Abbott Laboratories (NYSE: ABT) Executive Summary and

advertisement

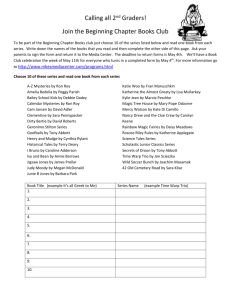

Abbott Laboratories (NYSE: ABT) Executive Summary and Investment Recommendation Investment Managers: Shih-Yi Chang, Richie Hartz, and Anastasia Sutjahjo Company Overview Abbott Labs (NYSE: ABT) was founded in Chicago in 1900, and went public in 1929. The company operates in five key divisions – proprietary pharmaceuticals, nutritional products, established pharmaceuticals, diagnostic products, and vascular products. However, in January 2013, Abbott will spin off its proprietary pharmaceutical division, which accounts for about 44% of 2011 revenue, into an independent, publicly traded company. This new company, Abbvie, will also trade on the NYSE with ticker symbol ABBV. Abbott will remain a public company operating through the remaining four business segments mentioned above. Each of Abbott’s investors will receive one share of ABBV for each share of ABT that they own as of December 12, 2012. One of Abbvie’s growth drivers is the arthritis drug Humira, for which Abbott received rights through their acquisition of Knoll Pharmaceuticals. This single drug accounted for 21% of Abbott’s sales in 2011. Macroeconomic and Industry Overview The growing and aging population domestically is expected to increase demand for the pharmaceutical industry moving forward. Further, as the economy recovers, the unemployment rate is expected to decline – enabling more individuals to be covered by employee health insurance. The legal progression of “Obama-Care” will also likely enhance pharmaceutical performance in future years. Emerging markets internationally represent a key opportunity for the pharmaceutical industry, and Abbott has become increasingly reliant on this market in recent years. Rising costs of research and development, the highly regulated clinical trial process, and intense competition from generic pharmaceuticals have established a significant barrier for new entrants. Financial Analysis, Projection, and Valuation Abbott has increasingly stable gross profit margins and EBIT margins. We expect an artificial pullback in the equity value during the immediate timeline of the spin-off, though this pullback represents analysis outside of the fundamentals driving valuation and therefore presents a buying opportunity. DCF valuation presents an implied stock price of around $72, using a discount rate of just under 10%. Looking to Johnson & Johnson, Pfizer, and Merck as competitors, multiples analysis presents an implied stock price of around $65. The spin-off is expected to unlock and enhance the value of both equities. Recommendation On November 27, 2012, the RCMP investment management team recommends to purchase 100 additional shares of Abbott at the current market price.