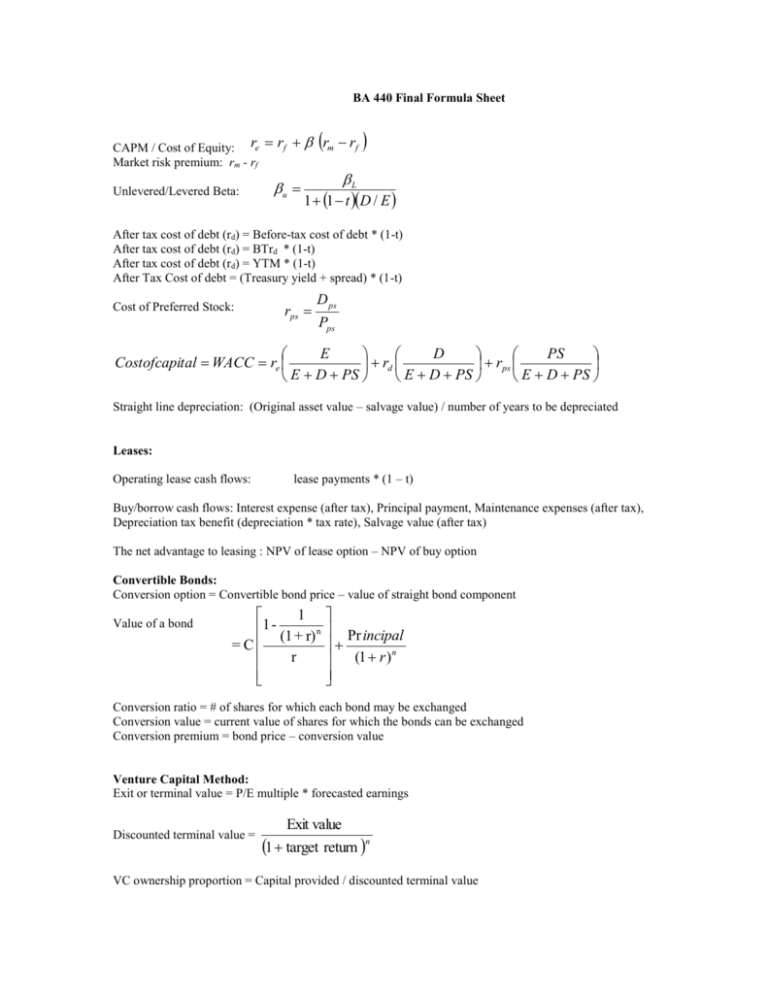

Final Formula Sheet

advertisement

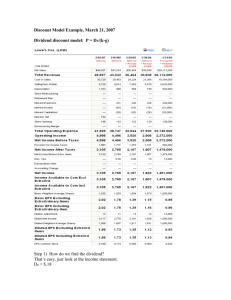

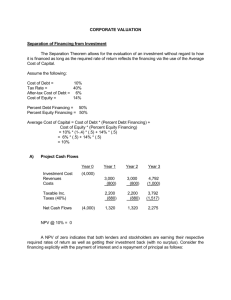

BA 440 Final Formula Sheet CAPM / Cost of Equity: re rf rm rf Market risk premium: rm - rf Unlevered/Levered Beta: u L 1 1 t D / E After tax cost of debt (rd) = Before-tax cost of debt * (1-t) After tax cost of debt (rd) = BTrd * (1-t) After tax cost of debt (rd) = YTM * (1-t) After Tax Cost of debt = (Treasury yield + spread) * (1-t) Cost of Preferred Stock: rps D ps Pps E D PS Costofcapital WACC re rd rps E D PS E D PS E D PS Straight line depreciation: (Original asset value – salvage value) / number of years to be depreciated Leases: Operating lease cash flows: lease payments * (1 – t) Buy/borrow cash flows: Interest expense (after tax), Principal payment, Maintenance expenses (after tax), Depreciation tax benefit (depreciation * tax rate), Salvage value (after tax) The net advantage to leasing : NPV of lease option – NPV of buy option Convertible Bonds: Conversion option = Convertible bond price – value of straight bond component Value of a bond 1 1 - (1 + r) n =C r Pr incipal (1 r ) n Conversion ratio = # of shares for which each bond may be exchanged Conversion value = current value of shares for which the bonds can be exchanged Conversion premium = bond price – conversion value Venture Capital Method: Exit or terminal value = P/E multiple * forecasted earnings Discounted terminal value = Exit value 1 target return n VC ownership proportion = Capital provided / discounted terminal value IPO Underpricing: Underpricing (return) = (first day closing price – offer price) / offer price Rights offerings: Rights required to purchase one share = Value of the right = # of original shares # of shares issued in RO rights-on price – subscription price n+1 OR rights-on price – ex-rights price Ex-rights price = New value of equity New number of shares Benefits/Costs of debt: Yearly tax benefit from debt = Tax Rate * Interest Payment Cost of Capital Approach to Optimal Capital Structure: Interest Coverage Ratio = EBIT / Interest Expenses Implied growth rate assuming constant growth model: g V *WACC CF CF V Firm Value (Stable growth) = CF to Firm (1 + g) / (WACC -g) Firm Value opt WACC- Firm Value orig WACC Dividend policy: Free cash flow to equity = Net Income + Depr&Amort – Chg in WC – Cap Exp + (New Debt Issue – Debt Repay) – Pref. Dividends Estimated FCFE = Net Income - (1- ) (Capital Expenditures - Depreciation) - (1- ) (Chg in WC) – Preferred Dividends where is the debt ratio (D / (D+E) and Chg in WC = WCt – WCt-1 where WC = Non-cash current assets – non-debt current liabilities CF to stockholders to FCFE Ratio = (Dividends + Buybacks) / FCFE Valuation: Relative valuation (P/E, P/BV, P/S, EV/EBITDA): Firm value = Comparable multiple * Firm-specific denominator value PEG = (P/E)/ Growth in earnings BV (of equity) = total shareholders equity – preferred stock Profit margin = Net income/Sales Retention ratio = 1 – Dividends/Earnings Enterprise value = market cap + Debt – Cash EBITDA = earnings before interest taxes depreciation and amortization DCF valuation: t=N FCFE t TerminalVa lue t (1 re ) N t =1 (1 + re ) Value of Equity = FCFEN * (1 g s ) re g s Terminal value: Equity Reinvestme nt Rate (Cap Exp. - Depr in WC)(1 - ) Net Income - Interest Income where is the debt ratio (D / (D+E)) and Chg in WC = WCt – WCt-1 where WC = Non-cash current assets – non-debt current liabilities Growth in earnings = ERR * non-cash ROE where Non cashROE NetIncome InterestIncome BVofequity (cash marketablesec urities ) PV equations: Present value of a perpetuity: PV Present value of multiple cash flows: CF r n PV t 1 FV Present value of single future cash flow: PV (1 r )t 1 1 - (1 + r) n PV of an Annuity = PV(A, r, n) = A r CFt 1 r t