What is the expected value of your income? Show your work.

B.

What would be the actuarially fair premium for this individual? Show your work.

C.

Assume your utility function is given as U=ln(4I) where I is the amount of income you make in a year (you need a calculator that has logarithms to do this question but it’s simply plugging in

values to the utility function). a.

Given this utility function what is the utility of your expected income when covered by insurance? b.

Calculate the expected utility if you do not have insurance to protect you against an adverse medical event? Show your work. c. Graduate students only: determine the amount of the risk premium.

4. Assume a patient’s demand for medical services is given as P=$200-2.5Qd and the marginal cost

(MC) of medical services is $150. Construct a graph showing the market for medical services labeling the relevant intercepts.

A.

Determine the quantity of medical services consumed and the price per unit in a market with no insurance. Show this on your graph.

B.

What are total expenditures on medical services?

C.

Assume insurance is available in this market with a co-insurance rate of 30%. Show the impact on the market for medical services by determining the quantity of medical services consumed and the price per unit of medical services.

D.

What are total expenditures on medical services? How much does the patient pay out of pocket? How much does the insurance company pay?

E.

Does insurance lead to an efficient consumption of medical services? Briefly explain.

F.

Show the area of deadweight loss and determine its dollar value.

Answers:

Question 1:

The expected payout is 1,000,000(0.075) + 500,000(0.010) = $80,000.

Question 2:

A.

.10(100) + .90(0) = $10

B.

Option 1: .20(100) + .80(0)= $20

Option 2: .10(200) + .90(0) = $20

C.

Risk Averse agents want to minimize exposure to income swings—or losses in income.

Hence, although the two options have the same expected payout ($20), Option 1 has a maximum loss of only $100. Since the MU of income is diminishing, each additional dollar lost has larger and larger consequences for the consumer. Consumers will want to lose as little income as possible.

Question 3:

A.

There is a 95 percent chance of no illness, in which case income is $30,000, and a 5 percent chance of illness, in which case income is $10,000 because of the $20,000 loss. Thus, expected income is (0.95)(30,000) + (0.05)(10,000) = 29,000.

B.

An actuarially fair premium would be $1,000 since there is a one in twenty chance that the insurance company will have to cover losses of $20,000.

The utility of having income of $29,000 with certainty is 11.66, but the expected utility is only (0.95)U(30,000) + (0.05)U(10,000) = (0.95)(11.695) + (0.05)(10.597) = 11.64.

C.

Setting the expected utility equal to 11.64 and solving for income yields approximately

$28,388, indicating that the individual is indifferent between bearing the risk and having expected income of $29,000 or purchasing insurance with a certain income of $28,388. If the insurance costs $30,000 - $28,388 = $1,612, the individual is indifferent between having insurance and not having insurance, so $1,612 is the most they’d be willing to pay for a risk premium (allow some difference for rounding).

Question 4:

A. Set P=MC; Q=20 units; P=$150.

B. Total expenditures will be $3,000.

C. Set .30P=MC; Q=62 units; P=MC of firm=$150 but Price paid by patient is $45

D.

Total expenditure is $9300; insurance pays $6510; patient pays $2790;

E.

Insurance leads to overconsumption (MB at 62 units is $45 but the MC is $150) creating a deadweight loss.

F.

Area is triangle between two quantities, above demand and is valued at $2205.