- Bankir.Ru

advertisement

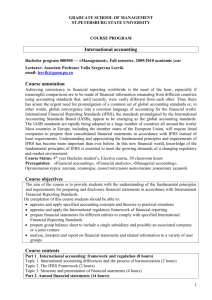

for Accounting Professionals IFRS INTRODUCTION 2011 http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng [Type text] IFRS INTRODUCTION IFRS WORKBOOKS (1 million downloaded) Welcome to IFRS Workbooks! These are the latest versions of the legendary workbooks in Russian and English produced by 3 TACIS projects, sponsored by the European Union (2003-2009) and led by PricewaterhouseCoopers. They have also appeared on the website of the Ministry of Finance of the Russian Federation. The workbooks cover various concepts of IFRS based accounting. They are intended to be practical self-instruction aids that professional accountants can use to upgrade their knowledge, understanding and skills. Each workbook is a self-standing short course designed for approximately of three hours of study. Although the workbooks are part of a series, each one is independent of the others. Each workbook is a combination of Information, Examples, Self-Test Questions and Answers. A basic knowledge of accounting is assumed, but if any additional knowledge is required this is mentioned at the beginning of the section. Having written the first three editions, we want to update them and provide them to you to download. Please tell your friends and colleagues. Relating to the first three editions and updated texts, the copyright of the material contained in each workbook belongs to the European Union and according to its policy may be used free of charge for any non-commercial purpose. The copyright and responsibility of later books and the updates are ours. Our copyright policy is the same as that of the European Union. We wish to especially thank Elizabeth Appraxine (European Union) who administered these TACIS projects, Richard J. Gregson (Partner, PricewaterhouseCoopers) who led the projects and all friends at Bankir.Ru for hosting the books. TACIS project partners included Rosexpertiza (Russia), ACCA (UK), Agriconsulting (Italy), FBK (Russia), and European Savings Bank Group (Brussels). The help of Philip W. Smith (editor of the third edition) and Allan Gamborg, project managers and Ekaterina Nekrasova, Director of PricewaterhouseCoopers, who managed the production of the Russian version (2008-9) is gratefully acknowledged. Glyn R. Phillips, manager of the first two projects conceived the idea, designed the workbooks and edited the first two versions. We are proud to realise his vision. Robin Joyce Professor of the Chair of International Banking and Finance Financial University under the Government of the Russian Federation Visiting Professor of the Siberian Academy of Finance and Banking http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng Moscow, Russia 2011 Page 2 IFRS INTRODUCTION 4 Remuneration Group .......................................................... 11 5 Listed Company Group ....................................................... 12 6 Special Case 2 Group ......................................................... 13 7 Disclosure Group ................................................................ 14 8 Banks Group ....................................................................... 14 1.2 Introductory Standards ......................................................... 4 9 Industry Specific Group ...................................................... 15 1.3 Foundation Standards .......................................................... 4 10 Consolidation Standards ..................................................... 16 1.4 Property, Plant and Equipment Standards ........................... 5 11 Additional Publications ........................................................ 17 CONTENTS An Introduction to IFRS ............................................................... 3 1.1 Scope ................................................................................... 3 Grouping of IFRS ........................................................................ 4 1.5 Special Case 1 Standards .................................................... 5 1.6 Remuneration Standards ..................................................... 5 1.7 Listed Company Standards .................................................. 5 11.1 Transformation................................................................ 17 An Introduction to IFRS 1.1 Scope 1.8 Special Case 2 Standards .................................................... 5 1.9 Disclosure Standards ........................................................... 5 1.10 Banking Standards ........................................................... 5 1.11 Industry Specific Standards .............................................. 5 1.12 Consolidation Standards ................................................... 5 1.13 Additional Publications ........................................................ 5 2 Overview of the Standards ................................................... 6 These notes are an unofficial guide to IFRS and introduce the series, IFRS Workbooks for Accounting Professionals. The main objective is to help you navigate the IFRS standards by grouping them by theme. The secondary purpose is to highlight how our publications can assist in learning IFRS. For each Standard there is a workbook to download comprising text, examples, multiple-choice questions and answers on our website www.bankir.ru/ifrs. 2.1 Introductory Group .............................................................. 6 2.2 Foundation Group ................................................................ 7 2.3 Property, Plant and Equipment Group.................................. 8 3 Special Case 1 Group......................................................... 11 http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng The architecture of IFRS must be taken as a whole. Financial statements prepared under IFRS must use all of the required applicable standards to be “IFRS compliant”. IFRS can be grouped by theme rather than date of publication as published by IASB. Page 3 IFRS INTRODUCTION The themes chosen recognise that some standards, such as ‘Impairment’ interact with a range of other standards. ALTERNATIVES FOR APPROPRIATE ACCOUNTING INTERNATIONAL FINANCIAL REPORTING STANDARDS. Financial reporting standards have two main aims: POLICIES discuss specific accounting for certain types of assets and activities. They apply to all commercial banks. Policies indicate, where applicable, which method of accounting is required when alternatives exist. -disclosure -timing of profit All standards identify the disclosure of information required according to those aims. IAS 24 Related Parties, IAS 32 Financial Instruments and IFRS 8 Operating Segments are only about disclosure. Most other standards prescribe the timing of recognition of revenue, costs or both, and therefore the timing of the recognition of profit. They may prescribe that revenue, costs or both (and therefore, profit) are recognised in a single specific period, or are spread over more than one period. Note: IFRS 9-13 have an effective date of 2013. The standards they replace are listed here and supported by our books as the older standards can be used until 2013. PRINCIPLE, STANDARD, POLICY, PROCEDURE RELATIONSHIPS PRINCIPLES are guiding concepts. STANDARDS ARE WRITTEN GUIDELINES FOR THE TREATMENT OF VARIOUS TYPES OF FUNCTIONS AND ACTIVITIES. THEY APPLY TO ALL COMMERCIAL BANKS. STANDARDS INCLUDE ACCEPTABLE http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng UNDER PROCEDURES give detailed instruction on the handling of specific transactions arising from activities or in accounting for assets or liabilities. They are written by individual banks for internal use. A number of separate procedures are typically necessary to cover all the various activities associated with accounting for one type of function. Grouping of IFRS The standards are grouped into eleven themes as follows: 1.2 Introductory Standards The Conceptual Framework for Financial Reporting Main Financial Statements and Accounting Policies: IAS 1: Presentation of Financial Statements IAS 7: Statements of Cash Flows IAS 8: Accounting Policies, Changes in Accounting Estimates and Errors 1.3 Foundation Standards IAS 18: Revenue IAS 2: Inventories IAS 37: Provisions, Contingent Liabilities and Contingent Assets IAS 12: Income Taxes Page 4 IFRS INTRODUCTION 1.4 Property, Plant and Equipment Standards IAS 16: Property, Plant and Equipment IAS 36: Impairment of Assets IAS 40: Investment Property IAS 17: Leases IAS 38: Intangible Assets IAS 11: Construction Contracts IAS 23: Borrowing Costs IAS 20: Accounting for Government Grants and Disclosure of Government Assistance IFRS 5: Non-current Assets Held for Sale and Discontinued Operations 1.5 Special Case 1 Standards IAS 21: The Effects of Changes in Foreign Exchange Rates 1.6 Remuneration Standards IAS 19: Employee Benefits IAS 26: Accounting and Reporting by Retirement Benefit Plans IFRS 2: Share-based Payment 1.7 Listed Company Standards IFRS 8: Operating Segments IAS 34: Interim Financial Reporting IAS 33: Earnings per Share 1.8 Special Case 2 Standards IAS 29: Financial Reporting in Hyperinflationary Economies IFRS 1: First-time Adoption of International Financial Reporting Standards http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng 1.9 Disclosure Standards IAS 24: Related Party Disclosure. IAS 10: Events after the Reporting Date 1.10 Banking Standards IAS 32: Financial Instruments: Disclosure and Presentation IAS 39: Financial Instruments: Recognition and Measurement IFRS 7: Disclosure in the Financial Statements of Banks and Similar Financial Institutions IFRS 9: Financial Instruments IFRS 13: Fair Value Measurement 1.11 Industry Specific Standards IAS 41: Agriculture IFRS 4: Insurance Contracts IFRS 6. Exploration for and evaluation of mineral resourses 1.12 Consolidation Standards IAS 27: Separate Financial Statements IAS 28: Investments in Associates IAS 31: Interests in Joint Ventures IFRS 3: Business Combinations IFRS 10: Consolidated Financial Statements IFRS 11: Joint Arrangements IFRS 12: Disclosure of Interests in Other Entities 1.13 Additional Publications RAS to IFRS Transformation Page 5 IFRS INTRODUCTION 2 Overview of the Standards 2.1 Introductory Group The Conceptual Framework for Financial Reporting This framework document deals with: (i) (ii) (iii) (iv) the objective of financial statements; the qualitative characteristics that determine the usefulness of information in financial statements; the definition, recognition and measurement of the elements from which financial statements are constructed; and concepts of capital and capital maintenance. It specifies that IFRS accounts are prepared using the accrual concept and that financial statements are normally prepared on the assumption that an undertaking is a going concern, and will continue in operation for the foreseeable future. The Framework document is a comprehensive overview of the foundations of IFRS, and is referred to by the IASB in its deliberations on new standards and amendments to existing standards. As well as financial performance, financial statements also show the results of management’s stewardship of resources and must provide information on: (i) assets; (ii) liabilities; (iii) equity; (iv) income and expenses, including gains and losses; (v) other changes in equity; and (vi) cash flows. A complete set of financial statements comprises: (i) a balance sheet (Statement of Financial Performance); (ii) an income statement; (iii) a statement of changes in equity showing either: (iv) all changes in equity, or (v) changes in equity (not normal buying and selling); (vi) a statement of cash flows; and (vii) notes, comprising a summary of significant accounting policies, and other explanatory notes. IAS 1 AND IAS 7 cover the primary presentation issues of IFRS financial statements and specify the information that needs to be included in those statements. IAS 7 requires the disclosure of information on changes in cash and cash equivalents by means of a cash flow statement. Main Financial Statements and Accounting Policies IAS 1: Presentation of Financial Statements + IAS 7: Statements of Cash Flows http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng IAS 7 classifies cash flows into: (i) operating, (ii) investing and (iii) financing activities. Foreign currency cash flows are covered, as are Acquisitions and Disposals of Subsidiaries and Other Business Units. Page 6 IFRS INTRODUCTION IAS 8: Accounting Policies, Changes in Accounting Estimates and Errors Retrospective application is applying a new policy as if that policy had always been applied. An undertaking shall disclose in the summary of significant policies: Retrospective restatement is restating financial statements as if a prior-period error had never occurred. (i) the measurement bases used in the financial statements; and (ii) the other policies used that are relevant to an understanding of the financial statements. IAS 8 prescribes the criteria for selecting and changing accounting policies, and disclosing the effects of estimates and errors. Accounting policies are rules and practices applied in presenting financial statements. Retrospective application and restatement may be new to some of our readers. Our workbook on IAS 8 provides guidance and examples. 2.2 Foundation Group IAS 18: Revenue A change in accounting estimate is an adjustment of the carrying amount of an asset or a liability or the consumption of an asset. Revenue is income that is derived from ordinary activities of the firm. (See also IAS 17, 28, 39 & 41+ IFRS 9 which complement IAS 18 in respect of revenue.) Income comprises revenue and gains. Changes in estimates result from new information, or new developments and are not corrections of errors. The timing of recognition of revenue is a key issue of the standard. Prior-period errors are omissions or misstatements in the financial statements of prior-periods.Information that was available, and should have been taken into account, is classified as an error. Revenue will be recognised when it is probable that future economic benefits will be secured, and the benefits can be measured. Errors include IAS 2: Inventories (i) (ii) (iii) (iv) calculation error; incorrect application of accounting policies; oversights or misinterpretations; and fraud. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng Inventories are: (i) (ii) assets that are held for sale, or being prepared for sale, materials to be used in the production process or provision of services. Page 7 IFRS INTRODUCTION In the case of the provision of services, inventories include the cost of unbilled services (similar to work in progress). Valuation of inventory at cost, fair value and net realisable value are all discussed in the workbook. IAS 37: Provisions, Contingent Liabilities and Contingent Assets IAS 37 sets out recognition criteria and measurement bases for provisions, contingent liabilities and contingent assets and specify the information to be disclosed in the notes to the financial statements. Provisions are used to provide for future liabilities that are uncertain. Contingent assets are uncertain cash inflows that may be received. Contingent liabilities (e.g. guarantees and warranties) do not appear on balance sheets, but need to be disclosed in financial statements to enable users to have a complete picture of the undertaking’s financial position. IAS 12: Income Taxes IAS 12 prescribes the accounting treatment for income taxes, and the tax consequences of: (i) (ii) transactions of the current period; and the future liquidation of assets and liabilities. If liquidation of those assets and liabilities will make future tax payments larger or smaller, IAS 12 generally requires recording of a deferred tax liability (or deferred tax asset). IAS 12 also covers: (i) recognition of deferred tax assets arising from unused tax losses or unused tax credits, (ii) presentation of income taxes, and (iii) disclosure of information relating to income taxes. 2.3 Property, Plant and Equipment Group IAS 16: Property, Plant and Equipment The main issues in accounting for property, plant and equipment are: (i) the recognition of the assets; (ii) the determination of their carrying amounts; (iii) the depreciation charges; and (iv) impairment losses to be recognised. IAS 36: Impairment of Assets The objective of IAS 36 is to prescribe the procedures to ensure that assets are carried at no more than their recoverable amount and the disclosures that must be made. An asset is described as impaired when its carrying amount exceeds the recoverable amount (amount to be recovered through use or sale). IAS 36 requires the recording of an impairment loss. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng Page 8 IFRS INTRODUCTION IAS 40: Investment Property Investment property can be: (i) (i) (ii) (iii) land, or a building, or part of a building, or both land and building. Short-term rental agreements are mostly accounted for as ‘operating leases’ in the same way as rental payments are booked. Operating leases are treated as expense items in the income statement. IAS 38: Intangible Assets IAS 38 requires an undertaking to record an intangible asset only if: It is held by the owner (or by the lessee, under a finance lease) to earn rent, or for capital appreciation, or both. (i) It does not include property: (ii) (i) (ii) (iii) for use in the production, supply of goods, services; or for administrative purposes; or for sale in the ordinary course of business. future benefits of the asset will flow to the undertaking; and the cost of the asset can be measured. This requirement applies whether an intangible asset is acquired externally or generated internally. IAS 17: Leases IAS 38 includes additional recognition criteria for internallygenerated intangible assets. Leases involve the owner of an asset renting it to others for payment. After initial recognition, IAS 38 requires an intangible asset to be measured at: Long-term rentals (‘finance leases’) have seen dramatic growth over the last 50 years. IAS 17 addresses this issue by accounting for finance leases in a similar manner as the purchase of an asset, matched by a loan for the same amount. The asset appears on the balance sheet even though the lessee does not own it. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng (i) (ii) cost, less any accumulated amortisation and any accumulated impairment losses; or revalued amount, less any accumulated amortisation, and any accumulated impairment losses. IAS 11: Construction Contracts The start and finish of construction contracts often falls into different accounting periods. Thus, the timing of recognition of contract revenue and contract costs are key issues of the standard. Page 9 IFRS INTRODUCTION An effective internal financial budgeting and reporting system, which is kept up-to-date at all times, is required to control construction contracts. 4. Investment properties. 5. Intangible assets Regular reviews of costs and revisions of estimates are necessary throughout the contract. IAS 20: Accounting for Government Grants and Disclosure of Government Assistance Construction contracts include: IAS 20 covers accounting and disclosure of government grants and similar assistance that transfers resources to qualifying firms. The firms qualify by past or future compliance with the grant conditions. Grants exclude assistance that cannot be reasonably valued, and transactions with government which are in the normal course of trade. (i) (ii) services related to the construction, such as project managers and architects; contracts for demolition, or restoration, of assets and the restoration of the environment. IAS 23: Borrowing Costs Borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset form part of the cost of that asset. Incentives such as free technical assistance, marketing advice and the provision of guarantees are excluded form accounting unless there is a direct cost. Other borrowing costs are recognised as an expense. IFRS 5: Non-current Assets Held for Sale and Discontinued Operations A qualifying asset is one that takes a long time to prepare for its intended sale or use. IFRS 5 sets out requirements for the classification, measurement and presentation of non-current assets ‘held for sale’. Examples of Qualifying Assets: IFRS 5 arises from the IASB’s consideration of the U.S. based FASB Statement No. 144 and addresses two areas: 1. Inventories that require a long time to bring them to a saleable condition. (i) 2. Manufacturing plants. (ii) the classification, measurement and presentation of assets ‘held for sale’; the classification and presentation of discontinued operations. 3. Power-generation facilities http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng Page 10 IFRS INTRODUCTION 3 Special Case 1 Group (iii) other long-term staff benefits, including long-service or sabbatical leave, jubilee or other long-service benefits, long-term disability benefits and, if they are payable twelve months or more after the end of the period, profitsharing, bonuses and deferred compensation; (iv) termination benefits; (v) equity compensation benefits. IAS 21: The Effects of Changes in Foreign Exchange Rates Transactions in foreign currencies, investments and liabilities in foreign currencies are covered, as are financial statements of foreign operations. The standard sets out how to recognise and record income, expenditure, assets and liabilities denominated in a foreign currency and how gains and losses are recognised. IAS 26: Accounting and Reporting by Retirement Benefit Plans 4 Remuneration Group Providing guidance on remuneration, these standards are of specific interest to those involved in private pension schemes and the use of shares and share options to pay staff and others. IAS 26 should be applied in the reports of private retirement benefit (pension) plans where such reports are prepared. IAS 19: Staff Benefits IFRS 2 covers settlements made in an entity’s own equity instruments or in cash, if the amount payable depends on the price of the entity’s shares (or other equity instruments, such as options). IAS 19 identifies, and provides guidance on the accounting for, five categories of staff benefits: (i) (ii) short-term staff benefits, such as salaries and social security contributions, paid annual leave and paid sick leave, profit-sharing and bonuses payable within twelve months and non-cash benefits such as medical care, housing, cars and free or subsidised goods or services for current staff; IFRS 2: Share-based Payment Estimates are required of the number of options, or other instruments, expected to be exercised. Such estimates are complex to calculate where performance criteria, such as earnings targets, are involved. Specialist valuation skills are likely to be required in order to determine the amounts to be reported in the financial statements. post-employment benefits such as pensions, other retirement benefits, post-employment life insurance and post-employment medical care; http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng Page 11 IFRS INTRODUCTION 5 Listed Company Group These three standards are compulsory only for companies listed on stock exchanges, or mandatory under national accounting regulations. For other companies these standards are recommended. Different segments will generate dissimilar streams of cash flows to which are attached disparate risks and which bring about unique values. Thus, without disaggregation, there is no sensible way to predict the overall amounts, timing, or risks of a complete undertaking’s future cash flows. IFRS 8: Operating Segments The additional detail should: As undertakings become larger, understanding how they operate: - in different markets, - with different products and services and - providing to a growing range of clients becomes more difficult, unless additional detail is provided. Information about components of an undertaking, the products and services that it offers, its foreign operations, and its major clients is useful for understanding and making decisions about the undertaking as a whole. Users observe that the evaluation of the prospects for future cash flows is the central element of investment and lending decisions. The evaluation of prospects requires assessment of the uncertainty that surrounds both the timing and the amount of the expected cash flows to the undertaking, which in turn affect potential cash flows to the investor or creditor. Users also observe that uncertainty results in part from factors related to the products and services an undertaking offers and the geographic areas in which it operates. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng (1) increase the number of reported segments and provide more information; (2) enable users to see an undertaking through the eyes of management; (3) enable an undertaking to provide timely segment information for external interim reporting with relatively low incremental cost; (4) enhance consistency with the management discussion and analysis or other annual report disclosures; and (5) provide various measures of segment performance. Knowledge of the structure of an undertaking’s internal organisation is valuable in itself because it highlights the risks and opportunities that management believes are important. Segments based on the structure of an undertaking’s internal organisation have at least three other significant advantages: 1. An ability to see an undertaking “through the eyes of management” enhances a user’s ability to predict actions or Page 12 IFRS INTRODUCTION reactions of management that can significantly affect the undertaking’s prospects for future cash flows. period, and between different reporting periods for the same undertaking. 2. As information about those segments is generated for management’s use, the incremental cost of providing information for external reporting should be relatively low. Earnings per share (earnings / number of shares) as a measure of performance has its limitations, as accounting policies for determining “earnings” may differ. 3. Practice has demonstrated that the term ‘industry’ is subjective. Segments based on an existing internal structure should be less subjective. The focus of IAS 33 is on determining the number of shares used in the EPS calculation, which may not be immediately clear (for example where options exist). IAS 34: Interim Financial Reporting 6 IAS 34: (i) IAS 29: Financial Reporting in Hyperinflationary Economies (ii) defines the minimum content of an interim financial report; and identifies the recognition and measurement principles that should be applied in an interim financial report. The notes to interim financial reports include primarily an explanation of the events, and changes, that are significant to an understanding of the changes in financial position, and performance, since the last annual reporting date. Virtually none of the notes to the annual financial statements are repeated, or updated in the interim report. Special Case 2 Group IAS 29 is based on current purchasing power principles and requires that financial statements, prepared in the currency of a hyperinflationary economy, be stated in terms of the value of money at the reporting balance sheet date. This straightforward requirement needs an understanding of complex economic concepts, a thorough knowledge of the enterprise’s financial and operating patterns and a detailed series of procedures to implement. IFRS 1: First-time Adoption of International Financial Reporting Standards IAS 33: Earnings per Share The objective of IAS 33 is to prescribe principles for the calculation and presentation of earnings per share. This is to improve comparisons between different undertakings in the same reporting http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng IFRS 1 sets out the requirements for first time adopters of IFRS. The standard allows companies to avoid some of the need for reconstructing old records by providing exemptions from other standards. Page 13 IFRS INTRODUCTION 7 Disclosure Group (ii) if the company can no longer be considered a goingconcern during this period, the financial statements should not be prepared on a going-concern basis. (iii) events that were unknown or unclear at the balance sheet date, will cause the financial statements to be adjusted. (iv) conditions that arose after the balance sheet date should not adjust the financial statements, but should be suitably noted. IAS 24: Related Party Disclosure. The standard will be applied in: (i) identifying related party relationships and transactions; (ii) identifying outstanding balances between an undertaking and related parties; (iii) identifying when the disclosures should be made; and (iv) determining what disclosures should be made. Related party relationships are a normal feature of business throughout the world. The related party relationships can have an impact on the profit, or loss, of an undertaking. Transactions with related parties may be made on different terms or prices than would have been made with unrelated parties. 8 Banks Group IFRS 7, IFRS 9,, IFRS 13, IAS 32 and IAS 39 must be applied to financial instruments in any company reporting under IFRS. IAS 10: Events after the Reporting Period Financial instruments are used extensively in banking but only to a limited extent in enterprises. IFRS 10 details the post-balance-sheet events, when they should be recognised and how they should be recorded and disclosed. IFRS 7: Disclosure in the Financial Statements of Banks and Similar Financial Institutions Post-balance-sheet events happen in the period starting immediately after the balance sheet date and ending at the date of approval of the financial statements by the shareholders. IFRS 7 requires banks to provide disclosures in their financial statements that enable users to evaluate: (i) the significance of financial instruments for the bank’s financial position and performance; (ii) the nature and extent of risks arising from financial instruments to which the bank is exposed during the period and at the reporting date; and There are 4 main types of material post-balance-sheet event in this period: (i) dividends declared in the period should be noted, but not shown as a liability, at the balance sheet date. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng Page 14 IFRS INTRODUCTION (iii) how the entity manages those risks. There are specified minimum disclosures on credit risk, liquidity risk and market risk. 9 Industry Specific Group IAS 41: Agriculture IAS 41 should be applied to the following agricultural activities: IAS 32: Financial Instruments: Disclosure and Presentation IAS 39: Financial Instruments: Recognition and Measurement These two standards are primarily used by financial institutions and specify disclosure, presentation, recognition and measurement of financial instruments. Our approach to these 2 complex, comprehensive standards is to provide 4 detailed workbooks on different stages of accounting for financial instruments: Initial Recognition. De-recognition. (i) (ii) (iii) biological assets; agricultural produce at the point of harvest; and certain government grants. Agricultural activity includes: (i) (ii) (iii) (iv) (v) livestock, forestry, cropping, cultivation, and aquaculture (including fish farming). In each case, living animals and plants perform a biological transformation that takes place in a managed environment. Management is the key issue that differentiates agricultural activity from other activities such as sea fishing or harvesting virgin forest neither of which are classified as agricultural activities. Subsequent Recognition. Hedge Accounting. The extent of change in the biological asset can be measured in a wide variety of ways, ripeness, dimensions, fat content, etc. We are also producing an Explanations of Terminology to provide more detail. Biological transformation results in: (i) IFRS 9 is superseding IAS 39. IFRS 13 comprehensively covers Fair Value. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng (ii) Change in the asset through an increase or decrease in quantity, or quality. Additional assets may result from procreation or agricultural produce (cereals, legumes, beef, milk). Page 15 IFRS INTRODUCTION IFRS 4: Insurance Contracts IFRS 4 specifies the financial reporting for insurance contracts for issuers of such contracts. In particular, IFRS 4 requires: (i) certain improvements to accounting, and (ii) disclosure that identifies and explains the amounts in an insurer’s financial statements, particularly in relation to: a. amounts arising from insurance contracts and timing; and b. uncertainty of cash flows. It includes a number of important changes to previous practice, outlined below, but must be read in conjunction with IAS 27, 28 and 31. Accounting Business combinations within the scope of IFRS 3 are accounted for using the ‘purchase method’. The acquirer records the acquiree’s identifiable assets, liabilities and contingent liabilities at their fair values at the acquisition date and also records goodwill, which is subsequently tested for impairment. Assets acquired and assumed: IFRS 6. Exploration for and evaluation of mineral resources Recognition IFRS 6 is an interim solution, pending development of a comprehensive solution, to help companies deal with the IAS 16 and IAS 38 scope exclusions. 10 Consolidation Standards These consolidation standards are for business groups and specify the techniques for combining the financial statements of the members of the group into a single consolidated set of financial statements, and list the required disclosures. IFRS 3: Business Combinations IFRS 3 is the latest standard relating to consolidated accounts. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng If there is an existing restructuring liability per IAS 37, it is included in the goodwill calculation. If fair values can be measured reliably, the acquirer must record separately the acquiree’s contingent liabilities, at the acquisition date, as part of allocating the cost of a business combination. If the contingent liabilities cannot be measured, they are not included in the allocation of cost. Measurement IFRS 3 requires the acquiree’s identifiable assets, liabilities and contingent liabilities to be measured initially at their fair values, at the acquisition date. Page 16 IFRS INTRODUCTION Any minority interest in the acquiree is the minority’s proportion of the net fair values. 11 Additional Publications 11.1 Transformation Goodwill IFRS 3 requires goodwill to be measured after initial recognition at cost, less any accumulated impairment losses. Goodwill is not amortised, but must be tested for impairment annually, or more frequently. Negative goodwill IFRS 3 requires that negative goodwill must be credited to income by the acquirer immediately. IAS 27: Consolidated and Separate Financial Statements IAS 28: Investments in Associates IAS 31: Interests in Joint Ventures We have produced workbooks Consolidation 1+2+3 to cover these standards, focussed on the practical techniques required to consolidate financial statements. RAS to IFRS Transformation The purpose of this workbook is to examine the process and adjustments necessary to transform a trial balance based on Russian Accounting Standards (RAS) into a set of IFRS financial statements comprising Income Statement and Balance Sheet. The workbook has been designed around a series of the most common adjustments covering the main aspects of transformation. These are presented in the form of 17 separate companies each of which requires 2/5 adjustments. Each company uses the same opening, unadjusted, RAS based trial balance which is then adjusted in accordance with the 2/5 entries required. Adjustments from all of the seventeen companies are brought together in a summary that reflects all of the adjustment made in the individual companies. IAS 27 still covers Separate Financial Statements, while the consolidation has moved to IFRS 10 and IFRS 11 covers joint arrangements. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng Page 17