Chapter 1: Lecture Notes

advertisement

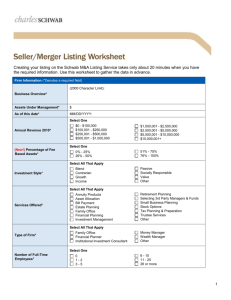

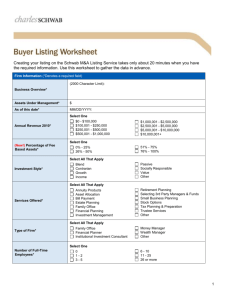

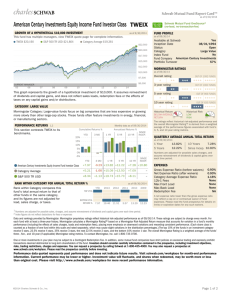

Chapter 1: Lecture Notes I. Understanding the Forces That Shape Strategy: “Business model” was a buzzword of the Internet boom. The concept is not new—it dates back to the 1960s. Chandler’s book, Strategy and Structure, described how the alignment of strategy with the environment within which a company operates and the resources and capabilities required to execute that strategy drives growth and create value for stakeholders. Today, the key components of a business model remain the same: (see Figure 1.1) A business model defines how an enterprise interacts with its environment to define a unique strategy, attract the resources and build the capabilities to execute it, and create value for all stakeholders. A well-aligned business model creates a virtuous cycle – innovation, productivity, and increasing returns. A poorly-aligned business model can create a vicious cycle, causing a business to spin out of control and destroy value. II. Conducting a Strategy Audit A. Michael Porter—successful strategies define how a company plans to achieve a distinctive, unique position that draws customers from competitors and attracts new customers. B. Strategic positions result from choices in 4 areas: (Figure 1.2, p. 27) Market/Channel positioning—determines which customers to serve, needs/expectations that will be met, channels to reach customers. Product positioning—determines choice of products/services to offer, their features and price. Value chain/Value network positioning—determines the role an organization plays/activities it performs with an extended network of suppliers, producers, distributors, and partners. Boundary positioning—determines markets, products, and business you will NOT pursue. C. Sustainable advantage – when barriers exist that make it difficult for competitors to imitate and/or customers to switch. Ex: Charles Schwab entered the market as a discount broker, serving markets under the radar of full-service brokerage firms like Merrill Lynch. Schwab then began providing differentiated product/service offerings to serve this underserved market at a price that could not be matched by full service brokers. Technology helped keep his costs low and made it difficult for new entrants to entice his customers to switch. D. A Strategic Audit includes: Customer Audit --What do they want? Competitor Audit—traditional rivals, potential new entrants, substitute products and services. Porter’s Five Forces Industry Analysis is used for competitor analysis. Unique Product/Market Positioning Audit Value Network Audit— o Determine the activities, resources, and capabilities required to design, produce, market, sell, and service your products for the target market. o Determine which of them your firm will perform, and which will be sourced. o Activities should be performed internally if 1) they are core to the strategy of the firms, 2) if company has the expertise/infrastructure to product them at less cost/higher quality than with sourcing, and 3) if the costs/risks of internal production are less than with sourcing. Ex: Because of the value Kodak placed on quality, it originally had in-house facilities to launder cloths for wiping film and to produce machines and parts. Recently, Kodak has found that IT support for inter-organizational sharing information has reduced the costs/risks of sourcing even core activities. Business Context Audit—political, societal, regulatory, legal, and economic factors that affect a business today and in the future. III. Strategic Shifts: Evolution and Revolution Four key approaches to evolving an organization’s strategy: (see Figure 1.4 (p. 33) Enhancements—incremental changes to an existing product, market, channel, or value network. Expansions—the launch of new products or product categories, entry into new markets, the launch of a new channel to complement existing ones, or the decision to outsource an activity to a new partner. Extensions—the launch of a new business or business model. Exits-decision to drop a product or product category, exit a market, and/or close a channel or business. A shift can be considered revolutionary when an entire business is entered or exited, requiring radical changes to existing business model or adoption of a new one. Ex: Charles Schwab dominated the discount broker segment of retail financial services industries from 1975-1005. In late 1990s, online Internet brokers offered discounted fees, and full-service brokers discounted their fees. Schwab lost its place as a discount broker and value-added service provider. In 2000, Schwab made a radical strategic change—it purchased US Trust, a full-service financial advisory and brokerage firm that served wealthy investors. IV. Assessing IT Impact and Alignment A. Facts: Cyclists expend less energy when positioned to draft off of one another. Geese can travel 70% farther when aligned in a V formation. Businesses achieve success when they are well-aligned. But, this is easier said than done. B. The Strategic Grid (see Figure 1.6, p, 37) Initiatives and projects translate strategy into reality. McFarlan suggests assessment of organizational IT portfolios along two dimensions, in order to assess the alignment of IT with strategic goals: impact on business operations-EX: for Nasdaq Stock Exchange, IT impact is strong, and zero-defect operation of IT is essential. For a law firm, impact on business operations is much less. impact on strategy—Ex: At Charles Schwab, evolution of IT drove the evoluation of their strategy. The strategic grid identifies four categories of IT impact that determine the approach used to identify opportunities, define and implement IT-enabled business initiatives, and organize and manage IT assets and professionals. Support quadrant—projects have little impact on core strategy or operations. Focus is on local improvements and incremental cost savings. Designed, implemented, managed by IT specialists, in partnership with local end users. Factory quadrant—projects are designed to reduce costs and improve performance of core operations. Focus is on costs and quality benefits. Designed, implemented, and managed by business unit execs, in partnership with IT execs. Turnaround quadrant—projects are designed to exploit emerging strategic opportunities. Designed, implemented, managed through partnerships between business execs, IT execs, and emerging technologies groups. Strategic quadrant—IT is used to enable both core operations and core strategy. Defined, implemented, and managed at top levels. Strategic grid can be used to assess alignment of projects with business operations and strategy, benchmark a company’s IT portfolio with other firms, and assess changes over time. In the 21st century, more and more firms are embedding IT projects in their core operations and core strategy. V. Opportunities and Risks—how IT can be used to support the search for strategic opportunities. The search for opportunities often begins with a creative idea-generation process, but opportunity identification requires a more analytically driven evaluation of the viability of the business model. Five questions that can guide execs in the search for opportunities to use IT to support and drive strategy in the search for value-creating opportunities. 1. Can IT change the basis of competition? IT automates activities, but it can also be used to both inform and transform. In the 1950s and 1960s, IT was used to automate back-office transactions. More recently, IT began to be used in the front office, for transactions with suppliers, distributors, customers, and other value chain participants. Now, real-time information provides improved coordination/control and transparency that provides strategic advantage. Can IT change the nature of relationships and the balance of power in buyer-seller relationships? 2. Can IT build or reduce barriers to entry? 3. Can IT raise or lower switching costs? 4. Can IT add value to existing products or services or create new ones? Strategic Risk: Key questions for analyzing strategic risk of IT: 1. Can emerging technologies disrupt current business models? Disruptive technologies are: Technologies that evolve faster than the evolutionary path of the dominant technology in the industry. (Ex: evolution of pcs was faster than that of mainframes.) Technology enables new products, services, pricing, or business models that change the basis of competition in ways established players can’t match. Emergence of the technology coincides with regulatory changes or significant customer dissatisfaction with status quo that dramatically influences the competitive power of established players to respond. Disruptive technologies can be seen as an opportunity. 2. Are we too early or too late to exploit an IT opportunity Cash Flow Curve for comparing business opportunities (see Fig. 1.9a p. 53): 3. Does IT lower entry barriers? The Internet and low-cost, open standard, nonproprietary technologies have lowered barriers. In other words, “the world is flat” phenomenon. 4. Does IT trigger regulatory action?