4. Org Chart for Re-launched Aeris Therapeutics

Aeris Therapeutics

Investor Presentation

Prepared for:

Author: David R. Leon

Collaboration with: Chip Hennen, Tom Hoster,

Jan. 28, 2013

Mobile: 901.356.1565

Email: davidrleon@gmail.com

2014

Investor Purchase Proposal — Aeris Therapeutics

Table of Contents:

Page 2 of 31

Investor Purchase Proposal — Aeris Therapeutics

1. Executive Summary

Founded in 2001, Aeris Therapeutics is a privately held medical device start-up company specializing in the development and commercialization of novel treatments for patients with emphysema and other advanced lung diseases. With corporate offices in Woburn, MA, the company ceased operations in November 2013 after it lost its funding. The company’s principals, including the estate of the sole investor, are disposing of all of the company’s intangible assets, including its IP portfolio, via a closed auction tentatively scheduled to close

February 28, 2014. This prospectus outlines the opportunity available from the purchase of those assets and the successful re-launch of Aeris Therapeutics.

Aeris spent ten (10) years developing its initial product, the AeriSeal ® System, a relatively simple and innovative 30-minute procedure therapy for advanced emphysema invented by the company’s founder, Edward Ingenito, MD. Dr. Ingenito has served as the company’s Chief

Medical Officer and Scientific Director. He is a recognized expert in pulmonary physiology and lung volume reduction and has published extensively in peer-reviewed journals.

Emphysema is a progressive, debilitating lung disease for which there are few treatment options. In recent years, lung volume reduction surgery (LVRS), which involves surgical removal of diseased portions of the lung in order to enable the remaining portions of the lung to function better, has become an accepted procedure for advanced emphysema. Though considered the only truly effective treatment for advanced emphysema, the procedure is complicated and is accompanied by substantial morbidity and mortality risks, as well as economic cost, so it is performed infrequently.

The AeriSeal System is intended to provide benefits similar to those of LVRS via a completely non-surgical in-patient treatment. AeriSeal Foam Sealant, a cross-linked polymer agent, is administered by a medical device through the working channel of a bronchoscope into the target areas of the lung, where it polymerizes and seals the diseased lung regions. Over time, the sealed regions collapse, thereby reducing lung volume.

The AeriSeal System has been shown in open-label investigational and peer-reviewed published studies to reduce lung volume, improve lung function, and improve quality of life in patients with advanced emphysema and a favorable risk/benefit profile. The system has been granted CE Mark approval in the European Union (EU). About 350 patients have been treated to date.

This prospectus proposes to attract an investor(s) to quickly acquire and control all of Aeris

Therapeutics’ intellectual property for $2 to $3 Million, re-launch the company, then prepare a private placement memorandum to obtain the estimated $25-$30 Million necessary to complete critical milestones for a successful exit.

Page 3 of 31

Investor Purchase Proposal — Aeris Therapeutics

Country COPD Rate

COPD Gold III-

IV

18.8%

Endoscopic Lung Volume Reduction Market Size

Meet

G O L D III- IV Clinical

>40%

Dx w/ involvement w/

Upper Lobe Homogenous

E m p h ysem a

Criteria for

Emphysema

Predominant Reduced

LVRS

70.2% 49.9% 70.0% 59.2% 18.2%

U.S.

13,090,000

Europe 17.45%

Germany 4,483,668

France

Italy

3,624,987

2,779,593

Spain 2,766,615

U.K.

3,927,864

Subtotal EU5 17,582,727

2,456,000

841,244

680,135

521,519

519,084

736,962

3,298,944

1,724,112 860,332

590,554

477,455

366,106

364,397

294,686

238,250

182,687

181,834

517,347 258,156

2,315,859 1,155,613

602,232

206,280

166,775

127,881

127,284

180,709

808,929

356,522

122,118

98,731

75,705

75,352

106,980

478,886

109,606

37,543

30,353

23,274

23,166

32,889

147,225

Treatable

Patients

466,128

159,661

129,084

98,980

98,518

139,869

626,111

Market Size

$ 13,000

$ 6,059,644,000

$ 2,075,592,864

$ 1,678,089,912

$ 1,286,737,388

$ 1,280,729,464

$ 1,818,298,301

$ 8,139,447,929

2. Previous Funding

Aeris Therapeutics ’ operations were funded entirely by an angel investor, xxxxxx, principal of xxxx Enterprises, Framingham, MA. He owns 86% of the company, including its intangible assets. The estimated investment expenditures to date is $70-$75 Million, which is consistent for PMA novel device development costs. More recently, he funded operations month to month.

Mr. Rosse, who is 86 years old, is now suffering from advanced dementia. As a result, his estate recently assumed decision authority and determined as of November 22 nd , 2013, to cease al l operations and put the company’s intellectual property and other assets up for sale to the highest bidder.

3. Company Acquisition and Re-launch Strategy

The value offered with this transaction is acquiring a novel medical device technology for less than 5% of the total development cost, substantially lowering the return basis for a successful, profitable exit. Total European sales revenue for 2012 was $481,000 and $650,000 in 2013.

The auction process is being managed by xxxxxx xxxxxx an intangible asset disposition company engaged by the assignee of the creditors of Aeris Therapeutics. In conversations with

Hilco, it was stated the transaction value should be in the “low seven figures.” The target close date is February 28th, 2014. Potential buyers have also been informed that the sellers are motivated and the transaction could happen sooner.

The relaunch strategy shall operate Aeris Therapeutics in three (3) phases over the next 5 years, during which the following should be completed.

Restart, complete and publish the pivotal randomized U.S. clinical trials that were underway prior to the shutdown.

Obtain a U.S. CPT code with sufficient reimbursement.

Establish and grow U.S. and European sales.

Seek a full company sale.

Page 4 of 31

Investor Purchase Proposal — Aeris Therapeutics

Phase I: The core technology is well developed and needs very little R&D expenditure and is ready for Phase III execution. Over the next 12 months, the following core operations should be established. Estimated cost: $9 Million ($3 Million to acquire the IP and $6 Million to reestablish operations).

Quickly acquire the IP.

Re-launch the company with key personnel.

Re-start product manufacturing.

Re-establish the clinical trials now underway.

Re-establish commercialization of Europe and the U.S. to generate revenue.

Phase II: Months 13-36 the following activity should be completed. Estimated cost: $9 Million.

Published pivotal RCT in peer-reviewed, prestigious journal and complete other critical publications that support commercialization and direct revenue generation.

Physician professional society sponsorship, CPT submission with appropriate reimbursement.

Procedure refinement, training, clinical pathway, and KOL adoption.

Established and growing sales of ELVR approach in Europe (maintain less than

$500,000 month case burn rate with $2 Million in new revenue).

Phase III: Months 37-60 the following activity should be completed. Estimated cost: $9 Million.

CPT code issued with sufficient reimbursement.

Expansion of European and U.S. sales.

$4 Million in U.S. and EU sales revenue.

ELVR established as leading procedure with follow-up economics validation study.

Completed widespread patient activation.

Established and validated a scaleable business model.

During the acquisition of Aeris Therapeutics’ IP and other key intangible assets and the relaunch of the company, David Leon will serve as its General Manager and President responsible for its successful re-launch and completion of the foregoing objectives, including its product commercialization and exit strategy.

The anticipated exit strategy will most likely be direct acquisition via one of the major biotech or medical device companies. However, once a clear reimbursement pathway is established, sales revenue is expected to accelerate significantly, providing greater company valuation and ample opportunity to determine the most appropriate timing and exit strategy.

Page 5 of 31

Investor Purchase Proposal — Aeris Therapeutics

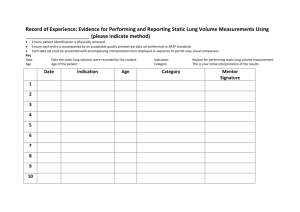

4. Org Chart for Re-launched Aeris Therapeutics

Following is the interim org chart for the key executive staff at the re-launch of Aeris:

GM/President

CFO

Chief Scientific

Officer and Medical

Director

VP, Operations

Director of Clinical

Affairs

Director of

Marketing/Marketing

Communications

Chip Hennen.

25 years of senior-level marketing management experience in the medical device and hi-tech industries including

EndoGastric Solutions, Intersect, Cannuflow, Providence Medical

Technology, Thayer IP, and Equilar. Founder and a principal with several hi-tech startups, including Edge Diagnostic Systems, successfully sold to a Fortune 500 company, with which he served as a divisional vice president. San Mateo School of Law and a MacArthur

Foundation scholarship recipient.

Page 6 of 31

Investor Purchase Proposal — Aeris Therapeutics

5.

Milestones Timeline for Re-Launched Aeris Therapeutics

Following are the key milestones to be met in three (3) phases to ensure the success of the relaunched Aeris Therapeutics and maximize possible return for its funding investments from angel investors.

Page 7 of 31

Investor Purchase Proposal — Aeris Therapeutics

6. Financial Plan for Re-launch of Aeris Therapeutics

Cash on hand

Operating Cash Flow Projection

Aeris Therapeutics

Beginning Q1 2014 Q2 2014 Q3 2014 Q4 2014 2015 2016 2017 2018

6,000,000 6,000,000 4,492,500 3,087,500 1,382,500 8,757,500 2,087,500 4,932,500 1,254,500

Total

Revenue

(Units $10,000 ASP)

US

Europe

Funding Proceeds

Interest

TOTAL CASH RECEIPTS

Total cash available

Expenditures

Comp & Benefits

Headcount

Administrative

QC

Clinical & Regulatory

Medical Affairs

Operations

Sales/Marketing

Research

Totals

ASPIRE Pivotal Trail

Clinical Trial Other,

Registry

Marketing

Insurance, Legal &

Accounting

Facilities

Consulting / Contract

Services

Travel

Manufacturing

Other

SUBTOTAL

Loan principal payment

Capital purchases

Other startup costs

TOTAL CASH PAID OUT

Cash on hand

10

100,000

22,500

30 75

150,000

300,000 600,000

9,000,000

22,500 250,000

110 230 500 955

300,000 800,000 2,200,000 3,450,000

800,000 1,500,000 2,800,000 6,100,000

9,000,000 18,000,000

350,000 25,000 300,000 1,015,000 22,500 22,500

22,500 22,500 122,500 9,322,500 1,150,000 10,450,000 2,325,000 5,300,000 28,565,955

6,000,000 6,022,500 4,515,000 3,210,000 10,705,000 9,907,500 12,537,500 7,257,500 6,554,500

500,000

3

1

2

1

3

10

200,000

50,000

10,000

80,000

150,000

550,000 550,000

3

1

2

1

3

1

2

1

3

1

3

1

11

400,000

50,000

20,000

80,000

50,000

11

750,000

50,000

30,000

80,000

50,000

550,000 2,400,000 2,800,000 3,200,000 3,200,000 13,750,000

0

2

1

2

1

2

1

3

1

3

1

0

0

3

1

3

1

3

1

3

1

3

1

0

0

3

1

3

2

3

3

1

3

4

1

3

4

1

0

0

0

11 12 14 16 16 0

0

750,000 3,500,000 2,700,000 700,000 400,000 9,400,000

100,000 400,000

30,000 90,000

80,000

50,000

330,000

200,000

500,000

120,000

600,000

140,000

300,000 2,050,000

180,000 620,000

460,000 460,000 460,000 2,030,000

225,000 225,000 250,000 1,200,000

50,000

20,000

200,000

60,000

80,000

37,500

120,000

80,000

37,500

200,000

80,000

37,500

520,000

150,000

220,000

420,000 298,000 220,000 1,888,000

150,000 150,000 150,000 860,000

220,000 220,000 220,000 1,192,500

0

1,260,000 1,327,500 1,747,500 1,877,500 7,810,000 7,595,000 5,993,000 5,380,000 32,990,500

0

-120,000

-150,000

-50,000

-50,000

-30,000

-50,000

-20,000

-50,000

-10,000 -10,000 -10,000 -10,000 -260,000

-300,000

1,530,000 1,427,500 1,827,500 1,947,500 7,820,000 7,605,000 6,003,000 5,390,000 32,430,500

6,000,000 4,492,500 3,087,500 1,382,500 8,757,500 2,087,500 4,932,500 1,254,500 1,164,500

Phase I Phase II Phase III

Page 8 of 31

Investor Purchase Proposal — Aeris Therapeutics

7. Heath Economics & Reimbursement

The FDA approval strategy for the AeriSeal System will be to have it indicated as a treatment for severe, heterogeneous upper lobe predominant (ULP) Emphysema. In Europe, the AeriSeal

System is indicated for ULP and homogeneous with reduced upper lobe perfusion Emphysema.

Medicare will be the predominant payer for targeting future coverage/payment models. A comprehensive commercial payer strategy will be created to leverage Medicare gains. It is expected that AeriSeal System treatment will be performed on an in-patient basis. Emphysema patients are medically complex and are expected to have post-treatment complications that warrant inpatient status.

Current inpatient reimbursement amounts for ICD-9 code 33.79 (Endoscopic insertion of other bronchial device or substances) maps to Medical MS-DRG 190-192.

The current crosswalk of ICD-9 to ICD-10 procedure codes does not create an anatomically/physiologically accurate code for AeriSeal. However, the AeriSeal System is not expected to receive FDA approval until after implementation of ICD-10 in September 2014. The following reimbursement amounts are expected.

National Base Rates do not include other adjusted amounts paid to the hospital such as Indirect

Medical Expense and Disproportionate share. Including these adjustments, the hospital often gets more than the stated base amount. In reviewing the DRG reimbursements for the ASPIRE

Clinical Trial sites, the average DRG value was $15,000-$22,000, depending on complications or comorbidities. With the higher ICD-10 reimbursement, the anticipated device average selling price per procedure of $13,000 should be easily absorbed and will not provide an economic disincentive to adopt the new technology.

CPT Code Strategy: Develop clinical publication and professional societies plan to gain support for coverage policies and sponsorship for eventual Level I code. Aeris will submit an application to the AMA for a Category III code in parallel with RCT publication dates to be available for use upon FDA approval.

Page 9 of 31

Investor Purchase Proposal — Aeris Therapeutics

If the MS-DRG assignment changes, Aeris will seek Inpatient New Technology Add-On. The criteria includes newness and cost and clinical improvement. AeriSeal will easily meet all three criteria. If the pivotal RCT shows that AeriSeal System will be used in an outpatient setting, reimbursement options will include New Tech APC or Device Pass-Through revenue codes.

8. The Market Opportunity

Emphysema is the 3rd leading cause of death in the U.S.

(1) , with substantial annual patient care costs with an increasing global prevalence currently afflicting more than 60M patients worldwide.

4.8M patients in the U.S.

(1)

8.4M in Western Europe

2.3M Japan

About 10% of these patients have severe disease and are potential candidates for treatment with the AeriSeal System.

(2)

AeriSeal Revenue and Market Opportunity

Lung Volume Reduction

Qualified Cases

AeriSeal

Treatable

Patients

Average

Selling

Price

Total Market Size

U.S.

Western Europe

466,128

626,111

$ 13,000 $ 6,059,664,000

$ 13,000 $ 8,139,443,000

9. About Emphysema

Emphysema is a progressive, debilitating disease characterized by destruction of lung tissue as a result of inflammation caused by exposure to noxious inhaled agents for extended periods.

The most common cause of this condition is cigarette smoking, although genetic, occupational, and environmental causes account for up to 10% of cases. Emphysema is unique among the different forms of chronic obstructive pulmonary disease (COPD) in that it involves irreversible destruction of alveolar tissue of the lung.

Air sacs and other alveolar lung tissue in the lungs are gradually destroyed, resulting in a decrease in lung elasticity and a collapse of the small airways leading to the air sacs, causing air and gases to become trapped in them. Since air cannot be effectively exhaled from the air sacs, the diseased regions of the lungs expand and crowd out the healthy ones, causing the lungs to over inflate, or “hyper inflate,” until they become too large for the chest cavity, severely

Page 10 of 31

Investor Purchase Proposal — Aeris Therapeutics restricting diaphragm movement. The restricted movement of the diaphragm means insufficient air is being inhaled and exhaled from the lungs. Emphysema patients are only able to take small breaths and experience debilitating shortness of breath (dyspnea) and concomitant exercise limitations.

10. Current Treatment Options

The most commonly prescribed therapies for emphysema are oxygen, bronchodilators and antiinflammatory drugs, agents that help relieve obstruction to airflow. These agents are beneficial in patients with airway diseases such as asthma and chronic bronchitis. However, no pharmacologic therapy slows the progressive loss of lung function that occurs with emphysema.

Surgical treatment, in the form of lung volume reduction surgery (LVRS), has proved a beneficial but costly option for select patients with advanced emphysema. In addition, morbidity following LVRS is common (40-50%) and includes a high incidence of prolonged post-operative air-leaks, respiratory failure, and pneumonia. Fewer than 500 LVRS cases are performed annually in the U.S. In addition, LVRS is palliative, not curative.

Bronchoscopic lung volume reduction (BLVR) approaches were developed to address the need for a less invasive and less expensive alternative to LVRS that could produce the same physiological results. Though all of these minimally invasive techniques are still under investigation, they “have the potential of benefiting a broader emphysema population than

LRVS.

” (3)

11. Endoscopic Lung Volume Reduction (ELVR)

The various bronchoscopic lung volume reduction therapies include placing one-way valves, wire-like coils, steam vapor, or chemical foam sealant into the lungs. All are seeking a portion of this huge market. All of these endoscopic LVR (ELVR) treatments are designed to capture

Page 11 of 31

Investor Purchase Proposal — Aeris Therapeutics the clinical benefits of LVRS while reducing or eliminating the costly and high-risk side effects of

LVRS. The bulk of qualifying cases are medically managed patients, on oxygen with limited treatment options.

12. AeriSeal System Description

The AeriSeal System falls within the non-surgical pulmonary intervention product category of Lung Volume

Reduction (LVR) and is designed to reduce lung volume without surgery to improve overall lung function and quality of life in patients with advanced emphysema.

The procedure involves the delivery of a liquid foam sealant into diseased areas of the lung, where it polymerizes and produces collapse of the diseased area. The liquid foam sealant is delivered via a standard bronchoscope. The sealant physically seals both small airways and collateral air channels, causing the treated areas to collapse via absorption atelectasis, thereby reducing the volume of that area of the lung, restoring a more normal physiological relationship between the lung and the chest cavity.

Page 12 of 31

Investor Purchase Proposal — Aeris Therapeutics

The net result is that the diaphragm has sufficient room to move properly, enabling the patient to inhale and exhale air more normally.

Most patients achieve an improvement in lung function and quality of life equivalent to what is achieved with lung volume reduction surgery (LVRS), but without the substantial morbidity and mortality risks associated with LVRS. Typically, most patients achieve a 20%-25% improvement in overall lung function and quality of life, considered a medically significant improvement.

DELIVERY OF THE AERSEAL FOAM SEALANT

With the patient under conscious or full sedation, a dual lumen catheter is advanced via a bronchoscope into the airways of the diseased portion of the lung, with the tip stationed 3-4 cm distal to the bronchoscope. The fibrinogen and thrombin solutions comprising the AeriSeal liquid foam sealant are administered through the catheter over 10 –15 seconds. Immediately afterward, 60 mL of air is injected through the working channel of the bronchoscope to advance the reagent distally. After 30 seconds, the bronchoscope is then moved to the next intervention site. Typically, a total of four (4) lung segments are treated in one procedure.

The average selling price for the AeriSeal System foam sealant is $3,250 per lung segment each patient requires 4 lung subsegment treatments in a single treatment session therefore the per procedure revenue generation is $13,000.

CLASSIFICATION OF THE AERISEAL SYSTEM

In the U.S., the AeriSeal System is regulated as a Class III medical device, for which a premarket approval application (PMA) is required. In accordance with the European Medical Device

Directive, the AeriSeal System is classified as a Class IIb, long-term invasive medical device.

Page 13 of 31

Investor Purchase Proposal — Aeris Therapeutics

13. AeriSeal Clinical Results, History, and Status

The first-generation AeriSeal System involved six (6) initial biocompatibility/toxicology studies in animal models which were completed and published in 2001 and 2003. In 2004, an open-label phase 1 trial deemed the use of the AeriSeal System sealant in COPD patients safe. It was followed by three (3) phase II trials in Europe and Israel to assess the safety and efficacy of the

AeriSeal Emphysematous Lung Sealant System (i.e., the “AeriSeal System”).

Subsequently three (3) single arm pilot studies conducted in Europe and Israel also served to identify the optimal treatment strategy for the AeriSeal System treatment. Results from these studies led to the development of a well-defined, prospectively-validated approach for selecting patients with advanced emphysema who are likely to respond to AeriSeal System treatment.

Current recommendations for patient selection, treatment site selection, patient preparation, procedural instructions, expected and potential complications, and post treatment management are summarized in the AeriSeal Instructions for Use document. The optimal approach includes treatment at four (4) lung sites, two (2) in each upper lobe, administered during a single treatment session.

Page 14 of 31

Investor Purchase Proposal — Aeris Therapeutics

The use of the second-generation AeriSeal System was initiated in 2011. To date, six (6) clinical articles have been published and three (3) abstracts, including a 24-month follow-up and three (3) 12-month follow-up studies.

In early 2012, a large 300-patient, 30-site randomized U.S. clinical trial comparing AeriSeal versus medical management was started. Called ASPIRE , the trial’s sites include some of the most highly respected medical institutions in the U.S., including:

Brigham and Women’s Hospital

Johns Hopkins University

Mayo Clinic

Duke University Medical Center

Cleveland Clinic

University of Alabama Birmingham

Emory University Hospital

Yale-New Haven Hospital

As of January 1, 2014, ninety (90) of the 300 required patients have been enrolled and randomized. It is believed that completion of the ASPIRE trial will lead to FDA approval and reimbursement support.

Page 15 of 31

Investor Purchase Proposal — Aeris Therapeutics

ASPIRE AeriSeal Highly Confidential Pivotal US Randomized

Clinical Trial Preliminary Results

6 Month results 19 AeriSeal treatment patients 13 control patients

Complications First 90 Days

AeriSeal 15.8% 25.8% 15.5% 34.5% 31.0% 17.2% 12.1% 1.7

Page 16 of 31

Investor Purchase Proposal — Aeris Therapeutics

14. Competition

Bronchoscopic lung volume reduction is a novel approach and a promising method for the treatment of severe emphysema. As expected, in addition to the AeriSeal System procedure, various other methods of bronchoscopic lung volume reduction are also currently under investigation, these include one way valves, airway implant/coils and thermal vapor ablation.

Endobronchial valves are the most studied bronchoscopic lung volume reduction technique.

The lung is divided into compartments (lobes) and the valves are placed in the air ways of one of the lobes of the lung. The valves allow air and secretions to pass out through the valve but not back in. This may result in the lobe shrinking in volume and may allow healthier parts of the lung to expand and take part in the exchange of oxygen and carbon dioxide. Patient numbers are still relatively small, 127 for duckbill valves and 98 for umbrella shaped valves. The most commonly used products are the IBV valve (Olympus) & Zephyr valve (PulmonX, Neuchatel,

Switzerland, Redwood City, CA).

Thermal vapor ablation uses controlled doses of steam which produces an inflammatory response that results in lung volume reduction. A 2 mm catheter is inserted via flexible bronchoscopy to the target airways a precise does of steam generated by an electronically controlled pressure vessel is then delivered to the isolated airways. The InterVapor system by

Uptake Medical (Tustin, CA) is the only available system.

Airway coils use nitinol of 10 to 20 cm in length are delivered via a bronchoscope and catheter.

The coil technique tether small airways helping to hold them open and preventing airway collapse during exhalation. The REPNEU coil by PneumRx (Mountain View, CA) is the only available coil.

Page 17 of 31

Investor Purchase Proposal — Aeris Therapeutics

Competitive Product Comparison*

OUS

RegulatoryApproval

US FDA Approval

Status

Clinical Trials Results (

-

is Not Significant)

Class Product/Company

Sealants

AeriSeal / Aeris Therapeutics

Valves

IBV Valve / Olympus

X X x

NO YES

YES

30%

25% 8.6% 16.6%

↑ ↑

387

NO** YES

YES

NO

N / A 12%

↑

-

Zephyr / PulmonX X NO YES

YES

6.8%

0%

5.8% 7.9% -

Steam

Inter Vapor Steam / Uptake x x ¥ NO NO

NO

NO

10% N / A

↑ ↑

Coils

RePneu / PneumRx x YES

YES

15.40% 19.4%

50%

9.1%

↑ ↑

280

*Only includes the more widely available products does not include university single site products or products under proof

**Humanitarian Device Exemption (HDE) in the US & EU for the management of prolonged air leaks HDE devices effect less

¥ Outside United States Pivotal trial recruiting patients. No US sites participating

Page 18 of 31

Investor Purchase Proposal — Aeris Therapeutics

Page 19 of 31

Investor Purchase Proposal — Aeris Therapeutics

15.

Key Opinion Leader Feedback

Gerard Criner, MD, Temple University, Philadelphia, PA . Dr. Criner believes the AeriSeal

System procedure is a “game changing” modality. He estimates that there are 3-4 Million severe emphysema patients in the U.S. 12% - 15% are potential ELVR candidates, meaning about a

500,000 patient market size.

Dr. Criner has worked with all the bronchoscopic lung volume reduction therapies since 1993 and has done over 100 ELVR cases using coils, valves, steam, and polymer agents. He believes that there is a large unmet patient need in this area and that patients are attracted to the minimally invasive approach. He also believes that the clinical benefits are understated and cited that their internal data shows that the benefits of ELVR may extend patient’s lives up to 17 years. He believes the AeriSeal polymer sealant and the coils methods have the broadest patient application, meaning they can offer a therapy for the largest patient population.

Dr. Criner also says that hyperinflation tracks directly to mortality better than to other indices.

Therefore, treating hyperinflation with a less invasive approach like the AeriSeal System procedure that has a good cost profile is well received.

Dr. stated that up to 6,000 patients have been treated with the valves method, mostly in Europe, but the cases were limited to patients without collateral ventilation.

On Aeris’ ASPIRE clinical trial, Dr. Criner stated that Aeris set up the trial without the necessary funding support believing they could raise additional capital as they were completing the study.

However, the U.S. ELVR market is not as mature at Europe, so U.S. patient recruitment was slower than anticipated. The additional patient education required to recruit patients resulted in

Aeris’ burning too much cash. The small single center trials in Europe were promising, but the serious adverse events in ASPIRE were higher than expected, resulting in unanticipated delays while they were investigated. This is the purpose of quality studies, to reveal issues like this. Dr.

Criner believes that as more experience is gained with the AeriSeal System procedure, the

SAEs, patient selection, treatment protocols (such as administrating steroid pre-procedure), post-procedure treatment regiments, and agent refinements will all improve significantly.

Edmundo R. Rubio, MD, Virginia Tech Medical School, Roanoke, VA.

Dr. Rubio believes that of all the ELVR treatments under investigation, the AeriSeal System has shown in preliminary data as having the most effective treatment results and best side effects profile. He believes it is a very promising therapy with a large potential patient population. Of the two patients he has treated with the AeriSeal procedure, one has shown very significant improvement and the other good improvement.

Dr. Rubio’s patients are averse to surgery and for many the AeriSeal System procedure is really there best option, if not there only viable alternative. According to Dr. Rubio, the valve method has failed in the broader population.

Page 20 of 31

Investor Purchase Proposal — Aeris Therapeutics

On Aeris’ ASPIRE clinical trial, Dr. Rubio believes that recruiting patients for the trial was difficult because the criteria was too narrow. He also thinks that many of the patients recruited did not have upper lobe-only disease.

Herman Ingerl, MD, Robert Bosch Krankenhaus GmbH. Dr. Ingerl has treated 17 patients with the AeriSeal System procedure. All have done very well (90% success rate vs. 70% success rate with valves). Measurement of success included testing patient before treatment and again 6 weeks after: 6MWT, lung function tests (FEV1), X-ray, CT scan, and blood gas measurement.

Dr. Ingerl says the AeriSeal System is an extremely easy procedure to complete and can be done in a short amount of time. He also believes it is the safest ELVR procedure. Patients overall feel better and there is an improvement in lung function long-term. Most adverse events occur in the first 3-4 days, but symptoms usually go away. Patients are kept in the hospital for 5-

6 days for reimbursement purposes only, not because of any AEs. Dr. Ingerl says that treating patients with LVR modalities has good reimbursement. (If the patient leaves after only 2 days, then the hospital receives only 20% of the reimbursement funds available.) Most patients experience inflammation on the first day. However, after 1 week, the patients feel better and do well.

On his experience with the valves method, patients have done well, but there have been a number of pneumothorax cases and the placement of valves is challenging. He believes the reimbursement funds price is comparable to the AeriSeal system; there is little difference between 5 valves ($10K) and then AeriSeal ($12K) currently receive reimbursement for the valves and the procedure.

On his experience with the coils method, Dr. Ingerl does not to pursue this method because he currently does not see any advantages with it. He believes this method has the worst safety profile and most patients overall do not feel well. He has had patients referred to him to have their coils removed because of various complications. Once implanted, however, coils are very difficult to remove and a significant amount of lung tissue is destroyed. He believes that coils are associated with a high number of pneumothorax cases.

Wolfgang Gesierich , MD, Asklepios Fachkliniken Muenchen – Gauting . Dr. Gesierich has treated about 10 patients with the AeriSeal System procedure and believes that they all responded

“overall quite well.” He believes the efficacy impact on the patient is similar to valves, but that the AeriSeal System is the best and safest way principally because short/slow volume reduction is gentler on the lung and therefore safer. With the AeriSeal System, he believes there is not an enormous volume reduction on the lobe immediately following the procedure, unlike with valves.

Dr. Gesierich states that with the AeriSeal System procedure patients experience severe inflammatory response in the first few days, but they are given prophylactic treatments and the symptoms go away after 1-2 weeks. He advises his patients to tolerate this initial inflammatory response because the AeriSeal procedure is really the better treatment.

Page 21 of 31

Investor Purchase Proposal — Aeris Therapeutics

Figure 1. Dr. Gesierich ’s AeriSeal System and other ELVR procedure experience.

By comparison, Dr. Gesierich believes the valve method is too aggressive because it causes immediate atelectasis of a whole lobe (“very cruel to the lung”). Complications frequently include pneumothorax (at least 15% - 20% of patients). Every patient with a pneumothorax has needed a chest tube. Some with severe bronchial fistulas (several liters of volume/minute) have had to have 2-3 chest drains placed.

With the coil method, Dr. Gesierich believes it does not provide much improvement in lung function, so it usually is the last treatment modality considered. Says Dr. Gesierich, “most patients also don’t like the feeling of the coils inside them.”

EXPERIENCE USER CONTACTS

Edmundo R. Rubio, MD, FCCP

Section Chief of Pulmonary, Critical Care, Sleep and Environmental Medicine

Carilion Clinic

Assistant Professor of Medicine, VTC School of Medicine

1906 Belleview Avenue, Suite 320

Roanoke, VA 24014

Email:

Tel:

Notes: Treated first U.S. pivotal trial patient; 2 treated patients in ASPIRE study.

Gerard J. Criner, MD, FACP, FACCP

Chair, Department of Medicine, Professor, Medicine

Temple University

Director, Medical Intensive Care Unit and Ventilator Rehabilitation Unit

Co-Director, Center for Inflammation, Translational and Clinical Lung Research

Tel:

Email:

Mark Dransfield, MD

Associate Professor of Medicine

Medical Director, UAB Lung Health Center

Division of Pulmonary, Allergy & Critical Care Medicine

University of Alabama at Birmingham

Tel:

Email:

Page 22 of 31

Investor Purchase Proposal — Aeris Therapeutics

Tom Gildea, MD

Advanced Lung Disease Section

Department of Pulmonary Allergy and Critical Care Medicine

Cleveland Clinic, Cleveland OH

Advanced training in interventional and advanced diagnostic bronchoscopy

Tel:

Email:

Hermann Ingerl, MD

Oberarzt Endoskopie / Pneumologie

Robert Bosch Krankenhaus GmbH

Klinik Schillerhöhe Solitudestr. 18 70839 Gerlingen

Tel.

Wolfgang Gesierich, MD

Oberarzt Bronchologie / allg. Pneumologie

Asklepios Fachkliniken Muenchen-Gauting

Dr.ssa Michela Bezzi

Endoscopia Respiratoria

Spedali Civili di Brescia

Italy

INDEPENDENT EXPERTS

Bartolome R. Celli, MD

Professor of Medicine

Pulmonary and Critical Care Medicine

Brigham and Women’s Hospital, Pulmonary Division

Page 23 of 31

Investor Purchase Proposal — Aeris Therapeutics

16. Intellectual Property Portfolio

The AeriSeal System is protected under broad IP the portfolio includes:

• 10 issued US patents (8361484, 8198365, 8445589, 6610043, 6682520,

7654998, 7654999, 7300428, 7819908, 7861710)

•2 pending US applications

• 23 international issued patents

• 7 pending international patent applications

Broad method of use claims

“A method for reducing lung volume in a patient, the method comprising: introducing a material into a diseased alveolar region…”

Multiple types of materials and delivery methods

Tissue volume reduction by applying energy with a catheter

Composition of matter claims cover:

Multiple types of materials including polymers, cross-linked hydrogels, biopolymers and polymeric additives

Patent estate:

Strong blocking patents and extended coverage

Key claim

Aeris Therapeutics IP Portfolio

Key Claims, Status, Coverage*

Status Title Expiration

Years to

Expiration

A method for reducing lung volume in a patient, hydrogel, non-natural polymer & cross-linker

Granted

Lung Volume

Reduction Therapy

Using Cross-Linked

Non-Natural

Polymers

13-Apr-31 17

Region

US

Patent #

8,198,365

A Method of reducing lung volume in a patient, bronchoscope, introducing biochemical material

Granted

Tissue Volume

Reduction

A method for reducing lung volume, introducing a material into diseased alveolar region

Granted

Tissue Volume

Reduction

5-Sep-19

28-Aug-20

5

6

US

US

6,682,520

7,654,998

A non-surgical method of reducing lung volume via trachea, antisurfactant

Granted

Tissue Volume

Reduction

31-Oct-20 6 US 7,654,999

*This is an abbreviated description and list of significant patents, does not including pending or published IP in Europe, Japan, Korea

& Mexico, full descriptions are available up request

Page 24 of 31

Investor Purchase Proposal — Aeris Therapeutics

Aeris Therapeutics IP Portfolio

Key Claims, Status, Coverage*

Key claim

Blocking Patents and Extended Coverage

Status Title Expiration

17-Jun-23

Years to

Expiration

9 A Method for non-surgical lung volume reduction, applying an amount of energy

Granted

Compositions & Methods for Reducing Lung

Volume

23-Jun-17 3

A non-surgical method of reducing lung volume in a patient, collapsing a target region, with fibrinogen & activator

Granted

Tissue Volume

Reduction

23-Aug-20 6

A method of sealing a bronchopleural fistula, non-natural polymer & crosslinker

Granted

A handheld apparatus that deoivers pressurized gas to airway

Granted

Lung Volume

Reduction Therapy

Using Crosslinked

Non-Natural

Polymers

Respiratory assistance apparatus & methods

8-May-28 14

Region

US

Canada

US, Australia,

Austria, Belgium,

Europe, France,

Germany,UK**

US

US

Patent #

7,819,908

2,530,042

6,610,043

8,445,589

7,861,710

BLVR can be carried out by collapsing a region of the lung adhering one portion to another

Granted

Promoting fibrosis in or around adherent tissue

US 7,300,428

A Method for reducing lung volume, multi-lumen catheter, bronchoscope, polymer, crosslinker and sclerosing agent

Granted

Polymer Systems for Lung Volume

Reduction Therapy

26-Sep-27 13

*This is an abbreviated description and list of significant patents full descriptions are available up request

**This patent covers 22 countries, this is an abbreviated list, complete list available upon request

US 8,361,484

Page 25 of 31

Investor Purchase Proposal — Aeris Therapeutics

17. Past Financial Statements

Aeris Therapeutics 2011 to Year to Date 2013

Financial Statement

Years

Income Statement

Net sales

Cost of Sales

Operating Margin

Sales & Marketing

Development

General & Administrative

Operating expenses

Operating Income/ (loss)

Interest Expense

Other Income and Expenses

Total Other Income / Expenses

Net Income /(Loss)

2011

$161,189

$162,582

($1,393)

$752,318

$3,349,027

$1,039,979

$5,141,324

($5,142,717)

$1,917,605

($7,060,322)

2012

$640,621

$62,528

$578,093

$600,757

$1,162,358

$3,011,640

$6,054,513

($5,476,420)

$279,760

($255)

$279,505

($5,755,925)

YTD August

2013

$632,469

$37,943

$594,526

$489,662

$1,258,539

$2,352,732

$4,982,382

($4,387,856)

$60,000

$13,392

$73,392

($4,461,248)

Balance Sheet

Current Assets:

Cash & Equivalents

Accounts receivable

Inventory

Prepaid expenses

Total Current Assets

Property, Plant & Equipment

Accumulated Depreciation

Other Assets

Goodwill and Intangible Assets

Security Deposits & Other Assets

Total Assets

$338,251

$42,590

$304,075

$194,820

$879,736

$123,281

$9,946,704

$10,949,721

$220,442

$125,143

$430,341

$108,538

$884,464

$911,244

($870,983)

$9,850,404

$96,300

$10,871,429

$601,018

$17,312

$564,522

$90,090

$1,272,942

$913,447

($889,565)

$9,850,404

$96,300

$11,243,528

Current Liabilities

Accounts payable

Accrued Expenses

Accrued Interest

Total Current Liabilities

Notes Payable

Total Liabilities

Shareholders' equity

Members' Equity

Accumulated Deficit

YTD Net Income

Total Stockholders' Equity

Total Liabilities and Stockholders' Equity

$264,833

$327,152

$2,812,329

$3,404,314

$12,000,000

$15,404,314

$2,605,728

($7,060,322)

($4,454,594)

$10,949,720

$181,734

$308,127

$82,500

$572,361

$3,000,000

$3,572,361

$33,726,331

($20,671,335)

($5,755,927)

$7,299,069

$10,871,430

$333,425

$429,782

$142,500

$905,707

$3,000,000

$3,905,707

$38,226,331

($26,427,262)

($4,461,248)

$7,337,821

$11,243,528

Page 26 of 31

Investor Purchase Proposal — Aeris Therapeutics

18. AeriSeal System Cost of Goods Sold Analysis

Page 27 of 31

Investor Purchase Proposal — Aeris Therapeutics

19. Reasons for Aeris’ Closing

A careful analysis of Aeris Therapeutics’ previous development/growth strategies and operations was performed to understand why the company failed and how to ensure the success of the re-launched company.

Though the safety and efficacy of the AeriSeal System was proven fairly early in the company’s history via several European pilot studies, the company faced four (4) major obstacles: 1) topheavy staffing, 2) inadequate Phase III clinical study enrollment strategy, 3) cost structure/control problems, and 4) slow revenue growth from Europe.

Employee Cost. Aeris had a relatively small staff (under 20 staff members) for most of its history, but it was also top-heavy with senior executives, seven (7) for most of the last several years. Though they were all highly qualified medical and scientific professionals, their salaries were substantial and their direct medical device commercialization experience limited. In addition other FTE costs such as quality control and manufacturing could have been outsourced.

Page 28 of 31

Investor Purchase Proposal — Aeris Therapeutics

Pivotal Clinical Trial problems.

The company successfully designed and executed several small early-stage pilot studies in Europe and Israel and received CE approval and reimbursement in Germany. Aspire, a 300 patient randomized controlled U.S. and international clinical trial commenced in late 2011 having secured 30 well respected medical institutions. Enrollment was very slow; therefore, it was determined to expand the study site locations to 40 then 60 locations in an effort to increase enrollment velocity. However, this simply increase cost without increasing enrollment. The correct strategy should have been concentration on a smaller number of case producing sites, eliminating non-producing sites, allocation of clinical trial patient recruitment services, and direct customer service activity with site Clinical Coordinators. Each study case randomized to AeriSeal required direct in person procedure support therefore travel expenses and per case costs were high. Case stacking, putting 2-4 cases per travel event, should have been utilized.

European commercialization. CE mark approval was awarded in 2011 although there was a distinct clinical advance over more established therapies and some reimbursement limits on widespread adoption revenue growth was slow, supporting competitive studies were never undertaken, post market registry follow on data ceased therefore the initiative to establish a revenue stream lost.

Cost structure/control problems.

The foregoing costs, taken together with the company’s other operating costs, resulted in a significant burn rate of between $750K to $1.1M per month for its last three (3) years of operation. The company’s existing funding structure could not support the organization through the time required to complete the clinical studies

Page 29 of 31

Investor Purchase Proposal — Aeris Therapeutics necessary to obtain a CPT code and satisfactory reimbursement. 19.5 FTE was high along with the 15,000 SF facility and unneeded internal departments could not be sustain without significant additional capital.

Summary. It appears key executives did not transition from conducting basic science and research activity to pre-commercialization and phase III execution and implementing a successful funding strategy to obtain the additional resources the company required. What’s more, the company was very slow to implement the cost cutting measures necessary to ensure the com pany’s survival beyond 2013, resulting in its closing down its operations in

November 2013. In soliciting strategic partners, Aeris management focused on bigger med device companies.

Page 30 of 31

Investor Purchase Proposal — Aeris Therapeutics

REFERENCES

(1) Centers for Disease Control and Prevention, National Vital Statistics Reports, 2010, Death:

Final Data for 2010. Published May 8th, 2013, Sherry L. Murphy, B.S.; Jiaquan Xu, M.D.;

Kenneth D. Kochanek, M.A., Davison of Vital Statistics.

(2) CTS Inspirations, Winter 2013-2014, California Thoracic Society, Novel methods for Lung

Volume Reduction, Bonet, Antonio, MD, Pulmonary & Critical Care Fellow, Cedars-Sinai

Medical center and Zab Mosenifar, MD Geri & Richard Brawerman Chair in Pulmonary &

Critical Care Medicine, Professor & Executive Vice Chairman, Department of Medicine,

Medical Director Women ’s Guild Lung Institute, Cedars Sinai Medical Center, Los Angeles,

CA.

(3) A Randomized Trial Comparing Lung-Volume –Reduction Surgery with Medical Therapy for

Severe Emphysema. National Emphysema Treatment Trial Research Group. New England

Journal of Medicine; 348:2059-2073 May 22, 2003.

(4) American Lung Association, Trends in COPD (Chronic Bronchitis and Emphysema): Morbidity and Mortality, Epidemiology and Statistics Unit, Research and Program Services Division,

August 2011.

(5) Mannino et al., Arch Intern Med. 2000 Jun 12;160(11):1683-9., Akuthota et al., Ann Thorac

Surg. 2012;94:205 –11.

Information gathered in this document has been obtained from various sources including:

Aeris Therapeutics Company documents under Confidential Disclosure Agreement with the estate assignee.

Interviews with past employees including the VP of Operations, Chief Medical Officer,

CFO, Scientific Officer, and VP of Product Development.

Publicly available research.

Page 31 of 31